Wealth Minerals Ltd. (TSXV: WML) (OTCQB: WMLLF) (SSE: WMLCL) (FSE: EJZN) (the "Company" or "Wealth"), announces it has shifted its license portfolio in both the Atacama and Ollague Projects. This shift was conducted to best reflect management's conversations with local stakeholders, geological prospectivity and to position the Company for easier future permitting efforts.

Atacama Project

Wealth Minerals has tailored its license footprint in the Atacama Salar. The Company has reconfigured its original 46,200 hectares license package. The Company has moved away from licenses which have low prospectivity for shallow brines, as determined by past geophysical work by the Company. Additionally, the Company no longer has licenses which cover the Laguna Cejar, a topographical feature important to local indigenous peoples. Wealth notes that the new license hectares package contain the best geophysical anomalies for potential shallow and deep brine recovery.

Management believes this move is in the best interests of the Company and local stakeholders, and Management anticipates that future permitting work from various Chilean agencies, Company dialog with local indigenous peoples, and total license holding costs will be eased due to this corporate action.

Additionally, the Company has expanded its license footprint in the east of the Atacama Salar next to Highway 23, previously referred to as the "Harry Project" (see press release February 11, 2019). The original Harry Project was 7,900 hectares, to which has been added 3,500 hectares. The Company has entered into an arm's length property purchase agreement for the acquisition of this additional 3,500 hectares license position (the "Harry Agreement"). Upon approval, the Company will issue 1,290,000 common shares of Wealth to the vendor. Completion of the Harry Agreement is subject to acceptance by the TSX Venture Exchange.

In total, the entire Wealth Minerals' claim portfolio in the Atacama Salar is 46,200 hectares, which is the same as the original position acquired by Wealth, and is a major position on par in size with state-company CORFO, which currently hosts Sociedad Quimica y Minera de Chile (SQM) and Albemarle Corporation who collectively account for a fourth of global lithium production here.

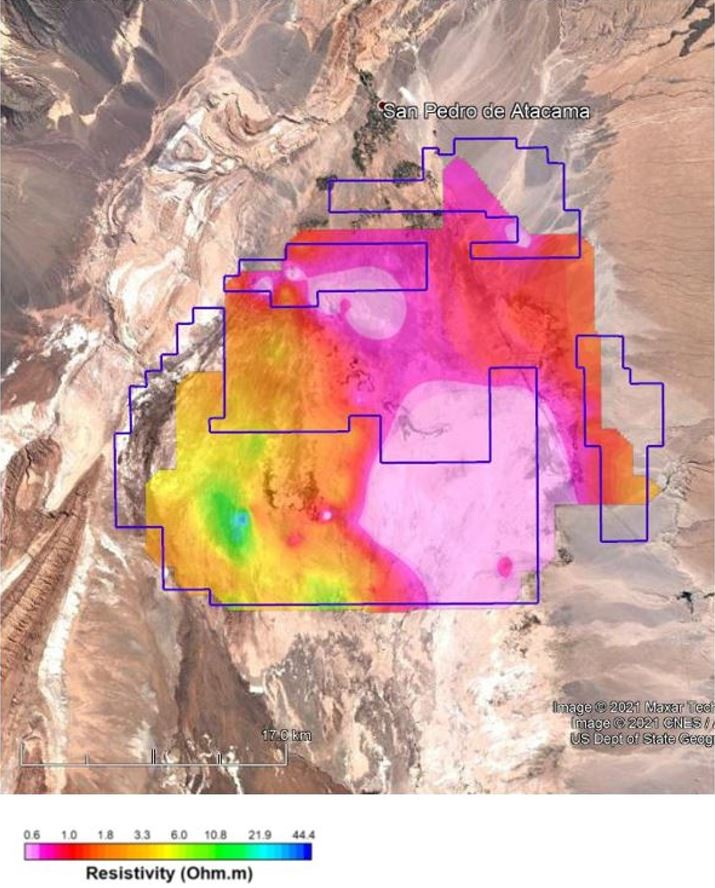

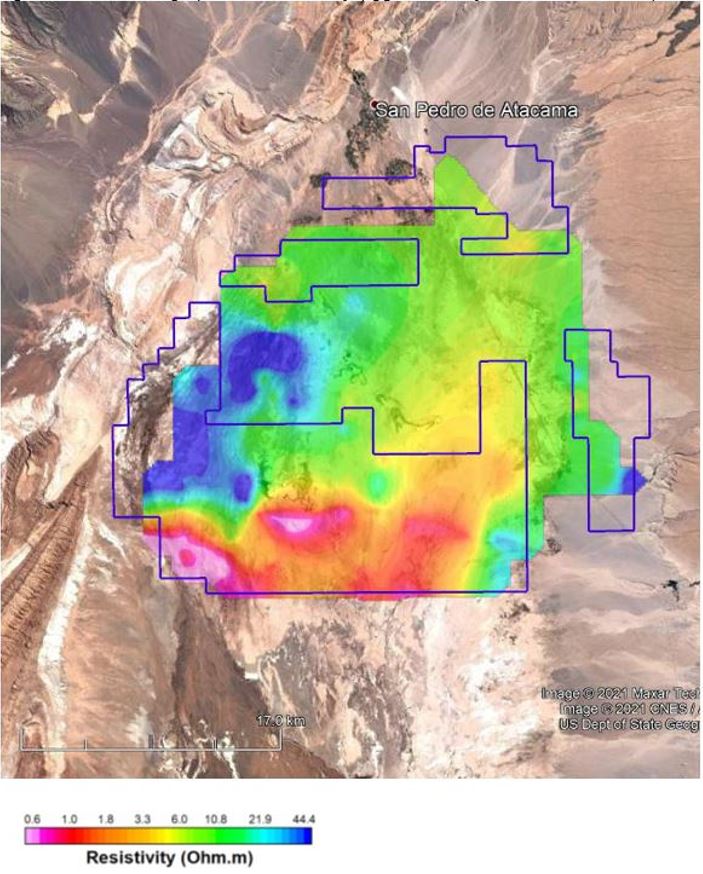

The Company has superimposed its geophysical work onto the license map (below in Maps 1 and 2). The geophysical data identified very high conductivity (very low resistivity) zones (as denoted by pink and red colors), which are interpreted to represent porous media with high-salinity fluids (potentially lithium-bearing brines).

Updated License Map 1, Deep Anomaly (approximately 800m below surface)

Updated License Map 1, Deep Anomaly (approximately 800m below surface)

Updated License Map 2, Shallow Anomaly (approximately 100m below surface)

Updated License Map 2, Shallow Anomaly (approximately 100m below surface)

Ollague Project

The Ollague Salar (previously referred to as "Vapor") is in northern Chile (see press release February 11, 2019) and the Company has added to its existing claim portfolio an additional 2,100 hectares for a total of 6,420 hectares. The Company has entered into an arm's length property purchase agreement (the "Ollague Agreement") for the acquisition of this additional 2,100 hectares license position. Upon approval, the Company will issue 1,210,000 common shares of Wealth to the vendor. Completion of the Ollague Agreement is subject to acceptance by the TSX Venture Exchange.

Recent drilling activity by a peer company in the area returned lithium grades up to 480 Li mg/l. Readers are cautioned that the properties held by a peer company are adjacent properties and that Wealth has no interest in or right to acquire any interest in any part of the properties and that mineral deposits on adjacent or similar properties are not in any way indicative of mineral deposits on Wealth's position in the Ollague Salar.

Wealth has interpreted past geophysical work to identify shallow zones of very low electric resistivity (Map 3), which are the most obvious targets for lithium bearing brines to be tested with drilling (see press release of February 28, 2019).

Map 3, Ollague License Area with Pink Color Highlighting Interpreted Area of Shallow Anomaly (less than 400m below surface) Showing Resistivity Less than 1 ohm.m

Map 3, Ollague License Area with Pink Color Highlighting Interpreted Area of Shallow Anomaly (less than 400m below surface) Showing Resistivity Less than 1 ohm.m

Hendrik van Alphen, CEO of Wealth, commented: "Our Company has a fantastic asset portfolio in Chile and we have analyzed and acted the best way to create value for our shareholders while taking into account the interests of our wider range of stakeholders. I look forward to updating you on our progress."

About Wealth Minerals Ltd.

Wealth is a mineral resource company with interests in Canada, Mexico and Chile. The Company's main focus is the acquisition and development of lithium projects in South America. To date, the Company has positioned itself to work alongside existing producers in the prolific Atacama salar, where the Company has a substantial license package.

Lithium market dynamics and a rapidly increasing metal price are the result of profound structural issues with the industry meeting anticipated future demand. Wealth is positioning itself to be a major beneficiary of this future mismatch of supply and demand. The Company also maintains and continues to evaluate a portfolio of precious and base metal exploration-stage projects.

For further details on the Company readers are referred to the Company's website (www.wealthminerals.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

On Behalf of the Board of Directors of

WEALTH MINERALS LTD.

"Hendrik van Alphen"

Hendrik van Alphen

Chief Executive Officer

For further information, please contact:

Marla Ritchie

Phone: 604-331-0096 Ext. 3886 or 604-638-3886

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, anticipated exploration program results from exploration activities, the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves, the closing and amount of the Placement, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "postulate" and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of lithium, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in the Placement, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including acceptance by the TSX-V, required for the Placement, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and risks related to joint venture operations, and other risks and uncertainties disclosed in the Company's latest interim Management Discussion and Analysis and filed with certain securities commissions in Canada. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

| Last Trade: | US$0.05 |

| Daily Change: | 0.0045 9.47 |

| Daily Volume: | 1,000 |

| Market Cap: | US$17.780M |

September 23, 2025 July 14, 2025 April 23, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS