Voyageur Pharmaceuticals Ltd. (“Voyageur” or the “Company”) (TSXV:VM) is pleased to announce the results of its Preliminary Economic Assessment (“PEA”) for the development of its Frances Creek pharmaceutical barium sulfate project (the “Project”), located in British Columbia, Canada. The PEA was prepared by SGS Geological Services (“SGS”). The effective date of the PEA is January 11, 2022 and a technical report relating to the PEA will be filed on SEDAR within 45 days of this news release. All values are in Canadian dollars.

Economics

Initial Project horizon – 10 Years |

Total Capital Required over 3 years – $36 million |

Equipment delivery and installation period (including mine permitting) – 24 months |

Payback period after start of production – 11 Months |

Operating Gross Margins average 75% over the Project |

Base Case | Pre-Tax | After-Tax |

Net Present Value - 8% discount rate | $464 Mn | $344 Mn |

Total Project Cash Flow (10 year cumulative) | $839 Mn | $626 Mn |

The base case economics for the Project, indicates a pre-tax net present value (“NPV”) of $464 million CAD and internal rate of return (“IRR”) of 168%, while the post tax NPV is $344 million CAD with an IRR of 137% at a discount rate of 8%. The Project assumes a pre-production period of 2 years for equipment delivery and installation, and mine permitting. The payback period under the base case is 11 months.

Based on current shares issued and outstanding, the NPV after tax = $3.38 per share (fully diluted share value = $2.59 per share).

Processing products include the following:

Smooth X

Barium Sulfate 98% HDX

Barium Sulfate 96% LDX

MultiXThick

MultiXThin

Bulk Product

BaSO Drill Product

Current pricing of 97.5% BaSO4 available from China has a delivered price of $4,760 USD per tonne, or $5,960 CAD per tonne. This pricing is used for bulk sales of BaSO4, that are not used in the manufacture of pharmaceutical products. Voyageur’s product has a higher quality of 98.3% BaSO4 and pricing in the PEA is based on 97.5% BaSO4 product. The BaSO4 product rejected for the Company's manufacturing process will be relatively high-quality Barite, which is assumed to be suitable for drilling fluids products and is assumed to be sold as drilling grade barite in bulk to the Alberta energy industry.

Resource Model

For the mineral resource estimation, SGS relied upon data that Voyageur supplied in pdf, xlsx and other formats. The final database contains 57 drillholes and 3 channels totalling 3,106.12 m. The length of the channels ranges from 2.5 to 8.4 m and the drillholes range from 18.29 to 122.53 m in length. There are 169 assays varying from 0.15 to 18.3 m in length and from 0.22 to 99.09 % BaSO4, and there are 100 lithology intervals.

Voyageur provided SGS with a three-dimensional lidar topography. The verification of the surface shows a great accuracy. The site visit indicated that the overburden was estimated to be 2m deep in most places. Therefore, a depth of 2m vertical was applied for the entire project for the overburden.

The 2003-2017 drilling was used to make a 3-dimensional mineralisation model. A total of 3 volumes were modelled and named A, B1 and B2.

A block model was then created and estimated by Inverse Distance squared (IDS) using calculated composites of about 2.5 m but with the avoidance of remainders by slight adjustments in the composite lengths. Capping was found to affect minimally the resource results. Nevertheless, samples of more than 5 m in length got their grades reduced by 10% to reduce the risk related to these long intervals. The global impact is a reduction of the grade by about 5%. The block size used was 5 x 5 x 5m. Block fractions were used so the blocks have a “percent block” variable between 0 and 1 to account for incomplete blocks partly inside the mineralized volumes. Similar estimation parameters were used for the 3 estimation passes: minimum number of samples: 3, maximum number of samples: 5, maximum number of samples per drillhole: 2. There were 3 successive estimation passes with “variable orientation” search ellipsoids: pass 1 with a search ellipsoid of 20 x 20 x 5m, pass 2 with a search ellipsoid of 40 x 40 x 10m; and pass 3 with a search ellipsoid of 80 x 80 x 30m. Hard boundaries were used for all 3 solids.

Because of the small deposit and the high value of the Barite, the 2 pits were not optimized using a pit optimizer. The pit designs were created around the mineral volumes. The following assumptions were used to estimate a cut-off grade of 10% BaSO4.

The specific gravity used for the mineralized material is based on the BaSO4 grade using the following formula: SG = 2.828 + 0.0000009404*(BaSO4)3 - 0.000030963*(BaSO4)2 + 0.010623107*BaSO4 that fits very well with the 87 measurements from 2017. The formula also fits reasonably well with the 82 measurements from 2003 and 2005.

The resources are shown in the table below:

(1) Effective date for resources is January 11, 2022.

(2) The independent QP for this resources estimate is Yann Camus, P.Eng., SGS Geological Services.

(3) The base case is reported at a cut-off grade of 10% BaSO4.

(4) Open pit mineral resources are reported at a base case cut-off grade of 10% BaSO4 within a conceptual pit shell. Cut-off grades are based on a barite price, barite mining and processing recovery and mining and processing cost.

(5) The resources are presented in-situ and without dilution.

(6) Block fraction was applied to the mineral resources.

(7) Mineral resources that are not mineral reserves do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(8) This Resource Estimate has been prepared in accordance with CIM definition (2014).

(9) The density used for each block is based on grade and the following formula:

2.828+(0.0000009404*(BaSO4)3) - (0.000030963*(BaSO4)2) + (0.010623107* BaSO4)

(10) A variable BaSO4 capping grade was used by removing 10% of the grade on assay with lengths >5 m and resulting in an overall reduction of 5% of the barite content.

(11) Total may not add due to rounding.

Quarry

The Project has a very small environmental footprint at the quarry site. Management has moved forward to create a project that limits environmental issues. Voyageur has eliminated tailing ponds, reduced water consumption, designed a quarry and concentrate processing site that uses minimal land and low land disturbance to the area. Mining will be seasonal, and work will continue to expand the resource. The PEA economics are based on quarry operations on the B zone. Voyageur has resource below the B zone at the A zone. Voyageur will be expanding its exploration program after positive cash flow to continue to expand the Project.

Capital & Operating Costs

Capital and operating costs for both the mine and processing facilities were developed based on first principal calculations, factored estimates, project benchmarking, vendor quotes and conceptual scheduled production/equipment hours where available. The qualified persons have reviewed these costs and concluded they are reasonable for inclusion in the PEA. Capital and operating costs are estimated within +/- 40% at a Preliminary Economic Assessment level of accuracy. Process capital costs include a 15% contingency, while mining costs are based on current rental quotes, contractor rates and first principal calculations.

Mining and infrastructure costs, as well as primary processing of the BaSO4 product was conducted by SGS, while capital and operating costs for the pharmaceutical products was provided by Alberta Veterinary Laboratories (“AVL”).

A summary of Mine and Process capital costs are presented in the Table below.

Description | Capital |

Mining and On-Site Processing | 3.82M |

Process plant | 13.18M |

Process Plant Infrastructure | 5.36M |

Bottling Facility | 2.96M |

Subtotal Direct Costs | 25.3M |

Indirects | 1.85M |

Engineering and project management | 3.70M |

Provisions and Owners’ costs | 1.31M |

Contingency | 4.26M |

Subtotal Indirect Costs | 11.2M |

Grand Total Project Capital | 36.4M |

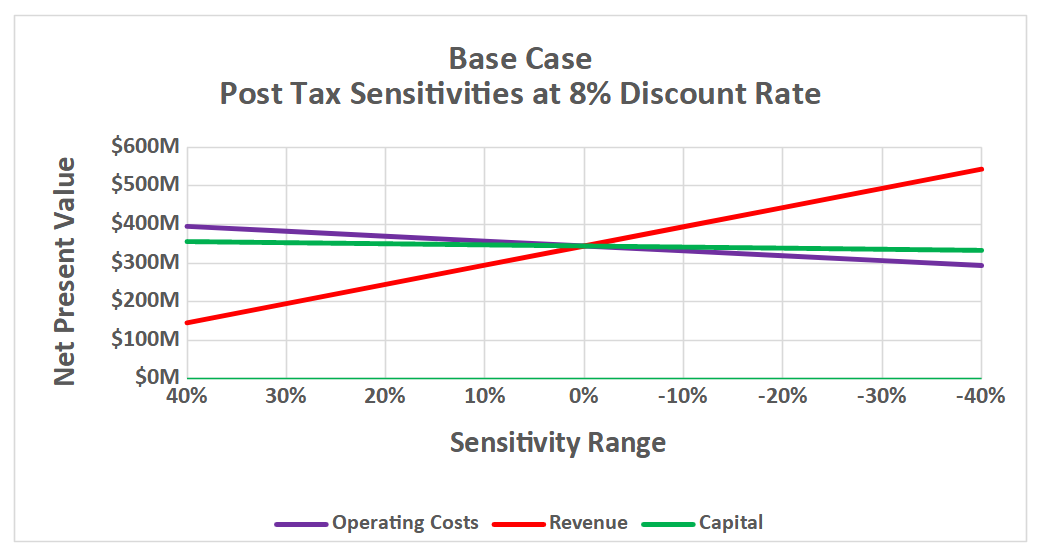

Sensitivities

Figures show the results for the base case for post-tax NPVs.

A sensitivity analysis was conducted on capital costs, operating costs and revenue in 10% increments from 60% of base values to 140% of base values (+/- 40%). Results indicate that any scenario within this large range still produce strong NPVs.

Brent Willis, CEO of Voyageur, stated: “We are pleased to have delivered a positive PEA for the Frances Creek Project that has the potential to be one of the highest purity natural barium projects in the world. Barium Sulfate is a critical and strategic mineral for North America, our plan to fully integrate the barium radiology contrast market will be essential to providing low-cost pharmaceuticals and secure supply chains to market. The results of the PEA reveal the Frances Creek Project demonstrates robust economics and low initial CAPEX via a staged development scenario to fully integrate the barium contrast drug and device market. The SGS report establishes a path forward to allow Voyageur to become a competitive force, utilising our low cost barium to become a market leader. The fully integrated team at SGS was critical to pull in all the pieces for our dynamic project. SGS mining, metallurgical and life science divisions where instrumental to bring together all our segments of our fully integrated project. Voyageur now has a process to upgrade and produce the highest quality barium sulfate, at a low cost to industry standards. The Frances Creek project is a stand alone, one of a kind project in the barium sulfate industry.”

Voyageur Near Term Strategy

Voyageur is currently using third party manufacturing and mineral supplies to develop its first products for market. Voyageur has Health Canada approval on five barium contrast products and is moving forward with FDA and EU licencing. Voyageur plans to generate revenue in 2022 utilising AVL's good manufacturing process pharmaceutical manufacturing plant located in Calgary, Alberta. The following are the planned phased in steps to full integration in the contrast media market:

Produce products using third parties

Build critical mineral active pharmaceutical ingredient (“API”) good manufacturing practice (“GMP”) processing plant and barium Quarry

Fully integrate the barium contrast market and supplement revenue with high purity industrial barium sales

Produce iodine products utilising third parties

Produce iodine products from brine waters with fully integrated processing plant from the well head to the bottle

Voyageur is continuing to advance its full integration of the radiology barium and iodine drug and device market. Management believes Voyageur’s From The Earth To Bottle strategy has sound economics to create high growth and profitability in the near future.

About Voyageur

Voyageur is a Canadian public company listed on the TSXV under the trading symbol VM. Voyageur is focused on the development of barite and iodine Active Pharmaceutical Ingredients (“API”) and high-performance cost-effective imaging contrast agents for the medical radiology marketplace. Voyageur’s goal is to initially generate positive cash flow from operations using third party GMP pharmaceutical manufacturers in Canada and internationally. Ultimately, Voyageur has plans to build all the required infrastructure to become 100% self-sufficient with all manufacturing. Voyageur owns a 100% interest in three barium sulphate (barite) projects including the Frances Creek property, suitable in grade for the pharmaceutical barite marketplace, with interests in a high-grade iodine, lithium & bromine brine project located in Utah, USA.

Voyageur is moving forward with its business plan of becoming the only fully integrated company in the radiology medical field, by controlling all primary input costs under the motto of: "From the Earth to the Bottle".

Independent Qualified Persons

The resource estimate was prepared by Yann Camus, P.Eng., of SGS Canada Inc for Voyageur. Marc-Antoine Laporte, P. Geo., of SGS Geological Services reviewed and approved the scientific and technical disclosure of this press release.

Both Mr Camus and Laporte are independent of Voyageur and are “Qualified Persons” as defined by National Instrument 43-101.

For Further Media Information or to set up an interview, please contact:

Brent Willis

President & CEO

E This email address is being protected from spambots. You need JavaScript enabled to view it.

www.voyageurpharmaceuticals.ca

Ron Love

CFO

T 403.818.6086

E This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release may contain certain forward-looking information and statements, including without limitation, statements pertaining to: the estimates set out in the PEA including total capital required, capital and operating costs, equipment delivery and installation period, payback period, operating gross margins, net present value, cash flow, and the resource estimation and grade of the barite; Voyageur generating revenue in 2022; the timing and success of penetrating the US and other markets; the timing and success of the Company's products meeting various regulatory standards; and the Company's long term plans, including with respect to becoming 100% self-sufficient with all manufacturing. All statements included herein, other than statements of historical fact, are forward-looking information and such information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. A description of assumptions used to develop such forward-looking information and a description of risk factors that may cause actual results to differ materially from forward-looking information can be found in the Company's disclosure documents on the SEDAR website at www.sedar.com. Voyageur does not undertake to update any forward-looking information except in accordance with applicable securities laws.

| Last Trade: | US$0.05 |

| Daily Volume: | 0 |

| Market Cap: | US$6.280M |

December 20, 2024 September 05, 2024 May 28, 2024 December 21, 2023 | |

GreenPower Motor designs, builds and distributes a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, cargo van, and a cab and chassis...

CLICK TO LEARN MORE

Surf Air Mobility is a regional air mobility platform expanding the category of regional air travel to reinvent flying through the power of electrification. In an effort to substantially reduce the cost and environmental impact of...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS