Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

ValOre Metals Initiates Comprehensive Metallurgical Testwork Program at Pedra Branca

VANCOUVER, British Columbia, Nov. 20, 2023 (GLOBE NEWSWIRE) -- ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTCQB: KVLQF; Frankfurt: KEQ0, “the Company”) today initiated a broad and comprehensive metallurgical testwork program for ValOre’s 100%-owned Pedra Branca Platinum Group Elements (“PGE”, “2PGE+Au”) Project (“Pedra Branca”) in northeastern Brazil.

Thiago Diniz, Exploration Manager, ValOre Metals Corp., stated: “This metallurgical testwork program is designed to develop a flowsheet to treat palladium-platinum bearing material of Pedra Branca, with subsequent phases of testwork aimed at refining and optimizing the effective metallurgical processes for the other resource zones at Pedra Branca.”

Jim Paterson, Chairman and CEO added: “ValOre’s exploration team continues to successfully identify extensions to the known mineralization, as well as make new discoveries along the mineralized trend at Pedra Branca. Over the past 18 months, the Company has intensified its focus on advancing the metallurgical testwork to better reflect our improved understanding of the geology. We have advanced in a number of areas collaborating with some of the top experts in their respective fields and this work is now expanding.”

Program Highlights

The planned metallurgical program will focus on samples collected from the near surface, high-grade Esbarro Deposit (mineral resource zone, having an Inferred Resource* totaling 403,000 oz at 1.16 g/t 2PGE+Au in 10.8 Mt) and includes:

- Comparing PGE liberation and subsequent recovery utilizing different crushing and comminution techniques, including conventional crushing and VeRo Liberator® crushing technology;

- Re-evaluation of gravity concentration and cyanide leaching;

- Testwork on the CLEVR® process (Dundee Sustainable Technologies).

A total of 1,200 kilograms (“kg”) of three material types from the Esbarro Deposit, those being Chromitite, Fresh and Weathered materials, have been sampled and shipped to Blue Coast Research (“Blue Coast”), a metallurgical testwork laboratory located in Parksville, BC, Canada.

It is expected that this program will be the first phase of a larger program with later optimization conducted on flowsheet options that provide the greatest potential to maximize recoveries.

Subsequent phases will also include expansion of metallurgical testwork to other zones that comprise the Inferred Mineral Resource* at Pedra Branca.

“This broad program is based on an enhanced understanding of the host rock lithologies, PGE mineralogy, mineralization controls, and grade distributions of PGE that has been developed over the last few years by ValOre’s team. This has resulted in the classification of Chromitite as a third material type at Pedra Branca, in addition to the Weathered and Fresh material types. The distinct physical and chemical properties of each of the three mineralized rock classes will enable us to design the most appropriate processes to maximize recoveries,” added Mr. Diniz.

To support the material re-classification and help guide future process optimization, advanced mineralogical evaluation is on-going at SGS Canada in Lakefield, Ontario (“SGS”) on thin sections from selected drill core from Esbarro, Cedro, Curiu and Trapia deposits, which collectively form more than 85% of the 2022 Inferred Resource* at Pedra Branca.

The mineralogical studies include thin section microscopy, TIMA-X (Tescan Integrated Mineral Analyzer), and chemical assays, and will help to characterize palladium and platinum mineral assemblages and their associations with the three material types.

It is estimated that Phase 1 of the metallurgical testwork program will be completed in 6 months.

Previous Pedra Branca Metallurgical Testwork Programs Completed by ValOre

Since 2020, metallurgical test work programs performed on material from the Pedra Branca project have focused on testing Fresh and Weathered materials from the Curiu and Esbarro Deposits.

For more information on historical and ValOre’s metallurgical testwork programs please refer to the technical report published to Sedar on May 08th, 2022 in addition to the following news releases:

- March 14, 2022: ValOre Reports Recoveries of 82.9% for Platinum, 71% for Palladium and 85.2% for Gold on a locked cycle flotation test of a Fresh composite sample from the Curiu deposit;

- October 4, 2021: ValOre PGE Assays from Metallurgical Drilling at Pedra Branca Confirm Historical Drilling Averages in Curiu and Esbarro Zones;

- January 13, 2021: ValOre Reports Ore Sorting Potential for Pedra Branca PGE Project; 176.52 g/t 2PGE+Au in Historical Core Re-Assay;

- November 9, 2020: ValOre Reports Further Metallurgical Testing Results from Pedra Branca PGE Project: 91% palladium recoveries in cyanide leach and 82% platinum recovered in 32% mass in gravity sort on Curiu Core composites, comprising fresh mineralized rock types;

- November 2, 2020: ValOre Initiates Multi-Faceted Optimization Testwork at Pedra Branca and Receives Preliminary Platsol™ Metallurgical Recoveries of 93.4% for Palladium and 95.3% for Platinum on Curiu Core and Outcrop composites, comprising fresh and weathered mineralized rock types.

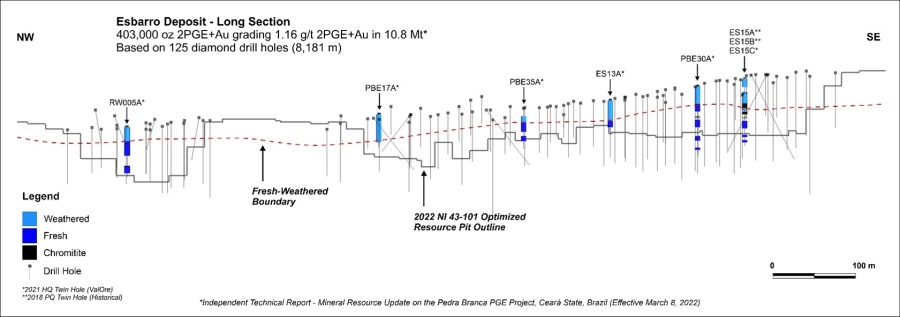

Figure 1: Long section of the Esbarro Deposit, showing location of the metallurgical twin holes sampled to form the Chromitite, Fresh and Weathered composite samples that will be subject to the testwork program. Dashed red line represents the modeled weathering surface, with approximately 45% of the 2022 Inferred Resource* at the Esbarro deposit modeled within the Weathered domain.

Figure 1: Long section of the Esbarro Deposit, showing location of the metallurgical twin holes sampled to form the Chromitite, Fresh and Weathered composite samples that will be subject to the testwork program. Dashed red line represents the modeled weathering surface, with approximately 45% of the 2022 Inferred Resource* at the Esbarro deposit modeled within the Weathered domain.

About Blue Coast Research

Blue Coast provides bankable metallurgical laboratory testwork and consulting services, with a 12,000 sq. ft. laboratory facility located in Parksville, BC, specialized in precious and base metals metallurgical flowsheet development, evaluating a wide range of processes and technologies including grinding, froth flotation and gravity concentration at scales from micro-testing to full continuous pilot plant. In addition, Blue Coast has extensive capability in cyanidation, including heap leach amenability testwork. For more information about Blue Coast Research, please CLICK HERE.

About CLEVR® process (Dundee Sustainable Technologies – “DST”)

The CLEVR® process uses sodium hypochlorite with a catalytic amount of sodium hypobromite in acidic conditions to put precious metals into solution. Contact time is short, and the process operates in a closed loop. All chemicals are recycled within the circuit and, if needed, sea water may be used and can be beneficial to the process. The tailings from the process are inert from toxic substances, sulfide depleted and non-acid generating, and as a result, meeting and/or exceeding environmental norms. DST’s process eliminates the need for a costly tailings pond and the risks of land failure. For more information about DST and the CLEVR® process, please CLICK HERE.

About VeRo Liberator®

The VeRo Liberator® technology applies high-velocity impacts to solve the problem of inefficient comminution and incomplete particle liberation and release. The groundbreaking VeRo Liberator® technology delivers high degrees of comminution, liberation, and release in just one quick flow-through operation and consumes significantly less energy than conventional comminution methods – the VeRo Liberator® also works dry. In its modular, scalable, and mobile structure, the VeRo Liberator® can be individually adapted for various operations. For more information about VeRo Liberator®, please CLICK HERE.

Quality Assurance/Quality Control (“QA/QC”)

CLICK HERE for a summary of ValOre’s policies and procedures related to QA/QC and grade interval reporting.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Thiago Diniz, P.Geo., ValOre’s QP and Exploration Manager.

ValOre Closes Previously Announced Re-Pricing of Options and Warrants

The TSX Venture Exchange (the “TSXV”) has approved repricing of ValOre’s convertible securities so as to reflect the new value of ValOre’s equity after completion of its disposition of the Angilak Property, with the exercise price of such securities being adjusted to equal the volume weighted average trading price of the common shares of ValOre on the TSXV from June 21, 2023, to June 29, 2023, being $0.10 (i.e. $0.0987). The new exercise price for both options and warrants will be $0.10.

The repricing is with respect to 6,600,000 stock options expiring December 9, 2024 and 22,069,166 warrants, with 9,166,666 of such warrants expiring November 17, 2023; 3,720,000 warrants expiring August 30, 2024; and 9,182,500 warrants expiring April 21, 2025.

The terms of the warrants have also been amended to include a mandatory acceleration provision (the "Acceleration Provision") as required under the policies of the TSXV pursuant to which, if for any ten consecutive trading days (the "Premium Trading Days") following the date hereof, the closing price of the Company's common shares on the TSXV exceeds $0.125, the expiry date of warrants will be accelerated such that holders will have 30 calendar days to exercise the warrants (if they have not first expired in the normal course).

The repricing of the warrants was approved by the disinterested shareholders of the Company, and by each warrant holder or pursuant to the terms and conditions of the Company’s warrant indenture dated November 17, 2021, as applicable.

Certain options and warrants are held by insiders and related parties, and as such, would constitute a related party transaction as defined under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”). However, such actions are exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the options and / or warrants, exceeds 25 per cent of the ValOre’s market capitalization.

Closing of Previously Announced Debt Settlement

The Company is also pleased to announce that further to the news release dated May 9th, 2023 and upon receipt of TSXV, the Company has on May 26th, 2023 completed its settlement of a portion of the fees payable to Canaccord Genuity Corp., being $400,219.09, by issuance of 1,793,900 shares of the Company at a price of $0.2231 per Company share.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a team aiming to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration and innovation.

ValOre’s Pedra Branca Platinum Group Elements Project comprises 52 exploration licenses covering a total area of 56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101* inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au. ValOre’s team believes the Pedra Branca project has significant exploration discovery and resource expansion potential. (CLICK HERE to download 2022 technical report* and CLICK HERE for news release dated March 24, 2022).

*The 2022 Technical Report is entitled “Independent Technical Report –Mineral Resource Update on the Pedra Branca PGE Project, Ceará State, Brazil” was prepared as a National Instrument 43-101 Technical Report on behalf of ValOre Metals Corp. with an effective date of March 08, 2022. The 2022 Technical Report by Independent qualified persons, Fábio Valério (P.Geo.) and Porfirio Cabaleiro (P.Eng.), of GE21, commissioned to complete the mineral resource estimate while Chris Kaye of Mine and Quarry Engineering Services Inc. (MQes), was commissioned to review the metallurgical information.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at This email address is being protected from spambots. You need JavaScript enabled to view it..

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.07 |

| Daily Change: | 0.001 1.47 |

| Daily Volume: | 1,334 |

| Market Cap: | US$17.590M |

December 22, 2025 | |