SALT LAKE CITY, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Recursion (Nasdaq: RXRX), a leading clinical stage TechBio company decoding biology to industrialize drug discovery, today reported business updates and financial results for its second quarter ended June 30, 2024.

“Our mission at Recursion is to decode biology to radically improve lives. We are leading the industry by integrating technology to map and navigate biology and chemistry to achieve this ambitious aim,” said Chris Gibson, Ph.D., Co-founder and CEO of Recursion. “Today, with the announcement of our proposed combination with Exscientia, we leap closer to our vision of a full-stack technology-enabled small molecule discovery platform that we are confident has the potential to meaningfully improve the efficiency of drug discovery in the coming decade. The culmination of this vision, which we will build together with the team from Exscientia, will be the broader availability of high quality medicines and lower prices for consumers.”

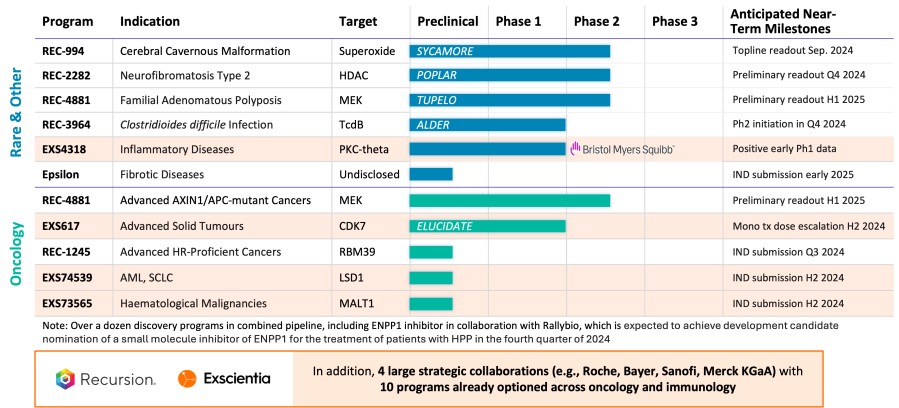

The proposed business combination with Exscientia provides deep complementarity on many levels.

Chris Gibson, Ph.D., Co-founder and CEO of Recursion went on to say, “Additionally, we are thrilled that our first neuroscience phenomap has been optioned under our collaboration with Roche and Genentech. We believe that this industry-first milestone showcases Recursion’s scientific approach to mapping and navigating biology as well as our ability to deliver value to our partners.”

Strategic Rationale for Recursion-Exscientia Combination

Summary of Recursion Business Highlights

Additional Corporate Updates

Second Quarter 2024 Financial Results

About Recursion

Recursion is a clinical stage TechBio company leading the space by decoding biology to industrialize drug discovery. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously expands one of the world’s largest proprietary biological, chemical and patient-centric datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale — up to millions of wet lab experiments weekly — and massive computational scale — owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology, chemistry and patient-centric data to advance the future of medicine.

Recursion is headquartered in Salt Lake City, where it is a founding member of BioHive, the Utah life sciences industry collective. Recursion also has offices in Toronto, Montreal and the San Francisco Bay Area. Learn more at www.Recursion.com, or connect on X (formerlyTwitter) and LinkedIn.

Media Contact

This email address is being protected from spambots. You need JavaScript enabled to view it.

Investor Contact

This email address is being protected from spambots. You need JavaScript enabled to view it.

Consolidated Statements of Operations

| Recursion Pharmaceuticals, Inc. | ||||||||||||||

| Condensed Consolidated Statements of Operations (unaudited) | ||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||

| Three months ended | Six months ended | |||||||||||||

| June 30, | June 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Revenue | ||||||||||||||

| Operating revenue | $ | 14,404 | $ | 11,016 | $ | 27,895 | $ | 23,150 | ||||||

| Grant revenue | 13 | 1 | 316 | 1 | ||||||||||

| Total revenue | 14,417 | 11,017 | 28,211 | 23,151 | ||||||||||

| Operating costs and expenses | ||||||||||||||

| Cost of revenue | 9,199 | 9,382 | 20,365 | 21,829 | ||||||||||

| Research and development | 73,928 | 55,060 | 141,488 | 101,737 | ||||||||||

| General and administrative | 31,833 | 28,290 | 63,241 | 51,165 | ||||||||||

| Total operating costs and expenses | 114,960 | 92,732 | 225,094 | 174,731 | ||||||||||

| Loss from operations | (100,543 | ) | (81,715 | ) | (196,883 | ) | (151,580 | ) | ||||||

| Other income, net | 2,480 | 4,989 | 6,668 | 9,527 | ||||||||||

| Loss before income tax benefit | (98,063 | ) | (76,726 | ) | (190,215 | ) | (142,053 | ) | ||||||

| Income tax benefit | 523 | - | 1,302 | - | ||||||||||

| Net loss and comprehensive loss | $ | (97,540 | ) | $ | (76,726 | ) | $ | (188,913 | ) | $ | (142,053 | ) | ||

| Per share data | ||||||||||||||

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.40 | ) | $ | (0.38 | ) | $ | (0.79 | ) | $ | (0.71 | ) | ||

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 242,196,409 | 201,415,475 | 239,107,879 | 198,957,804 | ||||||||||

Consolidated Balance Sheets

| Recursion Pharmaceuticals, Inc. | ||||||||

| Condensed Consolidated Balance Sheets (unaudited) | ||||||||

| (in thousands) | ||||||||

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 474,341 | $ | 391,565 | ||||

| Restricted cash | 1,783 | 3,231 | ||||||

| Other receivables | 2,526 | 3,094 | ||||||

| Other current assets | 43,725 | 40,247 | ||||||

| Total current assets | 522,375 | 438,137 | ||||||

| Restricted cash, non-current | 6,629 | 6,629 | ||||||

| Property and equipment, net | 83,633 | 86,510 | ||||||

| Operating lease right-of-use assets | 44,088 | 33,663 | ||||||

| Financing lease right-of-use assets | 28,562 | - | ||||||

| Intangible assets, net | 38,210 | 36,443 | ||||||

| Goodwill | 52,056 | 52,056 | ||||||

| Other assets, non-current | 308 | 261 | ||||||

| Total assets | $ | 775,861 | $ | 653,699 | ||||

| Liabilities and stockholders’ equity | ||||||||

| Accounts payable | $ | 3,762 | $ | 3,953 | ||||

| Accrued expenses and other liabilities | 33,401 | 46,635 | ||||||

| Unearned revenue | 32,204 | 36,426 | ||||||

| Notes payable and financing lease liabilities | 8,109 | 41 | ||||||

| Operating lease liabilities | 8,607 | 6,116 | ||||||

| Total current liabilities | 86,083 | 93,171 | ||||||

| Unearned revenue, non-current | 29,169 | 51,238 | ||||||

| Notes payable and financing lease liabilities, non-current | 22,921 | 1,101 | ||||||

| Operating lease liabilities, non-current | 50,239 | 43,414 | ||||||

| Deferred tax liabilities | - | 1,339 | ||||||

| Other liabilities, non-current | 3,000 | - | ||||||

| Total liabilities | 191,412 | 190,263 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Common stock (Class A, B and Exchangeable) | 3 | 2 | ||||||

| Additional paid-in capital | 1,740,981 | 1,431,056 | ||||||

| Accumulated deficit | (1,156,535 | ) | (967,622 | ) | ||||

| Total stockholder's equity | 584,449 | 463,436 | ||||||

| Total liabilities and stockholders’ equity | $ | 775,861 | $ | 653,699 | ||||

Forward-Looking Statements

This document contains information that includes or is based upon statements that are not historical facts that may be considered "forward-looking statements'' within the meaning of the Securities Litigation Reform Act of 1995 and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “enables” or words of similar meaning, including, without limitation, those statements regarding the option exercise by Roche-Genentech as validating our scientific approach and ability to deliver value to partners; the potential future revenue related to the option of the neuroscience phenomap and the potential creation, delivery, and option of future maps; whether such mapping effort will support the discovery and development of therapeutic programs in neuroscience; the completion and uses of additional maps being built; continuing to advance efforts to discover new therapeutics for undruggable oncology targets with Bayer; Bayer becoming the first external beta-user of LOWE and integrating software across the collaboration; the timing for completing 25 unique multi-modal data packages; expectations related to early and late stage discovery, preclinical, and clinical programs, including timelines for enrollment in studies, data readouts, and progression toward IND-enabling studies; developments with Recursion OS and other technologies, including construction of foundation models and augmentation of our dataset; developments of our transcriptomics technology, including the timing of development of a whole-genome knockout transcripts map; expectations and developments with respect to licenses and collaborations, including option exercises by partners and additional partnerships; prospective products and their potential future indications and market opportunities; expectations for business and financial plans and performance, including cash runway; outcomes and benefits expected from the Tempus partnership, including the development of causal AI models and biomarker and patient stratification strategies; Recursion’s plan to maintain a leadership position in data generation and aggregation and advancing the future of medicine; and

many other statements. Such statements also include statements regarding the proposed business combination of Recursion and Exscientia and the outlook for Recursion’s or Exscientia’s future business and financial performance, including the combined company’s first-in-class and best-in-class opportunities; potential for sales from successful programs with peak sales opportunities of over $1 billion each; potential milestone payments of the combined company of approximately $200 million over the next 2 years from current partnerships; potential for more than $20 billion in total deal value for the combined company from partners before royalties; percentage of the pro forma company to be received by Exscientia shareholders; ability to reduce pro forma spend of the combined company; revenue, business synergies, and reduced pro forma spend from the combination resulting in cash runway extending into 2027; completion of the business combination by early 2025; the tax effect of the transaction on U.S. holders of American Depositary Shares of Exscientia; and many others. Such forward-looking statements are based on the current beliefs of Recursion’s and Exscientia’s respective management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including: the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement; the inability to obtain Recursion’s stockholder approval or Exscientia’s shareholder approval or the failure to satisfy other conditions to completion of the proposed combination, including obtaining the sanction of High Court of Justice of England and Wales to the Scheme of Arrangement, at all, or in a timely manner; risks that the proposed combination disrupts each company’s current plans and operations; the diversion of the attention of the respective management teams of Recursion and Exscientia from their respective ongoing business operations; the ability of either Recursion, Exscientia or the combined company to retain key personnel; the ability to realize the benefits of the proposed combination, including cost synergies; the ability to successfully integrate Exscientia's business with Recursion’s business, at all or in a timely manner; the outcome of any legal proceedings that may be instituted against Recursion, Exscientia or others following announcement of the proposed combination; the amount of the costs, fees, expenses and charges related to the proposed combination; the effect of economic, market or business conditions, including competition, regulatory approvals and commercializing drug candidates, or changes in such conditions, have on Recursion’s, Exscientia’s and the combined company’s operations, revenue, cash flow, operating expenses, employee hiring and retention, relationships with business partners, the development or launch of technology enabled drug discovery, and commercializing drug candidates; the risks of conducting Recursion’s and Exscientia’s business internationally; the impact of changes in interest rates by the Federal Reserve and other central banks; the impact of potential inflation, volatility in foreign currency exchange rates and supply chain disruptions; the ability to maintain technology-enabled drug discovery in the biopharma industry; and risks relating to the market value of Recursion’s common stock to be issued in the proposed combination.

Other important factors and information are contained in Recursion’s most recent Annual Report on Form 10-K and Exscientia’s most recent Annual Report on Form 20-F, including the risks summarized in the section entitled “Risk Factors,” Recursion’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31 and June 30, 2024 and Exscientia’s filing on Form 6-K filed May 21, 2024, and each company’s other filings with the U.S. Securities and Exchange Commission (the “SEC”), which can be accessed at https://ir.recursion.com in the case of Recursion, http://investors.exscientia.ai in the case of Exscientia, or www.sec.gov. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. Neither Recursion nor Exscientia undertakes any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This communication relates to a proposed business combination of Recursion and Exscientia that will become the subject of a joint proxy statement to be filed by Recursion with the SEC. The joint proxy statement will provide full details of the proposed combination and the attendant benefits and risks, including the terms and conditions of the scheme of arrangement and the other information required to be provided to Exscientia’s shareholders under the applicable provisions of the U.K. Companies Act 2006. This communication is not a substitute for the joint proxy statement or any other document that Recursion or Exscientia may file with the SEC or send to their respective stockholders in connection with the proposed combination. Investors and security holders are urged to read the definitive joint proxy statement and all other relevant documents filed with the SEC or sent to Recursion’s stockholders or Exscientia’s shareholders as they become available because they will contain important information about the proposed combination. All documents, when filed, will be available free of charge at the SEC’s website (www.sec.gov). You may also obtain these documents by contacting Recursion’s Investor Relations department at This email address is being protected from spambots. You need JavaScript enabled to view it.; or by contacting Exscientia’s Investor Relations department at This email address is being protected from spambots. You need JavaScript enabled to view it.. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

| Last Trade: | US$6.76 |

| Daily Change: | -0.63 -8.53 |

| Daily Volume: | 13,149,427 |

| Market Cap: | US$2.590B |

November 20, 2024 November 13, 2024 November 12, 2024 | |

Northstar Clean Technologies is a cleantech company focused on the sustainable recovery and reprocessing of asphalt shingles. Northstar’s mission is to be the leader in the recovery and reprocessing of asphalt shingles in North America...

CLICK TO LEARN MORE

Else Nutrition is changing the face of early childhood nutrition with clean, sustainable, plant-based products. The company has developed the world’s first whole plant-based infant formula that is targeting the $100+ billion global...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS