SASKATOON, SK, Feb. 29, 2024 /CNW/ - IsoEnergy Ltd. ("IsoEnergy" or the "Company") (TSXV: ISO) (OTCQX: ISENF) is pleased to announce its strategic decision to reopen access to the underground at our Tony M uranium mine ("Tony M" or the "Mine) in the first half of 2024 ("H1-2024"), with the goal of restarting uranium production operations in 2025, should market conditions continue as expected. The decision to advance Tony M is underpinned by rising uranium prices, the climate of increasing support and demand for nuclear energy, and the recent announcement by Energy Fuels Inc. ("EFR") to restart its uranium circuit at the White Mesa Mill (the "Mill"), with whom IsoEnergy has a toll milling agreement.

Tony M, along with our Daneros and Rim projects, is one of three past-producing, fully-permitted, uranium mines in Utah owned by IsoEnergy, and is a large-scale, fully-developed and permitted underground mine that previously produced nearly one million pounds of U3O8 during two different periods of operation, from 1979-1984 and from 2007-2008.

IsoEnergy CEO and Director Phil Williams stated, "With the uranium spot price now trading around US$100 per pound1, we are in the very fortunate position of owning multiple, past-producing, fully-permitted uranium mines in the U.S. that we believe can be restarted quickly with relatively low capital costs. Our existing toll-milling agreement with Energy Fuels places IsoEnergy in a unique position to become a conventional uranium producer in the near-term.

Multiple work streams are now underway to move our flagship Tony M Mine back toward production in 2025, in line with the timing Energy Fuels has announced for its White Mesa Mill for which IsoEnergy has a toll milling agreement. Given current and expected near term uranium market dynamics, we think this restart timing is ideal and would firmly place us in a very small group of uranium companies able to deliver uranium production in the near term. I would also like to welcome Josh to the team. We are fortunate to be able to attract such high-quality talent, which we believe is a testament to our projects and vision for the Company."

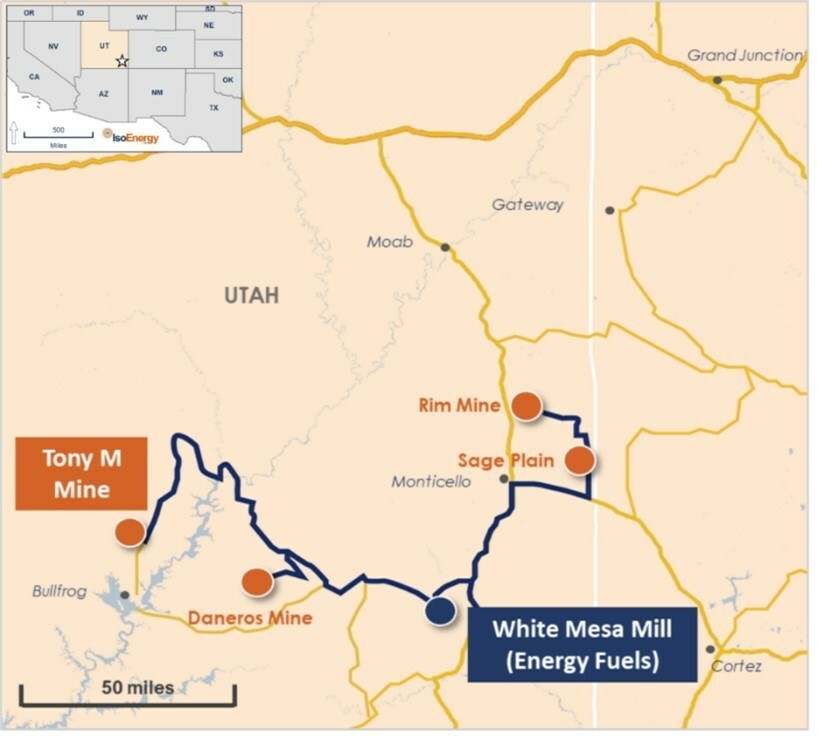

Figure 1 – Location map of Tony M, Daneros and Rim Mines and the Sage Plain Project in proximity to Energy Fuel's White Mesa Mill, the only operational conventional uranium mill in the U.S. with licensed capacity of over 8Mlbs of U₃O₈ per year, located in Utah.

_____________________________ |

1 Uranium - Price - Chart - Historical Data - News (tradingeconomics.com) |

The Company is continuing to advance plans to reopen the underground mine workings in preparation for a potential restart of Tony M. This work program includes updating mine ventilation and escape plans, maintenance of the existing ventilation fans and power infrastructure, surveying of the underground mine workings, rehabilitation of mine workings and ground support as needed, and upgrading and/or replacement of utilities.

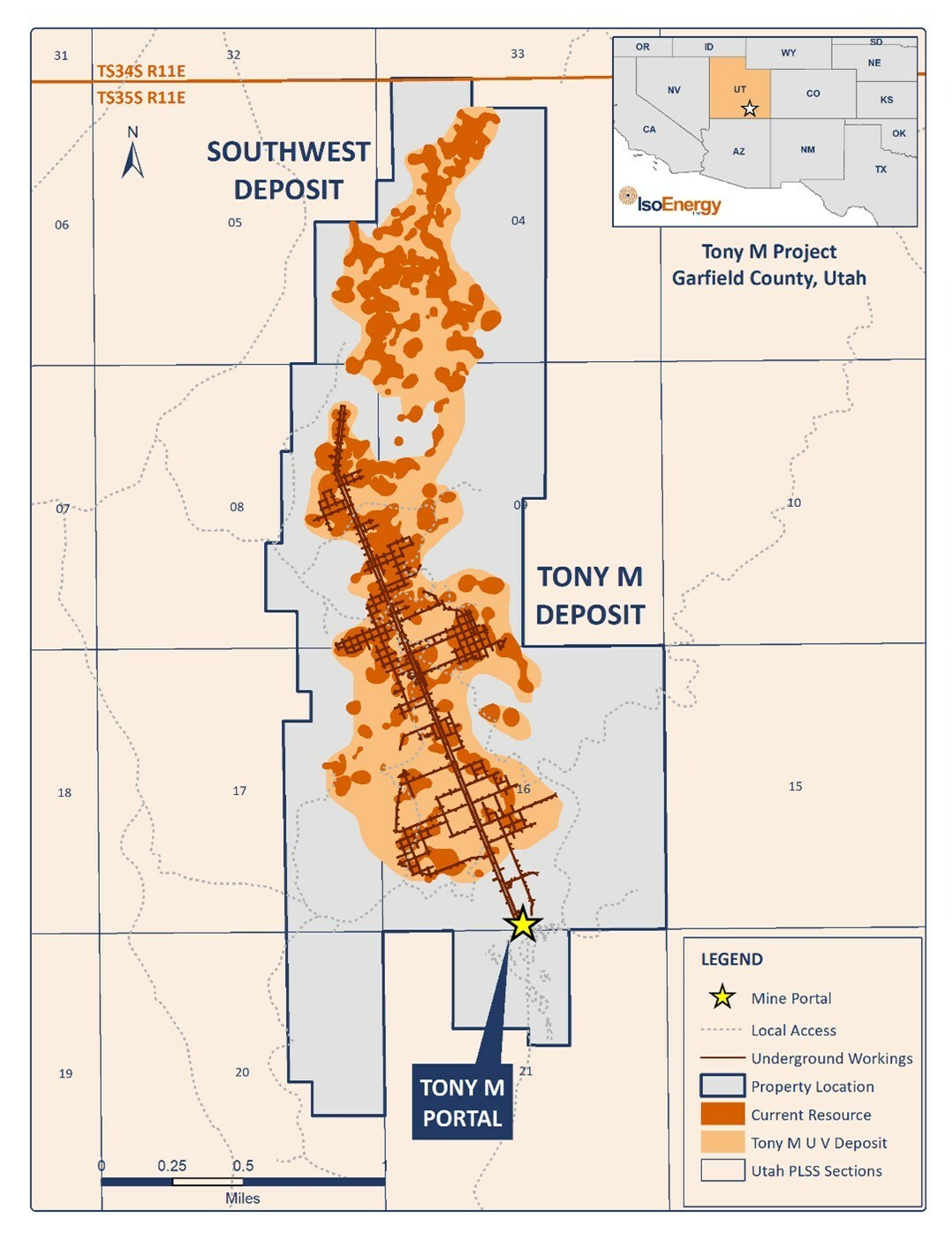

Rehabilitation of the underground is expected to take place during H1-2024, followed by planned geologic mapping and sampling alongside mine planning ahead of anticipated completion of the Study. The Company currently expects to utilize contract mining initially. In addition to the 18 miles of underground development, including multiple production headings, the Mine has complete surface infrastructure in place (Figure 2).

IsoEnergy continues to work with RME Consulting, a leading international, technical underground mining ventilation and refrigeration design firm, to oversee the design and implementation of the ventilation plan and Call & Nicholas, Inc., an international mining consulting firm that specializes in geological engineering, geotechnical engineering, and hydrogeology, to assess the mine's ground conditions.

Figure 2 – Image of large-scale surface infrastructure at the Tony M Mine, which includes two parallel declines extending 10,200 ft, a power generation station, fuel storage facility, ore bays, maintenance building, offices, dry facilities and evaporation pond.

IsoEnergy has guaranteed access to the White Mesa Mill by way of a toll milling agreement with Energy Fuels, providing a significant advantage to the Company. The Mill is the only operational conventional uranium mill in the U.S. with licensed capacity of over 8Mlbs of U₃O₈ per year. The Mill is within trucking distance to Tony M. It is an important distinction worth noting that a toll milling agreement and the selling of ore to EFR/White Mesa are very different, with toll milling allowing IsoEnergy to participate in the upside of the uranium price.

The Tony M Mine is located in eastern Garfield County, southeastern Utah, approximately 66 air miles (107 kilometers) west northwest of the town of Blanding and 215 miles (347 kilometers) south-southeast of Salt Lake City. The project is the site of the Tony M underground uranium mine that was developed by Plateau Resources, a subsidiary of Consumer Power Company, in the mid-1970s.

Uranium and vanadium mineralization at the Tony M mine is hosted in sandstone units of the Salt Wash Member of the Jurassic age Morrison Formation, one of the principal hosts for uranium deposits in the Colorado Plateau region of Utah and Colorado.

Tony M has been estimated to contain the following mineral resources:

Table 1: Summary of Mineral Resources – Effective Date September 9, 2022

Classification | Tons | Grade | Contained Metal |

Indicated | 1,185,000 | 0.28 | 6,606,000 |

Inferred | 404,000 | 0.27 | 2,218,000 |

Notes:

Figure 3 – Plan view of the Tony M Mine

The scientific and technical information contained in this news release was reviewed and approved by Dean T. Wilton: PG, CPG, MAIG, a consultant of IsoEnergy who is a "Qualified Person" (as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects).

IsoEnergy Ltd. (TSXV: ISO) (OTCQX: ISENF) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S., Australia, and Argentina at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East Project in Canada's Athabasca Basin, which is home to the Hurricane deposit, boasting the world's highest grade Indicated uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels Inc. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, statements with respect to the planned work program starting in H1-2024 and potential results and benefits thereof; plans for the potential restart of mining operations at Tony M, Daneros and Rim; expectations regarding the preparation and timing of the Study; underground sampling program and potential benefits thereof; expectations regarding the preparation of a potential vanadium mineral resource estimate; expectations regarding the potential upgrade of existing mineral resources from "inferred" to "indicated"; expectations regarding the restart of Tony M; expectations regarding the preparation and timing of a Preliminary Economic Assessment; the Company's ongoing business plan, sampling, exploration and work programs. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the price of uranium, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, the limited operating history of the Company, the influence of a large shareholder, alternative sources of energy and uranium prices, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to the Company set out in the Company's filings with the Canadian securities regulators and available under IsoEnergy's profile on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

| Last Trade: | US$2.43 |

| Daily Change: | 0.01 0.41 |

| Daily Volume: | 2,400 |

| Market Cap: | US$434.510M |

November 06, 2024 October 22, 2024 October 02, 2024 August 15, 2024 | |

Else Nutrition is changing the face of early childhood nutrition with clean, sustainable, plant-based products. The company has developed the world’s first whole plant-based infant formula that is targeting the $100+ billion global...

CLICK TO LEARN MORE

Northstar Clean Technologies is a cleantech company focused on the sustainable recovery and reprocessing of asphalt shingles. Northstar’s mission is to be the leader in the recovery and reprocessing of asphalt shingles in North America...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS