Sunday - May 4, 2025

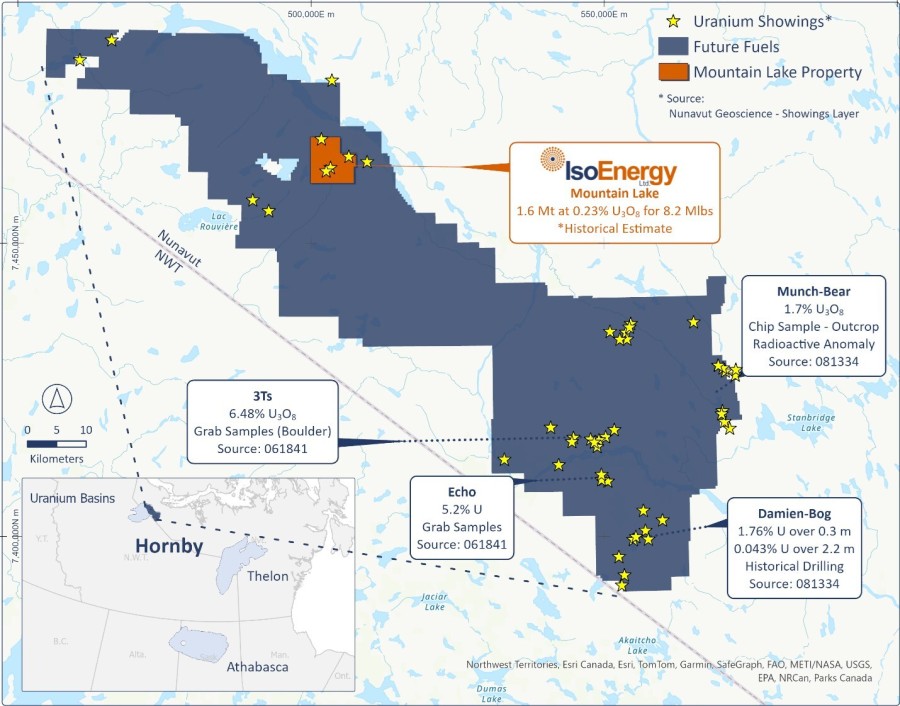

TORONTO, Nov. 14, 2024 /CNW/ - IsoEnergy Ltd. ("IsoEnergy" or the "Company") (TSX: ISO) (OTCQX: ISENF) is pleased to announce that it has entered into an asset purchase agreement (the "Agreement") with with Future Fuels Inc. ("Future Fuels"), pursuant to which the Company has agreed to sell (the "Transaction") to Future Fuels all of its right, title and interest in and to the Mountain Lake property located in Nunavut (the "Property" or "Mountain Lake"). Future Fuels (TSXV: FTUR) is a publicly traded company that has consolidated a significant land holding in the Hornby Basin, surrounding Mountain Lake (Figure 1).

Transaction Highlights

_____________________________ |

1 Equity portfolio value as of November 13, 2024. |

Figure 1: IsoEngery's Mountain Lake Property, Located within Future Fuels Hornby Project1

For additional information regarding the Mountain Lake project, please refer to the Technical report entitled "Mountain Lake Property Nunavut" dated February 15, 2005 reported by Triex Mineral Corporation. |

This estimate is a "historical estimate" as defined under NI 43-101 (as defined herein). A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources and neither IsoEnergy nor Future Fuels is treating the historical estimate as current mineral resources. See Appendix for additional details. |

Transaction Details

Pursuant to the Agreement, Future Fuels has agreed to acquire the Mountain Lake Property from IsoEnergy in consideration for:

(i) | the issuance to IsoEnergy of 12,500,000 common shares of Future Fuels (the "Upfront Shares") on closing of the Transaction (the "Closing"); |

(ii) | the issuance to IsoEnergy of 2,500,000 common shares of Future Fuels (the "Deferred Shares", and together with the Upfront Shares, the "Consideration Shares") on the earliest date practicable following Closing that will ensure that such issuance will not result in IsoEnergy owning or controlling more than 19.9% of the outstanding common shares of Future Fuels on a partially-diluted basis; and |

(iii) | the grant by Future Fuels to IsoEnergy of (a) a 2% NSR royalty, payable on all production from Mountain Lake, of which 1% will be eligible for repurchase by Future Fuels for $1,000,000, and (b) a 1% NSR royalty, payable on all uranium production from Future Fuels properties in Nunavut other than Mountain Lake. |

The Consideration Shares, when issued, will be subject to contractual restrictions on resale beginning from the date of closing, as well as a statutory hold period of four months and one day from the date of issuance. Closing of the Transaction is subject to certain conditions and approvals, including:

(i) | the execution of an investor rights agreement providing IsoEnergy, for so long as IsoEnergy owns 10% or more of the issued and outstanding common shares of Future Fuels on a partially diluted basis, with the right to: | |

a. nominate one director to the Future Fuels board of directors; and | ||

(ii) | completion of the Concurrent Financing (as defined below) for minimum gross proceeds of $2,000,000; and | |

(iii) | the approval of the TSX Venture Exchange (the "Exchange"). | |

Future Fuels Concurrent Financing

As a condition to Closing of the Transaction, Future Fuels will complete a non-brokered private placement (the "Concurrent Financing" of a minimum of 8,000,000 units (the "Units") at a price of $0.25 per Unit, each Unit to consist of one common share and one-half of one warrant of Future Fuels. Each whole warrant will entitle the holder to purchase one additional common share of Future Fuels at a price of $0.40 per share for a period of 24 months from the closing of the Concurrent Financing.

Qualified Person Statement

The scientific and technical information contained in this news release was reviewed and approved by Dr. Dan Brisbin, P.Geo., IsoEnergy's Vice President, Exploration, who is a "Qualified Person" (as defined in NI 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101")).

About IsoEnergy Ltd.

IsoEnergy Ltd. (TSX: ISO) (OTCQX: ISENF) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S., and Australia at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East Project in Canada's Athabasca Basin, which is home to the Hurricane deposit, boasting the world's highest grade Indicated uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels Inc. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

About Future Fuels Inc.

Future Fuels' principal asset is the Hornby Uranium Project, covering the Hornby Basin in north-western Nunavut, a geologically promising area with over 40 underexplored uranium showings, including the historic Mountain Lake Deposit. Additionally, Future Fuels holds the Covette Property in Quebec's James Bay region, comprising 65 mineral claims over 3,370 hectares.

Neither the TSX Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, statements with respect to the statements with respect to the completion of the Transaction; the anticipated benefits of the Transaction to the Company and its shareholders; the expected receipt of regulatory and other approvals relating to the Transaction; the expected satisfaction of the other conditions to completion of the Transaction; the Company's ongoing business plan, exploration and work programs. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Transaction will be completed in accordance with the terms and conditions thereof, that the parties will receive the required regulatory approvals and will satisfy, in a timely manner, the other conditions to completion of the Transaction, the accuracy of management's assessment of the effects of the successful completion of the Transaction and that the anticipated benefits of the Transaction will be realized, the price of uranium, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: the inability of IsoEnergy to complete the Transaction, a material adverse change in the timing of and the terms and conditions upon which the Transaction is completed, the inability to satisfy or waive all conditions to completion of the Transaction, the failure to obtain regulatory approvals in connection with the Transaction, the inability to realize the benefits anticipated from the Transaction, negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, the limited operating history of the Company, the influence of a large shareholder, alternative sources of energy and uranium prices, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to the Company set out in the Company's annual information form in respect of the year ended December 31, 2023 and other filings with the Canadian securities regulators and available under IsoEnergy's profile on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

| Last Trade: | US$1.86 |

| Daily Volume: | 0 |

| Market Cap: | US$332.590M |

February 18, 2025 February 13, 2025 January 23, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS