Highlights

Patriot Battery Metals Inc. (the “Company” or “Patriot”) (CSE: PMET) (OTCQB: PMETF) (FSE: R9GA) is pleased to announce core sample analytical results for an additional ten (10) drill holes completed during the winter/spring phase of its 2022 drill campaign at the Company’s wholly owned Corvette Property (the “Property”). The Property is located proximal to the regional and all-weather Trans-Taiga Road and powerline infrastructure, within the James Bay Region of Quebec. The primary objective of the 2022 exploration is to infill drill and further delineate the spodumene pegmatite body present along the CV5-1 corridor, with the intent of completing an initial mineral resource estimate this fall.

Blair Way, Company President, CEO and Director, comments: “I could not be more pleased with the assay results from our winter drill program. We are consistently seeing wide intervals of lithium mineralization in the CV5-1 Pegmatite corridor over a lateral distance of at least 1.4 km. To see higher grades and big intercepts to the east, at the edge of our drilling completed to date, is very exciting as we commence our summer drill program. The mineralized body remains open along trend and at depth, with drills currently turning at both the east and west end of the corridor to further test the scale of this discovery. I am also looking forward to another site visit after PDAC to spend some time with the site team and work through the details of the summer drill program as we prepare for the arrival of the third drill rig in July”.

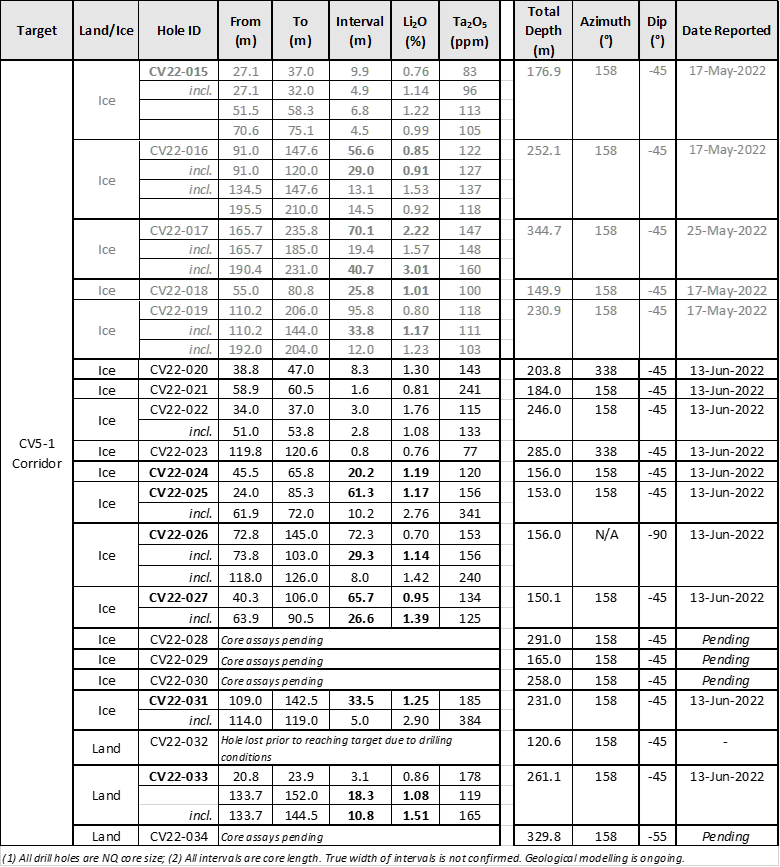

Core assay results are announced herein for drill holes CV22-020, 021, 022, 023, 024, 025, 026, 027, 031, and 033, and continue to demonstrate the presence of wide intervals of lithium mineralization along the CV5-1 pegmatite corridor. A summary of lithium (and tantalum) intercepts for the ten (10) drill holes reported herein is presented in Table 1 and Figures 2 and 3. Drill hole locations are presented in Figure 1. Drill holes CV22-022, 023, 024, 025, 026, 027, and 031 were designed to test for mineralized pegmatite beneath the shallow lake between the CV5 and CV1 outcrops (Figures 1, 2, and 3). Collectively, these drill holes confirm that the main pegmatite body trending through this corridor remains mineralized in lithium and tantalum and, further, the mineralized zone appears to widen considerably along strike between drill holes CV22-024 (1.19% Li2O over 20.2 m) and 025 (1.17% Li2O over 61.3 m), a distance of approximately 100 m. The mineralized zone is also traced further to depth by drill hole CV22-031, completed as a 100 m step back to drill hole CV22-025, returning an intercept of 1.25% Li2O over 33.5 m.

Drill holes CV22-022, 023, 024, 025, 026, 027, and 031 were designed to test for mineralized pegmatite beneath the shallow lake between the CV5 and CV1 outcrops (Figures 1, 2, and 3). Collectively, these drill holes confirm that the main pegmatite body trending through this corridor remains mineralized in lithium and tantalum and, further, the mineralized zone appears to widen considerably along strike between drill holes CV22-024 (1.19% Li2O over 20.2 m) and 025 (1.17% Li2O over 61.3 m), a distance of approximately 100 m. The mineralized zone is also traced further to depth by drill hole CV22-031, completed as a 100 m step back to drill hole CV22-025, returning an intercept of 1.25% Li2O over 33.5 m.

Drill holes CV22-020 and 033 were designed to further constrain the orientation (i.e. the dip) of the CV1 Pegmatite outcrop. Both holes intersected moderate to strong intervals of spodumene pegmatite. Drill hole CV22-033, collared on the north side of CV1 and oriented southerly, intersected an interval of pegmatite near surface of 0.86% Li2O over 3.1 m and another interval starting from 134 m depth interpreted to be the main pegmatite body trending beneath the shallow lake – 1.08% Li2O over 18.3 m, including 1.51% Li2O over 10.8 m. Drill hole CV22-020, collared on the south side of CV1 and oriented northerly, returned a mineralized pegmatite intercept grading 1.30% Li2O over 8.3 m. and is interpreted to be represent an extension of the CV1 Pegmatite outcrop at depth.

Collectively, the drill information collected to date supports the interpretation of the CV1 outcrop representing a splay off the main pegmatite body at depth, or a second sub-parallel trending body marked by a fault offset between. The drill holes completed over this area are widely spaced (Figure 3), and therefore, additional infill drilling is required to refine the interpretation of the area.

Drill hole CV22-021 was designed to test the orientation of the main pegmatite body trending beneath the lake at this location. The drill hole returned only a narrow interval of lithium mineralization at 0.81% Li2O over 1.6 m, thereby supporting a near-vertical to northerly dip for the main pegmatite body at this location. The current drill program intends to test the northerly dip of the main pegmatite body beneath the collar of holes 020 and 021, and extend the high-grade mineralization in drill hole CV22-017 (2.22% Li2O over 70.1 m – see news release dated May 24th, 2022).

The drilling to date in the area around the CV1 Pegmatite outcrop has demonstrated potential for very strong lithium grades over wide widths, most notably in drill hole CV22-017 at 2.22% Li2O over 70.1 m. Additionally, the tantalum grades in this area are also very strong and typically higher than those encountered in drill hole further west towards the CV5 Pegmatite. This is highlighted by drill holes CV22-017 (3.01% Li2O and 160 ppm Ta2O5 over 40.7 m), CV22-025 (1.17% Li2O and 156 ppm Ta2O5 over 61.3 m), CV22-031 (1.25% Li2O and 185 ppm Ta2O5 over 33.5 m) and CV22-026 (1.14% Li2O and 156 ppm Ta2O5 over 29.3 m). The strong zone of lithium and tantalum mineralization identified in this area surrounding the CV1 Pegmatite remains open along strike and at depth, with additional well-mineralized pegmatite outcrop (CV7 – 4.44% Li2O in grab sample), located more than 100+ m along strike to the northeast, remaining to be drill tested (Figure 1).

The Company recently re-commenced its drilling operations at the Property after a short break, following its 4,345 m twenty (20) hole winter drill program, and is fully funded to continue its 2022 drill campaign with an additional 15,000 m of NQ coring planned over the summer/fall period. This drilling will focus on continued land-based infill and step-out holes at the CV5-1 corridor, as well as testing of new regional targets (see news release dated June 2nd, 2022). The Company will add a third drill rig to the program, expected to arrive by mid-July, as well as a lake barge, which will allow continued focus on delineating the main pegmatite body beneath the shallow glacial lake between the CV5 and CV1 pegmatites.

The surface component of the 2022 drill program will commence in mid-June with detailed outcrop mapping proximal to the known spodumene pegmatite outcrops present across the Property (CV1 through CV12), as well as prospecting over more than 25 km of trend across the Property that has never been evaluated for lithium pegmatite.

The Company notes that it has developed a COVID Management Plan for the program and will carry out its field programs while adhering to all federal, provincial, and regional restrictions in place due to the COVID-19 pandemic. Mineral exploration has been recognized as an essential service in Canada and the Province of Quebec.

Quality Assurance / Quality Control (QAQC)

A Quality Assurance / Quality Control protocol following industry best practices was incorporated into the program and included systematic insertion of quartz blanks and certified reference materials into sample batches, as well as collection of quarter-core duplicates, at a rate of approximately 5%. Additionally, analysis of pulp-split and course-split sample duplicates were completed to assess analytical precision at different stages of the laboratory preparation process, and external (secondary) laboratory pulp-split duplicates were prepared at the primary lab for subsequent check analysis and validation.

All core samples collected were shipped to SGS Canada’s laboratory in Lakefield, ON, for standard sample preparation (code PRP89) which includes drying at 105°C, crush to 75% passing 2 mm, riffle split 250 g, and pulverize 85% passing 75 microns. Due to capacity issues, SGS forwarded several sample batches to alternate preparation labs in Sudbury, ON, and Burnaby, BC. The pulps were shipped by air to SGS Canada’s laboratory in Burnaby, BC, where the samples were homogenized (if preparation was not at Burnaby) and subsequently analyzed for multi-element (including Li and Ta) using sodium peroxide fusion with ICP-AES/MS finish (code GE_ICM91A50).

About the CV Lithium Trend

The CV Lithium Trend is an emerging spodumene pegmatite district discovered by the Company in 2017 and spans the FCI West, FCI East, and Corvette claim blocks. The core area includes an approximate 2 km long corridor (the CV5-1 Corridor), which is part of the more than 25-km long CV Lithium Trend extending across the Property. It consists of numerous spodumene pegmatite occurrences, which include the CV1, CV2, CV3, CV5, CV6, CV7, and CV11 pegmatites and has returned drill intercepts of 0.94% Li2O and 117 ppm Ta2O5 over 155.1 m (CF21-002), and 2.22% Li2O and 147 ppm Ta2O5 over 70.1 m, including 3.01% Li2O and 160 ppm Ta2O5 over 40.7 m (CV22-017). Drilling to date indicates a principal pegmatite body of significant size and has been traced by drilling over a distance of at least 1.4 km, and therefore, is considerably larger than that observed in outcrop. The high number of well-mineralized pegmatites in this core area of the trend indicate a strong potential for a series of relatively closely spaced/stacked, sub-parallel, and sizable spodumene-bearing pegmatite bodies, with significant lateral and depth extent, to be present.

Qualified Person

Darren L. Smith, M.Sc., P. Geo., Vice President of Exploration of the Company, a registered permit holder with the Ordre des Géologues du Québec and Qualified Person as defined by National Instrument 43-101, has reviewed the technical information in this news release.

About Patriot Battery Metals Inc.

Patriot Battery Metals Inc. is a mineral exploration company focused on the acquisition and development of mineral properties containing battery, base, and precious metals.

The Company’s flagship asset is the Corvette Property, located proximal to the Trans-Taiga Road and powerline infrastructural corridor in the James Bay Region of Québec. The land package hosts significant lithium potential highlighted by the CV5-1 spodumene pegmatite corridor with drill intercepts of 0.94% Li2O and 117 ppm Ta2O5 over 155.1 m (CF21-002), and 2.22% Li2O over 70.1 m, including 3.01% Li2O over 40.7 m (CV22-017). Additionally, the Property hosts the Golden Gap Trend with grab samples of 3.1 to 108.9 g/t Au from outcrop and 10.5 g/t Au over 7 m in drill hole, and the Maven Trend with 8.15% Cu, 1.33 g/t Au, and 171 g/t Ag in outcrop.

The Company also holds 100% ownership of the Freeman Creek Gold Property in Idaho, USA which hosts two prospective gold prospects - the Gold Dyke Prospect with a 2020 drill hole intersection of 4.11 g/t Au and 33.0 g/t Ag over 12 m, and the Carmen Creek Prospect with surface sample results including 25.5 g/t Au, 159 g/t Ag, and 9.75% Cu.

The Company’s other assets include the Pontax Lithium-Gold Property, QC; and the Hidden Lake Lithium Property, NWT, where the Company maintains a 40% interest, as well as several other assets in Canada.

For further information, please contact us at This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: +1 (778) 945-2950, or visit www.patriotbatterymetals.com.

On Behalf of the Board of Directors,

“BLAIR WAY”

Blair Way, President, CEO, & Director

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements other than statements of historical fact, included in this news release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include the results of further exploration and testing, and other risks detailed from time to time in the filings made by the Company with securities regulators, available at www.sedar.com. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable law.

No securities regulatory authority or stock exchange has reviewed nor accepts responsibility for the adequacy or accuracy of the content of this news release..

| Last Trade: | US$4.42 |

| Daily Change: | 0.02 0.45 |

| Daily Volume: | 2,700 |

| Market Cap: | US$717.230M |

December 14, 2025 November 14, 2025 November 12, 2025 October 20, 2025 October 08, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS