DeFi Technologies Inc. (the "Company" or "DeFi Technologies") (NEO: DEFI) (GR: RMJR) (OTC: DEFTF), a technology company bridging the gap between traditional capital markets and decentralized finance, announced today that its wholly owned subsidiary, Valour Inc. ("Valour"), the pioneering issuer of digital asset exchange traded products ("ETPs"), has surpassed US$274 million in assets under management (AUM).

Valour recently unveiled two new products: the Valour Avalanche (AVAX) ETP and Valour Terra (LUNA) ETP. With the recent announcements of a joint ETP venture with SEBA Bank AG, a digital asset backed program and a special purpose vehicle to support the distribution of that program, the Company expects additional growth of Valour's AUM.

Current AUM:

BTC Zero: $95,232,000

ETH Zero: $67,371,000

ADA Valour: $43,408,000

DOT Valour: $24,409,000

SOL Valour: $38,498,000

UNI Valour: $1,450,000

LUNA Valour: $2,605,000

AVAX Valour: $1,256,000

Total AUM : $274,229,000

"Since listing our first product, Bitcoin Zero, on the Nordic Growth Market just over a year ago we have seen an incredible reception to our ETP offerings," said Russell Starr, CEO of DeFi Technologies. "We are still in a very early growth stage and our team has done a tremendous job of planting seeds for future growth by launching eight ETPs across several exchanges in Europe that enable individuals and institutions to invest in digital assets simply and securely. With more product launches, new exchange listings, a digital asset backed program and our joint ETP venture with SEBA Bank AG we are very excited for the Company's growth trajectory in 2022 and the years to come."

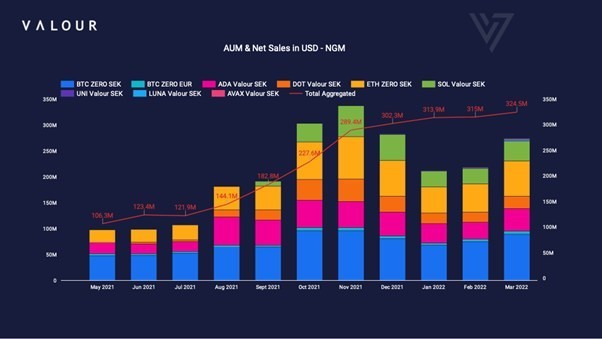

Despite volatility, Valour has also seen an increase of 205% in net sales month over month reaching over $324.5 million to date in March 2022 from $106.3 million in May 2021.

"Despite declines in the crypto market we are continuously increasing our net sales of ETP's," said Tommy Fransson, CEO of Valour. "It is a very strong sign that our ETP operation continues to have inflow regardless of market conditions. We are continuously working on launching new, interesting products, extending our distribution as well as further developing our infrastructure and presence in local markets. All this in combination makes us very confident that we are well on our way to achieve our ambition of becoming the leading ETP provider of digital assets."

Valour offers fully hedged digital asset ETPs with low to zero management fees, with product listings across four European exchanges. Valour's existing product range includes Valour Uniswap (UNI), Cardano (ADA), Polkadot (DOT), Solana (SOL), Avalanche (AVAX), and Terra (LUNA) ETPs, as well as Valour's flagship Bitcoin Zero and Valour Ethereum Zero products, the first fully hedged, passive investment product with Bitcoin (BTC) and Ethereum (ETH) as underlyings which are completely fee-free, with competitors charging up to 2.5% in management fees.

Learn more about DeFi Technologies and Valour at defi.tech and valour.com.

About DeFi Technologies

DeFi Technologies Inc. (NEO: DEFI) (GR: RMJR) (OTC: DEFTF) is a technology company bridging the gap between traditional capital markets and decentralized finance. Our mission is to expand investor access to industry-leading decentralized technologies which we believe lie at the heart of the future of finance. On behalf of our shareholders and investors, we identify opportunities and areas of innovation, and build and invest in new technologies and ventures in order to provide trusted, diversified exposure across the decentralized finance ecosystem. For more information or to subscribe to receive company updates and financial information, visit defi.tech.

About Valour

Valour Inc. issues exchange-listed financial products that enable retail and institutional investors to access investment in disruptive innovations, such as digital assets, in a simple and secure way. Established in 2019 and based in Zug, Switzerland, Valour is a wholly owned subsidiary of DeFi Technologies Inc. For more information on Valour, visit valour.com.

Cautionary note regarding forward-looking information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to development of ETPs by Valour; joint venture with SEBA Bank; the growth of AUM and net sales; expansion of DeFi Technologies and Valour into other geographic areas; the growth and adoption of decentralized finance; the pursuit by DeFi Technologies and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited to acceptance of Valour ETPs by Frankfurt, Euronext and other exchanges; investor demand for DeFi Technologies' and Valour's products; the growth and development of DeFi and cryptocurrency sector; rules and regulations with respect to DeFi and cryptocurrency; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

THE NEO STOCK EXCHANGE DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

| Last Trade: | US$2.72 |

| Daily Change: | -0.12 -4.23 |

| Daily Volume: | 181,953 |

| Market Cap: | US$832.370M |

December 18, 2024 December 12, 2024 December 10, 2024 November 26, 2024 | |

Surf Air Mobility is a regional air mobility platform expanding the category of regional air travel to reinvent flying through the power of electrification. In an effort to substantially reduce the cost and environmental impact of...

CLICK TO LEARN MORE

UGE International develops, owns, and operates commercial and community solar projects in the United States and strategic markets abroad. Our distributed energy solutions deliver cheaper, cleaner energy to businesses and consumers...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS