Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Atlantic Lithium Limited Announces Quarterly Activities and Cash Flow Report Dec 2022

- Corporate Update

- Quarterly Activities and Cash Flow Report for the quarter ended 31 December 2022

- Highlights

SYDNEY, AUSTRALIA / ACCESSWIRE / January 30, 2023 / The Board of Atlantic Lithium Limited ("Atlantic Lithium" or the "Company"), the funded African-focussed lithium exploration and development company targeting to deliver Ghana's first lithium mine, is pleased to present its Quarterly Activities Report for the period ended 31 December 2022.

During the quarter, Atlantic Lithium successfully lodged the Mining License Application for the Ewoyaa Lithium Project ("Ewoyaa" or the "Project"), appointed a new Chief Operating Officer, awarded the Front-End Engineering Design (FEED) contract to Primero Group, appointed a Project Manager and continued to focus on advancing studies with further drill results received and highest intersections to date in drilling at the Project, located in Ghana, West Africa.

During the reporting period, Atlantic Lithium:

- Submitted a Mining Licence ("ML") application in respect to the extraction of minerals from the proposed Ewoyaa Lithium Mine to the Minerals Commission of Ghana ("MinCom").

- Completed the infill diamond core and reverse circulation drilling programme at Ewoyaa Project to a total of 47,000m.

- Assay results reported for a further 26,423m of infill and exploration drilling outside of the current 30.1Mt at 1.26% Li2O Mineral Resource, providing potential for further resource upgrade.

- The contract for the processing plant FEED for the Ewoyaa Lithium Project in Ghana, West Africa was awarded to the Primero Group, an industry-leading vertically integrated engineering group.

- Appointed Keith Muller as its new Chief Operating Officer and Roux Terblanche as Project Manager of the Ewoyaa Project.

- Vincent Mascolo was shortlisted for 'Mining CEO of the Year Award' at the Mine and Money London 2022 Conference

- Cash on hand at end of quarter was A$19.1 million.

Final high-grade assays were received for the infill and exploration drilling program on 12 January 2023, after the reporting period.

Ewoyaa Lithium Project, Ghana, West Africa

Ewoyaa is the Company's flagship project and is targeted to be Ghana's first lithium-producing mine, having secured US$103m project development funding via a partnership agreement with Piedmont Lithium Inc. (NASDAQ: PLL; ASX: PLL, refer RNS of 31 August 2021).

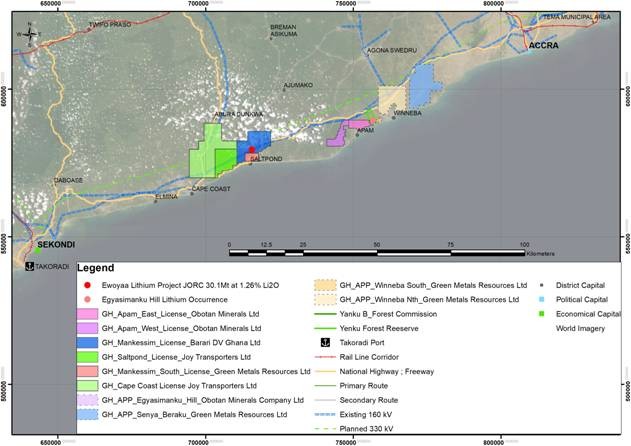

The Project includes the Ewoyaa, Anokyi, Grasscutter, Abonko and Kaampakrom deposits and is located in Ghana, West Africa, approximately 100km southwest of the capital of Accra. The Project is well located being adjacent to operational infrastructure including 1km from the Takoradi - Accra N1 highway, 110km from the Takoradi deep-sea port and adjacent to hydroelectric sourced grid power, within the pro-mining jurisdiction of Ghana.

The Project is proven to produce a premium Spodumene concentrate ("SC6") product suitable for conversion to battery grade lithium carbonate and hydroxide. The site is easily accessed from Accra via the bitumen Accra-Cape Coast-Takoradi highway being 100km from the Capital city Accra (refer Figure 1).

Figure 1: Location of the Ewoyaa Lithium Project

December Quarter Activities

Mining Licence Application lodged for Ewoyaa Lithium Project, Ghana, West Africa

The Company successfully lodged the Mining License ("ML") application in respect to the extraction of minerals from the proposed Ewoyaa Lithium Mine ("Ewoyaa" or the "Mine") to the Minerals Commission of Ghana in West Africa (refer announcement of 13 October 2022).

Atlantic Lithium's majority-owned Ghana company, Barari DV Ghana Ltd, and wholly owned Ghana subsidiary company, Green Metals Resources Ltd, lodged initial documents in support of its ML application for the Project.

The application will now be assessed by the Ghanaian Government as soon as practicably possible as part of the approval process ahead of the grant of the ML and includes the submission of the Company's recent Pre-Feasibility Study (announced 22 September 2022) as part of the necessary documentation.

Ewoyaa Lithium Project Drilling Assays received

During the quarter, assay results were received for approximately 26,423m of infill diamond drilling ("DD") and Reverse Circulation ("RC") drilling completed at the project (see releases dated 20 October 2022, 2 November 2022, 9 November and 29 November 2022). This formed part of the now completed 47,000m resource evaluation and exploration RC and DD programme which commenced in March 2022.

During the quarter the Company received its highest reported diamond drilling assay of 6.78% Li2O over 1m in hole GDD0071 from 30m and the highest single RC assay to date of 4.52% Li2O over 1m in hole GRC0704 from 54m and 3.99% Li2O from 53m.

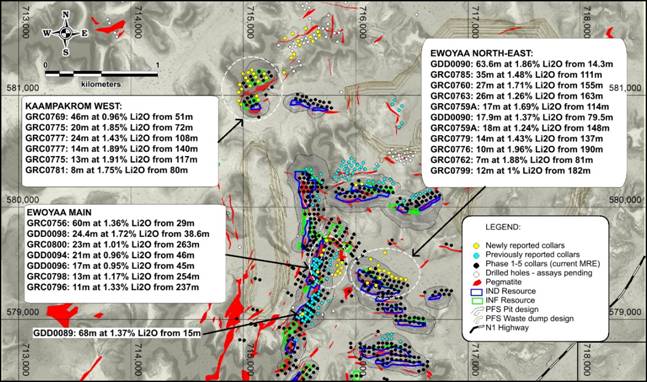

Newly reported drilling results fall both within and outside the currently defined 30.1Mt @ 1.26% Li2O Ewoyaa JORC (2012) Compliant Mineral Resource Estimate ("MRE" or the "Resource"); both extending and infilling mineralisation and providing further confidence in Resource conversion and growth at the Ewoyaa project (refer Figure 2, Figure 3 and Figure 4).

Resource infill drilling results received to date at the Ewoyaa Main and Ewoyaa North-East deposits have confirmed good mineralisation continuity and increased resource confidence on a nominal 40m x 40m Indicated grid and 20m x 20m Measured grid. Measured drilling targeted the first 1.5 to 2 years of planned production at the Ewoyaa Main deposit. Additionally, infill drilling provided further material for test-work and customer acceptance samples within the planned starter pit.

Broad, high-grade drill intersections were returned within the current MRE, reported at the Ewoyaa Main deposit, including highlights at a 0.4 Li2O cut-off and a maximum 4m of internal dilution of:

- GDD0073: 84.5m at 1.63% Li2O from 6m

- GRC0690: 89m at 1.52% Li2O from 9m

- GDD0071: 90.5m at 1.48% Li2O from 0m including 1m at 6.78% Li2O from 30m

- GDD0070: 77.5m at 1.5% Li2O from 13m

- GDD0069: 71.5m at 1.49% Li2O from 25m

- GRC0686: 62m at 1.29% Li2O from 32m

- GDD0074: 63.3m at 1.1% Li2O from 27m

- GDD0075: 44.6m at 1.56% Li2O from 37m

- GDD0078: 47.3m at 1.4% Li2O from 43.2m

- GRC0677: 50m at 1.25% Li2O from 33m

- GDD0079: 55m at 1% Li2O from 23m

- GRC0669: 59m at 0.95% Li2O from 113m

- GRC0697: 95m at 1.48% Li2O from 5m

- GRC0703: 87m at 1.61% Li2O from 0m

- GRC0701: 78m at 1.67% Li2O from 12m

- GRC0710: 74m at 1.65% Li2O from 15m

- GRC0692: 76m at 1.43% Li2O from 14m

- GRC0720: 62m at 1.34% Li2O from 28m

- GRC0722: 57m at 1.31% Li2O from 23m

- GRC0717: 47m at 1.57% Li2O from 43m

- GRC0712: 72m at 0.85% Li2O from 18m

- GRC0700: 44m at 1.32% Li2O from 46m

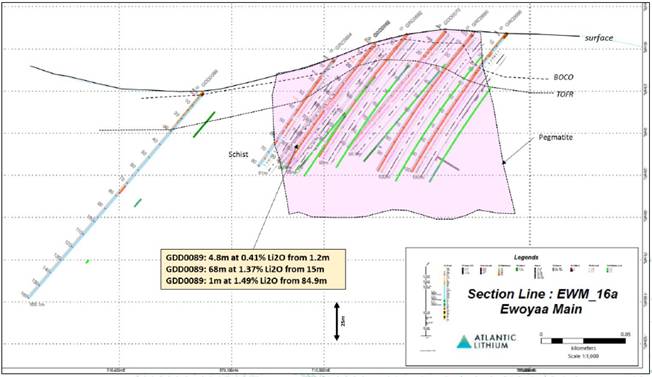

- GDD0089: 68m at 1.37% Li2O from 15m

- GRC0756: 60m at 1.36% Li2O from 29m

Broad, high-grade drill intersections were returned outside of the current MRE, reported at the Ewoyaa Main, Grasscutter East and West, Anokyi and Kaampakrom West deposits, including highlights of:

- GRC0688A: 67m at 1.51% Li2O from 235m

- GRC0721: 45m at 1.16% Li2O from 274m

- GRC0785: 35m at 1.48% Li2O from 111m

- GRC0760: 27m at 1.71% Li2O from 155m

Figure 2: Location of selected reported assay results and drillhole IDs with highlight drill intersections at >10 lithium x meters metal content

Figure 2: Location of selected reported assay results and drillhole IDs with highlight drill intersections at >10 lithium x meters metal content

Figure 3: Cross-section A-A' showing assay results received for GDD0089 at the Ewoyaa Starter Pit deposit.

Figure 3: Cross-section A-A' showing assay results received for GDD0089 at the Ewoyaa Starter Pit deposit.

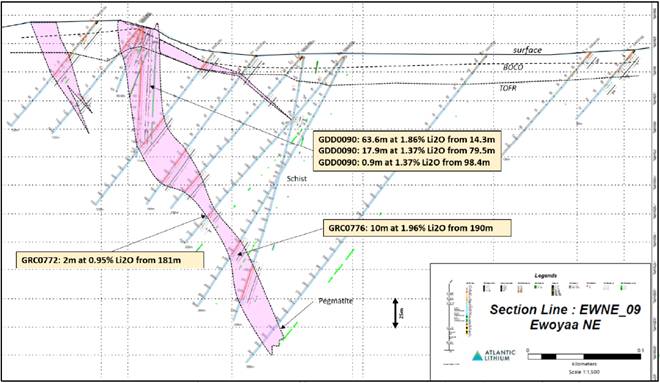

Figure 4: Cross-section C-C' assay results received for GDD0090, GRC0776 and GRC0772 at the Ewoyaa North-East deposit.

Figure 4: Cross-section C-C' assay results received for GDD0090, GRC0776 and GRC0772 at the Ewoyaa North-East deposit.

Processing Plant FEED contract awarded

On 13 December 2022 the Company announced the award of the processing plant Front-End Engineering Design contract (the "Contract") for the Project to Primero Group ("Primero"), an industry-leading vertically integrated engineering group.

Primero, a wholly owned subsidiary of NRW Holdings Limited (ASX: NRW), specialises in the design, construction and operation of global resource projects. The group has extensive experience in delivering large-scale construction contracts, including in the lithium industry and in West Africa, demonstrating significant expertise, versatility, and competence. Primero has provided services for a number of lithium projects with comparable flow sheets to Ewoyaa's, including Bald Hill (Alliance Mineral Assets), Pilgangoora (Pilbara Minerals), Finnis Lithium (Core Lithium), Mt Holland (Covalent Lithium) and Xuxa (Sigma Lithium).

Under the terms of the agreement, Primero will provide services to optimise the Project's flow sheet, identify long lead items, look to maximise the Project's long-term profitability, reduce execution risk and ultimately support the advancement of the Project towards becoming a financially and operationally robust lithium-producing mine. The value of the Contract is US$980,000; the consideration of which is to be paid in accordance with the 3-stage earn-in agreement the Company has with Piedmont Lithium Inc. (NASDAQ: PLL; ASX: PLL) to fund the Project towards production.

Ore Reserves and Resources

Table 1 provides a summary of Ore Reserves and Resources by status for the Project, where the Ore Reserves are reported as part of the total Mineral Resource. Table 2 provides a breakdown of Mineral Resources by deposit.

Probable Ore Reserves were declared for the Project. All stated Probable Ore Reserves (refer Table 1) are completely included within the quoted Mineral Resources and are quoted in dry tonnes. Probable Ore Reserves were declared based on the Indicated Mineral Resources only contained within the pit designs.

Table 1: Summary of Reserves (as of 22 September) and Resources by status

Category2 | Gross | Net attributable1 | Operator | ||||

Tonnes (Mt) | Grade (% Li20) | Contained Li Metal kt | Tonnes (Mt) | Grade (% Li2O) | Contained Li Metal kt | ||

Ore Reserves | |||||||

Proven | - | - | - | - | - | - | - |

Probable | 18.9 | 1.24 | 109 | 8.5 | 1.24 | 49 | ALL |

Sub-total | 18.9 | 1.24 | 109 | 8.5 | 1.24 | 49 | ALL |

Mineral Resources | |||||||

Measured | - | - | - | - | - | - | - |

Indicated | 20.5 | 1.29 | 123 | 9.23 | 1.29 | 55 | ALL |

Inferred | 9.6 | 1.19 | 53 | 4.32 | 1.19 | 24 | ALL |

Sub-total | 30.1 | 1.26 | 176 | 13.55 | 1.26 | 79 | ALL |

- Whilst the asset is currently wholly owned by Atlantic Lithium Limited, Piedmont Lithium Inc. can earn up to half the project through the funding agreement, whilst the Government of Ghana has the right to a 10% free carry once in production.

- Competent Person Statements - The information in this quarterly report that relates to the estimation and reporting of Ore Reserves and Mineral Resources for the Ewoyaa Lithium Project was reported by the Company on 22 September 2022. All stated Ore Reserves are completely included within the quoted Mineral Resources and are quoted in dry tonnes. The Company confirms that it is not aware of any new information or data that materially affects the information included in that announcement and that all material assumptions and technical parameters underpinning the Mineral Resource estimates, Ore Reserve estimates, production targets and forecast financial information in that announcement continue to apply and have not material ly changed. Mineral Resources are reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code - JORC 2012 Edition).

Table 2: Ewoyaa MRE by Deposit and JORC Classification (0.5% Li 2O Cut-off, above -190mRL)

Deposit | Indicated |

Tonnage Li2O Cont. Lithium Oxide Mt % kt | |

Abonko Anokyi Bypass Ewoyaa Ewoyaa Northeast Grasscutter Kaampakrom Okwesi Sill | 1.1 1.30 14 2.2 1.46 33 0.0 0.00 0 10.0 1.23 123 2.5 1.42 36 3.3 1.19 39 0.4 1.43 5 0.6 1.48 9 0.4 1.34 5 |

Total | 20.5 1.29 265 |

Deposit | Inferred |

Tonnage Li2O Cont. Lithium Oxide Mt % kt | |

Abonko Anokyi Bypass Ewoyaa Ewoyaa Northeast Grasscutter Kaampakrom Okwesi Sill | 0.7 1.18 8 1.1 1.29 14 0.2 1.15 3 4.2 1.09 46 0.9 1.19 10 1.5 1.28 19 0.6 1.31 8 0.3 1.34 4 0.1 1.57 1 |

Total | 9.6 1.19 114 |

Deposit | Total Mineral Resource |

Tonnage Li2O Cont. Lithium Oxide Mt % kt | |

Abonko Anokyi Bypass Ewoyaa Ewoyaa Northeast Grasscutter Kaampakrom Okwesi Sill | 1.8 1.25 22 3.4 1.40 47 0.2 1.15 3 14.2 1.19 169 3.4 1.36 46 4.8 1.22 58 0.9 1.35 13 0.9 1.43 13 0.5 1.38 6 |

Total | 30.1 1.26 379 |

Competent Person Statements - The information in this quarterly report that relates to the estimation and reporting of Ore Reserves and Mineral Resources for the Ewoyaa Lithium Project was reported by the Company on 22 September 2022. The Company confirms that it is not aware of any new information or data that materially affects the information included in that announcement and that all material assumptions and technical parameters underpinning the Mineral Resource estimates, Ore Reserve estimates, production targets and forecast financial information in that announcement continue to apply and have not materially changed. Mineral Resources are reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code - JORC 2012 Edition).

Competent Person Statements - The information in this quarterly report that relates to the estimation and reporting of Ore Reserves and Mineral Resources for the Ewoyaa Lithium Project was reported by the Company on 22 September 2022.

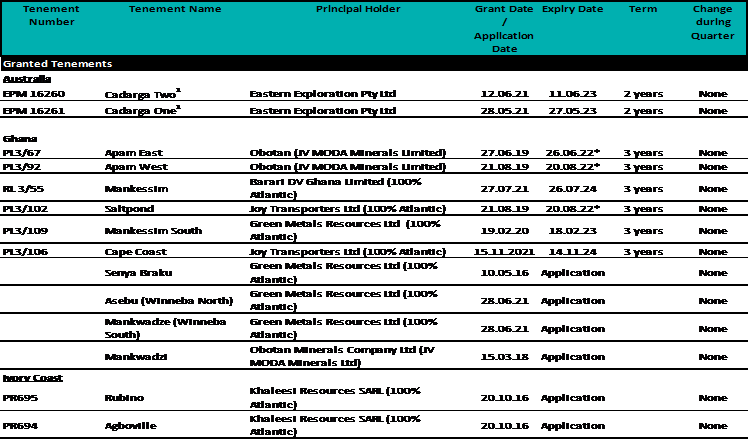

Interest in Tenements

At Quarter Ended 31 December 2022, the Group has an interest in the following tenements:

- The Australian tenures will be relinquished in the financial year ended 30 June 2023 and has been written down to zero value at 30 June 2022.

* Renewal applications have been submitted to the various mining departments of the relevant Governments and the Group has no reason to believe the renewals will not be granted.

Corporate

Appointment of Key Personnel

Recruitment of key executives and project members included Keith Muller as Chief Operating Officer; Roux Terblanche as Project manager; Leasha Denney as Contracts Manager and Prince Kenneth Lartey as Finance Manager Ghana.

Anna Boldiston started post quarter end as Assistant Company Secretary.

Conferences attended

The company attended the following conferences during the period:

- 121 Mining Investment, Sydney | 12-13 October 2022

- International Mining and Resources Conference + Expo (IMARC), Sydney | 2-4 November 2022

- Noosa Mining Investor Conference, Queensland | 9-11 November 2022

- Mines and Money, London | 29 November-1 December 2022

Share Capital changes - Ordinary Shares, Options and Performance Rights

On 28th November the Company issued 4,000,000 unlisted options to Keith Muller as part of his employment contract. Details of the unlisted options were:

No of Options | Strike Price | Grant Date | Expiry Date |

2,000,000 | 60 pence | 28 November 2022 | 28 November 2024 |

2,000,000 | 70 pence | 28 November 2022 | 28 November 2024 |

On 21st December 2022, the Board approved the proposed issue of unlisted Options to the current executive team and senior independent non-executive director as part a review of the appropriateness of the company's remuneration and incentive arrangements. These options are subject to shareholder approval and have not been issued at the date of this report. Details of the unlisted options were:

Director | No of Options | Strike Price | Expiry Date |

Mr Neil Herbert | 2,000,000 | 60 pence | 2 years from date of issue |

Mr Lennard Kolff | 2,000,000 | 60 pence | 2 years from date of issue |

Ms Amanda Harsas | 2,000,000 | 60 pence | 2 years from date of issue |

Mr Stu Crow | 1,000,000 | 60 pence | 2 years from date of issue |

On 30 December 2022, the Board amended the expiry date of the unlisted Options held by the Estate of the late Mr Mascolo to the original expiry date the Options were issued to, as detailed below:

No of Options | Strike Price | Original Expiry Date | Amended Expiry Date (22 April 2022 announcement) | New Expiry Date |

5,000,000 | 40 pence | 18 August 2023 | 31 December 2022 | 18 August 2023 |

6,000,000 | 50 pence | 18 August 2023 | 31 December 2022 | 18 August 2023 |

A summary of movement and balances of equity securities between 1 October 2022 and date of this report is as follows:

Ordinary Shares | Unquoted Options | Unquoted performance rights | |

On issue at start of Quarter | 605,741,660 | 50,500,500 | 2,700,000 |

Options issued | 4,000,000 | ||

Total Securities on issue at date of this report | 605,741,660 | 54,500,000 | 2,700,000 |

Compliance

During the quarter, the Company spent A$3.1 million on its exploration and feasibility activities and $0.4 million on its Capex for its Ewoyaa Lithium Project in Ghana. Exploration and feasibility activities is 50% funded by Piedmont Lithium Inc. and Capex 100% funded as part of the partnership arrangement announced on 1 July 2021.

The Dual Listing Prospectus in the previous quarter (30 August 2022) was a sell-down of the Company's existing shares (Sell-Down) rather than an issue of new Shares. The Company and SaleCo entered into agreements with those security shareholders who wished to participate in the Sell-Down, including several option holders who exercised their options and sold their resulting Shares as part of the Sell-Down.

According, the sale of the shares itself did not raise any cash for the Company but raised approximately A$4.5 million (before costs) from the exercise of the Sell-Down Options.

The sale proceeds of A$13.3 million since the date of its admission to ASX official list on 21 September has been utilised as follows.

Actual | Budget | Variance | |

Offer 22,850,000 at $0.58c per share | $13,253,000 | $13,253,000 | $0 |

Distributed to Selling Shareholders | (8,783,466) | (8,873,466) | $0 |

Conversion Proceeds remitted to Atlantic at Completion | $4,469,534 | $4,469,534 | $0 |

Share Issue Costs | (795,180) | (795,180) | $0 |

Definite-Feasibility Study of Ewoyaa Lithium Project | (1,118,235) | (1,118,235) | $0 |

Planned Exploration Expenditure | (445,063) | (445,063) | $0 |

Remaining | $2,111,056 | $2,111,056 | $0 |

The company will use the above Conversion Proceeds (after costs) and existing funds to explore and develop the Company's mineral lithium interests.

Appendix 5B expenditure disclosure

As at end 31 December 2022, the Company had cash resources of A$19.1 million and no debt. Exploration and evaluation cash expenditure on the Project during the quarter was A$5.9 million. Piedmont Lithium Inc. funded A$4.8 million of the expenditure with A$1.5million to be reimbursed in the next quarter.

Appendix 5B includes a payment of A$0.9 million to a related party of the entity (item 6.1). This represents a payment of a creditor, Assore International Holdings Limited, a major shareholder for services of two Non-Executive Directors for the period February 2015 to June 2022.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity | ||

ATLANTIC LITHIUM LIMITED | ||

ABN | Quarter ended ("current quarter") | |

17 127 215 132 | 31 December 2022 | |

Consolidated statement of cash flows | Current quarter | Year to date (6months) | |

|---|---|---|---|

1. | Cash flows from operating activities | - | - |

1.1 | Receipts from customers | ||

1.2 | Payments for | - | - |

(a) exploration & evaluation | |||

(b) development | - | - | |

(c) production | - | - | |

(d) staff costs | (308) | (757) | |

(e) administration and corporate costs | (2,106) | (3,166) | |

1.3 | Dividends received (see note 3) | - | - |

1.4 | Interest received | - | - |

1.5 | Interest and other costs of finance paid | - | - |

1.6 | Income taxes paid | - | - |

1.7 | Government grants and tax incentives | - | - |

1.8 | Other | - | - |

1.9 | Net cash from / (used in) operating activities | (2,414) | (3,923) |

2. | Cash flows from investing activities | - | - |

2.1 | Payments to acquire or for: | ||

(a) entities | |||

(b) tenements | - | - | |

(c) property, plant and equipment | (64) | (258) | |

(d) exploration & evaluation | (5,933) | (11,759) | |

(e) investments | - | - | |

(f) other non-current assets-mine development | (237) | (237) | |

2.2 | Proceeds from the disposal of: | - | |

(a) entities | |||

(b) tenements | - | ||

(c) property, plant and equipment | - | ||

(d) investments | - | ||

(e) other non-current assets | - | ||

2.3 | Cash flows from loans to other entities | - | |

2.4 | Dividends received (see note 3) | - | |

2.5 | Other - Piedmont Contributions from farm-in arrangement | 4,781 | 8,656 |

2.6 | Net cash from / (used in) investing activities | (1,453) | (3,598) |

3. | Cash flows from financing activities | - | |

3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

3.2 | Proceeds from issue of convertible debt securities | - | |

3.3 | Proceeds from exercise of options | - | 4,626 |

3.4 | Transaction costs related to issues of equity securities or convertible debt securities | (145) | (1,676) |

3.5 | Proceeds from borrowings | - | - |

3.6 | Repayment of borrowings | - | - |

3.7 | Transaction costs related to loans and borrowings | - | - |

3.8 | Dividends paid | - | - |

3.9 | Other (provide details if material) | - | - |

3.10 | Net cash from / (used in) financing activities | (145) | 2,950 |

4. | Net increase / (decrease) in cash and cash equivalents for the period | ||

4.1 | Cash and cash equivalents at beginning of period | 23,398 | 23,882 |

4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (2,414) | (3,923) |

4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (1,453) | (3,598) |

4.4 | Net cash from / (used in) financing activities (item 3.10 above) | (145) | 2,950 |

4.5 | Effect of movement in exchange rates on cash held | (335) | (260) |

4.6 | Cash and cash equivalents at end of period | 19,051 | 19,051 |

5. | Reconciliation of cash and cash equivalents | Current quarter | Previous quarter |

5.1 | Bank balances | 19,050 | 23,395 |

5.2 | Call deposits | - | - |

5.3 | Bank overdrafts | - | - |

5.4 | Other - Petty Cash | 1 | 3 |

5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 19,051 | 23,398 |

6. | Payments to related parties of the entity and their associates | Current quarter |

6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 886 |

6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

7. | Financing facilities Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end | Amount drawn at quarter end |

7.1 | Loan facilities | - | - |

7.2 | Credit standby arrangements | - | - |

7.3 | Other | - | - |

7.4 | Total financing facilities | - | - |

7.5 | Unused financing facilities available at quarter end | - | |

7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

8. | Estimated cash available for future operating activities | $A'000 |

8.1 | Net cash from / (used in) operating activities (item 1.9) | (2,414) |

8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (5,933) |

8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (8,347) |

8.4 | Cash and cash equivalents at quarter end (item 4.6) | 19,051 |

8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

8.6 | Total available funding (item 8.4 + item 8.5) | 19,051 |

8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 2.3 |

Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

Answer: NA | ||

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

Answer: NA | ||

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

Answer: NA | ||

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

- This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

- This statement gives a true and fair view of the matters disclosed.

Date: 30 January 2023

Authorised by: Authorised by the Board of Atlantic Lithium Limited

Notes

- This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

- If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

- Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

- If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - eg Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

- If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For any further information, please contact:

Atlantic Lithium Limited | Tel: +61 2 8072 0640 |

SP Angel Corporate Finance LLP | Tel: +44 (0)20 3470 0470 |

Canaccord Genuity Limited | Tel: +44 (0) 20 7523 4500 |

Liberum Capital Limited | Tel: +44 (0) 20 3100 2000 |

| Yellow Jersey PR Limited Charles Goodwin Bessie Elliot | Tel: +44 (0)20 3004 9512 |

Notes to Editors:

About Atlantic Lithium

Atlantic Lithium (formerly "IronRidge Resources") is an AIM and ASX-listed lithium exploration and development company advancing a portfolio of lithium projects and licenses in Ghana and Côte d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is a significant lithium spodumene pegmatite discovery on track to become Ghana's first lithium producing mine. The Company signed a funding agreement with Piedmont Lithium Inc. for US$103m towards the development of the Ewoyaa Project. Based on the Pre-Feasibility Study, the Ewoyaa Project has indicated Life of Mine revenues exceeding US$4.84bn, producing a spodumene concentrate via simple gravity only process flowsheet.

Atlantic Lithium holds 560km2 & 774km2 of tenure across Ghana and Côte d'Ivoire respectively, comprising significantly under-explored, highly prospective licenses.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact This email address is being protected from spambots. You need JavaScript enabled to view it. or visit www.rns.com.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.16 |

| Daily Volume: | 0 |

| Market Cap: | US$121.730M |

February 01, 2023 November 29, 2022 November 02, 2022 | |