Recursion (Nasdaq : RXRX), a clinical-stage biotechnology company decoding biology by integrating technological innovations across biology, chemistry, automation, data science and engineering, today reported business updates and financial results for its third quarter ending September 30, 2021.

"In Q3, our team made progress towards our vision to industrialize drug discovery. We are now harvesting the efforts of the past few years to build a map of human cellular biology through the continued refinement and increased usage of our inference-based approach to drug discovery. With the power of our Recursion Map illuminating new and exciting relationships in biology, we are now deeply focused on extending our chemistry capabilities to significantly improve, scale and speed up new chemical entity development to address the plethora of novel biological relationships we are discovering," said Recursion Co-Founder & CEO Chris Gibson, Ph.D. "In addition, our rapidly growing development team is preparing for our four clinical-stage programs to initiate Phase 2 or Phase 2/3 studies in the first half of 2022, including two of the programs that we expect will enroll their first patients in early 2022. To facilitate our broad ambition, we continue to rapidly grow our workforce while nurturing Recursion's culture and community."

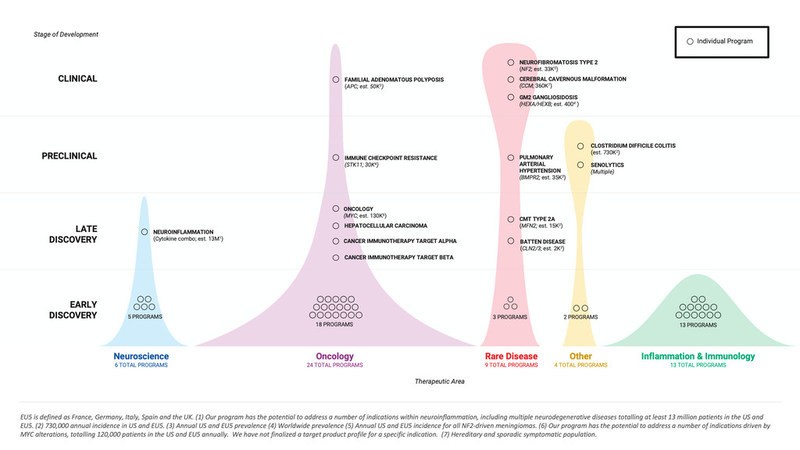

Recursion finished the third quarter of 2021 with a portfolio of 4 clinical stage programs, 4 preclinical programs, 7 late discovery programs, and 41 early discovery programs. Additionally, Recursion continued scaling the total number of executed phenomic experiments to approximately 95 million, the size of its proprietary data universe to over 11 petabytes, and the number of biological inferences to approximately 200 billion. Data have been generated on the Recursion OS across 38 human cell types, an in-house chemical library of over 717 thousand compounds, and an in silico library of 12 billion small molecules, by a growing team of more than 330 Recursionauts that is balanced between life scientists and computational and technical experts.

Summary of Business Highlights

Third Quarter 2021 Financial Results

Additional Corporate Updates

About Recursion

Recursion is a clinical-stage biotechnology company decoding biology by integrating technological innovations across biology, chemistry, automation, machine learning and engineering. Our goal is to radically improve the lives of patients and industrialize drug discovery. Central to our mission is the Recursion Operating System, which combines an advanced infrastructure layer to generate what we believe is one of the world's largest and fastest-growing proprietary biological and chemical datasets. We combine that with the Recursion Map, a suite of custom software, algorithms, and machine learning tools that we use to explore foundational biology unconstrained by human bias and navigate to new biological insights. We are a biotechnology company scaling more like a technology company. Learn more at www.Recursion.com, or connect on Twitter and LinkedIn. Recursion is also a founding member ofBioHive, the Utah life sciences industry collective.

Contact

Elyse Freeman - Senior Communications and Content Manager

This email address is being protected from spambots. You need JavaScript enabled to view it.

Condensed Consolidated Statements of Operations

Recursion Pharmaceuticals, Inc. Condensed Consolidated Statements of Operations (unaudited) (in thousands, except share and per share amounts) | ||||||

Three months ended | Nine months ended | |||||

September 30, | September 30, | |||||

Revenue | 2021 | 2020 | 2021 | 2020 | ||

Grant revenue | $ 34 | $ 163 | $ 145 | $ 409 | ||

Operating revenue | 2,500 | 862 | 7,500 | 862 | ||

Total revenue | 2,534 | 1,025 | 7,645 | 1,271 | ||

Operating expenses | ||||||

Research and development | 33,246 | 16,535 | 86,979 | 42,621 | ||

General and administrative | 15,690 | 6,964 | 38,481 | 17,684 | ||

Total operating expenses | 48,936 | 23,499 | 125,460 | 60,305 | ||

Loss from operations | (46,402) | (22,474) | (117,815) | (59,034) | ||

Other loss, net | (1,026) | (1,399) | (3,731) | (2,206) | ||

Net loss | $ (47,428) | $ (23,873) | $ (121,546) | $ (61,240) | ||

Per share data | ||||||

Net loss per share of Class A and B common stock, basic and diluted | $ (0.28) | $ (1.09) | $ (1.10) | $ (2.82) | ||

Weighted average shares (Class A and B) outstanding, basic and diluted | 168,533,550 | 21,817,900 | 110,513,231 | 21,704,008 | ||

Condensed Consolidated Balance Sheets

Recursion Pharmaceuticals, Inc. Condensed Consolidated Balance Sheets (unaudited) (in thousands) | |||

September 30, | December 31, | ||

2021 | 2020 | ||

Assets | |||

Current assets | |||

Cash and cash equivalents | $ 394,721 | $ 262,126 | |

Restricted cash | 10,233 | 5,041 | |

Accounts receivable | 34 | 156 | |

Other receivables | 2,248 | - | |

Investments | 184,189 | - | |

Other current assets | 9,445 | 2,155 | |

Total current assets | 600,870 | 269,478 | |

Property and equipment, net | 55,439 | 25,967 | |

Intangible assets, net | 2,262 | 2,490 | |

Other non-current assets | 35 | 650 | |

Total assets | $ 658,606 | $ 298,585 | |

Liabilities, convertible preferred stock and stockholders' equity (deficit) | |||

Current liabilities | |||

Accounts payable | $ 6,326 | $ 1,074 | |

Accrued expenses and other liabilities | 25,113 | 10,485 | |

Current portion of unearned revenue | 10,000 | 10,000 | |

Current portion of notes payable | 88 | 1,073 | |

Current portion of lease incentive obligation | 1,416 | 467 | |

Total current liabilities | 42,943 | 23,099 | |

Deferred rent | 3,348 | 2,674 | |

Unearned revenue, net of current portion | 9,167 | 16,667 | |

Notes payable, net of current portion | 656 | 11,414 | |

Lease incentive obligation, net of current portion | 3,460 | 2,708 | |

Total liabilities | 59,574 | 56,562 | |

Commitments and contingencies | |||

Convertible preferred stock | - | 448,312 | |

Stockholders' equity (deficit) | |||

Common stock (Class A and B) | 2 | - | |

Additional paid-in capital | 934,175 | 7,312 | |

Accumulated deficit | (335,147) | (213,601) | |

Accumulated other comprehensive income | 2 | - | |

Total stockholder's equity (deficit) | 599,032 | (206,289) | |

Total liabilities, convertible preferred stock and stockholders' equity (deficit) | $ 658,606 | $ 298,585 | |

Forward-Looking Statements

This document contains information that includes or is based upon "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995, including, without limitation, those regarding Recursion's mission; early and late stage discovery, preclinical, and clinical programs; collaborations; prospective products and their future indications and market opportunities; Recursion OS and other technologies; expansion of facilities and expected uses; workforce growth; employee stock trading plans; business and financial performance; and all other statements that are not historical facts. Forward-looking statements may or may not include identifying words such as "plan," "will," "expect," "anticipate," "intend," "believe," "potential," "continue," and similar terms. These statements are subject to known or unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements, including but not limited to: challenges inherent in pharmaceutical research and development, including the timing and results of preclinical and clinical programs, where the risk of failure is high and failure can occur at any stage prior to regulatory approval due to lack of sufficient efficacy, safety considerations, or other factors; our ability to leverage and enhance our drug discovery platform; our ability to obtain financing for development activities and other corporate purposes; the success of our collaboration activities; our ability to obtain regulatory approval of, and ultimately commercialize, drug candidates; the impact of the COVID-19 pandemic; our ability to obtain, maintain, and enforce intellectual property protections; cyberattacks or other disruptions to our technology systems; our ability to attract, motivate, and retain key employees and manage our growth; and other risks and uncertainties described under the heading "Risk Factors" in our filings with the U.S. Securities and Exchange Commission, including our most recent Quarterly Report on Form 10-Q. All forward-looking statements are based on management's current estimates, projections, and assumptions, and Recursion undertakes no obligation to correct or update any such statements, whether as a result of new information, future developments, or otherwise, except to the extent required by applicable law.

| Last Trade: | US$6.38 |

| Daily Change: | 0.49 8.32 |

| Daily Volume: | 10,661,799 |

| Market Cap: | US$1.750B |

November 20, 2024 November 13, 2024 November 12, 2024 November 06, 2024 | |

Northstar Clean Technologies is a cleantech company focused on the sustainable recovery and reprocessing of asphalt shingles. Northstar’s mission is to be the leader in the recovery and reprocessing of asphalt shingles in North America...

CLICK TO LEARN MORE

Hillcrest Energy Technologies is a clean technology company developing high value, high performance power conversion technologies and digital control systems for next-generation powertrains and grid-connected renewable...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS