Atco Mining Inc. (the “Company” or “Atco”) (CSE:ATCM) (OTC:ATMGF) (Frankfurt:QP9) is pleased to announce that it has entered into a mineral property acquisition agreement (the “Definitive Agreement”) to acquire a new project on the west coast of Newfoundland. The newly staked project named the Flat Bay Project (the “Project”) will be 100% owned by Atco upon completion of the acquisition and is located in the St. Georges Basin of Newfoundland. The Project consists of one license, totaling 1,000 hectares.

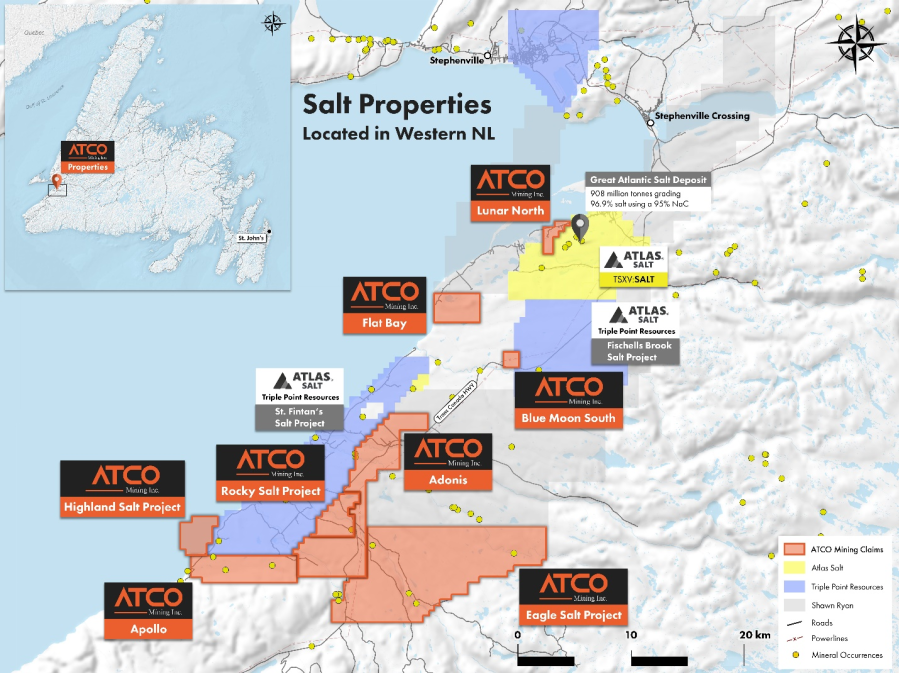

With the newly acquired Project, Atco will control eight projects in the region, for an aggregate of 21,450 hectares. In comparison, Atlas Salt’s spinout company, Triple Point Resources, currently holds approximately 22,599 hectares.

The Project boasts a historically mapped gravity low, which suggests the presence of a salt dome at depth. The Company plans to reinterpret a 2013 government-funded airborne gravity survey and a historical seismic survey that covers the target area. The information will be used to guide additional exploration with the goal of defining a salt dome structure.

Please see map below:

“This is a significant acquisition for us,” says Neil McCallum, Director of Atco Mining. “I am very pleased to bring this high-quality project into our portfolio as we build one of the most prolific land positions in Southwestern Newfoundland. The Flat Bay Project is not only strategically located directly to the North and West of Triple Point, but having an already existing historical gravity low gives us another target to explore. I look forward to updating our shareholders over the coming weeks with our next steps.”

Transaction terms

The Definitive Agreement was entered into with Voa Exploration Inc. (the “Vendor”), a private corporation existing under the laws of the Province of British Columbia. Pursuant to the Definitive Agreement, the Company has agreed to purchase the Project for and in consideration of the issuance of 700,000 common shares in the capital of the Purchaser (the “Consideration Shares”), and a one-time cash payment of $20,000 (the “Consideration Payment”). Upon closing of the acquisition (the “Closing Date”), 300,000 Consideration Shares will be issued to the Vendor along with the Consideration Payment, with a further 200,000 Consideration Shares issued on or before the twelve-month anniversary of the Closing Date, and the final 200,000 Consideration Shares issued on or before the twenty-four month anniversary of the Closing Date.

All Consideration Shares will be subject to a statutory hold period of four-months-and-one-day following issuance. No finders’ fees or commissions are payable in connection with the Definitive Agreement.

Following issuance of the Consideration Shares, the Company will grant a two percent royalty on returns from the commercial production of minerals from the Project to the Vendor. The royalty shall be freely assignable by the Vendor, upon written notice to the Purchaser, and one-half (1.0%) of the royalty may be purchased at any time for a cash payment of $1,500,000 to the Vendor.

QP Statement

The technical information contained in this news release has been reviewed by Neil McCallum B.Sc., P.Geo., of Dahrouge Geological Consulting, who is a “Qualified Person” as defined in NI 43-101.

About Atco Mining (CSE: ATCM):

Atco is a junior exploration mining company focused on exploring for green energy metals throughout Canada. Atco is also exploring for sulphide-rich VHMS deposits in Saskatchewan as well as salt opportunities in Western Newfoundland. Investors are encouraged to visit the company’s website here: www.atcomining.com

On behalf of the Board of Directors of Atco Mining Inc.

President & CEO, Director

Alex Klenman

For further information contact:

Atco Mining Inc.

Alex Klenman – President & CEO

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Telephone: (604) 681-0084

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this news release. The Canadian Securities Exchange has not in any way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release.

FORWARD LOOKING STATEMENTS:

Completion of the acquisition is subject to a number of conditions, including receipt of appropriate regulatory approvals.

Certain information in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements other than statements of historical fact included in this news release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations are detailed from time to time in the filings made by the Company with securities regulations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company disclaims any intention or obligation to update or revise such information, except as required by applicable law.

| Last Trade: | C$0.02 |

| Daily Change: | -0.005 -25.00 |

| Daily Volume: | 21,000 |

| Market Cap: | C$1.160M |

November 07, 2023 October 19, 2023 September 28, 2023 September 05, 2023 | |

Surf Air Mobility is a regional air mobility platform expanding the category of regional air travel to reinvent flying through the power of electrification. In an effort to substantially reduce the cost and environmental impact of...

CLICK TO LEARN MORE

GreenPower Motor designs, builds and distributes a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, cargo van, and a cab and chassis...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS