Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Millennial Potash Announces Maiden Mineral Resource Estimate in the Northern Part of the Banio Potash Project: Indicated Mineral Resources of 657 Million Tonnes of 15.9% KCl and Inferred Mineral Resources of 1.159 Billion Tonnes of 16.0% KCl

Vancouver, British Columbia--(Newsfile Corp. - January 16, 2024) - Millennial Potash Corp. (TSXV: MLP) (OTCQB: MLPNF) (FSE: X0D) ("MLP", "Millennial" or the "Company") is pleased to announce the results of a maiden Mineral Resource Estimate ("MRE") for the northern part of its Banio Potash Project in Gabon. The estimate was completed by ERCOSPLAN Ingenieurgesellschaft Geotechnik und Bergbau mbH ("ERCOSPLAN"), an established potash specialist with significant experience in the Congo Basin. The MRE includes new assay data from historic holes BA-002, and BA-003 plus assay results from additional potash cycles intersected in the drilling extension of BA-002, completed in September 2023, (see Press release dated Nov. 14, 2023). The MRE includes Indicated Mineral Resources of approximately 657 million tonnes grading 15.9% KCl which equates to 104.6 million tonnes of contained KCl and Inferred Mineral Resources of approximately 1.159 billion tonnes grading 16.0% KCl which equates to 185.3 million tonnes of contained KCl (see Tables 1 and 2).

Farhad Abasov, Millennial's Chair, commented "Millennial Potash is delighted to announce its maiden Mineral Resource Estimates (MRE) for the northern part of its Banio Potash Project. These substantial resources, with 657M tonnes at 15.9% KCl for Indicated and additional Inferred resources of 1.159 billion tonnes grading 16% KCl, underscores the project's immense potential, considering that only 2 holes have been used in the compilation of the resource estimate. The presence of sylvinite seams constitute a higher-grade resource that adds further promise to the Project and will be explored in future drill programs. It is important to note that the resources cover only a fraction of the northern part of the entire Project area, and based on the historical drill results and seismic work we believe the deposit continues to the south. We also believe there is a significant potential in the northern part that needs further exploration. Particularly exciting for the Project is confirmation that the carnallite-rich potash seams that are potentially exploitable by solution mining exceed 70m in thickness. Moving forward this MRE is expected to provide a solid base for a follow-on Preliminary Economic Assessment (PEA) which will investigate various production scenarios via solution mining and is expected to include a proven processing route producing MOP right on the Atlantic coast."

The Banio Potash Project is located at the north end of the Early-Cretaceous (Aptian) aged Congo Evaporite Basin which extends southwards from Gabon into the Republic of Congo. This is a well-established potash basin with historic potash production (Holle Mine) and ongoing exploration and development of extensive potash deposits (Kore Resources, Kanga Resources) in the Republic of Congo. The Mineral Resource Estimate for MLP's Banio Potash Project is comprised of Indicated and Inferred resources based on the definition of potash-bearing seams or beds in numerous sedimentary evaporite cycles or stages that were identified from drill core collected from potash specific exploration drill holes. The resources are comprised of sylvinite and carnallitite resources as outlined in Tables 1 and 2.

Table 1: Indicated Mineral Resources*

| DRILLHOLE | EVAP.CYCLE | MINERALOGY | TONNAGE (MT) | GRADE % KCl | TONNAGE (MT KCl) |

| BA-002 | VIII | Sylvinite | 7.73 | 24.9 | 1.93 |

| BA-003 | VIII | Sylvinite | 12.38 | 19.5 | 2.41 |

| INDICATED | SUBTOTAL | Sylvinite | 20.12 | 21.6 | 4.34 |

| BA-003 | VIII | Carnallitite | 37.02 | 15.7 | 5.79 |

| BA-002 | VII | Carnallitite | 88.69 | 14.8 | 13.11 |

| BA-003 | VII | Carnallitite | 102.90 | 15.8 | 16.26 |

| BA-002 | VI | Carnallitite | 105.72 | 15.1 | 16.01 |

| BA-003 | VI | Carnallitite | 144.78 | 16.5 | 23.81 |

| BA-002 | V | Carnallitite | 51.72 | 15.0 | 7.73 |

| BA-003 | V | Carnallitite | 72.12 | 15.9 | 11.50 |

| BA-002 | IV | Carnallitite | 15.79 | 17.1 | 2.69 |

| BA-002 | III | Carnallitite | 17.76 | 18.7 | 3.33 |

| INDICATED | SUBTOTAL | Carnallitite | 636.53 | 15.8 | 100.23 |

| TOTAL IND | CT+SYL | 656.65 | 15.9 | 104.57 |

Table 2: Inferred Mineral Resources*

| DRILLHOLE | EVAP.CYCLE | MINERALOGY | TONNAGE (MT) | GRADE % KCl | TONNAGE (MT KCl) |

| BA-002 | VIII | Sylvinite | 13.94 | 24.9 | 3.47 |

| BA-003 | VIII | Sylvinite | 29.85 | 19.5 | 5.81 |

| INFERRED | SUBTOTAL | Sylvinite | 43.79 | 21.2 | 9.28 |

| BA-003 | VIII | Carnallitite | 43.16 | 15.7 | 6.76 |

| BA-002 | VII | Carnallitite | 160.76 | 14.8 | 23.76 |

| BA-003 | VII | Carnallitite | 173.82 | 15.8 | 27.46 |

| BA-002 | VI | Carnallitite | 191.64 | 15.1 | 29.02 |

| BA-003 | VI | Carnallitite | 244.57 | 16.5 | 40.22 |

| BA-002 | V | Carnallitite | 93.74 | 15.0 | 14.01 |

| BA-003 | V | Carnallitite | 121.83 | 15.9 | 19.42 |

| BA-002 | IV | Carnallitite | 40.39 | 17.1 | 6.88 |

| BA-002 | III | Carnallitite | 45.42 | 18.7 | 8.51 |

| INFERRED | SUBTOTAL | Carnallitite | 1115.35 | 15.8 | 176.04 |

| TOTAL INF | CT+SYL | 1159.14 | 16.0 | 185.32 |

*Cautionary Notes:

1. MT=Million Tonnes, tonnage is for in-situ resource with no discount for recovery as mining and processing methods are to be finalized. Potash deposits have been mined by underground, open pit and solution mining methods.

2. The numbers for tonnage, average KCl per cent are rounded figures

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimates of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

4. The quantity and grade of reported Inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred resources as an Indicated or Measured mineral resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured mineral resource category.

5. Densities used in resource calculations are 2.11-2.14 g/cm3 for Sylvinite and 1.67-1.92 g/cm3 for Carnallitite

Geological Model

The geological model of Banio Potash mineralization identifies 16 carnallitite seams and 3 sylvinite seams. Each of the seams identified meets the required thickness and grade to be considered potentially suitable for solution mining, which is deemed to be the best potential mining method to sustain an economic operation at Banio. In order to be considered as potentially mineable via solution mining the following cut-off parameters were employed on the carnallitite and sylvinite seams:

- Carnallitite: seam thickness has to be > 2.5 m when single, and > 1.25 m when other seams are present within 5 m vertical distance, and Carnallite content > 47 %.

- Sylvinite: seam thickness has to be > 2 m and the Sylvite content > 16 %. Combined Sylvite/Carnallite seams (e.g., Cycle VIII seam 4 in Ba-003, Cycle VII seam 14 in Ba-002) have been considered as separate seams.

The seams which meet these criteria are outlined in Table 3 below.

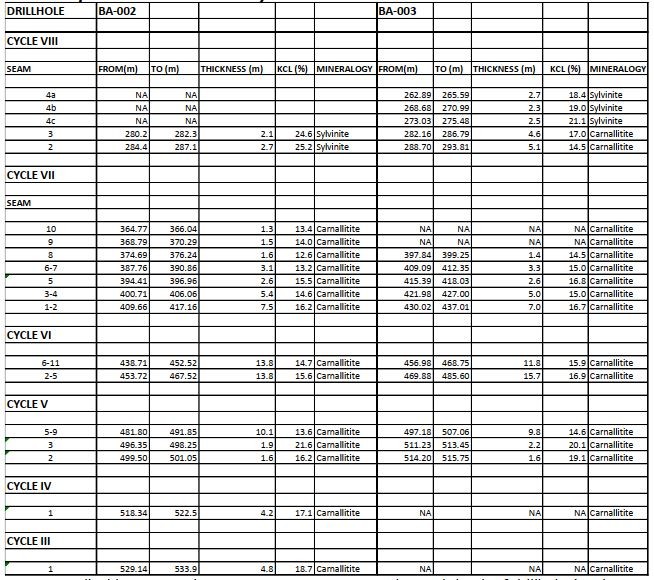

Table 3 Composite carnallitite and sylvinite seam data from drillholes utilized in the MRE.

Table 3 Composite carnallitite and sylvinite seam data from drillholes utilized in the MRE.

*NA=Not Applicable as seam is not present, too narrow or beyond depth of drillhole (Cycle III, IV)

The flat-lying nature of the Congo Evaporite Basin, confirmed in the project area by results from extensive seismic studies coupled with drillhole geological information, allows for extrapolation of the various cycles and seams over significant distances. The results showing in Figure 1 confirms continuity of potash seams over +2,260m based solely on drill holes BA-002, BATC-1 and BA-003. Note that the potash cycles in BATC-1 are interpreted from downhole gamma-ray logs and geological logging and that no assays are available, and that BA-001 was not drilled deep enough to intersect the full potash stratigraphy.

Resource Estimate

In calculating the mineral resource tonnages, the following procedures were completed (Mineral Resources are given as in-situ mineralisation):

- (1) Around each drill hole, a Radius of Influence (ROI) was defined and by intersection of these ROIs, polygons around drill holes where constructed.

- (2) Each polygon was clipped by the coast of Banio Lagoon and restricted to only onshore areas within the Mayumba Permit. The volume for each potash seam was calculated by multiplying the clipped polygon area with the thickness of the potash seam.

- (3) The carnallitite tonnage was calculated by multiplying the volume assigned to each seam with a carnallitite tonnage factor (density). The density for each seam was determined individually from the relative abundance of the salt minerals in the carnallitite seam and varies from between 1.67 g/cm³ for high grade carnallitite and 1.92 g/cm³ for low grade carnallitite seams. For Sylvinite seams, a sylvinite tonnage factor was similarly determined. Based on Sylvite grade, density varied between 2.11 g/cm³ and 2.14 g/cm³.

- (4) The KCl grade of each seam was calculated from a weighted average grade of drillholes sample results collected from the individual seams.

The MRE classifies the carnallitite and sylvinite mineralisation as Indicated and Inferred Mineral Resources as defined by NI 43-101. This reflects the level of confidence in the extent and grade of both the carnallitite and sylvinite bodies. There is insufficient drilling and assaying completed on the Project at this time for Measured Mineral Resources to have been defined.

The criteria used in the MRE to define the extension of mineralization from each drillhole for Indicated and Inferred carnallitite resources is as follows:

- Indicated Mineral Resources occur within a radius of 1,000m of a drill hole, as long as the seismic survey results show no significant change in thickness of the overall salt section. The ROI for Indicated Mineral Resources is not extended beyond the position of faults interpreted from the seismic survey sections.

- Inferred Mineral Resources occur within a radius of 2,000m of a drillhole, minus the Indicated resources within this area. Considering that for Inferred Mineral Resources the continuity of grade and thickness only have to be implied, the ROI for this category is predicted to extend into the fault bounded downthrown block that has been interpreted from the seismic sections.

Fig. 1 Correlation of potash cycles displaying good continuity from BA-002, BA-003 drillholes.

Similarly, the MRE utilizes the following criteria to estimate the extension of the Indicated and Inferred sylvinite resources from a drillhole:

- Indicated Mineral Resources occur within a radius of 500m of a drill hole, as long as the seismic survey results show no significant change in thickness of the overall salt section.

- Inferred Mineral Resources occur within a radius of 1,000m of a drill hole, minus the Indicated resources within this area.

Since the extent of the Sylvite mineralisation is secondary and mainly structurally controlled, the ROIs for the sylvinite mineralisation are not extended beyond faults interpreted from the seismic survey sections. Minor uncertainty remains regarding the exact position of the faults interpreted from the seismic sections and consequently a 100 m wide barrier with no Mineral Resources is defined along the interpreted fault. Fig. 2 presents the ROI distribution for carnallitite seams in Cycles V to VII showing the Indicated resource ROI clipped at interpreted faults and the Inferred ROI extending beyond these same faults.

The resulting Indicated and Inferred mineral resources for the Banio Project are presented in Tables 1 and 2. The robust carnallitite Indicated Resource of 636.5M tonnes at 15.8% KCl and Inferred Resource of 1.1B tonnes at 15.8% KCl provide a solid base for continuing exploration at the project and for a Preliminary Economic Assessment which is planned on this resource base with completion in Q1 2024. The PEA the Company plans to complete will focus only on the North Target although significant potential for potash mineralization is interpreted from downhole geophysical studies completed in several oil and gas wells at the South Target of the permit area.

In addition to carnallitite resources, the sylvinite mineralization with Indicated resources of 20.1M tonnes at 21.6 % KCl and Inferred resources of approximately 43.8M tonnes at 21.2% KCl represent an attractive exploration target with higher grades that may enhance the overall grade of the project. In addition, the potential to expand resources at the North Target are considered excellent, the flat-lying potash beds remain open for expansion in all directions with the exception of northeast which trends under the lagoon.

The Company's Phase 1 drill program includes additional drilling at the North Target including the extension of BA-001 and the drilling of a new hole to test the potential of potash mineralization east of the current drilling. Preparation work and repairs to the drill on site remain in progress however procurement of spare parts and supply chain delays have now pushed restart of the drilling program into Q1 2024.

The Company is required to file an NI 43-101 compliant technical report on SEDAR within 45 days of the initial disclosure of the MRE made herein.

The Company has granted a total of 2,181,000 incentive stock options to certain directors, officers, and consultants of the Company. The incentive stock options are exercisable for a period of 5 years at an exercise price of $ 0.35 per share.. The options are granted pursuant to the Company's stock option plan and are subject to its approval by the TSX Venture Exchange.

Figure 2 Indicated and Inferred ROI Polygons for Carnallitite Seams in Cycles V to VII

Figure 2 Indicated and Inferred ROI Polygons for Carnallitite Seams in Cycles V to VII

The information in this news release has been reviewed and approved by Sebastiaan van der Klauw, EurGeol, of ERCOSPLAN and Peter J. MacLean, Ph.D., P. Geo, Director of the Company, and both are Qualified Persons as that term is defined in National Instrument 43-101.

To find out more about Millennial Potash Corp. please contact Investor Relations at (604) 662-8184 or email at This email address is being protected from spambots. You need JavaScript enabled to view it..

MILLENNIAL POTASH CORP.

"Farhad Abasov"

Chair of the Board of Directors

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This document may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan" or "planned", "forecast", "intend", "may", "schedule" and similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to future prices of commodities, accuracy of mineral or resource exploration activity, reserves or resources, regulatory or government requirements or approvals including approvals of title and mining rights or licenses and environmental (including land or water use), local community or indigenous community approvals, the reliability of third party information, continued access to mineral properties or infrastructure, changes in laws, rules and regulations in Gabon or any other jurisdiction which may impact upon the Company or its properties or the commercial exploitation of those properties, currency risks including the exchange rate of USD$ for Cdn$ or CFA or other currencies, fluctuations in the market for potash or potash related products, changes in exploration costs and government royalties, export policies or taxes in Gabon or any other jurisdiction and other factors or information. The Company's current plans, expectations and intentions with respect to development of its business and of the Banio Potash Project may be impacted by economic uncertainties arising out of any pandemic or by the impact of current financial and other market conditions on its ability to secure further financing or funding of the Banio Potash Project. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, environmental and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | C$3.18 |

| Daily Change: | 0.20 6.53 |

| Daily Volume: | 365,307 |

| Market Cap: | C$350.250M |

December 29, 2025 September 16, 2025 September 03, 2025 August 27, 2025 | |