Encinitas, California--(Newsfile Corp. - May 10, 2024) - Kiora Pharmaceuticals, Inc. (NASDAQ: KPRX) ("Kiora" or the "Company") announces first quarter 2024 financial results and updates on its development pipeline of treatments for retinal disease.

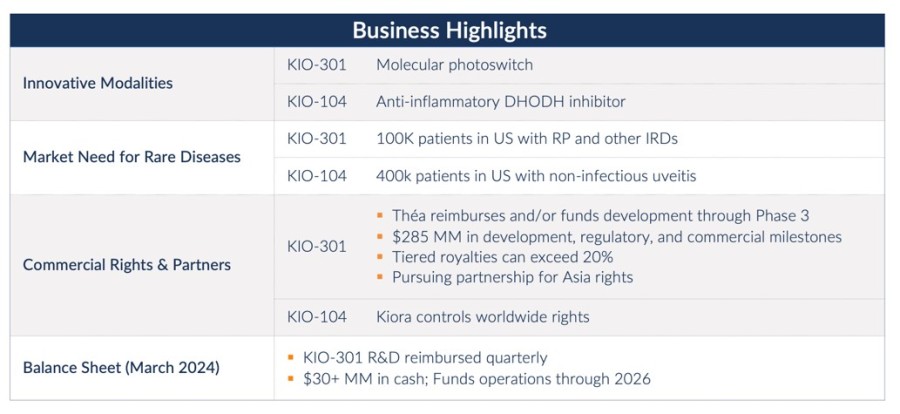

"Our balance sheet and strategic partnership with Théa Open Innovation (TOI) put us in a strong position to advance our two retinal programs, KIO-301 and KIO-104, into mid-stage clinical trials," said Brian M. Strem, Ph.D., chief executive officer of Kiora. "Both compounds, given their mechanisms of action, have the potential to address multiple diseases; KIO-301 for the treatment of inherited retinal disorders, and KIO-104 for the treatment of retinal inflammatory diseases. Our upcoming Phase 2 ABACUS-2 trial of KIO-301 for the treatment of retinitis pigmentosa, is a multi-center double-masked, randomized, controlled, multiple-dose study performed in collaboration with TOI.

"As part of our partnership, TOI will fund the remaining clinical development of KIO-301 across multiple indications, allowing us to efficiently invest our capital in the development of KIO-104 to treat retinal inflammatory diseases. KIO-104 may address the established need for eye treatments that spare the complications of chronic steroid use and/or systemic anti-inflammatory drugs. Clinical proof-of-concept for KIO-104 in the treatment of non-infectious uveitis, a rare retinal inflammatory condition, has been established with recently published results from a Phase 1/2a study. Prior to initiating a Phase 2 trial, we are conducting additional investigational new drug (IND) enabling work. Beyond non-infectious uveitis, the mechanism of action of KIO-104 could apply to other retinal conditions, such as macular edema, and proliferative vitreoretinopathy (PVR), a serious complication following retinal detachment repair."

"In the first quarter, we executed a strategic partnership with TOI, which included a $16 million upfront payment, and raised $15 million from an equity offering," added Melissa Tosca, EVP Finance. "These developments substantially strengthened our cash position, allowing us to advance our two exciting programs while maintaining G&A expenses, and provides a runway of greater than two years. The TOI upfront payment was recognized entirely in the first quarter as collaboration revenue and we expect future development and regulatory milestone payments to be treated similarly."

Milestones achieved in the first quarter and year-to-date 2024 include the following:

KIO-301

Entered a strategic partnership granting TOI exclusive worldwide co-development and commercialization rights, excluding Asia, to KIO-301 for the treatment of retinal degenerative diseases. Under the terms of the agreement, Kiora received an upfront payment of $16 million, recognized as collaboration revenue, and is eligible to receive up to an additional $285 million in development, regulatory, and commercial milestones; tiered royalties of up to low 20 percent on net sales; and full reimbursement of future KIO-301 research and development expenses.

Reported quantitative functional MRI results at the Association of Research in Vision and Ophthalmology (ARVO) annual conference from ABACUS-1, showing a statistically significant increase in neural activity over baseline specifically within the brain's visual processing center. This increase in observed brain activity was time-dependent and concordant with previously reported improvements in visual field, visual acuity, and functional vision.

KIO-104

Publication of results from a Phase 1 double-masked study of KIO-101 in the medical journal Pharmaceutics, documenting a 12-day treatment of KIO-101 topically at multiple doses was well tolerated in healthy volunteers and patients with inflammation of the eye. There was a significant decrease in conjunctival hyperemia in the treatment group compared to placebo.

Initiated Investigational New Drug enabling preclinical work in support of planned phase 2 retinal inflammation clinical trial.

Kiora anticipates achieving the following clinical and regulatory milestones:

| KIO-301 • Type D meeting with the FDA for functional vision endpoint • Initiate ABACUS-2 clinical trial • Begin design of additional inherited retinal disease studies | 1H 2024 2H 2024 1H 2025 |

| KIO-104 • Complete non-clinical package • Initiate Phase 2 clinical trial | 2H 2024 1H 2025 |

Financial Results Highlights

Kiora ended the first quarter of 2024 with $31.3 million in cash and cash equivalents plus $1.8 million in research and development incentive tax credits and $0.2 million in collaboration receivables from TOI.

Revenue was $16.0 million for the first quarter of 2024, compared to no revenue in the first quarter of 2023. The revenue comes from collaboration revenue as part of an upfront payment from TOI connected to the strategic development and commercialization partnership.

Research and development expenses were $1.5 million, net of $0.2 million in offsetting credits related to expenses for KIO-301 which will be reimbursed by TOI, for the first quarter of 2024, compared to $0.4 million, net of $0.3 million in offsetting tax credits, for the first quarter of 2023. The increase was primarily due to a one-time licensing payment made to the University of California related to a sublicense fee of $0.7 million, and a decrease of $0.3 million in R&D tax credits due to reduced credit-eligible expenses given the KIO-301 expenses are now being reimbursed by TOI.

General and administrative expenses were $1.3 million for the first quarter of 2024, compared to $1.3 million for the first quarter of 2023.

Net income was $13.5 million for the first quarter of 2024 compared to a net loss of $1.9 million for the first quarter of 2023. The change in income is attributable to the recognition of $16 million in collaboration revenue.

About Kiora Pharmaceuticals

Kiora Pharmaceuticals is a clinical-stage biotechnology company developing and commercializing products for the treatment of orphan retinal diseases. KIO-301 is being developed for the treatment of retinitis pigmentosa, choroideremia, and Stargardt disease. It is a molecular photoswitch that has the potential to restore vision in patients with inherited and/or age-related retinal degeneration. KIO-104 is being developed for the treatment of posterior non-infectious uveitis. It is a next-generation, non-steroidal, immuno-modulatory, and small-molecule inhibitor of dihydroorotate dehydrogenase. In addition to news releases and SEC filings, we expect to post information on our website, www.kiorapharma.com, and social media accounts that could be relevant to investors. We encourage investors to follow us on Twitter and LinkedIn as well as to visit our website and/or subscribe to email alerts.

Forward-Looking Statements

Some of the statements in this press release are "forward-looking" and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These "forward-looking" statements include statements relating to, among other things, Kiora's ability to execute on development and commercialization efforts and other regulatory or marketing approval efforts pertaining to Kiora's development-stage products, including KIO-104, KIO-301, KIO-201 and KIO-101, as well as the success thereof, with such approvals or success may not be obtained or achieved on a timely basis or at all, the sufficiency of existing cash on hand to fund operations for specific periods, the projected cash runway, the ability to timely complete planned initiatives for 2024, including phase 2 clinical development of KIO-301 and KIO-104, the potential for KIO-301 to be the first treatment options for patients with inherited degenerative diseases like RP, Kiora's plans to further fund development of KIO-104, the potential for KIO-104 to reduce inflammation, the timing of topline results from a Phase 2b trial of KIO-104, the potential for KIO-104 to apply to other retinal inflammatory diseases, and expected trends for research and development and general and administrative spending in 2024. These statements involve risks and uncertainties that may cause results to differ materially from the statements set forth in this press release, including, among other things, the ability to satisfy the closing conditions related to the offering ,the ability to conduct clinical trials on a timely basis, market and other conditions and certain risk factors described under the heading "Risk Factors" contained in Kiora's Annual Report on Form 10-K filed with the SEC on March 25, 2024 or described in Kiora's other public filings including on Form 10-Q filed with the SEC on May 10, 2024. Kiora's results may also be affected by factors of which Kiora is not currently aware. The forward-looking statements in this press release speak only as of the date of this press release. Kiora expressly disclaims any obligation or undertaking to release publicly any updates or revisions to such statements to reflect any change in its expectations with regard thereto or any changes in the events, conditions, or circumstances on which any such statement is based, except as required by law.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2024 (unaudited) | December 31, 2023 | ||||||

| ASSETS | |||||||

| Current Assets: | |||||||

| Cash and Cash Equivalents | $ | 31,276,330 | $ | 2,454,684 | |||

| Prepaid Expenses and Other Current Assets | 206,671 | 233,382 | |||||

| Collaboration Receivables | 189,905 | — | |||||

| Tax Receivables | 1,808,787 | 2,049,965 | |||||

| Total Current Assets | 33,481,693 | 4,738,031 | |||||

| Non-Current Assets: | |||||||

| Property and Equipment, Net | 12,918 | 8,065 | |||||

| Restricted Cash | 4,084 | 4,267 | |||||

| Intangible Assets and In-Process R&D, Net | 8,807,600 | 8,813,850 | |||||

| Operating Lease Assets with Right-of-Use | 94,298 | 106,890 | |||||

| Other Assets | 39,414 | 40,767 | |||||

| Total Assets | $ | 42,440,007 | $ | 13,711,870 | |||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

| Current Liabilities: | |||||||

| Accounts Payable | $ | 323,062 | $ | 206,260 | |||

| Accrued Expenses | 1,222,078 | 1,380,666 | |||||

| Operating Lease Liabilities | 47,851 | 47,069 | |||||

| Total Current Liabilities | 1,592,991 | 1,633,995 | |||||

| Non-Current Liabilities: | |||||||

| Contingent Consideration | 5,116,765 | 5,128,959 | |||||

| Deferred Tax Liability | 779,440 | 779,440 | |||||

| Operating Lease Liabilities | 46,448 | 59,822 | |||||

| Total Non-Current Liabilities | 5,942,653 | 5,968,221 | |||||

| Total Liabilities | 7,535,644 | 7,602,216 | |||||

| Commitments and Contingencies (Note 8) | |||||||

| Stockholders' Equity: | |||||||

| Preferred Stock, $0.01 Par Value: 10,000,000 shares authorized; 3,750 designated Series A, 0 shares issued and outstanding; 10,000 designated Series B, 0 shares issued and outstanding; 10,000 shares designated Series C, 0 shares issued and outstanding; 20,000 shares designated Series D, 7 shares issued and outstanding; 1,280 shares designated Series E, 0 shares issued and outstanding; 3,908 shares designated Series F, 420 issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 4 | 4 | |||||

| Common Stock, $0.01 Par Value: 50,000,000 shares authorized; 26,256,197 and 7,705,640 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 262,584 | 77,078 | |||||

| Additional Paid-In Capital | 168,429,797 | 153,192,228 | |||||

| Accumulated Deficit | (133,523,648 | ) | (146,976,855 | ) | |||

| Accumulated Other Comprehensive Loss | (264,374 | ) | (182,801 | ) | |||

| Total Stockholders' Equity | 34,904,363 | 6,109,654 | |||||

| Total Liabilities and Stockholders' Equity | $ | 42,440,007 | $ | 13,711,870 |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(unaudited)

| Three Months Ended March 31, | |||||||

| 2024 | 2023 | ||||||

| Revenue: | |||||||

| Collaboration Revenue | $ | 16,000,000 | $ | — | |||

| Total Revenue | 16,000,000 | — | |||||

| Operating Expenses: | |||||||

| General and Administrative | 1,296,441 | 1,269,458 | |||||

| Research and Development | 1,493,659 | 438,283 | |||||

| Change in Fair Value of Contingent Consideration | (12,194 | ) | 208,926 | ||||

| Total Operating Expenses | 2,777,906 | 1,916,667 | |||||

| Operating Income (Loss) | 13,222,094 | (1,916,667 | ) | ||||

| Other Income, Net: | |||||||

| Interest Income, Net | 223,047 | 33,465 | |||||

| Other Income, Net | 8,066 | 14,666 | |||||

| Total Other Income, Net | 231,113 | 48,131 | |||||

| Net Income (Loss) | $ | 13,453,207 | $ | (1,868,536 | ) | ||

| Net Income (Loss) per Common Share - Basic | $ | 0.52 | $ | (1.00 | ) | ||

| Weighted Average Shares Outstanding - Basic | 25,936,163 | 1,863,466 | |||||

| Net Income (Loss) per Common Share - Diluted | $ | 0.38 | (1.00 | ) | |||

| Weighted Average Shares Outstanding - Diluted | 35,025,494 | 1,863,466 | |||||

| Other Comprehensive Income (Loss): | |||||||

| Net Income (Loss) | $ | 13,453,207 | $ | (1,868,536 | ) | ||

| Foreign Currency Translation Adjustments | (81,573 | ) | (32,671 | ) | |||

| Comprehensive Income (Loss) | $ | 13,371,634 | $ | (1,901,207 | ) | ||

| Last Trade: | US$3.63 |

| Daily Change: | 0.05 1.40 |

| Daily Volume: | 61,105 |

| Market Cap: | US$10.890M |

November 08, 2024 August 09, 2024 | |

DevvStream provides upfront capital for sustainability projects in exchange for carbon credit rights. Through these rights, the company generates and manages carbon credits by utilizing the most technologically advanced...

CLICK TO LEARN MORE

Else Nutrition is changing the face of early childhood nutrition with clean, sustainable, plant-based products. The company has developed the world’s first whole plant-based infant formula that is targeting the $100+ billion global...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS