Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

ValOre Metals Drills 1.54 m @ 1.40% U3O8, 179 g/t Ag, 1.9% Mo and 0.34% Cu from a depth of 152.46 m, Angilak Property Uranium Project, Nunavut, Canada

VANCOUVER, British Columbia, March 02, 2023 (GLOBE NEWSWIRE) -- ValOre Metals Corp. (“ValOre”; TSX‐V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) today reported core assay results for the Dipole and J4 West (“J4W”) targets at ValOre’s 100% owned 68,552-hectare Angilak Property Uranium Project (“Angilak”), located in Nunavut Territory, Canada.

“Results from 2022 core drilling at Dipole substantiate the target’s potential, with all fourteen holes drilled returning U3O8 intervals at vertical depths ranging from ~15 to 250 metres, including 1.54 metres at 1.40% U3O8, 179 g/t Ag, 1.9% Mo and 0.34% Cu,” stated ValOre’s VP of Exploration, Colin Smith. “2022 core assays from J4 West confirm the presence of a uraniferous structure traceable to bedrock surface over a drilled strike length of 460 m. The target conductor extends largely undrilled for an additional 800 m along trend towards the Eastern Extension uranium deposit of Lac 50.”

Highlights from Dipole and J4 West Core Drilling:

Dipole 2022 Core Assay Highlights

- Seven of fourteen sampled holes intercepted uranium intervals above the Lac 50 resource cut-off grade (0.20% U3O8), including:

- 1.54 m @ 1.40% U3O8, 179 g/t Ag, 1.9% Mo and 0.34% Cu from a depth of 152.46 m incl. 0.60 m @ 3.40% U3O8, 332 g/t Ag, 3.4% Mo and 0.56% Cu from a depth of 153.40 m (22-DP-010)

- 0.64 m @ 1.10% U3O8, 42.8 g/t Ag and 0.98% Mo from a depth of 57.83 m (22-DP-002)

- 0.63 m @ 0.61% U3O8, 6.2 g/t Ag from a depth of 141.73 m (22-DP-008)

- Dipole remains open at depth and along strike in both directions.

2022 J4 West Core Assay Highlights

- Eight of nine sampled holes returned near-surface uranium mineralization at vertical depths ranging from ~13 to 80 metres, including:

- 0.72 m @ 0.60% U3O8, 27.5 g/t Ag and 0.21% Mo from a depth of 79.87 m (22-J4W-003)

- 0.65 m @ 0.40% U3O8, 8.4 g/t Ag, 0.05% Mo from a depth of 55.65 m (22-J4W-001)

- J4W remains open at depth and along strike to the west.

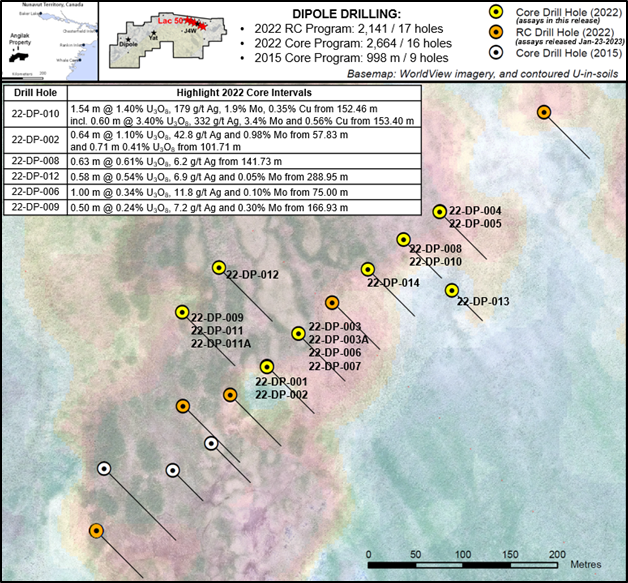

2022 Core Drilling, Dipole Target

A total of 2,664 m of core drilling was completed in sixteen holes from eight pads at the Dipole target in 2022, targeting permissive structures in a northeast trending belt of Archean metavolcanic basement rocks that represent a geological analogue to Lac 50. All holes were drilled at an azimuth of 135° and at dips ranging from -45° to -82°. Two holes (22-DP-003 and 22-DP-011) were lost at 16 m and 6 m, respectively, due to drilling conditions (Figure 1).

The 2022 core drilling was designed to test the strike potential to the northeast of the 2015 drilling discovery, along the coincident VLF-EM and uranium-in-soil trends, as well as down-dip extensions to 2015 core and 2022 Reverse Circulation ("RC") drilling (CLICK HERE for news release dated November 15, 2022, and CLICK HERE for news release dated October 19, 2015).

The 2022 core drilling results returned uranium mineralization (>0.01% U3O8) in all fourteen sampled holes, with seven of fourteen holes intercepting uranium intervals above the Lac 50 resource cut-off grade of 0.20% U3O8 (Table 1, Figures 2, 3 and 4). Reported mineralized intercepts range from 0.5 m to 6.30 m (drill hole length), at vertical depths ranging from approximately 15 m to 250 m.

Mineralization encountered in 2022 core drilling at Dipole further supports the presence of a geological analogue to Lac 50 located on the opposing side of the Angikuni Basin (~27 km away). Uranium is associated with sheared and brecciated hematite-carbonate-chlorite altered graphitic tuff units, containing pitchblende and sulphides, within a sequence of mafic to intermediate tuffs and massive to pillowed basalt. As is the case with Lac 50, molybdenum and silver occur with and adjacent to the uranium mineralization at Dipole.

2022 Core Drilling, J4 West Target

A total of 926 m of core drilling was completed in ten holes from five pads at J4W in 2022, testing an interpreted sinistral off-set and suspected continuation to the southwest of the high-grade J4 uranium deposit, which accounts for 15.3 Mlbs U₃O₈ @ 0.75% U₃O₈, 30.1 g/t Ag, 0.20% Mo and 0.26% Cu of the 43.3 Mlbs U₃O₈ Lac 50 Trend resource (Figure 5). All holes were drilled at an azimuth of 026° and at dips ranging from -45° to -90°. One hole (22-J4W-007) was lost at 31 m, due to drilling conditions.

The 2022 core drilling at J4W intercepted near-surface uranium mineralization in eight of nine sampled holes, at vertical depths ranging from ~13 to 80 m (Table 1). The mineralization styles, host rocks and alteration assemblages observed in core from 2022 are analogous to the proximal J4 deposit, supporting an off-set mineralized extension 500 m to the southwest of resource zone. Uranium occurs in a sheared interval of hematite-altered, graphitic, sulfidic, and locally brecciated tuff within a host sequence of foliated basalt and gabbro. For additional information on the J4W target, CLICK HERE for news release dated November 29, 2021, and CLICK HERE for news release dated June 15, 2022, and CLICK HERE for news release dated January 23, 2023.

The J4W target remains fully open at depth and along strike to the west, with the target VLF-EM conductor extending for an additional 800 m along strike towards the Eastern Extension of Lac 50. The western-most drill holes at J4W are represented by two 2013 core drill holes, both of which intercepted shallow uranium intervals, including: 0.30 m @ 1.06% U₃O₈ in drill hole 13-J1-002, and 0.60 m @ 0.56% U₃O₈, 0.28% Mo and 15.5 g/t Ag in drill hole 13-J1-003.

Table 1: 2022 Dipole and J4 West Core Drilling Assays

| Target | Drill Hole | Azimuth / Dip (°) | From (m) | To (m) | 2Interval (m) | 1U3O8 (%) | Ag (g/t) | Mo (%) | Cu (%) |

| Dipole | 22-DP-001 | 135 / -70 | 49.18 | 50.38 | 1.2 | 0.11 | 8.7 | 0.16 | 0.01 |

| Dipole | includes | 135 / -70 | 49.84 | 50.38 | 0.54 | 0.23 | 15.7 | 0.30 | 0.01 |

| Dipole | 22-DP-002 | 135 / -75 | 57.83 | 58.47 | 0.64 | 1.10 | 42.8 | 0.98 | 0.03 |

| Dipole | and | 135 / -75 | 101.71 | 102.42 | 0.71 | 0.41 | 3.0 | 0.05 | 0.02 |

| Dipole | 22-DP-003A | 135 / -45 | 97.69 | 98.25 | 0.56 | 0.03 | 3.0 | 0.00 | 0.03 |

| Dipole | 22-DP-004 | 135 / -70 | 79.00 | 80.36 | 1.36 | 0.05 | 4.5 | 0.00 | 0.19 |

| Dipole | and | 135 / -70 | 129.82 | 134.54 | 4.72 | 0.02 | 5.3 | 0.02 | 0.04 |

| Dipole | 22-DP-005 | 135 / -82 | 110.50 | 116.80 | 6.30 | 0.01 | 1.4 | 0.00 | 0.04 |

| Dipole | and | 135 / -82 | 171.81 | 173.77 | 1.96 | 0.02 | 4.4 | 0.00 | 0.05 |

| Dipole | 22-DP-006 | 135 / -65 | 75.00 | 76.00 | 1.00 | 0.34 | 11.8 | 0.10 | 0.02 |

| Dipole | 22-DP-007 | 135 / -82 | 103.22 | 103.90 | 0.68 | 0.02 | 4.3 | 0.10 | 0.03 |

| Dipole | and | 135 / -82 | 107.00 | 108.09 | 1.09 | 0.02 | 4.2 | 0.01 | 0.03 |

| Dipole | and | 135 / -82 | 136.13 | 137.54 | 2.13 | 0.02 | 5.3 | 0.05 | 0.02 |

| Dipole | 22-DP-008 | 135 / -45 | 141.73 | 142.36 | 0.63 | 0.61 | 6.2 | 0.05 | 0.05 |

| Dipole | 22-DP-009 | 135 / -55 | 166.93 | 167.43 | 0.50 | 0.24 | 7.2 | 0.30 | 0.01 |

| Dipole | and | 135 / -55 | 171.57 | 172.08 | 0.51 | 0.32 | 5.8 | 0.03 | 0.03 |

| Dipole | and | 135 / -55 | 175.34 | 175.87 | 0.53 | 0.29 | 4.1 | 0.00 | 0.02 |

| Dipole | 22-DP-010 | 135 / -70 | 152.46 | 155.15 | 1.54 | 1.40 | 179.0 | 1.90 | 0.34 |

| Dipole | includes | 135 / -70 | 153.40 | 154.00 | 0.60 | 3.40 | 332.0 | 3.40 | 0.56 |

| Dipole | 22-DP-011A | 135 / -70 | 223.86 | 224.54 | 0.68 | 0.02 | 6.1 | 0.34 | 0.03 |

| Dipole | and | 135 / -70 | 262.44 | 264.60 | 2.16 | 0.02 | 1.0 | 0.00 | 0.00 |

| Dipole | 22-DP-012 | 135 / -62 | 288.95 | 289.53 | 0.58 | 0.54 | 6.9 | 0.05 | 0.02 |

| Dipole | 22-DP-013 | 135 / -45 | 21.28 | 22.16 | 0.88 | 0.06 | 3.6 | 0.00 | 0.01 |

| Dipole | and | 135 / -45 | 38.45 | 38.98 | 0.53 | 0.06 | 4.6 | 0.03 | 0.03 |

| Dipole | 22-DP-014 | 135 / -45 | 57.00 | 60.24 | 3.24 | 0.06 | 3.0 | 0.00 | 0.06 |

| Dipole | and | 135 / -45 | 130.00 | 130.57 | 0.57 | 0.10 | 5.3 | 0.01 | 0.02 |

| J4 West | 22-J4W-001 | 026 / -45 | 55.65 | 56.30 | 0.65 | 0.40 | 8.4 | 0.06 | 0.07 |

| J4 West | 22-J4W-002 | 026 / -75 | 73.55 | 74.27 | 0.72 | 0.10 | 3.5 | 0.04 | 0.05 |

| J4 West | 22-J4W-003 | 026 / -90 | 79.87 | 80.59 | 0.72 | 0.60 | 27.50 | 0.21 | 0.02 |

| J4 West | 22-J4W-004 | 026 / -45 | 54.02 | 54.60 | 0.58 | 0.02 | 4.1 | 0.03 | 0.01 |

| J4 West | 22-J4W-005 | 026 / -75 | 69.34 | 70.62 | 2.25 | 0.02 | 5.1 | 0.12 | 0.01 |

| J4 West | 22-J4W-006 | 026 / -45 | 53.99 | 54.58 | 0.59 | 0.06 | 3.1 | 0.03 | 0.01 |

| J4 West | 22-J4W-007A | 026 / -75 | no significant assays | ||||||

| J4 West | 22-J4W-008 | 026 / -45 | 18.63 | 19.81 | 2.25 | 0.06 | 6.1 | 0.05 | 0.04 |

| J4 West | 22-J4W-009 | 026 / -75 | 77.44 | 78.14 | 0.70 | 0.02 | 2.9 | 0.01 | 0.01 |

Notes:

- 1Core samples submitted to Saskatchewan Research Council Geoanalytical Laboratories (“SRC”) in Saskatoon, Saskatchewan, for assay via ICP1, ICP2, and U3O8. ICP1 results >1,000 ppm U are subjected to SRC %U3O8 assay; ICP1 results for Cu, Mo and Ag are reported by SRC in parts per million (ppm). 1 ppm = 1 g/t, 10,000 ppm = 1%.

- 2All "From", "To" and "Interval" measurements are metres down-hole. True widths are yet to be determined.

Quality Control/Quality Assurance (“QA/QC”)

ValOre’s QA/QC procedure for core logging and sampling includes the systematic insertion of blanks, standards, and duplicates in the field, alternating on every 20th sample, in addition to in-house laboratory QA/QC protocol which includes blanks analysed every 49 samples and a repeat analysis on every 10th sample. All QA/QC results associated with the assays reported herein are within expectation.

Core drilling samples were submitted to the Saskatchewan Research Council Geoanalytical Laboratories (“SRC”) for assay. The SRC facility operates in accordance with ISO/IEC 17025:2005 (CAN-P-4E), General Requirements for the Competence of Mineral Testing and Calibration laboratories and is accredited by the Standards Council of Canada. For more information about SRC, CLICK HERE.

About Angilak

The 68,552-hectare Angilak Property is situated in the mining- and exploration-friendly Nunavut Territory, Canada, and has district-scale potential for uranium, precious and base metals. Since acquisition, ValOre has invested over CAD$65 million on resource delineation and exploration drilling (89,572 metres in 589 drill holes), metallurgy, geophysics, geochemistry, and logistics across the large land package. This work supported the development of the significant Lac 50 Trend inferred uranium resource estimate (“Lac 50”).

The Lac 50 NI 43-101 Technical Report (effective date March 1, 2013) defined an inferred resource estimate which represents the highest-grade uranium resource over 20 million pounds U3O8 outside of Saskatchewan. Highlights include:

- 43.3 M lbs U3O8 in 2,831,000 tonnes grading 0.69% U3O8, CLICK HERE for a summary table of the Lac 50 Trend inferred resource estimate;

- Supported by 351 resource delineation drill holes totaling 62,023 metres (“m”);

- Metallurgical results for Lac 50 demonstrate high uranium recoveries and rapid leach kinetics. See news releases: February 28, 2013, September 11, 2013 and February 27, 2014;

- Lac 50 Trend is a 15 kilometre (“km”) by 3 km area with excellent potential for resource growth and new discoveries;

- Uranium mineralization starts at surface, and has been drilled to 380 m vertical depth;

Qualified Person (“QP”)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 52 exploration licenses covering a total area of 56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022 NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6 Mt grading 1.08 g/t 2PGE+Au (CLICK HERE for news release dated March 24, 2022). All the currently known Pedra Branca inferred PGE resources have reasonable prospect of eventual economic extraction via open pit methods.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at This email address is being protected from spambots. You need JavaScript enabled to view it..

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.07 |

| Daily Change: | 0.001 1.47 |

| Daily Volume: | 1,334 |

| Market Cap: | US$17.590M |

December 22, 2025 | |