SYDNEY, AUSTRALIA / ACCESSWIRE / February 1, 2023 / Atlantic Lithium Limited (AIM:ALL)(OTCQX:ALLIF) ("Atlantic Lithium" or the "Company"), the funded African- focussed lithium exploration and development company on track to become Ghana's first lithium producing mine, is pleased to announce a significant Mineral Resource Estimate ("MRE" or the "Resource") upgrade to 35.3Mt at 1.25% Li2O for the Ewoyaa lithium deposit (collectively the "Ewoyaa Project" or the "Project") within the Cape Coast Lithium Portfolio in Ghana, West Africa. The Resource is reported in accordance with the JORC Code (2012).

Figures, Tables and Appendixes referred to in this release can be viewed in the PDF version available via this link: http://www.rns-pdf.londonstockexchange.com/rns/4969O_1-2023-1-31.pdf

HIGHLIGHTS:

Commenting on the Company's latest progress, Lennard Kolff, Interim Chief Executive Officer of Atlantic Lithium, said:

"The Resource upgrade represents a significant de-risking milestone for the Company, with 79% of the Resource now in the higher confidence Measured and Indicated categories with potential for further exploration growth. This, in addition to the larger overall tonnage, will provide the opportunity to evaluate extended mine life and increased throughput to enhance project economics.

"Our goal was to convert the Inferred to Indicated category, define the first 1 to 2 years of planned production to Measured category and increase the overall Resource scale. We have comfortably achieved all our goals, demonstrating the robust geological fundamentals of the Project.

"Metallurgical test-work to date has consistently delivered high-purity, low contaminants >6% Li2O coarse spodumene concentrate utilising simple gravity-only processing. Combining this with the excellent proximity to operational infrastructure and the availability of skilled services in pro-mining Ghana, we are on course to deliver one of the world's most efficient hard rock lithium projects, in terms of capital intensity and lower operating costs.

"The Company has transitioned from explorer to developer, with Ewoyaa funded to production through our agreement with Piedmont, key senior personnel recently recruited, and our Mining License application submitted. Today's Resource upgrade highlights the exceptional potential of the project and the value that it brings to Ghana and the Company."

Mineral Resource Estimate Upgrade

An upgraded MRE of 35.3Mt at 1.25% Li2O was completed for the Ewoyaa deposit and surrounding pegmatites; collectively termed the "Ewoyaa Project". The Mineral Resource is reported in accordance with the JORC Code (2012). The MRE includes a total of 3.5Mt at 1.37% Li2O in the Measured category, 24.5Mt at 1.25% Li2O in the Indicated category and 7.4Mt at 1.16% Li2O in the Inferred category (refer Table 1).

The independent MRE for Ewoyaa was completed by Ashmore Advisory Pty Ltd ("Ashmore") of Perth, Western Australia, with results tabulated in the Statement of Mineral Resources in Table 1. The Statement of Mineral Resources is reported in line with requirements of the JORC Code (2012) and is therefore suitable for public reporting.

High-level Whittle optimisation was completed by Mining Focus Consultants Pty Ltd of Perth, Western Australia and demonstrates reasonable prospects for eventual economic extraction.

Table 1: Ewoyaa Mineral Resource Estimate (0.5% Li2O Cut-off)

Measured Mineral Resource | |||||

Type | Tonnage | Li2O | Cont. Lithium Oxide | ||

Mt | % | kt | |||

Primary | 3.5 | 1.37 | 48 | ||

Total | 3.5 | 1.37 | 48 | ||

Indicated Mineral Resource | |||||

Type | Tonnage | Li2O | Cont. Lithium Oxide | ||

Mt | % | kt | |||

Weathered | 0.5 | 1.09 | 5 | ||

Primary | 24.1 | 1.26 | 302 | ||

Total | 24.5 | 1.25 | 307 | ||

Inferred Mineral Resource | |||||

Type | Tonnage | Li2O | Cont. Lithium Oxide | ||

Mt | % | kt | |||

Weathered | 1.8 | 1.13 | 20 | ||

Primary | 5.6 | 1.17 | 66 | ||

Total | 7.4 | 1.16 | 86 | ||

Total Mineral Resource | |||||

Type | Tonnage | Li2O | Cont. Lithium Oxide | ||

Mt | % | kt | |||

Weathered | 2.2 | 1.12 | 25 | ||

Primary | 33.1 | 1.25 | 415 | ||

Total | 35.3 | 1.25 | 440 | ||

Competent Persons Note:

The Mineral Resource has been compiled under the supervision of Mr. Shaun Searle who is a director of Ashmore Advisory Pty Ltd and a Registered Member of the Australian Institute of Geoscientists. Mr. Searle has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that he has undertaken to qualify as a Competent Person as defined in the JORC Code.

All Mineral Resources figures reported in the table above represent estimates at January 2023. Mineral Resource estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate. Rounding may cause some computational discrepancies.

Mineral Resources are reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code - JORC 2012 Edition).

There are four main geometallurgical domains at Ewoyaa; coarse-grained type P1 and finer-grained type P2 pegmatites and their weathered equivalents. Their estimated relative abundances, metallurgical recoveries and concentrate grades are shown in Table 2.

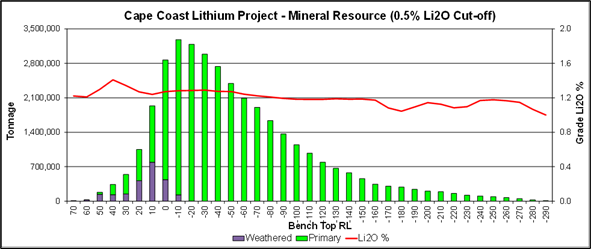

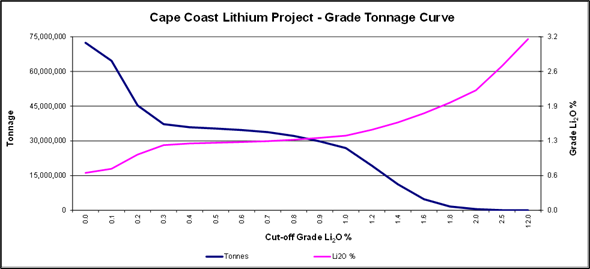

To show the tonnage and grade distribution throughout the entire deposit, a bench breakdown has been prepared using a 10m bench height which is shown in Figure 1 and grade-tonnage curve for the classified resource in Figure 2.

Table 2: Material types, recoveries and concentrate grades (recoveries based on laboratory results)

Weathered | |||||

Geomet Type | Tonnage | Li2O | Cont. Lithium Oxide | Recovery | Conc. Grade |

Mt | % | kt | % | Li2O (%) | |

P1 | 2.0 | 1.13 | 23 | 68 | 6.0 |

P2 | 0.2 | 1.00 | 2 | 50 | 6.0 |

Total | 2.2 | 1.12 | 25 | ||

Primary | |||||

Geomet Type | Tonnage | Li2O | Cont. Lithium Oxide | Recovery | Conc. Grade |

Mt | % | kt | % | Li2O (%) | |

P1 | 29.3 | 1.28 | 375 | 70 | 6.0 |

P2 | 3.8 | 1.06 | 40 | 50 | 5.5 |

Total | 33.1 | 1.25 | 415 | ||

Competent Persons Note: as per Table 1 above and metallurgical sign off in Competent Persons section at end of document.

Figure 1: Ewoyaa Tonnage and Grade - 10m Bench Elevation

Figure 1: Ewoyaa Tonnage and Grade - 10m Bench Elevation

Figure 2: Ewoyaa Lithium Project Grade - Tonnage curve for classified pegmatite resource

Figure 2: Ewoyaa Lithium Project Grade - Tonnage curve for classified pegmatite resource

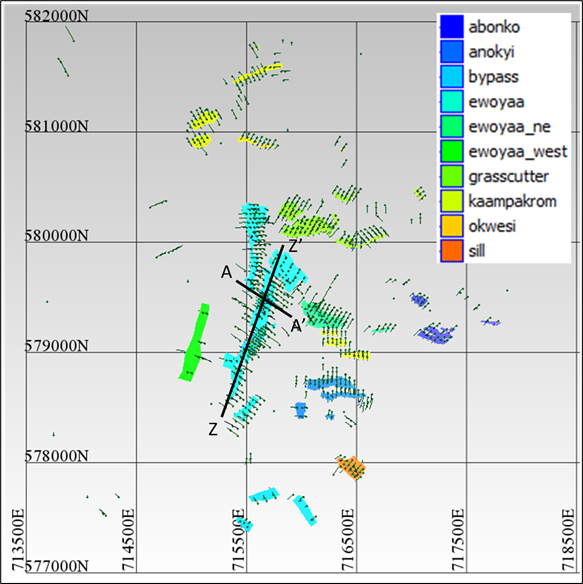

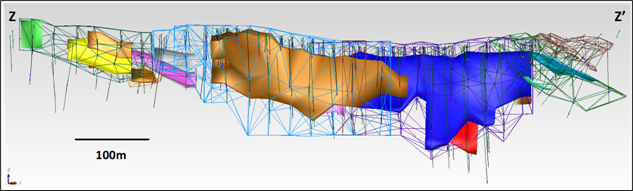

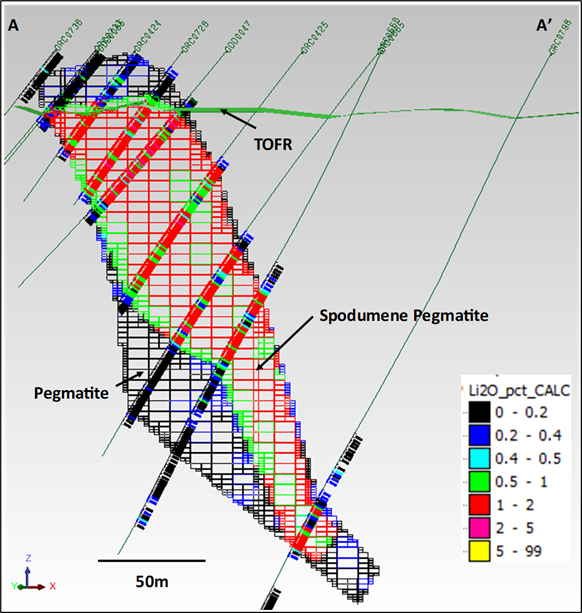

A plan view of the deposit areas is shown in Figure 3 with a long section shown in Figure 4 and cross-section within the Ewoyaa Main indicated category zone shown in Figure 5.

Figure 3: Plan View of Ewoyaa Resource wireframes and drilling with prospect names

Figure 3: Plan View of Ewoyaa Resource wireframes and drilling with prospect names

Figure 4: Long Section Z-Z' of Ewoyaa Main wireframes and drilling (View towards 300°; solid colours = Resource wireframes, wireframe edges = pegmatite wireframes)

Figure 4: Long Section Z-Z' of Ewoyaa Main wireframes and drilling (View towards 300°; solid colours = Resource wireframes, wireframe edges = pegmatite wireframes)

Figure 5: Cross Section A-A' of Ewoyaa Block Model Li2O grades and drilling

Figure 5: Cross Section A-A' of Ewoyaa Block Model Li2O grades and drilling

The current MRE is based on a 0.5% reporting cut-off grade within a 0.4% Li2O wireframed pegmatite body. However, when assessing all pegmatite volumes (with no cut-offs applied), there is significant scope to increase the resource tonnage. Table 3 below shows the overall resource tonnage and grade for the deposit, inclusive of all pegmatite material. For example, the Resource can be reported at a significantly larger tonnage by reducing the cut-off grade to 0.2% Li2O, giving an increased resource of 45.3Mt at 1.03% Li2O. Conversely, the Resource can be reported at a higher grade using a 0.8% Li2O cut-off for a resource of 32.1Mt at 1.3% Li2O.

Further studies will assess the potential benefits of increased production by reducing the cut-off grade or higher feed grade on overall Project economics, consistent with market price predictions and price trends realised by existing producers.

Table 3: Overall resource tonnage and grade for the deposit, inclusive all pegmatite material

Cape Coast Lithium Project - Peg and Min 0.4% Wireframes | |||||||

January 2023 Mineral Resource Estimate | |||||||

Grade | Incremental Resource | Cut-off | Cumulative Resource | ||||

Range | Tonnage | Li2O | Contained | Grade | Tonnage | Li2O | Contained |

Li2O | t | % | Li2O (t) | Li2O % | t | % | Li2O (t) |

0.0 -> 0.1 | 7,805,784 | 0.07 | 5,451 | 0.0 | 72,387,265 | 0.69 | 500,147 |

0.1 -> 0.2 | 19,273,356 | 0.15 | 28,859 | 0.1 | 64,581,481 | 0.77 | 494,697 |

0.2 -> 0.3 | 8,080,136 | 0.23 | 18,974 | 0.2 | 45,308,125 | 1.03 | 465,838 |

0.3 -> 0.4 | 1,349,802 | 0.34 | 4,549 | 0.3 | 37,227,989 | 1.20 | 446,864 |

0.4 -> 0.5 | 542,526 | 0.44 | 2,411 | 0.4 | 35,878,187 | 1.23 | 442,314 |

0.5 -> 0.6 | 635,742 | 0.55 | 3,526 | 0.5 | 35,335,661 | 1.25 | 439,903 |

0.6 -> 0.7 | 932,862 | 0.65 | 6,099 | 0.6 | 34,699,919 | 1.26 | 436,377 |

0.7 -> 0.8 | 1,628,854 | 0.75 | 12,266 | 0.7 | 33,767,057 | 1.27 | 430,278 |

0.8 -> 0.9 | 2,352,414 | 0.85 | 20,053 | 0.8 | 32,138,203 | 1.30 | 418,012 |

0.9 -> 1.0 | 2,892,363 | 0.95 | 27,540 | 0.9 | 29,785,789 | 1.34 | 397,959 |

1.0 -> 1.2 | 7,606,691 | 1.10 | 83,979 | 1.0 | 26,893,426 | 1.38 | 370,418 |

1.2 -> 1.4 | 8,065,436 | 1.30 | 104,721 | 1.2 | 19,286,735 | 1.48 | 286,440 |

1.4 -> 1.6 | 6,413,684 | 1.49 | 95,753 | 1.4 | 11,221,299 | 1.62 | 181,719 |

1.6 -> 1.8 | 3,163,177 | 1.68 | 53,275 | 1.6 | 4,807,615 | 1.79 | 85,965 |

1.8 -> 2.0 | 1,121,909 | 1.88 | 21,101 | 1.8 | 1,644,438 | 1.99 | 32,690 |

2.0 -> 2.5 | 479,555 | 2.17 | 10,413 | 2.0 | 522,529 | 2.21 | 11,589 |

2.5 -> 3.0 | 36,310 | 2.66 | 966 | 2.5 | 42,974 | 2.66 | 1,176 |

3.0 -> 3.5 | 6,664 | 3.16 | 210 | 12.0 | 6,664 | 3.16 | 210 |

Total | 72,387,265 | 0.69 | 500,147 | ||||

Geology and Geological Interpretation

The Ewoyaa Project area lies within the Birimian Supergroup, a Proterozoic volcano-sedimentary basin located in Western Ghana. The Project area is underlain by three forms of metamorphosed schist; mica schist, staurolite schist and garnet schist. Several granitoids intrude the basin metasediments as small plugs. These granitoids range in composition from intermediate granodiorite (often medium-grained) to felsic leucogranites (coarse to pegmatoidal grain size), sometimes in close association with pegmatite veins and bodies.

Pegmatite intrusions generally occur as sub-vertical dykes with two dominant trends: either east-southeast (Abonko, Anokyi, Ewoyaa Northeast, Grasscutter, Kaampakrom and Okwesi) dipping sub-vertically northeast; or north-northeast (Ewoyaa Main) dipping sub-vertically to moderately to the east. Pegmatite thickness varies across the Project, with thinner mineralised units intersected at Abonko and Kaampakrom between 4 and 12m; and thicker units intersected at Ewoyaa Main between 30 and 60m, and up to 100m at surface.

Drill Methods

The database contains data for the auger, RC and DD drilling conducted by the Company since 2018. The drilling was completed by the Company in six phases commencing in April 2018. All the drilling was undertaken by GeoDrill (Ghana), using both RC and DD rigs.

Drilling at the deposit extends to a vertical depth of approximately 319m and the mineralisation was modelled from surface to a depth of approximately 330m below surface. The estimate is based on good quality RC and DD drilling data. Drill hole spacing is predominantly 20m by 20m and 40m by 40m in the well-drilled portions of the Project and up to 80m by 80m to 100m by 100m across the breadth of the known mineralisation.

The RC drilling used a combination of 5.25' and 5.75' face sampling hammers. The DD used PQ and HQ (85mm and 63.5mm) diameter core barrels. The DD holes were completed from surface or as tails with PQ to maximise recovery in weathered zones, with reversion to HQ once ground conditions improved within fresh material.

In 2018, Phase 1 RC holes were completed on a nominal 100m by 50m grid pattern, targeting the Ewoyaa Main mineralised system. Phases 2 to 5 reduced the wide spacing to 80m by 40m and down to 40m by 40m in the well-drilled portions of the Project. Eleven DD twins of RC holes were completed.

During Phase 1 and 2, RC drilling bulk samples and splits were collected at the rig for every metre interval drilled, the splits being undertaken using a riffle splitter. During Phase 3, Phase 4, Phase 5 and Phase 6, RC samples were split with a rig mounted cone spitter, which took duplicate samples for quality control purposes.

DD was cut with a core saw and selected half core samples was dispatched to Nagrom Laboratory in Australia for metallurgical test work.

Selected core intervals were cut to quarter core with a saw at one-metre intervals or to geological contacts; and since December 2018, were sent to Intertek Laboratory in Tarkwa, Ghana for sample preparation. Prior to that, samples were sent to SGS Laboratory in Tarkwa for sample preparation.

All Phase 1 samples were submitted to SGS Tarkwa for preparation (PRP100) and subsequently forwarded to SGS Johannesburg and later SGS Vancouver for analysis (ICP90A).

PRP100 - Samples <3kg are dried in trays, crush to 100% passing 2mm, split using a rotary splitter to 5kg and pulverised in a LM2 to a nominal 85% passing 75µm. Approximately 100g sub-sample is taken for assay. All the preparation equipment is flushed with barren material prior to the commencement of the job. Coarse reject material was kept in the original bag.

Since December 2018, samples have been submitted to Intertek Tarkwa (SP02/SP12) for sample preparation. Samples were weighed, dried and crushed to -2mm in a Boyd crusher with an 800-1,200g rotary split, producing a nominal 1,500g split crushed sample, which was subsequently pulverised in a LM2 ring mill. Samples were pulverised to a nominal 85% passing 75µm. All the preparation equipment was flushed with barren material prior to the commencement of the job. Coarse reject material was kept in the original bag. Lab sizing analysis was undertaken on a nominal 1:25 basis. Final pulverised samples (20g) were airfreighted to Intertek in Perth, Australia for assaying.

Sample Analysis Method

Since December 2018, samples were sent to Intertek Laboratory in Perth for analysis (FP6/MS/OES). FP6/MS/OES is an analysis for lithium and a suite of 21 other elements. Detection limits for lithium range between 5ppm and 20,000ppm. The sodium peroxide fusion (in nickel crucibles) is completed with hydrochloric acid to dissolve the sub-sample and is considered a total dissolution. Analysis is conducted by Inductively Coupled Plasma Mass Spectrometry ("ICP-MS").

Prior to December 2018, Phase 1 samples were submitted to SGS Johannesburg and later SGS Vancouver for analysis (ICP90A). ICP90 is a 28-element combination Na2O2 fusion with ICP-OES. ICP-MS was added to some submissions for additional trace element characterisation purposes.

Mineral Resource Classification Criteria

The Ewoyaa lithium deposits show good continuity of the main mineralised units which allowed the drill hole intersections to be modelled into coherent, geologically robust domains. Consistency is evident in the thickness of the structure, and the distribution of grade appears to be reasonable along and across strike.

The Ewoyaa Mineral Resource was classified as Measured, Indicated and Inferred Mineral Resource based on data quality, sample spacing, and lode continuity. The Measured Mineral Resource was defined within areas of close spaced RC and DD drilling of less than 20m by 20m, and where the continuity and predictability of the lode positions was good. Indicated Mineral Resource was defined within areas of close spaced RC and DD drilling of less than 40m by 40m, and where the continuity and predictability of the lode positions was good. In addition, Indicated Mineral Resource was confined to the fresh rock. The Inferred Mineral Resource was assigned to transitional material, areas where drill hole spacing was greater than 40m by 40m, where small, isolated pods of mineralisation occur outside the main mineralised zones, and to geologically complex zones.

Estimation Methodology

A Surpac block model was created to encompass the extents of the known mineralisation. The block model was rotated on a bearing of 30°, with block dimensions of 10m NS by 10m EW by 5m vertical with sub-cells of 2.5m by 2.5m by 1.25m. The block size was selected based on results of Kriging Neighbourhood Analysis ("KNA") and also in consideration of two predominant mineralisation orientations of 30° and 100 to 120°.

The parent block size was selected based on KNA, while dimensions in other directions were selected to provide sufficient resolution to the block model in the across-strike and down-dip direction.

Bulk densities ranging between 1.7t/m3 and 2.78t/m3 were assigned in the block model dependent on lithology, mineralisation and weathering. These densities were applied based on 13,901 bulk density measurements conducted by the Company on 101 DD holes and 35 RC holes with diamond tails conducted across the breadth of the Project. The measurements were separated using weathering surfaces, geology and mineralisation solids, with averages assigned in the block model.

Cut-off Grade

The Statement of Mineral Resources has been constrained by the mineralisation solids and reported above a cut-off grade of 0.5% Li2O. The reporting cut-off grade is supported by a high-level Whittle optimisation.

Mining and Metallurgical Methods and Parameters

The Statement of Mineral Resources has been constrained by the mineralisation solids, reported at a cut-off grade of 0.5% Li2O. Whittle optimisations demonstrate reasonable prospects for eventual economic extraction. Preliminary metallurgical test work indicates four main geometallurgical domains; weathered and fresh coarse-grained spodumene-bearing pegmatite (P1) and weathered and fresh medium-grained spodumene-bearing pegmatite (P2). From test work completed for the Scoping Study at a 6.3mm crush, the P1 material produces a 6% Li2O concentrate at approximately 70 to 85% recovery (average 75% recovery), whilst P2 material produces 5.5 to 6% Li2O concentrate at approximately 35 to 65% recovery (average 47% recovery).

Further metallurgical test work completed for the PFS was done at a 10mm crush. Recoveries for P1 material into primary concentrate at a 10mm crush were 50-80% from the HLS test work with an average 68% recovery for weathered and 70% for the fresh used for the PFS before discounting.

A P2 recovery of 50% was used for weathered and fresh for the purpose of the PFS study. In the Scoping study, HLS tests on P2 weathered and fresh material at a 6.3mm crush size gave recoveries of 46-61%. Recoveries of P2 to primary concentrates at 10mm crush size ranged from 7-30% and averaged 20%. The middlings contained ~60% of the lithium and it is expected that after finer crushing at least 50% of this will be recovered giving an overall recovery of 50% before discounting.

Recoveries selected for the DMS Plant process design criteria were interpreted from laboratory results discounted by 4% to simulate the typical loss of recoveries from laboratory conditions to on-site, large-scale operations resulting in 66% recovery for P1 fresh, 64% recovery for P1 weathered and 46% for P2 weathered and fresh materials (refer announcement of 22 September 2022).

Further geological, geotechnical, engineering and metallurgical studies are recommended to further define the lithium mineralisation and marketable products.

JORC Table 1, Section 1 (Sampling Techniques and Data) and Section 2 (Reporting of Exploration Results) are included in Appendix 1.

JORC Table 1, Section 3 (Estimation and Reporting of Mineral Resources) is included in Appendix 2.

Competent Persons

Information in this report relating to the exploration results is based on data reviewed by Mr Lennard Kolff (MEcon. Geol., BSc. Hons ARSM), Chief Geologist of the Company. Mr Kolff is a Member of the Australian Institute of Geoscientists who has in excess of 20 years' experience in mineral exploration and is a Qualified Person under the AIM and ASX Rules. Mr Kolff consents to the inclusion of the information in the form and context in which it appears.

Information in this report relating to Mineral Resources was compiled by Shaun Searle, a Member of the Australian Institute of Geoscientists. Mr Searle has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Searle is a director of Ashmore. Ashmore and the Competent Person are independent of the Company and other than being paid fees for services in compiling this report, neither has any financial interest (direct or contingent) in the Company.

Information in this report relating to metallurgical results is based on data reviewed by Mr Noel O'Brien, Director of Trinol Pty Ltd. Mr O'Brien is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the December 2012 edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (JORC Code). Mr O'Brien consents to the inclusion in the report of the matters based upon the information in the form and context in which it appears.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For any further information, please contact:

Neil Herbert (Executive Chairman) | Tel: +61 2 8072 0640 |

Nominated Adviser |

|

Canaccord Genuity Limited | Tel: +44 (0) 20 7523 4500 |

Liberum Capital | Tel: +44 (0) 20 3100 2000 |

Yellow Jersey PR Limited charles Goodwin | Tel: +44 (0)20 3004 9512 |

Notes to Editors:

About Atlantic Lithium

Atlantic Lithium (formerly "IronRidge Resources") is an AIM and ASX-listed lithium company advancing a portfolio of projects in Ghana and Côte d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is a significant lithium spodumene pegmatite discovery on track to become Ghana's first lithium-producing mine. The Company signed a funding agreement with Piedmont Lithium Inc. for US$103m towards the development of the Ewoyaa Project. Based on the Pre-Feasibility Study, the Ewoyaa Project has indicated Life of Mine revenues exceeding US$4.84bn, producing a spodumene concentrate via simple gravity only process flowsheet.

Atlantic Lithium holds a 560km2 & 774km2 tenure across Ghana and Côte d'Ivoire respectively, comprising significantly under-explored, highly prospective licenses.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact This email address is being protected from spambots. You need JavaScript enabled to view it. or visit www.rns.com.

| Last Trade: | US$0.10 |

| Daily Volume: | 0 |

| Market Cap: | US$74.220M |

January 30, 2023 November 29, 2022 November 02, 2022 | |

COPYRIGHT ©2025 GREEN STOCK NEWS