Montréal, QC - TheNewswire - July 31, 2023 - St-Georges Eco-Mining Corp. (CSE:SX) (OTC:SXOOF) (FSE:85G1) would like to inform its shareholders that it has posted its Audited Financial Statements for the 12-month period ended March 31, 2023, and the prior 15 months period ended March 31, 2022, and the corresponding Management Discussion & Analysis on SEDAR.

The consolidated financial statements comprise the accounts of the Company and its controlled subsidiaries. All intercompany transactions, balances, and unrealized gains and losses from intercompany transactions are eliminated on consolidation. ZeU Technologies, Inc. (“ZeU”) is consolidated since common directors of St-Georges control the operations of ZeU.

Summary of the Results of Operation

For the year ended March 31, 2023, the Company recorded a net income of $1,669,392 (2022 - $23,277,671 loss), had a cumulative deficit of $41,445,897 (2022 – $39,486,653), and deficit non-controlling interest of $12,000,034 (2022 - $13,180,900). The Company had no source of operating revenues or any related operating expenditures.

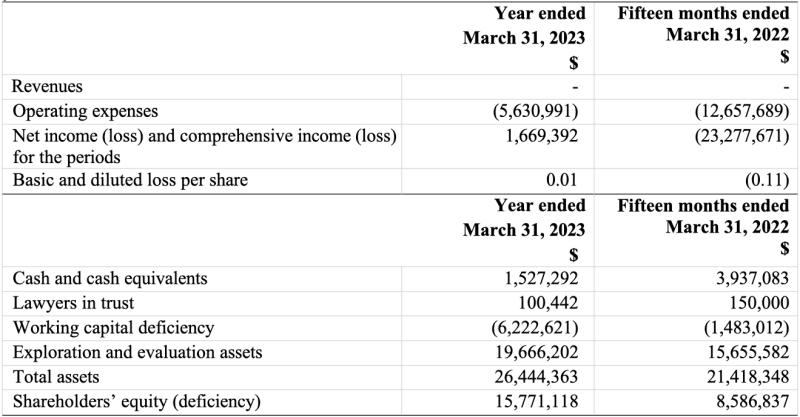

The following table provides a summary of the Company’s financial operations for the prior two fiscal years.

For the year ended March 31, 2023, the Company had no revenues.

The Company incurred a net income and comprehensive income for the year of $1,669,392 for the year ended March 31, 2023, compared to a net loss of $23,277,671 for the fifteen months ended March 31, 2022. The increase in the income is due to decreases in stock-based compensation payments to $nil (2022 - $3,755,245), in accretion and interest expenses of $1,574,129 (2022 - $2,370,806), in research and development fees of $601,083 (2022 - $1,657,450), and in operating expenses to $5,630,991 (2022 - $12,751,818).

The primary reason for the difference is that the Company had a gain on debt settlements of $7,966,523 (2022 – $nil). The amount of the debt settled was just under $10,000,000. $3,2000,000 of the debt being consolidated in the current financial statements remains the sole responsibility of ZeU Technologies.

Summary of the Quarterly Results

The following table outlines selected unaudited financial information of the Company for the last eight quarters.

The Company currently runs four operating segments: the acquisition and exploration of mining properties, the development of novel metallurgical processes, the development of hydrogen production technologies and the recycling of different chemistry types of used batteries. All the Company’s activities are conducted in Canada and Iceland.

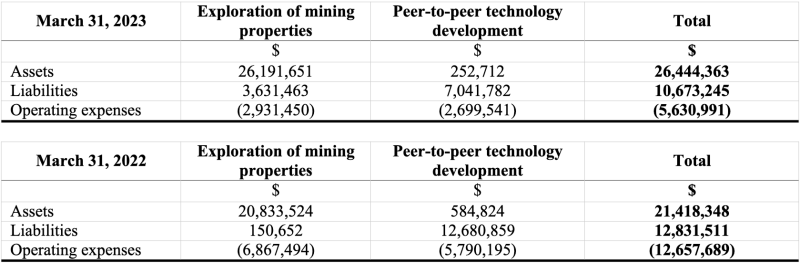

The assets, liabilities, and operating expenses are presented as geographic segment information. The primary indicators are as follows:

Key decision makers review assets, liabilities and operating expenses as the primary indicators of segment information. The primary indicators are as follows:

Significant Risks

Exploration and mining involve a high degree of risk. Few exploration properties end up going into production. Other risks related to exploration and mining activities include unusual or unforeseen formations, fire, power failures, labour disputes, flooding, explosions, cave-ins, landslides and shortages of adequate or appropriate manpower, machinery or equipment.

The development of a resource property is subject to many factors, including the cost of mining, variations in the quality of the material mined, fluctuations in the commodity and currency markets, the cost of processing equipment and others, such as First Nations claims and government regulations, including regulations regarding royalties, authorized production, import and export of natural resources and environmental protection.

There can be no assurance that the expenses incurred by the Company to explore its properties will result in the discovery of a commercial quantity of ore.

Environmental and other regulations

Current and future environmental laws, regulations and measures could entail unforeseeable additional costs, capital expenditures, restrictions, or delays in the Company’s activities. Environmental regulations and standards are subject to constant revision and could be substantially tightened, which could have a serious impact on the Company and its ability to develop its properties economically. Before it commences mining a property, the Company must obtain environmental permits and the approval of the regulatory authorities. There is no assurance that these permits and approvals will be obtained or that they will be obtained in a timely manner.

The Company does not presently have sufficient financial resources to undertake its planned exploration and development programs. Development of the Company’s properties, therefore, depends on its ability to raise the additional funds required. There can be no assurance that the Company will succeed in obtaining the funding required. The Company also has limited experience in developing resource properties, and its ability to do so depends on the use of appropriately skilled personnel or signature of agreements with other large resource companies that can provide the required expertise.

The factors that influence the market value of platinum, palladium, rhodium, copper, cobalt, nickel, carbon graphite, and any other mineral discovered are outside the Company’s control. The impact of these factors cannot be accurately predicted. Resource prices can fluctuate widely and have done so in recent years.

Risks not covered by insurance.

The Company may become subject to claims arising from cave-ins, pollution, or other risks against which it cannot insure itself due to the high cost of premiums or other reasons. Payment of such claims would decrease and could eliminate the funds available for exploration and mining activities.

Key Audit Matters

The valuation of the mineral exploration rights and licenses is based on qualitative data and comparable analysis related to the Company’s management judgement.

An important aspect of the current financial results comes from the carryover of one significant and non-recurring extinguishment of debt from ZeU Technologies, a stand-alone entity in which St-Georges has a controlling position. A large amount of debt being consolidated in the current financial statements for $3,2000,000 remains, and is the sole responsibility of ZeU Technologies.

The Company also reviewed the recognition of certain expenditures that were previously expensed and capitalized an additional $396,845 for the battery recycling plant.

The Company reviewed in depth the potential impacts of new emerging accounting standards that will be in force in the new financial period that will end March 31, 2024. Management found no issues in the current accounting methods employed. However, the expectation of imminent reoccurring revenues from the wholly owned battery recycling unit, EVSX Corp., will create new obligations and will require additional levels of oversight for which management has started to plan the implementation. Additional resources are expected to be required to meet the accounting standards considering the new nature of the operations. The new segment of operations is expected to have its own segregated layers of oversight for the Thorold plant operations.

New market listings requirements are also expected and will bring in additional challenges and force the Company to add significant accounting and auditing resources as well as to improve its reporting processes.

ON BEHALF OF THE BOARD OF DIRECTORS

“Richard Barnett”

Richard Barnett, CFO

About St-Georges Eco-Mining Corp.

St-Georges develops new technologies to solve some of the most common environmental problems in the mining sector, including maximizing metal recovery and full-circle battery recycling. The Company explores for nickel & PGEs on the Manicouagan and Julie Projects on Quebec’s North Shore and has multiple exploration projects in Iceland, including the Thor Gold Project. Headquartered in Montreal, St-Georges’ stock is listed on the CSE under the symbol SX and trades on the Frankfurt Stock Exchange under the symbol 85G1 and as SXOOF on the OTCQB Venture Market for early stage and developing U.S. and international companies. Companies are current in their reporting and undergo an annual verification and management certification process. Investors can find Real-Time quotes and market information for the company on www.otcmarkets.com

Visit the Company website at www.stgeorgesecomining.com

For all other inquiries: This email address is being protected from spambots. You need JavaScript enabled to view it.

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

| Last Trade: | US$0.04 |

| Daily Volume: | 0 |

| Market Cap: | US$11.780M |

November 13, 2025 October 21, 2025 October 14, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS