VANCOUVER, British Columbia, June 03, 2025 (GLOBE NEWSWIRE) -- ValOre Metals Corp. (“ValOre”) (TSX-V: VO, OTCQB: KVLQF, Frankfurt: KEQ0), today highlighted the strategic synergies and near-term exploration plans for the combined Pedra Branca Gold and Platinum Group Metals (“PGM”) Projects. This combination of projects will create a 100,000-hectare precious metals district in Ceara State, Brazil. For further details concerning ValOre’s acquisition of the Pedra Branca Gold Project, please see ValOre’s news releases of March 26 and May 20, 2025.

Jim Paterson, ValOre’s Chairman and C.E.O. stated: “Brazil is a great place to be advancing mining exploration and development projects today. With our in-country team actively supported by a strong capital markets presence, we are very excited to rapidly advance work at the 100,000-hectare Pedra Branca precious metals district once South Atlantic shareholders approve the transaction with ValOre. We look forward to being able to deliver significant exploration results and create value on behalf of all ValOre and South Atlantic stakeholders.”

South Atlantic Gold Corporation (“South Atlantic”) Shareholder Meeting

Thiago Diniz, ValOre’s VP of Exploration commented: “With years of experience in the region, our team brings valuable local knowledge and technical strength to the Pedra Branca Gold Project. We’re ready to hit the ground running and advance the Pedra Branca project immediately following the completion of the ValOre – South Atlantic transaction.”

Strategic and Operational Synergy Highlights

Comprehensive Work Program Planned for H2 2025

Upon closing of the transaction, ValOre will immediately initiate a broad and detailed data compilation and validation campaign, including the following key elements:

Proactive Regulatory Engagement with SEMACE and ANM

In parallel with ongoing regulatory and community engagement, the foundational exploration performed will enable ValOre to build a robust regional geological model and exploration strategy, resulting in the identification of new targets and opportunities for resource expansion.

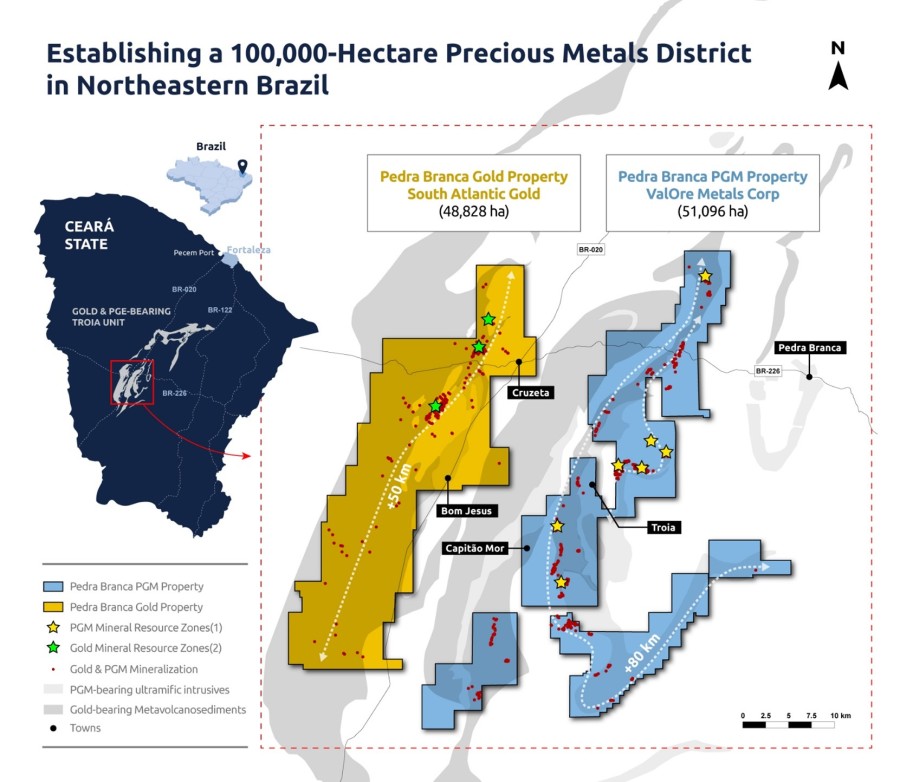

Figure 1: Pedra Branca PGM and Pedra Branca Gold property map

(1) Independent Technical Report – Mineral Resource Update on the Pedra Branca PGE Project, Ceará State, Brazil (Effective date: March 8, 2022)

(2) NI 43-101 Technical Report - Mineral Resource Estimation for the Pedra Branca Gold Project Ceará State – Brazil (Effective date: March 16, 2021)

About ValOre Metals Corp.

ValOre Metals Corp. (TSX-V: VO, OTCQB: KVLQF, Frankfurt: KEQ0) is a Canadian company with a team aiming to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration and innovation.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at This email address is being protected from spambots. You need JavaScript enabled to view it..

ValOre is a proud member of Discovery Group http://www.discoverygroup.ca

About South Atlantic Gold Inc.

South Atlantic is an exploration company engaged in acquiring and advancing mineral properties in the Americas.

For further information, please visit our website at www.southatlanticgold.com.

Additional Information about the Proposed Transaction and Where to Find It

Further details regarding the terms of the Proposed Transaction are set out in the Agreement, which will be publicly filed on ValOre’s and South Atlantic’s respective SEDAR+ profiles at www.sedarplus.ca. Additional information regarding the terms of the Agreement, the background to the Proposed Transaction and how the South Atlantic Shareholders can participate in and vote at the South Atlantic Shareholder Meeting will be provided in the management information circular which has been mailed to the South Atlantic Shareholders and also filed on the South Atlantic’s SEDAR+ profile at www.sedarplus.ca. South Atlantic Shareholders are urged to read these and other relevant materials when they become available.

No Offer or Solicitation

This document does not constitute an offer to sell, or the solicitation of an offer to buy, any securities in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Thiago Diniz, P.Geo., ValOre’s QP and Vice President of Exploration.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain forward-looking statements and forward-looking information, as defined under applicable Canadian securities laws (collectively, “forward-looking statements”). The words “will”, “intend”, “anticipate”, “could”, “should”, “may”, “might”, “expect”, “estimate”, “forecast”, “plan”, “potential”, “project”, “assume”, “contemplate”, “believe”, “shall”, “scheduled”, and similar terms and, within this news release, include, without limitation, any statements (express or implied) respecting: the terms and conditions of the Proposed Transaction, the pro forma capitalization of ValOre following completion of the Proposed Transaction, the South Atlantic Shareholder Meeting; the proposed timing and completion of the Proposed Transaction; the satisfaction of the conditions precedent to the Proposed Transaction; timing, receipt and anticipated effects of regulatory and other approvals; the delisting of the South Atlantic Shares from the TSXV, South Atlantic ceasing to be a reporting issuer and all other statements that are not statements of historical facts. Forward-looking statements are not guarantees of future performance, actions, or developments and are based on expectations, assumptions and other factors that management currently believes are relevant, reasonable, and appropriate in the circumstances.

Although management believes that the forward-looking statements herein are reasonable, actual results could be substantially different due to the risks and uncertainties associated with and inherent to each of ValOre’s and South Atlantic’s respective businesses (as more particularly described in each of their continuous disclosure filings available under their respective SEDAR+ profile at www.sedarplus.ca), as well as the following particular risks: risks that a condition to closing of the Proposed Transaction may not be satisfied; risks that the requisite South Atlantic Shareholder approvals, or other applicable approvals for the Proposed Transaction may not be obtained or be obtained subject to conditions that are not anticipated; the market price of parties’ respective common shares and business generally; potential legal proceedings relating to the Proposed Transaction and the outcome of any such legal proceeding; the inherent risks, costs and uncertainties associated with transitioning the business successfully and risks of not achieving all or any of the anticipated benefits of the Proposed Transaction, or the risk that the anticipated benefits of the Proposed Transaction may not be fully realized or take longer to realize than expected; the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement; the risk that the Proposed Transaction will not be consummated within the expected time period, or at all.

Actual results or events could differ materially from those contemplated in forward-looking statements as a result of, without limitation, the following: the ability to secure the required South Atlantic Shareholder or regulatory approvals; the occurrence of a material adverse effect, the receipt by South Atlantic of a superior proposal, or the failure by either party to satisfy any other closing condition in favour of the other provided for in the Agreement, which condition is not waived; general business, economic, competitive, political and social uncertainties; and the future performance, financial and otherwise, of ValOre and South Atlantic. All forward-looking statements included in this news release are expressly qualified in their entirety by these cautionary statements. The forward-looking statements contained in this news release are made as at the date hereof and neither ValOre nor South Atlantic undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

| Last Trade: | US$0.07 |

| Daily Volume: | 0 |

| Market Cap: | US$18.360M |

December 22, 2025 February 18, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS