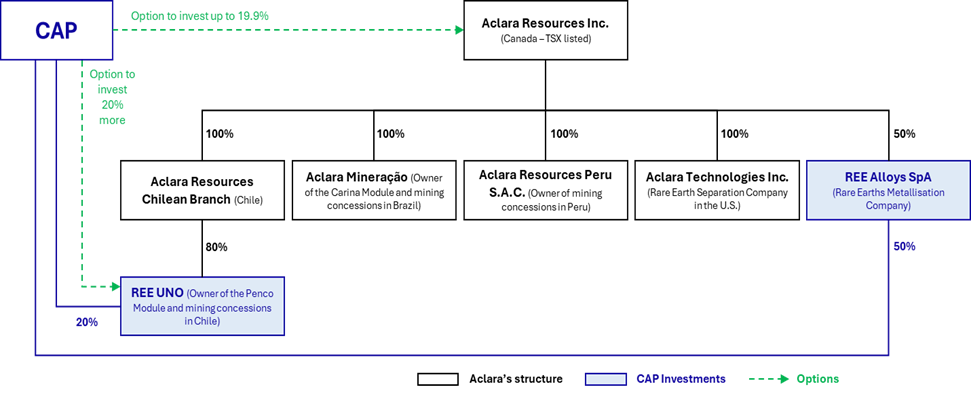

TORONTO, ON / ACCESSWIRE / April 17, 2024 / Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce the closing of the acquisition by CAP S.A. ("CAP") of its 20% equity ownership interest in REE Uno SpA ("REE Uno"), the Company's Chilean subsidiary that owns the Penco Module project, and receipt by the Company of the initial payment of approximately US$9.7 million in connection with such acquisition. The acquisition is made pursuant to the terms of the previously announced investment agreement entered into between CAP and Aclara on March 13, 2024 (the "Investment Agreement"). Under the terms of the Investment Agreement, payments are to be made in three tranches, of which the remaining two tranches in the amounts of US$12.5 million and US$6.9 million are to be made in January of 2025 and 2026, respectively.

Transaction Summary

Aclara Corporate Structure after the Completion of the Transaction with CAP

Transaction Benefits to Aclara

Funding

The US$29.1 million initial capital injection from CAP into REE Uno will support the ongoing development of the Penco Module throughout its permitting, community relations, and feasibility study phases. This allocation will allow Aclara Resources to reallocate its current cash reserves towards advancing its Carina Module project in Brazil.

The option for an additional US$50 million investment post-receipt of the environmental permit is intended to cover a significant part of the equity portion associated with the construction of the Penco Module. This provision mitigates financing risks linked to the module's construction for Aclara.

Permitting

Drawing upon CAP's extensive experience in environmental permitting from multiple mining projects in Chile, Aclara anticipates strengthened support for the forthcoming Environmental Impact Assessment permit application in respect of the Penco Module. CAP's involvement includes a thorough review and constructive contributions to the application preparation, as well as accompanying Aclara throughout the review and approval process by Chilean environmental agencies.

Vertical Integration

Furthermore, the establishment of a metals and alloys company represents a crucial step of Aclara's strategic vision to vertically integrate its rare earths concentrate production towards the manufacturing of permanent magnets. The newly formed joint venture company will harness CAP's substantial expertise in metal refining and ferro-alloyed special steels, synergizing with Aclara's thorough understanding of the rare earths and permanent magnet industry. The joint venture with CAP is intended to supplement the Company's efforts in developing independent rare earth separation capabilities in the United States through its U.S. subsidiary, Aclara Technologies Inc., as previously announced on April 10, 2024, and to further position Aclara as a source of geopolitically independent alternative supply of permanent magnets to the global market.

Valuation

The transactions contemplated under the Investment Agreement (the "Transaction") reflects the valuation of Aclara at the time of the Company's initial public offering (the "IPO") and is indicative of the belief both parties have in establishing Aclara as a leading producer of clean rare earths.

Upon closing, REE Uno has been valued at US$116.5 million on a pre-money valuation. In addition, Aclara will own 50% of the newly established joint venture company, which has a valuation of US$3.0 million. In total, the Transaction represents an aggregate valuation reflecting the Company's pre-money valuation at the IPO of US$119.5 million.

It's noteworthy that Aclara's Brazilian subsidiary, Aclara Mineracao, which oversees the Carina Module and all mining concessions in Brazil, is not part of the Transaction nor included in the valuation mentioned above. This aspect adds further value to Aclara Resources and its shareholders.

About CAP

CAPS.A., a company with more than 77 years of history and listed in the Chilean Stock Exchange since 1987, is the parent company of the CAP Group, a Chilean conglomerate operating in various industries including iron ore mining (CMP), with mines and industrial operations in the north of the country, as well as in Concepcion, in proximity to the Penco Module. CAP is one of the leading high-grade iron ore producers in the world with four operating mines in Chile. In addition, CAP has several steel product manufacturing plants in Chile, Peru and Argentina. It operates five ports, a seawater desalination plant and has vast industrial infrastructure in the Biobio region. CAP has a strong connection with the people of the Biobío region, where it has been a major employer for several decades, contributing directly to the development of the south of Chile.

About Aclara

Aclara Resources Inc. (TSX:ARA) is a development-stage company that focuses on heavy rare earth mineral resources hosted in Ion-Adsorption Clay deposits. The Company currently has two projects under development: the Penco Module in the Bio-Bio Region of Chile, and the Carina Project in the State of Goiás, Brazil.

Aclara's rare earth extraction process offers several environmentally attractive features. It does not involve blasting, crushing, or milling, and therefore does not generate tailings, thus eliminating the need for a tailings storage facility. The extraction process developed by Aclara minimizes water consumption through high levels of water recirculation made possible by the inclusion of a water treatment facility within its patented process design. The ionic clay feedstock is amenable to leaching with a common fertilizer, ammonium sulfate. Further, harmful levels of radionuclides, typical of hard rock rare earth deposits, are not concentrated within the Aclara flowsheet.

Simultaneously, alongside the development of the Carina and Penco projects, the Company intends to identify and evaluate further opportunities to increase future production of heavy rare earths. This will involve greenfield exploration programs and the development of additional projects within the Company's concessions in Brazil, Chile, and Peru.

Forward-Looking Statements

This press release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: the Company's strategic investments and partnerships, the current and future valuation of the Company and its subsidiary, the economic effect of the Investment Agreement, the closing of the strategic investment and other transactions contemplated thereby, and the Company's expectations as to the partnership and future financings by investors and the achievement of certain environmental and permitting milestones, and other transactions contemplated thereby. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Chile and Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Penco Module and/or the Carina Module. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 28, 2023, filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this press release is provided as of the date of this press release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Ramon Barua

Chief Executive Officer

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | C$2.60 |

| Daily Change: | -0.03 -1.14 |

| Daily Volume: | 114,811 |

| Market Cap: | C$571.970M |

November 07, 2025 November 06, 2025 October 24, 2025 October 14, 2025 October 01, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS