TORONTO, Dec. 10, 2024 /CNW/ - DeFi Technologies Inc. (the "Company" or "DeFi Technologies") (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF), a financial technology company that pioneers the convergence of traditional capital markets with the world of decentralised finance ("DeFi"), is pleased to announce the acquisition of a minority stake in Neuronomics AG ("Neuronomics"), a Swiss asset management firm specializing in quantitative trading strategies powered by artificial intelligence, computational neuroscience, and quantitative finance.

Under the terms of the LOI, DeFi Technologies will increase its stake in Neuronomics by subscribing for 10% of the issued and outstanding securities of Neuronomics (the "Investment"). This strategic investment aligns with DeFi Technologies' goals of expanding its presence in the asset management space, leveraging Neuronomics' technological innovations and market expertise. DeFi Technologies had previously acquired a toe-hold investment in Neuronomics.

Strategic Acquisition to Expand Capabilities

Neuronomics, founded in Switzerland, has established itself as a leader in asset management by developing advanced quantitative trading strategies based on artificial intelligence ("AI") and computational neuroscience. The firm holds an asset management license from the Swiss Financial Market Supervisory Authority ("FINMA"), enabling it to manage and administer financial assets on behalf of clients. Neuronomics' research-driven approach focuses on two key areas: AI and Computational Neuroscience in Finance.

Artificial Intelligence in Finance

Neuronomics has pioneered the application of advanced AI models in financial settings, delivering high risk-adjusted returns. The firm's proprietary AI models combine multiple algorithms to enhance predictive accuracy and reduce model overfitting. Their thermodynamics-based portfolio weighting approach translates AI model outputs into portfolio allocations, optimizing asset distribution to maximize returns while managing risk. Additionally, Neuronomics is at the forefront of customizing Large Language Models ("LLMs") for predicting asset price developments based on real-time market news. This capability positions Neuronomics to identify emerging investment narratives well ahead of competitors, offering a distinct edge in the market).

Computational Neuroscience in Finance

Neuronomics also explores how human cognitive biases and emotional responses shape financial behavior, uncovering market inefficiencies that traditional strategies often overlook. Through computational neuroscience, Neuronomics models the neuronal processes of traders, identifying predictable market behaviors that result from overreactions or emotional trading. This approach has been particularly successful in the cryptocurrency market, which is highly influenced by emotional decision-making. Since launching their neurofinance-based crypto strategy in July 2020, Neuronomics has consistently delivered high risk-adjusted returns with minimal correlation to traditional markets

Technological Innovation and Performance Excellence

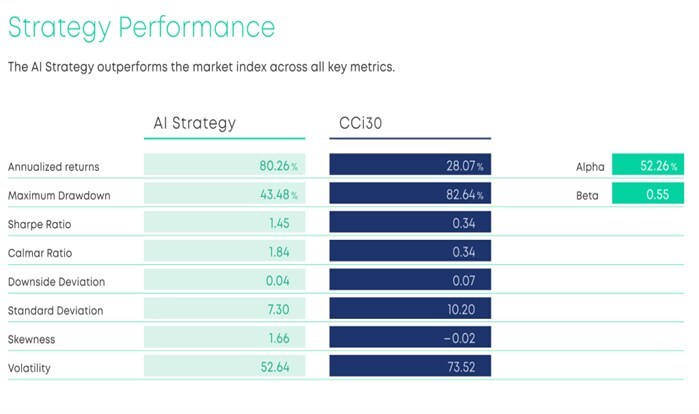

Neuronomics leverages cutting-edge AI technology to offer high risk-adjusted returns in the cryptocurrency market. Their latest developed AI-powered quantitative strategy has demonstrated exceptional performance, with forward-testing analysis showing annual returns of 80% and significantly reduced drawdowns and volatility compared to passive market exposure. The AI-driven model removes human bias, enhances consistency, and dynamically adapts to evolving market conditions, ensuring sustained performance even in volatile markets.

These strategies are built on a diversified, long-only crypto portfolio, rebalanced weekly based on advanced AI models that identify market inefficiencies such as momentum and reversal opportunities. The AI-driven approach has consistently outperformed benchmarks like the CCi30 index, achieving a Sharpe Ratio greater than 1, underscoring its superior risk-adjusted returns. Neuronomics' expertise in AI-driven strategies will significantly enhance DeFi Technologies' capabilities, especially as a complement to DeFi Alpha, its specialized arbitrage trading desk, which focuses on identifying and capitalizing on low-risk opportunities within the cryptocurrency market.

Background on Management

Executive Comments

Olivier Roussy Newton, Chief Executive Officer of DeFi Technologies, commented: "This strategic investment marks an exciting step for DeFi Technologies as we expand our presence in both asset management and trading. We have been a shareholder and partner of Neuronomics since 2023, and can see how Neuronomics' AI-driven quantitative trading strategies perfectly complement our existing capabilities and align with our broader goals. The Investment will deepen the relationship between Neuronomics and DeFi Technologies and will not only enhance our expertise in the trading sector but also diversifies our revenue streams, especially through DeFi Alpha—our specialized arbitrage trading desk that focuses on low-risk opportunities in the cryptocurrency market. By integrating Neuronomics' cutting-edge strategies, we will strengthen our ability to deliver consistent, market-neutral returns while further advancing our position in both traditional and decentralized finance."

Michael Kometer, Co-Founder of Neuronomics, added: "Partnering with DeFi Technologies presents a unique opportunity to scale our operations and continue driving innovation in quantitative trading. We believe this collaboration will bring tremendous value to our clients as we integrate Neuronomics' solutions into DeFi Technologies' comprehensive ecosystem."

Closing and Next Steps

The Investment will be subject to customary conditions and regulatory approvals.

About Neuronomics AG

Neuronomics AG is a Swiss asset management firm specializing in AI-powered quantitative trading strategies. By integrating artificial intelligence, computational neuroscience and quantitative finance, Neuronomics delivers cutting-edge solutions that drive superior risk-adjusted performance in financial markets. For more information please visit https://www.neuronomics.com/

About DeFi Technologies

DeFi Technologies Inc. (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF) is a financial technology company that pioneers the convergence of traditional capital markets with the world of decentralized finance (DeFi). With a dedicated focus on industry-leading Web3 technologies, DeFi Technologies aims to provide widespread investor access to the future of finance. Backed by an esteemed team of experts with extensive experience in financial markets and digital assets, we are committed to revolutionising the way individuals and institutions interact with the evolving financial ecosystem. Follow DeFi Technologies on Linkedin and Twitter, and for more details, visit https://defi.tech/

About Valour

Valour Inc. and Valour Digital Securities Limited (together, "Valour") issues exchange traded products ("ETPs") that provide retail and institutional investors with simple and secure access to digital assets through their traditional bank accounts. Valour's fully hedged digital asset ETPs feature low to zero management fees and are listed on various European exchanges, banks, and broker platforms. Valour operates as part of the asset management business line of DeFi Technologies Inc.

For more information about Valour, to subscribe, or to receive updates, visit valour.com

Cautionary note regarding forward-looking information:

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to statements regarding the closing of the Investment; the business and growth opportunities of Neuronomics; synergies realized from the Investment; ability of DeFi Technologies to utilize Neuronomic's trading strategies; the regulatory environment with respect to the growth and adoption of decentralized finance and digital assets; the pursuit by the Company and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited to the growth and development of decentralised finance and digital asset sector; rules and regulations with respect to decentralised finance and digital assets; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| Last Trade: | US$3.07 |

| Daily Volume: | 0 |

| Market Cap: | US$1.000B |

December 16, 2025 December 15, 2025 November 26, 2025 November 03, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS