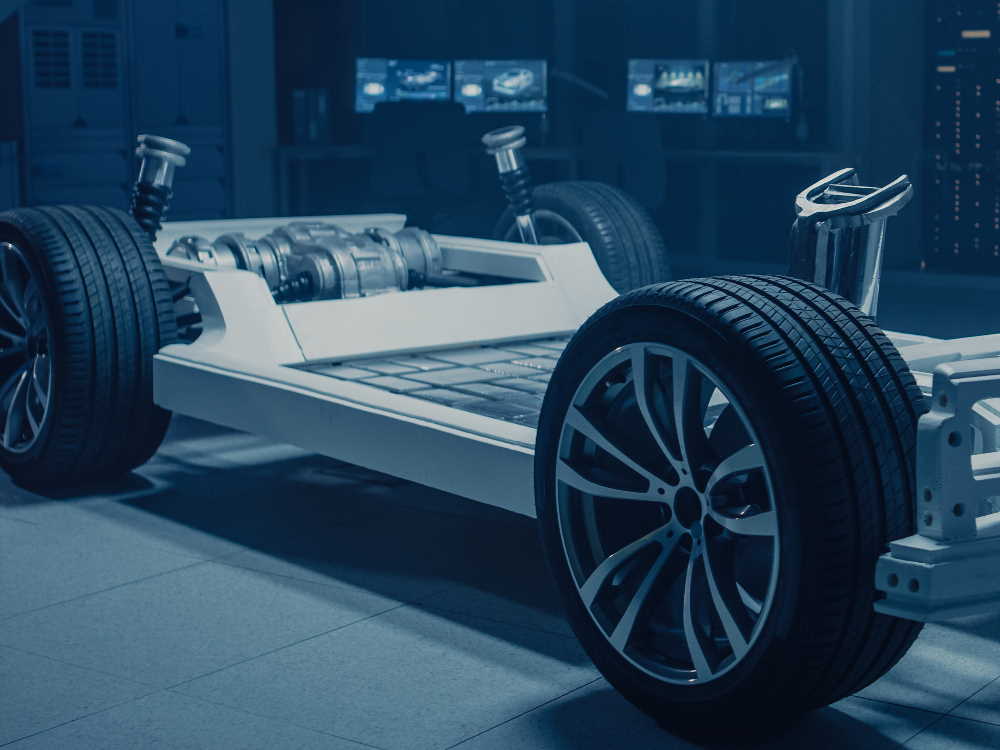

As demand for electric vehicles continues to exponentially increase, so does the growing thirst for lithium.

Analysts estimate there could be as many as 35 million electric vehicles in use by 2030. This will have a direct impact on the global demand for lithium, which the International Energy Agency has suggested will increase 40-fold between now and 2040. As automobile manufacturers increasingly shift towards electric vehicles, lithium is expected to play an irreplaceable role in the production of high-energy batteries over the coming decades.

At current rates, global lithium supplies will fail to meet the exponential growth in demand. With shortages expected to increasingly exacerbate, many lithium companies are turning towards new technologies, such as direct lithium extraction and recycling, to fill the coming supply deficit for lithium.

Below are the top lithium companies focused on developing projects and technologies that could potentially provide significant new sources of lithium in the coming decade:

1. LithiumBank Resources (TSX.V: LBNK)

LithiumBank Resources is a newly listed company focused on developing direct brine lithium resources in Western Canada. The company has acquired more than 3.2 million acres of potential direct lithium extraction assets across western Canada.

The company is formulating plans to extract lithium-bearing brines that will utilize existing oil and gas infrastructure. This novel approach will harness lithium-bearing brines that flow from underground reservoirs up to the surface. The brines will then pass through direct lithium extraction technology facilities which will concentrate the lithium. The remaining brine will then be reinjected back down into underground reservoirs.

LithiumBank has identified over 500 existing oil and gas wells throughout its claims. The project could also benefit from existing infrastructure access to railroad, pipelines and power. The company could potentially repurpose existing infrastructure and leverage the region’s large-scale and flow rates for direct lithium brine production.

The company has outlined an Inferred resource at its flagship project totaling 5.97 million tonnes of lithium carbonate equivalent*. Recent sampling of select wells across it’s land package outlined 6.3 kilometers of average lithium grades above current grade estimates. LithiumBank plans to release additional resource estimates in 2022 to increase total lithium carbonate resources and is working to complete a pre-feasibility study in 2023.

Shares of LithiumBank Resources trade in the U.S. under the symbol LBNKF and in Canada under the symbol LBNK.

2. Li-Cycle Holdings (NYSE: LICY)

Li-Cycle Holdings went public in 2021 via a $1.5 billion SPAC merger. The company is developing what it calls a proprietary Spoke & Hub technology process, which will include a closed-loop recycling solution that creates a secondary supply of critical battery materials, including lithium, cobalt and nickel.

Li-Cycle recently announced a $200 million investment from Glencore, one of the world’s largest natural resource companies and producers of cobalt and nickel. The deal also calls for Li-Cycle to take delivery of spent lithium-ion batteries and scrap metals under a supply agreement with Glencore. The company will then utilize its processing facilities to recover battery metals such as lithium, nickel and cobalt.

Li-Cycle trades on the NYSE under the ticker symbol LICY.

3. Cenntro Electric Group (NASDAQ: CENN)

While Cenntro Electric Group is primarily focused on manufacturing electric commercial vehicles, the company recently announced a strategic partnership with Princeton NuEnergy to focus on direct recycling of lithium-ion batteries.

The goal of the partnership between Cenntro and Princeton NuEnergy is to create an end-to-end recycling process that will reach net-zero emissions. Princeton NuEnergy’s proprietary recycling technology claims to recover over 95% of critical elements in spent lithium-ion batteries while emitting 70% less CO2.

Shares of Cenntro Electric Group trade on the NASDAQ under the ticker symbol CENN.

4. Sigma Lithium (NASDAQ: SGML)

Sigma Lithium is constructing a new lithium mine in Brazil. The company is building a state-of-the-art processing plant that will use 100% renewable energy and recycled water. The size of the new hard rock spodumene deposit will potentially be one of the largest in the western hemisphere once production is fully operational.

The company recently released an updated resource estimate for its Grota do Cirilo project in Brazil. A phase three pre-feasibility study is expected to be released in late 2022 and construction at the project remains on schedule and on budget. Sigma expects to commence production at the new mine in early 2023.

Share of Sigma Lithium trade on the NASDAQ under the ticker symbol SGML.

5. Standard Lithium (NYSEAMEX: SLI)

Standard Lithium is a lithium development company focused on advancing its flagship project in southern Arkansas. The Company is developing an industrial-scale Direct Lithium Extraction demonstration plant at Lanxess’s south plant facility in southern Arkansas.

The demonstration plant utilizes Standard Lithium’s proprietary LiSTR technology to selectively extract lithium from tailings brine. The demonstration plant is being used for proof-of-concept and commercial feasibility studies.

Standard Lithium claims that its technology is scalable, environmentally friendly, and will reduce recovery times from months down to hours.

Standard Lithium trades on the NYSEAMEX under the ticker symbol SLI.

6. E3 Lithium (OTCMKTS: EEMMF)

E3 Lithium is advancing the Clearwater lithium project in Alberta. The company plans to scale-up its direct lithium extraction technology to produce high purity lithium. Similar to LithiumBank Resources, E3 plans to leverage existing regional infrastructure.

The company recently announced that it will collaborate with Imperial Oil (NYSEAMEX: IMO) to explore the re-development of a historic oil field in Alberta. The pilot project will include evaluation wells as well as integration of E3’s proprietary technology. As part of the agreement, Imperial Oil has also made a strategic investment into E3 Lithium.

Shares of E3 Lithium trade on the OTCQX under the ticker symbol EEMMF.

Analysts and investors both agree that lithium will fuel the growth of the electric vehicle market over the coming years. Listed below are additional lithium stocks to watch:

*Report is titled:” NI 43-101 Technical Report, Inferred Resource Estimate on LithiumBank Resources Corp.’s Sturgeon Lake Lithium-Brine Property in West-Central Alberta, Canada” is available on SEDAR at www.sedar.com. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will be converted into a mineral reserve.

Disclaimer

This content is not financial advice and should not be taken as financial advice. This content is for information, education and entertainment purposes only. Green Stock News is not responsible for any losses related to the financial decisions made by you. This content is based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Green Stock News is not responsible for any gains or losses that result from the opinions expressed in this content or in other advertising materials that it publishes electronically. Green Stock News has been compensated US$10,200 by LithiumBank Resources for advertising services.

COPYRIGHT ©2025 GREEN STOCK NEWS