Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

ValOre Metals RC Drilling Confirms Mineralized Uranium Envelope at J4 West Target

VANCOUVER, British Columbia, Jan. 23, 2023 (GLOBE NEWSWIRE) -- ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTCQB: KVLQF; Frankfurt: KEQ0, “the Company”) today reported assays for J4 West (“J4W”) and Yat (“Yat”) targets Reverse Circulation (‘RC”) drilling at ValOre’s 100% owned 68,552-hectare Angilak Property Uranium Project (“Angilak”), located in Nunavut Territory, Canada.

“Results from 2022 RC drilling confirm J4 West as a uraniferous structure, with all four sampled holes returning near-surface U3O8 mineralization, and two of the four holes with assay intervals above the Lac 50 resource cut-off grade,” stated ValOre’s VP of Exploration, Colin Smith. “J4 West remains fully open at depth, and along strike to the west, with the target conductor extending for an additional 800 m along strike towards the Eastern Extension of Lac 50. Assays remain pending for ten core holes, totaling 926 m of follow-up drilling.”

Highlights from J4 West and Yat RC Drilling:

J4 West 2022 Highlights

- All four sampled RC drill holes from J4 West returned near-surface (35 to 65 metres vertical depth) uranium mineralization over a strike length of 200 metres, including the following highlights:

- 3.1 metres (“m”) @ 0.21% U3O8 and 10.6 g/t Ag from 50.3 m in drill hole RC22-J4W-001

- 1.5 m @ 0.38% U3O8 and 15.1 g/t Ag from 57.9 m in drill hole RC22-J4W-002;

- Mineralization at J4W remains open at depth and along strike to the west, with highlights from the 2013 drilling (located immediately west of 2022 J4W drilling):

- 0.30 m @ 1.06% U3O8 in drill hole 13-J1-002

- 0.60 m @ 0.56% U3O8, 0.28% Mo and 15.5 g/t Ag in drill hole 13-J1-003;

2022 Yat RC Drilling

- Three of four RC drill holes at Yat returned broad near-surface intervals of copper, silver and local uranium mineralization, including:

- 63.8 m @ 0.11% Cu and 3.2 g/t Ag from 1.5 m in drill hole RC22-YAT-004

- 42.6 m @ 0.15% Cu and 4.3 g/t Ag from 1.5 m, including 4.6 m @ 1.1% Cu and 20.8 g/t Ag from 1.5 m in drill hole RC22-YAT-003

- 33.4 m @, 0.15% Cu and 4.4 g/t Ag from 6.1 m in drill hole RC22-YAT-002;

- 1.5-kilometre-long uranium soil anomaly which is coincident with a strong 6.5-kilometre-long VLF-EM conductor is only drill-tested over 130 m of strike, and remains open to the southwest.

2022 RC Drilling, J4 West Target

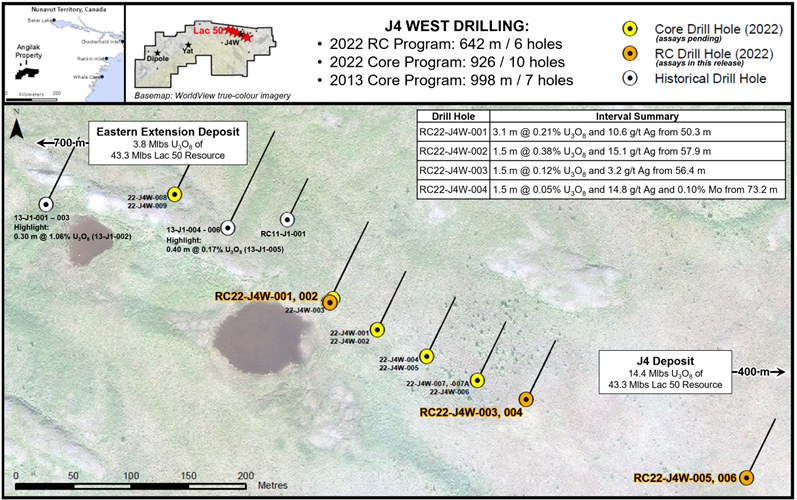

J4 West mineralization style, geology and alteration assemblage is analogous to Lac 50 deposits, supporting an off-set mineralized extension 500 m to the southwest of the J4 resource zone. A total of 642 m of RC drilling was completed in six holes at J4W (formerly known as J1) in 2022. Drilling targeted an interpreted sinistral off-set and suspected continuation to the southwest of the high-grade western J4 Zone. For additional information on the J4W target, CLICK HERE for news release dated November 29, 2021, and CLICK HERE for news release dated June 15, 2022.

The six 2022 RC holes were drilled from three pads spaced 200 m apart, with two holes per pad angled at -45° and -65° to the north-northwest, testing a strike length of 400 m in between the area of previous drilling and the sinistral structure to the east (Figure 1). All four holes from the central and western pads (RC22-J4W-001 to RC22-J4W-004) intercepted near-surface uranium mineralization, including two holes (RC22-J4W-001 to RC22-J4W-002) with U3O8 intervals above the Lac 50 Trend resource cut-off grade of 0.20% U3O8 (Table 1). Mineralization occurs as a sheared interval of hematite-altered, graphitic and sulfidic tuff within a host sequence of foliated basalt and gabbro, analogous to the lithological units hosting mineralization at the Lac 50 Trend resource.

Two RC holes drilled from the eastern pad at J4W did not encounter anomalous scintillometer counts per second (“CPS”) values, and thus were not sampled.

Ten core holes totaling 926 m were subsequently drilled in 2022, testing the along-strike continuity of radioactive intercepts drilled in the 2022 RC program. All core drill holes encountered anomalous radioactivity (>350 CPS), with a highlight of 15,821 CPS at 149 m vertical depth in drill hole 22-J4W-003. All assays remain pending.

2022 RC Drilling, Yat Target

A total of 383 m of RC drilling was completed in four holes from two pads at Yat in 2022, with holes drilled at -45° and -65° to the southeast. Drilling targeted at-depth extensions to high-grade precious metals (Pd-Pt-Au-Ag) and uranium values returned from 2016 trench channel sampling and frost heaved boulder assays. For additional information on the Yat target, CLICK HERE for news release dated June 2, 2022, and CLICK HERE for news release dated November 8, 2016.

Three of the four 2022 RC drill holes at Yat encountered broad (33.4 to 63.8 m wide), near-surface intervals of copper and silver mineralization, with localized anomalous uranium (Table 1). High-grade polymetallic mineralization that was encountered in 2016 trenching was not intersected by 2022 RC drilling and is interpreted to be restricted to centimetre-scale discontinuous veins and stringers hosted within 1.0 to 1.5 m wide structural zones in sandstone, conglomerate and Christopher Island volcanics of the Proterozoic Angikuni Basin.

The Yat target remains a priority Lac 50 style target at Angilak that warrants further exploration. 2022 ground VLF-EM geophysics defined a strong 6.5-kilometre-long extension to the primary Yat conductor, which is only drill-tested over 130 m of strike. This prospective structure is coincident with a 1.5-kilometre-long uranium soil anomaly which remains open along strike to the southwest (Figure 2).

Table 1: 2022 J4 West and Yat RC Drilling Assays

| Target | Drill Hole | From (m) | To (m) | Interval (m) | U3O8 (%) | Ag (g/t) | Mo (%) | Cu (%) | Interval Summary |

| J4 West | RC22-J4W-001 | 50.3 | 53.3 | 3.1 | 0.21 | 10.6 | 0.10 | 0.01 | 3.1 m @ 0.21 %U3O8and 10.6 g/t Ag from 50.3 m |

| J4 West | RC22-J4W-002 | 57.9 | 59.4 | 1.5 | 0.38 | 15.1 | 0.08 | 0.05 | 1.5 m @ 0.38 %U3O8and 15.1 g/t Ag from 57.9 m |

| J4 West | RC22-J4W-003 | 56.4 | 57.9 | 1.5 | 0.12 | 3.2 | 0.06 | 0.02 | 1.5 m @ 0.12 %U3O8and 3.2 g/t Ag from 56.4 m |

| J4 West | RC22-J4W-004 | 73.2 | 74.7 | 1.5 | 0.05 | 14.8 | 0.1 | 0.05 | 1.5 m @ 0.05 %U3O8and 14.8 g/t Ag and 0.10% Mo from 73.2 m |

| Yat | RC22-YAT-002 | 6.1 | 39.6 | 33.4 | 0.01 | 4.4 | 0.01 | 0.15 | 33.4 m @ 0.01% U3O8, 4.4 g/t Ag, and 0.15% Cu from 6.1 m |

| Yat | includes | 30.5 | 32.0 | 1.5 | 0.10 | 31.0 | 0.00 | 0.43 | 1.5 m @ 0.10% U3O8, 31.0 g/t Ag, and 0.43% Cu from 30.5 m |

| Yat | RC22-YAT-003 | 1.5 | 44.2 | 42.6 | 0.00 | 4.3 | 0.01 | 0.15 | 42.6 m @ 4.3 g/t Ag, and 0.15% Cu from 1.5 m |

| Yat | includes | 1.5 | 6.1 | 4.6 | 0.00 | 20.8 | 0.00 | 1.10 | 4.6 m @ 20.8 g/t Ag, and 1.10% Cu from 1.5 m |

| Yat | RC22-YAT-004 | 1.5 | 65.5 | 63.8 | 0.00 | 3.2 | 0.01 | 0.11 | 63.8 m @ 3.2 g/t Ag, and 0.11% Cu from 1.5 m |

| Yat | includes | 33.5 | 38.1 | 4.6 | 0.02 | 6.1 | 0.01 | 0.66 | 4.6 m @ 0.02% U3O8, 6.1 g/t Ag, and 0.66% Cu from 33.5 m |

Notes:

- RC samples <5,000 CPS outside the plastic pails were submitted to ALS Laboratory (“ALS”) in North Vancouver, British Columbia, for assay via ME-MS61U (4A multi-element ICP-MS + uranium), U-XRF10 (ore grade U assay, 0.01%-15% U) and Au-ICP21. Uranium assays are reported by ALS in parts per million (“ppm”) and converted to %U3O8 using the following formula: U3O8 (%) = U (ppm) x 0.01179%.

- RC samples >5,000 CPS outside the plastic pails were placed in steel pails and submitted to Saskatchewan Research Council Geoanalytical Laboratories (“SRC”) in Saskatoon, Saskatchewan, for assay via ICP1, ICP2, and U3O8. ICP1 results >1,000 ppm U are subjected to SRC %U3O8 assay; ICP1 results for Cu, Mo and Ag are reported by SRC in parts per million (ppm). 1 ppm = 1 g/t, 10,000 ppm = 1%.

- All "From", "To" and "Interval" measurements are metres down-hole. True widths are yet to be determined.

Quality Control/Quality Assurance (“QA/QC”)

ValOre’s QA/QC procedure for RC drill logging and sampling includes the systematic insertion of blanks, standards, and duplicates in the field, alternating on every 20th sample, in addition to in-house laboratory QA/QC protocol which includes blanks analysed every 49 samples and a repeat analysis on every 10th sample. All QA/QC results associated with the assays reported herein are within expectation.

RC drilling samples were submitted to the Saskatchewan Research Council Geoanalytical Laboratories (“SRC”) and ALS Geochemistry (“ALS”) for assay. The SRC facility operates in accordance with ISO/IEC 17025:2005 (CAN-P-4E), General Requirements for the Competence of Mineral Testing and Calibration laboratories and is accredited by the Standards Council of Canada. For more information about SRC, CLICK HERE.

About Angilak

The 68,552-hectare Angilak Property is situated in the mining- and exploration-friendly Nunavut Territory, Canada, and has district-scale potential for uranium, precious and base metals. Since acquisition, ValOre has invested over CAD$65 million on resource delineation and exploration drilling (89,572 metres in 589 drill holes), metallurgy, geophysics, geochemistry, and logistics across the large land package. This work supported the development of the significant Lac 50 Trend inferred uranium resource estimate (“Lac 50”).

The Lac 50 NI 43-101 Technical Report (effective date March 1, 2013) defined an inferred resource estimate which represents the highest-grade uranium resource over 20 million pounds U3O8 outside of Saskatchewan. Highlights include:

- 43.3 M lbs U3O8 in 2,831,000 tonnes grading 0.69% U3O8, CLICK HERE for a summary table of the Lac 50 Trend inferred resource estimate;

- Supported by 351 resource delineation drill holes totaling 62,023 metres (“m”);

- Metallurgical results for Lac 50 demonstrate high uranium recoveries and rapid leach kinetics. See news releases: February 28, 2013, September 11, 2013 and February 27, 2014;

- Lac 50 Trend is a 15 kilometre (“km”) by 3 km area with excellent potential for resource growth and new discoveries;

- Uranium mineralization starts at surface, and has been drilled to 380 m vertical depth.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 52 exploration licenses covering a total area of 56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au (CLICK HERE for news release dated March 24, 2022). All the currently known Pedra Branca inferred PGE resources have reasonable prospect of eventual economic extraction via open pit methods.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at This email address is being protected from spambots. You need JavaScript enabled to view it..

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.07 |

| Daily Change: | 0.001 1.47 |

| Daily Volume: | 1,334 |

| Market Cap: | US$17.590M |

December 22, 2025 | |