Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

ValOre Metals Drills Multiple Zones of Near-Surface Radioactivity at Dipole Target, Angilak Property Uranium Project

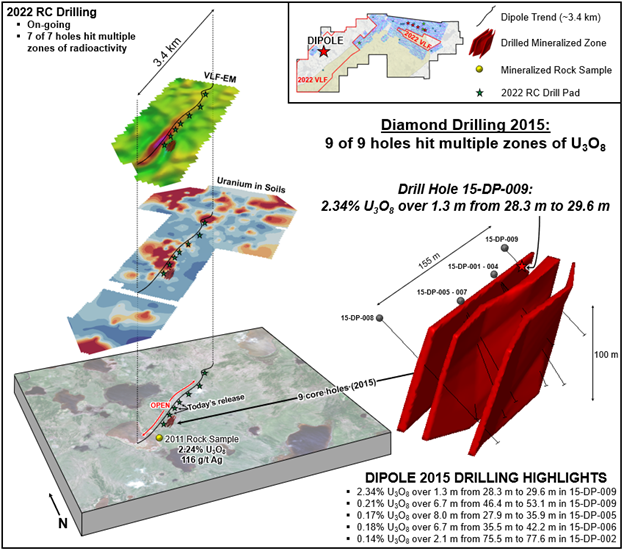

ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) today provided a preliminary update on the Reverse Circulation (“RC”) drilling at ValOre’s 100% owned 59,483-hectare Angilak Property Uranium Project (“Angilak”), located in Nunavut Territory, Canada. All seven RC holes drilled at the Dipole target have intersected multiple, shallow zones of radioactivity.

“Dipole was first drilled in 2015, where 9 of 9 ValOre diamond drill holes intersected multiple zones of near surface uranium mineralization in rocks analogous to those found in the Lac 50 Trend deposits,” stated ValOre’s VP of Exploration, Colin Smith. “2022 RC drilling at Dipole confirms that U3O8 mineralization remains open at depth and along strike in both directions coincident to a 3.4-km-long, coincident, VLF-EM conductor and uranium-in-soils anomaly.”

Angilak Property Uranium Project 2022 Dipole RC Drilling Highlights:

- Seven RC drill holes in 778.76 metres (“m”) drilled to date from 3 drill sites at Dipole, out of a planned 16 holes (1,865 m);

- Multiple zones of near-surface radioactivity intersected in 7 of 7 holes (Table 1), with all holes returning scintillometer counts per second (“CPS”) measurements over 500 CPS, with a maximum of 65,535 CPS in drill hole RC22-DP-005;

- RC drilling to date has expanded the prospective structure along strike by 150 m to the northeast, doubling the historical trend to 300 m in length and wide open in both directions, and at depth;

- Total of 43 samples (65.53 m total) from 7 holes have been submitted for assay to date;

- RC drilling continues at Dipole, with significant U3O8 intercepts to be followed-up in the summer core drilling program.

CLICK HERE for ValOre’s May 9, 2022 video summarizing this news release.

Table 1: Preliminary 2022 RC Drilling Results (Scintillometer CPS Radioactivity)

| Hole ID | EOH (m) | Max CPS | Zone 1* | Zone 2* | Zone 3* | Zone 4* |

| RC22-DP-001 | 100.58 | 1,020 | 64.01-65.5 m @ 560 CPS | 70.10-71.6 m @ 1,200 CPS | - | - |

| RC22-DP-002 | 128.02 | 5,320 | 36.58-38.10 m @ 2,280 CPS | 73.15-80.77 m @ 2,242 CPS (avg) and 5,320 CPS (max) | - | - |

| RC22-DP-003 | 100.58 | 590 | 65.53-67.06 m @ 590 CPS | 85.34-86.87 m @ 560 CPS | - | - |

| RC22-DP-004 | 120.40 | 630 | 73.20-77.72 m @ 630 CPS | 97.54-99.06 m @ 520 CPS | - | - |

| RC22-DP-005 | 111.25 | 65,535 | 30.48-35.05 m @ 5,648 CPS (avg) and 15,380 (max) | 47.24-54.86 m @ 17,270 CPS (avg) and 65,535 CPS (maxed out scintillometer) | 57.91-62.48 m @ 706 CPS (avg) and 773 CPS (max) | 68.58-73.15 m @ 550 CPS (avg) and 722 CPS (max) |

| RC22-DP-006 | 111.25 | 4,505 | 47.24-50.29 m @ 2,518 CPS (avg) and 4,505 CPS (max) | 60.96-62.48 m @ 630 CPS and 67.06-68.58 m @ 985 CPS | 76.20-82.30 m @ 1,246 CPS (avg) and 3,110 CPS (max) | 91.44-96.01 m @ 892 CPS (avg) and 1,750 CPS (max) |

| RC22-DP-007 | drilling | 26,580 | 65.53-70.10 m @ 8,486 CPS (avg) and 15,400 CPS (max) | 92.96-99.06 m @ 10,080 CPS (avg) and 26,580 CPS (max) | Drilling ongoing | Drilling ongoing |

* All zone interval measurements are metres (“m”) down-hole, and true widths are yet to be determined

2015 Core Drilling Success at Dipole

Nine of nine core holes drilled in 2015 intercepted multiple stacked zones of U3O8 mineralization at vertical depths ranging from 15 m to 110 m and along 150 m of strike length (Figure 1). Assay highlights include:

- 2.34% U3O8 and 44 g/t Ag over 1.3 m from 28.3 m, within a zone of 0.88% U3O8, 0.46% Mo and 17.6 g/t Ag over 3.5 m from 28.3 m, and a second separate zone of 0.21% U3O8 over 6.7 m from 46.6 m in drill hole 15-DP-009;

- 0.17% U3O8 over 8.0 m from 27.9 m in drill hole 15-DP-005;

- 0.18% U3O8 over 6.7 m from 35.5 m in drill hole 15-DP-006;

- 0.14% U3O8 over 2.1 m from 75.5 m in drill hole 15-DP-002.

2022 RC Drilling at Dipole

Exploration drilling at Dipole in 2022 will follow-up the high-grade U3O8 core intercepts from 2015, which outlined a 25 m to 48 m wide zone of multiple, steeply dipping mineralized intervals hosted in a sequence of structurally weak pyroclastic horizons. The 150 m of U3O8-bearing strike length drilled in 2015 will be further tested along 1.5 km of prospective trend, characterized by a strong VLF-EM conductor and coincident uranium-in-soil anomaly (Figure 2). It was the pairing of VLF-EM and soil data that led ValOre geologists to the Dipole drilling discovery in 2015.

The 1,865 m of proposed RC drilling will be conducted from approximately 7 drill sites, with an average of 2 holes per pad. Given the steep orientation (~70 to 75°) of Dipole’s uraniferous structures, the first hole from each pad will be drilled at a -45° dip to ensure a maximum thickness of target stratigraphy is tested, and that drilling intercepts are as close to true widths as possible. Subsequent drill hole(s) from the same pad will be drilled at steeper dips, in 10 to 15° increments, with a maximum of 3 holes at each pad.

Drill hole spacing proximal to the area of 2015 drilling will be 50 m, which is the average collar spacing at Lac 50. Subsequent step-outs along the regional strike will progressively increase to a collar spacing 100 m and 150 m (all divisible by 50 m), with a final regional step-out of 800 m along strike to the northeast, testing a strong geochemical anomaly. Favorable results on 100, 150, and 800 m step-outs may be followed up with infill drilling, to establish an overall spacing of 50 m between collars.

Preliminary RC drilling results indicate a strong continuity of the target uraniferous structure in all holes, with multiple zones of radioactivity encountered in 7 of 7 holes (7th hole, RC22-DP-007, is ongoing). This suggests a doubling of the drill-confirmed Dipole zone from 150 to 300 m, with expansion potential wide open in both directions of strike, and at depth, along a 3.4-km-long geochemically anomalous conductor. Furthermore, while the current soil sampling coverage spans 3.4 km of strike, strong uranium-in-soil anomalies are truncated on both ends of the grid, with the target conductor extending for approximately 9 km. Extensional EL soil sampling is warranted to assess the uranium potential of this regional target.

Upon receipt of continued favorable results, an expansion to the 2022 RC and/or core drilling program at Dipole will reviewed and considered.

Dipole Trend

Dipole is located approximately 27 km southwest of the Lac 50 Trend deposits (“Lac 50” - 43.3 Mlbs U3O8 in 2,831,000 tonnes grading 0.69% U3O8) in a northeast-trending belt of Archean metavolcanic rocks analogous to those that host Lac 50. In 2011, a ValOre prospecting crew uncovered highly mineralized (up to 2.24% U3O8 and 116 g/t Ag) angular boulders on the shore of a small lake proximal to and immediately down-ice from the southwest portion of a ~3.4-km-long VLF-EM conductor anomaly. Subsequent enzyme leach (“EL”) soil sampling in 2014 defined a coincident uranium anomaly, which was drill tested by 9 core holes (958 m) in 2015. All 9 holes intercepted multiple stacked zones of U3O8 mineralization at vertical depths ranging from 15 m to 110 m and along 150 m of strike length. At Dipole, U3O8 mineralization remains open at depth and along strike in both directions along a 3.4-km-long, coincident, VLF-EM conductor and uranium-in-soils anomaly.

CLICK HERE for news release dated October 19, 2015 and see Figure 1 below for a summary of Dipole.

Additional EL soil sampling in 2016 defined a new 600-m-long uranium anomaly that overlies a parallel EM conductor 1.5 km to 2.1 km northeast of the Dipole drilling. This extended the prospective trend to over 3.4 km, with both the VLF-EM and soil anomalies remaining open along strike in both directions.

Mineralization at Dipole is associated with sheared and brecciated hematite-carbonate-chlorite altered graphitic tuff units, mineralized with pitchblende and sulphides, within a sequence of mafic to intermediate tuffs and massive to pillowed basalt. Much like Lac 50, molybdenum and silver occur with, and adjacent to, the uranium mineralization at Dipole.

About Angilak

The 59,483-hectare Angilak Property is situated in the mining- and exploration-friendly Nunavut Territory, Canada, and has district-scale potential for uranium, precious and base metals. Since acquisition, ValOre has invested over CAD$55 million on resource delineation and exploration drilling (89,572 metres in 589 drill holes), metallurgy, geophysics, geochemistry, and logistics across the large land package. This work supported the development of the significant Lac 50 Trend NI 43-101 inferred resource estimate (“Lac 50”).

The Lac 50 NI 43-101 Technical Report (effective date March 1, 2013) defined an inferred resource estimate which represents Canada’s highest-grade uranium resource outside of Saskatchewan, and one of highest-grade uranium resources on a global basis. Highlights include:

- 43.3 Mlbs U3O8 in 2,831,000 tonnes grading 0.69% U3O8. CLICK HERE for a summary table of the Lac 50 Trend inferred resource estimate;

- Supported by 351 resource delineation drill holes totaling 62,023 metres (“m”);

- Metallurgical results for Lac 50 demonstrate high uranium recoveries and rapid leach kinetics. See news releases: February 28, 2013, September 11, 2013 and February 27, 2014;

- Lac 50 Trend is a 15 kilometre (“km”) by 3 km area with excellent potential for resource growth and new discoveries;

- Uranium mineralization starts at surface, and has been drilled to 380 m vertical depth;

CLICK HERE for ValOre’s May 6, 2021 video summarizing the highlights of Angilak.

CLICK HERE for ValOre’s May 6, 2021 video reviewing the 2021 focus for Angilak.

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

Information related to the independent Angilak mineral resource estimate has been approved by Michael Dufresne, M.Sc. P.Geo., President of Apex Geoscience Ltd., Robert Sim, P.Geo. of SIM Geological Inc. and Bruce Davis, FAusIMM of BD Resources Consulting Inc., who are independent QPs as defined under NI 43‐101.

Information related to the independent Pedra Branca mineral resource estimate has been approved by Fábio Valério, P.Geo., and Porfirio Cabaleiro, P.Eng., of GE21.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 52 exploration licenses covering a total area of 56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au (CLICK HERE for news release dated March 24, 2022). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at This email address is being protected from spambots. You need JavaScript enabled to view it..

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.07 |

| Daily Change: | 0.001 1.47 |

| Daily Volume: | 1,334 |

| Market Cap: | US$17.590M |

December 22, 2025 | |