Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Royal Helium Receives Independent Helium Resources Assessment and Evaluation for Steveville and Nazare

Royal Helium Ltd. (TSXV: RHC) (TSXV: RHC.WT) (OTCQB: RHCCF) ("Royal" or the "Company") is pleased to report that it has received a Competent Person's Report ("CPR") from GLJ Ltd. of Calgary, Alberta, Canada, dated August 19, 2022, with an effective date of July 31, 2022, which provides an independent resources assessment and evaluation of Royal's material helium assets to date. This CPR has been compiled in accordance with the guidelines and scope as set out in the AIM Note for Mining and Oil & Gas Companies (which forms part of the AIM Rules for Companies) in connection with the proposed listing of Company's shares on the AIM of the London Stock Exchange (see news release dated August 17, 2022).

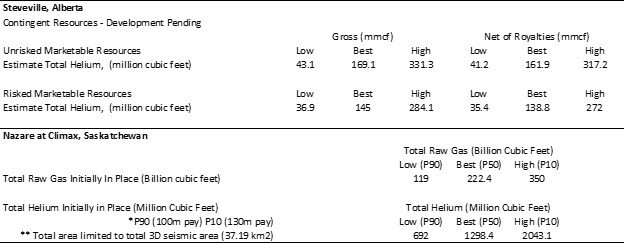

Resources highlights from Royal's Steveville and Nazare helium assets are set out in Table 1 and Net Present Values of Future Net Revenue for Steveville in Table 2 following. The Company also intends to obtain reports on its Climax conventional, Ogema and Val Marie wells in due course as additional work and testing data is compiled.

Andrew Davidson, President and CEO, Royal comments, "We are pleased to receive this independent third-party evaluation from GLJ Ltd. In addition to being a regulatory requirement as part of the Company's proposed listing on AIM, for us it affirms initial resources and economics that substantiates our first off-take sales agreement with a minimum delivery (no maximum) to our off-take partner of approximately 40% of the Steveville plant capacity. As for Nazare, a P50 at 114 meters (375 feet) of pay thickness, 1.298 billion cubic feet of helium is extraordinary considering it is still constrained to 27 sq km (14 sq miles) with limited 3D seismic area. We look to drill our first horizontal well into Nazare between Q4 2022 and Q1 2023 and additionally, we have only explored 6% of the Climax land block with an additional 10 conventional targets in our near-term drill plans."

* | GLJ Ltd. CPR effective date July 31, 2022 |

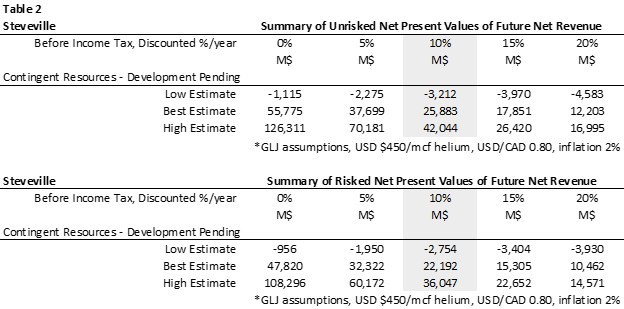

Table 2 highlights the Unrisked and Risked Net Present Values, at discount rates of 0% to 20% (Before Income Taxes) associated with the Marketable Resource values attributed to the Steveville, Alberta asset indicated in Table 1.

* | GLJ Ltd. CPR effective date July 31, 2022 |

Shayne Neigum, Chief Operating Officer, Royal comments, "The best estimate of risked contingent resources – development pending for Steveville has a risked net present value at 10% (before income taxes) of $22,192,000 for the 145 million cubic feet of company interest risked contingent marketable helium resources, which equates to an in-the-ground value of $153 per thousand cubic feet, after accounting for future capital expenditures, including the construction of a Helium Processing Plant and all pipelines, as well as future royalties, operating and maintenance expenses. This risked metric gives Royal the confidence to proceed with the installation of a gathering system and processing infrastructure at Steveville. The metrics provided by the GLJ Ltd. report are a compelling incentive to accelerate the development of Nazare as well as Climax conventional, Ogema, Val Marie and other land blocks in Saskatchewan and Alberta."

*Important report notes: This CPR has been compiled in accordance with the guidelines and scope and content of a CPR, as set out in the AIM Rules for Companies including the "Note for Mining and Oil & Gas Companies", as published by the London Stock Exchange in June 2009, for the purposes of publication in an AIM admission document. The effective date of this evaluation is July 31, 2022. GLJ Ltd is located at 1920, 401 – 9th Avenue SW, Calgary, Alberta, Canada, T2P 3C5.

It is understood that the Company is not currently required, nor able to file a compliant National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities ("NI 51-101") report under current regulations but for this analysis the methodology used to estimate resources as outlined in NI 51-101 will be applied. Included in the evaluation is an estimation of volume and value of helium associated with the hydrocarbons. The analysis of helium resources follows the same methodology as the analysis of hydrocarbons, as defined in NI 51-101 and the Canadian Oil and Gas Evaluation Handbook (the "COGEH"). This evaluation has been prepared to be consistent with reserves and resources definitions, standards and procedures contained in the COGEH; however, this evaluation is associated with discovered and undiscovered helium resources. The results of this evaluation would be the same or immaterially different under the use of procedures and standards contained in the Petroleum Resources Management System of the Society of Petroleum Engineers.

Royal controls over 1,000,000 acres of prospective helium land across southern Saskatchewan and southeastern Alberta. All of Royal's lands are in close vicinity to highways, roads, cities and importantly, close to existing oil and gas infrastructure, with a significant portion of its land in close proximity to existing helium producing locations. With stable, rising prices and limited, non-renewable sources for helium worldwide, Royal intends to become a leading North American producer of this high value commodity. Royal's helium reservoirs are carried primarily with nitrogen. Nitrogen is not considered a greenhouse gas ("GHG") and therefore has a low GHG footprint when compared to other jurisdictions that rely on large scale natural gas production for helium extraction. Helium extracted from wells in Saskatchewan and Alberta can be up to 99% less carbon intensive than helium extraction processes in other jurisdictions.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release includes certain statements that may be deemed to be "forward-looking statements". All statements in this news release, other than statements of historical facts, that address events or developments that management of the Company expects, are forward-looking statements, including anticipated deliveries under Royal's offtake agreement, anticipated drilling of the Nazare horizontal well and other drilling plans, the intended construction of a Steveville Helium Processing Plant and pipelines and accelerated development of the Company's other assets. In addition, all references to resources are deemed to be forward-looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the resources described exist in the quantities predicted or estimated and can be profitably produced in the future. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the Company's control, including without limitation, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, volatility in production rates, environmental risks, inability to obtain drilling rigs or other services, capital expenditure costs, including drilling, completion and facility costs, unexpected decline rates in wells, wells not performing as expected, delays resulting from or inability to obtain required third party and regulatory approvals, ability to access sufficient capital from internal and external sources, inability to access gas transportation and processing infrastructure, the impact of general economic conditions in Canada, the United States and overseas, industry conditions, changes in laws and regulations (including the adoption of new environmental laws and regulations) and changes in how they are interpreted and enforced, increased competition, the lack of availability of qualified personnel or management, fluctuations in foreign exchange or interest rates, and the uncertainty of estimates and projections of production, costs and expenses. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. The Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause actual results to differ materially from those in forward-looking statements, include market prices, exploration and development successes, continued availability of capital and financing, and general economic, market or business conditions. Please see the public filings of the Company at www.sedar.com for further information and risks applicable to the Company.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.01 |

| Daily Volume: | 0 |

| Market Cap: | US$3.580M |

June 21, 2024 June 17, 2024 | |