Highlights

Darren L. Smith, Company Vice President of Exploration, comments: “This maiden mineral resource estimate at CV5 is the culmination of an aggressive 20-month drill campaign that kicked off with our discovery hole in fall 2021, and is nothing less than a team effort to get us here. This first resource has firmly established CV5 as a Tier 1 spodumene pegmatite asset, already ranking as the largest lithium pegmatite resource in the Americas, as well as in the top 10 resources globally.”

“There remains significant potential for growth, with the resource open at both ends and to depth along a large portion of its length providing a clear path forward for further resource expansion. Further, there are multiple known spodumene pegmatite clusters yet to be drill tested at the Property and more than 20 km of prospective trend yet to be explored. In the case of CV13, the 2022 and 2023 drill programs are anticipated to underpin a maiden mineral resource estimate in 2024 at that spodumene pegmatite cluster. We believe we have only just begun to demonstrate the scale of the lithium mineralized pegmatite system at the Corvette Property,” Mr. Smith added.

Blair Way, Company President and CEO, comments: “We could not be happier with the result of this maiden mineral resource estimate at CV5, which will be the first of multiple resource estimates for the Corvette Property over the coming years. This Property is now officially host to at least one deposit that is definitely a world class asset with respect to the size, grade, and metallurgy when compared to its peers."

Emphasising Corvette’s development potential, Mr. Way explains: “It firmly positions the Company as a leading candidate to provide long-term spodumene supply to the North American and European markets. This is a key milestone for the Company and will underpin future economic and development studies as we look to aggressively advance this asset on the path to production. I would like to thank our shareholders for their support, and moreover, thank the exploration team for their focus and determination in delivering one of the largest spodumene pegmatite resources in the world.”

Patriot Battery Metals Inc. (the “Company” or “Patriot”) (TSX-V: PMET) (ASX: PMT) (OTCQX: PMETF) (FSE: R9GA) is pleased to announce the maiden (i.e., first) mineral resource estimate for the CV5 Spodumene Pegmatite at its wholly owned Corvette Property (the “Property”), located in the Eeyou Istchee James Bay region of Quebec. The CV5 Spodumene Pegmatite is located approximately 13.5 km south of the regional and all-weather Trans-Taiga Road and powerline infrastructure corridor, and within 50 km of the La-Grande 4 (LG4) hydroelectric dam complex.

The mineral resource estimate (“MRE”) at CV5 has firmly established it as the largest lithium pegmatite mineral resource in the Americas and 8th largest globally, returning 109.2 Mt at 1.42% Li2O and 160 ppm Ta2O5 inferred, at a cut-off grade of 0.40% Li2O, for a total of 3,835,000 t contained lithium carbonate equivalent (“LCE”) (Table 1, Figure 1, and Figure 2). The geological model underpinning the MRE interprets a single, continuous, principal spodumene pegmatite body ranging in true thickness from ~8 m to upwards of ~130 m, extending over a strike length of approximately 3.7 km (drill hole to drill hole), and which is flanked by multiple subordinate lenses. Additionally, the resource and geological modelling has outlined significant potential for growth at CV5, which remains open at both ends along strike, and to depth along a significant portion of its length.

This maiden MRE includes only the CV5 Spodumene Pegmatite (previously also termed the “CV5 Pegmatite cluster”), and therefore does not include any of the other known spodumene pegmatite clusters on the Property – CV4, CV8, CV9, CV10, CV12, and CV13 (Figure 3). At CV5, the MRE is supported by 163 diamond drill holes completed over the 2021, 2022, and 2023 (through the end of April – drill hole CV23-190) programs, for a collective total of 56,385 m, as well as eleven (11) outcrop channels totalling 63 m.

The mineral resource statement and relevant disclosure, sensitivity analysis, peer comparison, geological and block model views, and cross-sections are presented in the following figures and tables. A detailed overview of the Project is presented in the following sections in accordance with ASX Listing Rule 5.8.

Mineral Resource Statement (NI 43-101)

Table 1: NI 43-101 Mineral Resource Statement for the CV5 Spodumene Pegmatite

| Cut-off Grade Li2O (%) | Classification | Tonnes | Li2O (%) | Ta2O5 (ppm) | Contained Li2O (Mt) | Contained LCE (Mt) |

| 0.40 | Inferred | 109,242,000 | 1.42 | 160 | 1,551,000 | 3,835,000 |

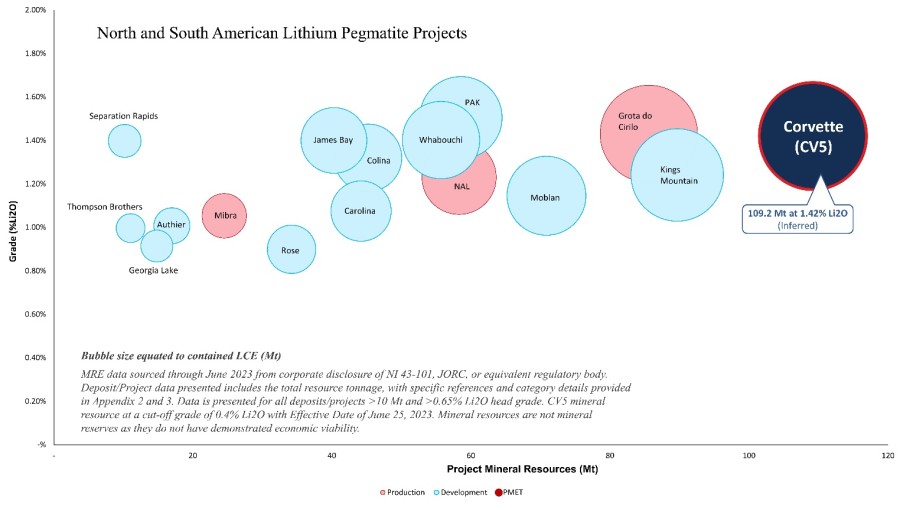

Based on publicly available defined mineral resource estimates completed in accordance with NI 43-101, JORC, or equivalent regulatory body, the maiden MRE for the CV5 Spodumene Pegmatite firmly establishes it as the largest lithium pegmatite resource in the Americas, (Figure 1). Further, using the same source information and metrics (see Appendix 2, and 3), CV5 ranks as a top 10 lithium pegmatite resource in the world, capturing the 8th position (Figure 2). These metrics and context firmly establish CV5 as a Tier 1, world class lithium pegmatite with only its first mineral resource estimate.

Figure 1: MRE tonnage vs grade chart, highlighting the CV5 Spodumene Pegmatite as the largest lithium pegmatite mineral resource in the Americas.

Figure 1: MRE tonnage vs grade chart, highlighting the CV5 Spodumene Pegmatite as the largest lithium pegmatite mineral resource in the Americas.

Figure 2: MRE tonnage vs grade chart, highlighting the CV5 Spodumene Pegmatite as the 8th largest lithium pegmatite mineral resource in the world.

Several of these peer mineral resource estimates include multiple individual deposits located distal to each other, although still in relative proximity to allow for joint infrastructure development (e.g., Grota do Cirilo consists of five (5) individual pegmatite deposits – Xuxa, Barreiro, Murial, Lavra do Meio, and NDC. By comparison, the CV5 mineral resource consists of five (5) immediately adjacent pegmatite dykes, of which a single, principal pegmatite dyke consists of approximately 93% (i.e., 101.8 Mt) of the total inferred resource tonnage reported herein. In other words, the CV5 MRE consists predominantly within a single, large, spodumene pegmatite body. Further, this maiden MRE includes only the CV5 Spodumene Pegmatite, and therefore does not include any of the other known spodumene pegmatite clusters on the Property – CV4, CV8, CV9, CV10, CV12, and CV13 (Figure 3). Several of these clusters – CV4, CV8, CV12, and CV13 – are located within approximately 7 km of the CV5 Spodumene Pegmatite and are therefore expected to share infrastructure in the event of development.

Figure 3: Extent of CV5 Spodumene Pegmatite’s mineral resource estimate, highlighting potential along trend at proximal spodumene pegmatite clusters.

The sensitivity analysis for the CV5 MRE is presented in Table 2 and Figure 4. At a lower cut-off grade of 0.10% Li2O, the deposit hosts 123.4 Mt at 1.28% Li2O inferred, and illustrates continued strong grade at higher tonnages. Alternatively, at a high cut-off grade of 1.40% Li2O, the deposit hosts 46.3 Mt at 2.03% Li2O inferred, and illustrates a considerable tonnage at very high-grade. The majority of this high-grade component at CV5 is located within the previously recognized Nova Zone, which has been traced over a strike length of approximately 1.1 km – from drill holes CV23-132 to 108 – and includes multiple drill intersections of 2 to 25 m (core length) at >5% Li2O. These end-members in cut-off grade effectively demonstrate, at the inferred level of classification, an overall very large tonnage pegmatite at strong grade (at low cut-off), with a significant tonnage component at very high-grade (at high cut-off). Both of these extremes compare favourably to the current resource estimates of its global peers.

The following Table 2 and Figure 4 outlines the corresponding tonnage and lithium grade at various cut-off grades for the CV5 MRE. In addition to evaluating sensitivities to cut-off grades, this table can help relate the tonnage and grades at CV5 more directly to those calculated for peer deposits, which may have applied different cut-off grades to their resources.

Table 2: Sensitivity Analysis for the CV5 Spodumene Pegmatite’s NI 43-101 MRE

| Cut-off Grade Li2O (%) | Classification | Tonnes ≥ Cut-off | Li2O ≥ Cut-off (%) |

| 0.10 | Inferred | 123,357,000 | 1.28 |

| 0.20 | Inferred | 116,246,000 | 1.35 |

| 0.30 | Inferred | 112,215,000 | 1.39 |

| 0.40 | Inferred | 109,242,000 | 1.42 |

| 0.50 | Inferred | 106,285,000 | 1.45 |

| 0.60 | Inferred | 102,461,000 | 1.48 |

| 0.70 | Inferred | 97,962,600 | 1.52 |

| 0.80 | Inferred | 92,132,900 | 1.57 |

| 0.90 | Inferred | 85,223,900 | 1.63 |

| 1.00 | Inferred | 77,555,100 | 1.69 |

| 1.10 | Inferred | 69,312,500 | 1.77 |

| 1.20 | Inferred | 61,176,200 | 1.85 |

| 1.30 | Inferred | 53,299,900 | 1.94 |

| 1.40 | Inferred | 46,308,100 | 2.03 |

| 1.50 | Inferred | 39,970,900 | 2.13 |

| 1.60 | Inferred | 34,157,600 | 2.22 |

| 1.70 | Inferred | 29,230,300 | 2.32 |

| 1.80 | Inferred | 24,956,000 | 2.42 |

| 1.90 | Inferred | 21,173,700 | 2.52 |

| 2.00 | Inferred | 18,115,400 | 2.62 |

Figure 4: CV5 mineral resource sensitivity analysis – grade-tonnage curve.

The geological model of the CV5 Spodumene Pegmatite, which forms the basis of the maiden mineral resource estimate, is presented in plan, inclined, and side view in Figure 5 to Figure 9, and in simplified cross-section in Figure 10 to Figure 12. The geological model is supported by drill holes through the end of the 2023 winter program (hole CV23-190). The resource block model of the CV5 Spodumene Pegmatite, classified as inferred, is presented in Figure 13, Figure 14, and Figure 15.

The CV5 Spodumene Pegmatite has been geological modelled, based on drill hole data, to extend over a strike length of approximately 3.7 km. However, the CV5 Spodumene Pegmatite’s mineral resource estimate block model only extends over a distance of approximately 3.4 km (Figure 13). This is because the block model presented includes only those blocks which have satisfied specific criteria to allow a lithium grade to be classified as inferred and constrained by a conceptual open-pit. Collectively, the blocks within the pit, which have a lithium value assigned, constitute the final block model of the mineral resource estimate. All blocks >0.4% Li2O (the adopted base case cut-off grade for the MRE) are presented in the block model views in Figure 13, blocks >0.1% Li2O in Figure 14, and blocks >2% Li2O and >3% Li2O in Figure 15. Geologically modelled pegmatite where blocks do not populate, have not reached the threshold confidence for the inferred mineral resource category based on the classification criteria applied nor the open-pit constraint applied. Therefore, in these areas (e.g., far east), there is sufficient geological confidence from the drill data to conclude mineralized pegmatite is present; however, additional drilling is required to elevate this confidence to the threshold allowing for an inferred classification of grade and tonnage to be assigned, and for these blocks to fall within a benchmarked pit constraint.

Figure 5: Plan view of CV5 Spodumene Pegmatite geological model – all lenses.

Figure 6: Inclined view of CV5 Spodumene Pegmatite geological model looking down dip (70°) – all lenses.

Figure 7: Side view of CV5 Spodumene Pegmatite geological model looking northerly (340°) – principal pegmatite & subordinate lenses.

Figure 8: Side view of CV5 Spodumene Pegmatite geological model looking northerly (340°) – principal pegmatite only.

Figure 9: Side view of CV5 Spodumene Pegmatite geological model looking southerly (160°) – principal pegmatite only.

Figure 10: Select simplified cross-sections of the CV5 Spodumene Pegmatite geological model.

Figure 11: Select simplified cross-sections of the CV5 Spodumene Pegmatite geological model.

Figure 12: Select simplified cross-sections of the CV5 Spodumene Pegmatite geological model.

Figure 13: Select views of pit constrained, inferred classified block model.

Figure 14: Select cross-sections of the CV5 mineral resource block model.

Figure 15: Select views of pit constrained, inferred classified block model (blocks >2% Li2O at top and middle, blocks >3% Li2O at bottom).

In addition to the lithium as the primary commodity of interest, the CV5 Pegmatite also contains a significant amount of tantalum as a potentially recoverable by-product – 109.2 Mt at 1.42% Li2O and 160 ppm Ta2O5, inferred. Preliminary mineralogy suggests that tantalite is the tantalum-bearing mineral at CV5, which may potentially be recoverable from the tailings of the primary lithium recovery process (i.e., potential valorization of waste streams).

Tantalum is currently listed as a critical and strategic mineral by the province of Quebec (Canada), Canada, European Union, and the United States, as it is required for a range of high-tech devices and essential niche applications, including in capacitors as it has the highest capacitance of any metal. According to the United States Geological Survey, no tantalum is currently produced in North America or Europe.

The Company intends to continue delineating the CV5 Spodumene Pegmatite as well as testing for extensions along strike, up dip, and down dip, where it remains open. The deposit has currently been delineated to within approximately 1.5 km of the CV4 Spodumene Pegmatite cluster to the east, and to within approximately 3.8 km of the CV13 Spodumene Pegmatite cluster to the west (Figure 3). Based on drilling to date, geological mapping, and interpretation of geophysical datasets, there is a reasonable potential for these lithium pegmatite clusters to connect subsurface, with the various pegmatite outcrops that define each cluster representing expressions of the mineralized system at surface.

ASX Listing Rule 5.8

As the Company is listed on both the Canadian TSX Venture Exchange (the “TSXV”) as well as the Australian Stock Exchange (the “ASX”), there are two applicable regulatory bodies resulting in additional disclosure requirements. This mineral resource estimate has been completed in accordance with the Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, and the Company will prepare and file a technical report on SEDAR+ within 45 days of this announcement. Additionally, in accordance with ASX Listing Rule 5.8 and the 2012 JORC reporting guidelines, a summary of the material information used to estimate the mineral resource for the CV5 Spodumene Pegmatite is detailed below. For additional information, please refer to JORC Table 1, Section 1, 2, and 3, as presented in Appendix 1 of this announcement.

Mineral Title

The Property is located approximately 220 km east of Radisson and 240 km north-northeast of Nemaska, QC, and is located within approximately 6 km to south of the regional Trans-Taiga Road and powerline infrastructure corridor (Figure 16). The La Grande-4 (LG4) hydroelectric dam complex is located approximately 40 km north-northeast of the Property. The CV5 Spodumene Pegmatite is located central to the Property, approximately 13 km south of KM270 on the Trans-Taiga Road.

The Property is comprised of 417 CDC mineral claims that cover an area of approximately 21,357 ha and extends dominantly east-west for approximately 51 km as a nearly continuous, single claim block.

Figure 16: Corvette Property and regional infrastructure

Geology and Geological Interpretation

The Property overlies a large portion of the Lac Guyer Greenstone Belt, considered part of the larger La Grande River Greenstone Belt, and is dominated by volcanic rocks metamorphosed to amphibolite facies. The claim block is dominantly host to rocks of the Guyer Group (amphibolite, iron formation, intermediate to mafic volcanics, peridotite, pyroxenite, komatiite, as well as felsic volcanics) (Figure 17). The amphibolite rocks that trend east-west (generally steeply south dipping) through this region are bordered to the north by the Magin Formation (conglomerate and wacke) and to the south by an assemblage of tonalite, granodiorite, and diorite, in addition to metasediments of the Marbot Group (conglomerate, wacke). The lithium pegmatites on the Property, including at CV5, are hosted predominantly within amphibolites, metasediments, and lesser ultramafics.

Exploration of the Property has outlined three primary mineral exploration trends, crossing dominantly east-west over large portions of the Property – Golden Trend (gold), Maven Trend (copper, gold, silver), and CV Trend (Li-Cs-Ta Pegmatite). The Golden Trend is focused over the northern areas of the Property, the Maven Trend in the southern areas, and the CV Trend “sandwiched” between. Historically, the Golden Trend has received the exploration focus followed by the Maven Trend. However, the identification of the CV Trend and the numerous lithium-tantalum pegmatites discovered to date, represents a previously unknown lithium pegmatite district that was first identified in 2016/2017 by Dahrouge Geological Consulting Ltd. and the Company. The Company’s Vice President of Exploration, Darren L. Smith, M.Sc., P.Geo., was a member of the initial team that identified the potential at Corvette, later joining the Company’s Advisory Board in 2018, and as Vice President of Exploration in 2019. Mr. Smith has managed the exploration of the Corvette Property since the initial work programs, including drilling of the lithium pegmatites.

To date, the lithium-cesium-tantalum (LCT) pegmatites at Corvette have been observed to occur within a corridor of approximately 1 km in width that extends in a general east-west direction across the Property for at least 25 km – the ‘CV Lithium Trend’ – with more than 20 km of trend yet to be evaluated for lithium. The core area includes an approximate 3.7 km long spodumene pegmatite (the ‘CV5 Spodumene Pegmatite’, also previously referred to as the ‘CV5 Pegmatite cluster’), as defined by drilling. To date, seven (7) distinct lithium pegmatite clusters have been discovered along this trend at the Corvette Property – CV4, CV5, CV8, CV9, CV10, CV12, and CV13. Each of these clusters includes multiple lithium pegmatite outcrops in close proximity, oriented along the same local trend, and have been grouped to simplify exploration approach and discussion (Figure 18). The maiden mineral resource estimate reported herein is limited to only the CV5 Spodumene Pegmatite (Figure 3).

To date, at the CV5 Spodumene Pegmatite, multiple individual spodumene pegmatite dykes have been geologically modelled. However, approximately 93% of the mineral resource is hosted within a single, large, principal spodumene pegmatite dyke, which is flanked on both sides by multiple, subordinate, sub-parallel trending dykes. The principal dyke is modelled to extend continuously over a lateral distance of at least 3.7 km and remains open along strike at both ends and to depth along a large portion of its length. The width of the currently known mineralized corridor at CV5 is approximately 500 m, with spodumene pegmatite intersected as deep as ~430 m in CV23-156 (vertical depth from surface). The pegmatite dykes at CV5 trend south-southwest (approximately 340°/070° RHR), and therefore dip northerly, which is different to the host amphibolites, metasediments, and ultramafics which dip moderately in a southerly direction.

The principal spodumene pegmatite dyke at CV5 ranges from ~8 m to ~130 m in true width, and may pinch and swell aggressively along strike, as well as up and down dip. It is primarily the thickest at near-surface to moderate depths (<225 m), forming a relatively bulbous, elongated shape, which may flair to surface and to depth variably along its length (see geological cross-sections in Figure 10 to Figure 12). As drilling has focused over the principal dyke, the immediate CV5 corridor has not been adequately drill tested and it is interpreted that additional subordinate pegmatite lenses are situated proximal. The pegmatites that define CV5 are relatively undeformed and very competent, although likely have some meaningful structural control.

At the Property, including CV5, lithium mineralization is observed to occur within Li-Cs-Ta pegmatites, which may be exposed at surface as isolated high relief ‘whale-back’ landforms (i.e., outcrops) (Photo 1). Given the proximity of some lithium pegmatite outcrops to each other at the various clusters, as well as the shallow till cover, it is probable that some of the outcrops may reflect a discontinuous surface exposure of a single, larger pegmatite ‘outcrop’ subsurface. Further, the high number of well-mineralized pegmatites along the trend at these clusters indicate a strong potential for a series of relatively closely spaced/stacked, sub-parallel, and sizable spodumene-bearing pegmatite bodies, with significant lateral and depth extent, to be present.

The pegmatites at Corvette, including CV5, are very coarse-grained and off-white in appearance, with darker sections commonly composed of mica and smoky quartz, and occasionally tourmaline. Spodumene is the dominant lithium-bearing mineral identified at all the lithium occurrences documented to date. It occurs as typically centimetre to decimetre-scale crystals that may exceed 1.5 m in length and ranges in colour from cream-white, to light-grey, to light-green. Minor localized lepidolite has been observed in core and in a small number of lithium pegmatite outcrops. The CV5 Spodumene Pegmatite displays internal fractionation along strike and up/down dip, which is evidence by variation in mineral abundance including spodumene and tantalite. This is highlighted by the high-grade Nova Zone, which has been traced over a strike length of at least 1.1 km – from drill holes CV23-132 to 108 – and includes multiple drill intersections ranging from 2 to 25 m (core length) at >5% Li2O (Figure 19).

The CV5 Spodumene Pegmatite has currently been delineated to within approximately 1.5 km of the CV4 Spodumene Pegmatite cluster to the east, and to within approximately 3.8 km of the CV13 Spodumene Pegmatite cluster to the west (Figure 3). Based on drilling to date, geological mapping, and interpretation of geophysical datasets, there is a reasonable potential for some of these lithium pegmatite clusters to connect subsurface (below the glacial till), with the various pegmatite outcrops that define each cluster representing expressions of the mineralized system at surface.

Photo 1: Principal spodumene pegmatite body outcroping at CV5 (left); typical mineralization from drill core at CV5 (right).

Figure 17: Property geology and mineral exploration trends.

Figure 18: Spodumene pegmatite clusters at the Property discovered to date.

Drilling Techniques and Classification Criteria

The mineral resource estimate for the CV5 Spodumene Pegmatite is supported by 163 diamond drill holes of NQ (predominant) or HQ size, totalling a collective 56,385 m, and eleven (11) outcrop channels totalling 63 m. The drilling includes programs in 2021, 2022, and through the end of the 2023 winter program (hole CV23-190). The 2021 and 2022 programs utilized exclusively helicopter transportable drill rigs, with the winter 2023 program utilizing a combination of helicopter transportable and skid mounted due to the construction of a temporary winter road for that program.

Each drill hole collar was surveyed with an RTK tool (Topcon GR5 or Trimble Zephyr 3), except for one (1) which was surveyed using a handheld GPS (Garmin GPSMAP 64s) only (Table 3). Downhole deviation surveys for each drill hole were completed with a Devico DeviGyro tool (2021 holes), or Reflex Gyro Sprint IQ tool (2022 and 2023 holes). Survey shots were continuous at approximate 3-5 m intervals. The use of the gyro tool system negated potential deflection issues arising from minor but common pyrrhotite within the host amphibolite. All collar and downhole deviation data has been validated by the project geologists on site, and by the database lead.

Drill core has not been oriented; however, downhole optical and acoustic televiewer surveys have been completed on multiple holes to assess overall structure. This data guided the current geological model supporting this maiden mineral resource estimate.

Drilling has been completed predominantly along a grid pattern at typically 100 m spacing; however, tightens to ~50 m in some places (typically over the high-grade Nova Zone), and widens to ~150 m in a small number of places. Subsurface pegmatite piece points generally reflect the collar spacing; however, are subject to typical downhole deviation. The initial drill holes targeting CV5, completed in 2021, assumed a southerly dip to the pegmatite and therefore three (3) of four (4) holes were oriented northerly. However, most holes completed to date are oriented southerly (typically 158°) to cross-cut perpendicular the steeply, northerly dipping pegmatite. Drill hole spacing and orientation is sufficient to support the geological model and resource classification applied herein.

All drill holes were completed by Fusion Forage Drilling Ltd. of Hawkesbury, ON. Procedures at the drill followed industry best practices with drill core placed in either 4 or 5 ft long flat, square-bottom wooden boxes (except for hole CV22-083 which used half-moon shaped wooden boxes), with the appropriate hole and box ID noted and block depth markers placed in the box. Core recovery typically exceeds 90%. Once full, the box was fibre taped shut with wooden lids at the drill and box slung north by helicopter to a laydown area on the Trans-Taiga Road (KM270 or KM277), where they were then transported by truck to Mirage Lodge for processing.

Channel sampling followed industry best practices with a 3 to 5 cm wide, saw-cut channel completed across the pegmatite outcrop as practical, perpendicular to the interpreted pegmatite strike. Samples were collected at ~1 m contiguous intervals with the channel bearing noted, and GPS coordinate collected at the start and end points of the channel. Channel samples were transported along the same route as drill core for processing at Mirage Lodge.

Figure 19: Diamond drill hole locations at the CV5 Spodumene Pegmatite, which form the basis of the maiden mineral resource estimate.

Sampling and Sub-Sampling Techniques

Core sampling protocols met industry standard practices. Upon receipt at the core shack at Mirage Lodge, all drill core is pieced together, oriented to maximum foliation, metre marked, geotechnically logged (TCR, RQD, ISRM, and Q-Method (since mid-winter 2023)), alteration logged, geologically logged (rock type), and sample logged on an individual sample basis. Wet and dry core box photos are also collected of all core drilled, regardless of perceived mineralization. Specific gravity measurements of entire pegmatite samples were collected at systematic intervals (approximately 1 SG measurement every 4-5 m) using the water immersion method.

Core sampling was guided by rock type as determined during geological logging (i.e., by a geologist). All pegmatite intervals were sampled in their entirety, regardless of whether spodumene mineralization was noted or not (in order to ensure an unbiased sampling approach) in addition to ~1 to 3 m of sampling into the adjacent host rock (dependent on pegmatite interval length) to “bookend” the sampled pegmatite. The minimum individual sample length is typically 0.3-0.5 m and the maximum sample length is typically 2.0 m. Targeted individual pegmatite sample lengths are 1.0 m. All drill core was saw-cut, using an Almonte automatic core saw in 2022 and 2023, with one half-core collected for assay, and the other half-core remaining in the box for reference.

Channels were geologically logged upon collection on an individual sample basis; however, were not geotechnically logged. Channel recovery was effectively 100%.

The logging of drill core and channels was qualitative by nature, and included estimates of spodumene grain size, inclusions, and model mineral estimates. These logging practices meet or exceed current industry standard practices and are of appropriate detail to support a mineral resource estimation and disclosure herein.

All core samples were bagged and sealed individually, and then placed in large supersacs for added security, palleted, and shipped by third party transport, or directly by representatives of the Company, to the designated sample preparation laboratory (Activation Laboratories Ltd. (“Activation Laboratories”) in Ancaster, ON, in 2021, SGS Canada Inc. (“SGS Canada”) in Lakefield, ON, in 2022 and 2023, and SGS Canada in Val-d’Or, QC, in 2023) being tracked during shipment along with chain of custody documentation. Upon arrival at the laboratory, the samples were cross-referenced with the shipping manifest to confirm all samples were accounted for and had not been tampered with.

Sample Analysis Method

Core samples collected from 2021 drill holes were shipped to Activation Laboratories in Ancaster, ON, for standard sample preparation (code RX1) which included crushing to 80% passing 10 mesh, followed by a 250 g riffle split and pulverizing to 95% passing 105 microns. All 2021 core sample pulps were analyzed, at the same lab, for multi-element (including lithium) by four-acid digestion with ICP-OES finish (package 1F2) and tantalum by INAA (code 5B), with any samples returning >8,000 ppm Li by 1F2 reanalyzed for Li by code 8-4 Acid ICP Assay. Activation Laboratories is a commercial lab with the relevant accreditations (ISO 17025) and is independent of the Company.

Core samples collected from 2022 and 2023 drill holes CV22-015 through CV23-107 were shipped to SGS Canada’s laboratory in either Lakefield, ON (vast majority), Sudbury, ON (CV22-028, 029, 030), or Burnaby, BC (CV22-031, 032, 033, and 034), for standard sample preparation (code PRP89) which included drying at 105°C, crush to 75% passing 2 mm, riffle split 250 g, and pulverize 85% passing 75 microns. Core samples collected from 2023 drill holes CV23-108 through 190 were shipped to SGS Canada’s laboratory in Val-d’Or, QC, for standard sample preparation (code PRP89). All 2022 and 2023 core sample pulps were shipped by air to SGS Canada’s laboratory in Burnaby, BC, where the samples were homogenized and subsequently analyzed for multi-element (including Li and Ta) using sodium peroxide fusion with ICP-AES/MS finish (codes GE_ICP91A50 and GE_IMS91A50). SGS Canada is a commercial lab with the relevant accreditations (ISO 17025) and is independent of the Company.

A Quality Assurance / Quality Control (QAQC) protocol following industry best practices was incorporated into the drill programs and included systematic insertion of quartz blanks and certified reference materials into sample batches, as well as collection of quarter-core duplicates, at a rate of approximately 5% each. Additionally, analysis of pulp-split and coarse-split sample duplicates were completed to assess analytical precision at different stages of the laboratory preparation process, and external (secondary) laboratory pulp-split duplicates were prepared at the primary lab for subsequent check analysis and validation at a secondary lab (SGS Canada in 2021, and ALS Canada in 2022 and 2023).

All channel samples collected were shipped to SGS Canada’s laboratory in Lakefield, ON, for standard preparation. Pulps were analyzed at SGS Canada’s laboratory in either Lakefield, ON, (2017), or Burnaby, BC (2022), for multi-element (including Li and Ta) using sodium peroxide fusion with ICP-AES/MS finish. A QAQC protocol following industry best practices was incorporated into the channel programs and included systematic insertion of quartz blanks and certified reference materials into sample batches.

Criteria Used for Classification

The Corvette resource classification has been completed in accordance with the JORC 2012 reporting guidelines. All reported mineral resources have reasonable prospects for eventual economic extraction.

Blocks were considered as inferred when the drill spacing was 140 m or lower and meeting the minimum estimation criteria parameters. There is no indicated or measured classified blocks. Smaller pegmatite dykes with lower level of information / confidence were also not classified.

Classification volumes are created around contiguous blocks at the stated spacing criteria with consideration for the selected mining method. The mineral resource estimates appropriately reflect the view of the Competent Person.

Estimation Methodology

Compositing was done every 1.0 m. Unsampled intervals were assigned a grade of 0.0005% Li and 0.25 ppm Ta. Capping was done after compositing. Based on the statistical analysis capping varies by lithological domain. For the spodumene-rich domain within the CV5 principal pegmatite, no capping was required for Li2O but Ta2O5 was capped at 1,500 ppm. For the feldspar-rich domain within the CV5 principal pegmatite, a capping of 2% Li2O and 1,500 ppm Ta2O5 was applied. For the parallel dykes a capping of 4% Li2O and 1,000 ppm Ta2O5 was applied.

Variography was done both in Leapfrog Edge and Supervisor. For Li2O, a well-structured variogram model was obtained for the CV5 principal pegmatite’s spodumene-rich domain. For the CV5 principal pegmatite, both domains (spodumene-rich and feldspar-rich domains) were estimated using ordinary kriging (OK), using Leapfrog Edge and validated using Datamine Studio RM.

For Ta2O5, the spodumene-rich domain and the feldspar-rich domain within CV5 principal pegmatite did not yield well-structured variograms. Therefore, Ta2O5 was estimated using Inverse Distance Square (ID2).

The remaining pegmatite dykes (7) domains did not yield well-structured variograms for either Li2O and Ta2O5 and therefore were estimated using Inverse Distance Square (ID2), also using Leapfrog Edge.

Three (3) orientated search ellipsoids were used to select data and interpolate Li2O and Ta2O5 grades in successively less restrictive passes. The ellipse sizes and anisotropies were based on the variography, drillhole spacing, and pegmatite geometry. The ellipsoids were 67.5 m x 45 m x 7.5 m, 135 m x 90 m x 15 m, and 180 m x 120 m x 20 m. A minimum of five (5) composites and a maximum of twelve (12) composites were selected during interpolation with a minimum of two (2) holes needed to interpolate during the first two (2) passes. For the third pass a minimum of three (3) composites with a maximum of fifteen (15) without a minimum per hole was used. Variable search ellipse orientations (dynamic anisotropy) were used to interpolate for the seven (7) parallel dykes. Spatial anisotropy of the dykes is respected during estimation using Leapfrog Edge’s Variable Orientation tool. The search ellipse follows the trend of the central reference plane of each dyke.

Parent cells of 10 m x 5 m x 5 m, subblocked four (4) times in each direction (for minimum subcells of 2.5 m in x, 1.25 m in y, and 1.25 m in z were used. Subblocks are triggered by the geological model. Li2O and Ta2O5 grades are estimated on the parent cells and automatically populated to subblocks.

The block model is rotated around the Z axis (Leapfrog 340°).

Fe grades were assigned to the block model based on the median value of individual lithologies.

Hard boundaries between all the pegmatite domains were used for all Li2O and Ta2O5 estimates.

The mineral resource estimate includes blocks within the pit shell above the cut-off grade of 0.40% Li2O.

Validation of the block model was performed using Swath Plots in each of the three (3) axes, nearest neighbours grade estimates, global means comparisons, and by visual inspection in 3D and along plan views and cross-sections.

Cut-off Grade and Basis for Selection

The cut-off grade (COG) adopted for the mineral resource estimate is 0.40% Li2O. It has been determined based on operational cost estimates, primarily through benchmarking, for mining (open-pit methods), tailings management, G&A, and concentrate transport costs from the mine site to Becancour, QC, as the base case. Process recovery assumed a Dense Media Separation (DMS) only operation at 70% overall recovery into a 5.5% Li2O spodumene concentrate. A spodumene concentrate price of US $1,500 was assumed with USD/CAD exchange rate of 0.76. A royalty of 2% was applied.

Mining & Metallurgical Methods and Parameters, and Other Modifying Factors Considered

Mineral resources that are not mineral reserves do not have demonstrated economic viability. This estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, economic, or other relevant issues.

The extraction scenario constraint retained for the maiden mineral resource estimate at the CV5 Spodumene Pegmatite is open-pit. Only material included in the pit shell is included in the mineral resource statement. A pit slope of 45° was assumed, resulting in a strip ratio of 6 (waste to minable resource).

The metallurgical assumptions are supported by metallurgical test programs completed by SGS Canada at their Lakefield, ON, facility. The testwork included Heavy Liquid Separation (HLS) and magnetics, which has produced 6+% Li2O spodumene concentrates at >70% recovery. A subsequent Dense Media Separation (DMS) test on CV5 Spodumene Pegmatite material returned a spodumene concentrate grading 5.8% Li2O at 79% recovery, strongly indicating potential for a DMS only operation to be applicable. For the mineral resource pit shell, an overall recovery of 70% to produce a 5.5% Li2O spodumene concentrate was used.

Various mandates required for advancing the Project towards economic studies have been initiated, including but not limited to, environmental baseline, metallurgy, geomechanics, hydrogeology, hydrology, stakeholder engagement, geochemical characterization, as well as concentrate transport and logistical studies.

Qualified/Competent Person

The information in this news release that relates the mineral resource estimate for the CV5 Spodumene Pegmatite, as well as other relevant technical information for the Corvette Property, is based on, and fairly represents, information compiled by Mr. Todd McCracken, P.Geo., who is a Qualified Person as defined by NI 43-101, and member in good standing with the Ordre des Géologues du Québec and with the Professional Geoscientists of Ontario. Mr. McCracken has reviewed and approved the technical information in this news release.

Mr. McCracken is Director – Mining & Geology – Central Canada, of BBA Inc. and is independent of the Company. Mr. McCracken does not hold any securities in the Company.

Mr. McCracken has sufficient experience, which is relevant to the style of mineralization, type of deposit under consideration, and to the activities being undertaken to qualify as a Competent Person as described by the JORC Code, 2012. Mr. McCracken consents to the inclusion in this news release of the matters based on his information in the form and context in which it appears.

Table 3: Attributes for drill holes completed at the CV5 Spodumene Pegmatite.

Appendix 1 – JORC Code 2012 Table 1 information required by ASX Listing Rule 5.8.2

Section 1 – Sampling Techniques and Data

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 – Reporting of Exploration Results

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralization widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

Section 3 – Estimate and Reporting of Mineral Resources

| Criteria | JORC Code explanation | Commentary |

| Database integrity |

|

|

| Site visits |

|

|

| Geological interpretation |

|

|

| Dimensions |

|

|

| Estimation and modelling techniques |

|

|

| Moisture |

|

|

| Cut-off parameters |

|

|

| Mining factors or assumptions |

|

|

| Metallurgical factors or assumptions |

|

|

| Environmental factors or assumptions |

|

|

| Bulk density |

|

|

| Classification |

|

|

| Audits or reviews |

|

|

| Discussion of relative accuracy/ confidence |

|

|

Appendix 2: Sources for Figure 1 (tonnage vs grade – the Americas) & Figure 2

(tonnage vs grade – world)

| Company name | Stock Ticker | Project Name | Source |

| Liontown Resources | LTR | Kathleen Valley | ASX announcement dated April 8, 2021 |

| Liontown Resources | LTR | Buldania | ASX announcement dated November 8, 2019 |

| Pilbara Minerals | PLS | Pilgangoora | ASX announcement dated October 13, 2022 |

| Alita Resources | A40 | Bald Hill | ASX announcement dated June 6, 2018 |

| Livent / IQ | AKE | Whabouchi | ASX announcement dated May 10, 2023 |

| Allkem | AKE | James Bay | ASX announcement dated May 10, 2023 |

| Allkem | AKE | Mt Cattlin | ASX announcement dated May 10, 2023 |

| European Lithium | EUR | Wolfsberg | ASX announcement dated December 1, 2021 |

| AVZ Minerals | AVZ | Manono | ASX announcement dated May 24, 2021 |

| Critical Elements | CRE | Rose | NI 43-101 technical report dated July 26, 2022 |

| Atlantic Lithium | ALL | Ewoyaa | AIM announcement dated February 1, 2023 |

| Talison JV | IGO | Greenbushes | ASX announcement dated July 29, 2022 |

| MARBL JV | MIN | Wodgina | ASX announcement dated October 7, 2022 |

| Albemarle | ALB | Kings Mountain | SEC filing dated February 15, 2023 |

| Mineral Resources | MIN | Mt Marion | ASX announcement dated October 7, 2022 |

| SQM / Wesfarmers | SQM | Mt. Holland | Annual Report 2022 |

| Leo Lithium | LLL | Goulamina | ASX announcement dated June 20, 2022 |

| Sayona Mining | SYA | Authier | ASX announcement dated April 14, 2023 |

| Sayona Mining | SYA | NAL | ASX announcement dated April 14, 2023 |

| Sayona Mining | SYA | Moblan | ASX announcement dated April 17, 2023 |

| Prospect Resources | PSC | Arcadia | ASX announcement dated October 11, 2021 |

| AMG Lithium | AMG | Mibra | Euronext announcement dated April 3, 2017 |

| Sibanye-Stillwater | SSW | Keliber | JSE announcement dated February 17, 2023 |

| Premier African Minerals | PREM | Zulu | AIM announcement dated June 6, 2017 |

| Frontier Lithium | FL | PAK (+Spark) | NI 43-101 technical report dated May 9, 2022 |

| Sigma Lithium | SGML | Grota do Cirilo | TSX.V announcement dated December 4, 2022 |

| Piedmont Lithium | PLL | Carolina | ASX announcement dated October 21, 2021 |

| Sinomine (Bikita Minerals) | (private) | Bikita | SZ Announcement dated April 25, 2023 |

| Delta Lithium | RDT | Mt Ida | ASX announcement dated October 19, 2022 |

| Avalon Advanced Materials | AVL | Separation Rapids | TSX.V announcement dated August 21, 2018 |

| Andrada Mining | ATM | Uis | AIM announcement dated February 6, 2023 |

| Global Lithium | GL1 | Manna | ASX announcement dated December 15, 2022 |

| Global Lithium | GL1 | Marble Bar | ASX announcement dated December 15, 2022 |

| Snow Lake Resources | SLR | Thompson Brothers | SEC filing effective June 9, 2021 |

| Latin Resources | LRS | Colina | ASX announcement dated June 20, 2023 |

| Essential Metals | ESS | Dome North | ASX announcement dated December 20, 2022 |

| Kodal Minerals | KOD | Bougouni | AIM announcement dated January 27, 2020 |

| Savannah Resources | SAV | Mina Do Barroso | AIM announcement dated 31 May 2019 |

| Zinnwald Lithium | (private) | Zinnwald | NI 43-101 technical report 31 May 2019 |

| Rock Tech Lithium | RCK | Georgia Lake | TSX.V announcement dated 21 April 2021 |

| Core Lithium | CXO | Finniss | ASX announcement dated 18 April 2023 |

Appendix 3: Mineral resource details for deposits/projects noted in Figure 1 & Figure 2.

| Company Name | Project Name | Region | Stage | Category | Tonnage (Mt) | Grade (Li2O) | |

| Liontown Resources | Kathleen Valley | APAC | Development | Measured | 20.0 | 1.32 | % |

| Indicated | 109.0 | 1.37 | % | ||||

| Inferred | 27.0 | 1.27 | % | ||||

| Liontown Resources | Buldania | APAC | Development | Measured | - | - | |

| Indicated | 9.1 | 0.98 | % | ||||

| Inferred | 5.9 | 0.95 | % | ||||

| Pilbara Minerals | Pilgangoora | APAC | Production | Measured | 19.0 | 1.40 | % |

| Indicated | 187.0 | 1.20 | % | ||||

| Inferred | 99.0 | 1.10 | % | ||||

| Alita Resources | Bald Hill | APAC | Production | Measured | - | - | |

| Indicated | 14.4 | 1.02 | % | ||||

| Inferred | 12.1 | 0.90 | % | ||||

| Livent / IQ | Whabouchi | Americas | Development | Measured | 17.7 | 1.60 | % |

| Indicated | 20.8 | 1.33 | % | ||||

| Inferred | 17.2 | 1.29 | % | ||||

| Allkem | James Bay | Americas | Development | Measured | - | - | |

| Indicated | 40.3 | 1.40 | % | ||||

| Inferred | - | - | |||||

| Allkem | Mt Cattlin | APAC | Production | Measured | 0.1 | 1.00 | % |

| Indicated | 11.4 | 1.31 | % | ||||

| Inferred | 1.3 | 1.30 | % | ||||

| European Lithium | Wolfsberg | EMEA | Development | Measured | 4.3 | 1.13 | % |

| Indicated | 5.4 | 0.95 | % | ||||

| Inferred | 3.1 | 0.90 | % | ||||

| AVZ Minerals | Manono | EMEA | Development | Measured | 100.0 | 1.67 | % |

| Indicated | 174.0 | 1.65 | % | ||||

| Inferred | 128.0 | 1.65 | % | ||||

| Critical Elements | Rose | Americas | Development | Measured | - | - | |

| Indicated | 31.5 | 0.91 | % | ||||

| Inferred | 2.7 | 0.77 | % | ||||

| Atlantic Lithium | Ewoyaa | EMEA | Development | Measured | 3.5 | 1.37 | % |

| Indicated | 24.5 | 1.25 | % | ||||

| Inferred | 7.4 | 1.16 | % | ||||

| Talison JV | Greenbushes | APAC | Production | Measured | 0.5 | 3.20 | % |

| Indicated | 249.4 | 1.80 | % | ||||

| Inferred | 110.3 | 1.00 | % | ||||

| MARBL JV | Wodgina | APAC | Production | Measured | - | - | |

| Indicated | 196.9 | 1.17 | % | ||||

| Inferred | 62.3 | 1.16 | % | ||||

| Albemarle | Kings Mountain | Americas | Development | Measured | - | - | |

| Indicated | 46.8 | 1.37 | % | ||||

| Inferred | 42.9 | 1.10 | % | ||||

| Mineral Resources | Mt Marion | APAC | Production | Measured | - | - | |

| Indicated | 21.4 | 1.54 | % | ||||

| Inferred | 30.0 | 1.38 | % | ||||

| SQM / Wesfarmers | Mt. Holland | APAC | Development | Measured | 71.0 | 1.57 | % |

| Indicated | 107.0 | 1.51 | % | ||||

| Inferred | 8.0 | 1.44 | % | ||||

| Leo Lithium | Goulamina | EMEA | Development | Measured | 13.1 | 1.59 | % |

| Indicated | 89.2 | 1.43 | % | ||||

| Inferred | 108.6 | 1.30 | % | ||||

| Sayona Mining | Authier | Americas | Development | Measured | 6.0 | 0.98 | % |

| Indicated | 8.1 | 1.03 | % | ||||

| Inferred | 2.9 | 1.00 | % | ||||

| Sayona Mining | NAL | Americas | Production | Measured | 1.0 | 1.19 | % |

| Indicated | 24.0 | 1.23 | % | ||||

| Inferred | 33.0 | 1.23 | % | ||||

| Sayona Mining | Moblan | Americas | Development | Measured | 6.3 | 1.46 | % |

| Indicated | 43.6 | 1.16 | % | ||||

| Inferred | 21.0 | 1.02 | % | ||||

| Prospect Resources | Arcadia | EMEA | Development | Measured | 15.8 | 1.12 | % |

| Indicated | 45.6 | 1.06 | % | ||||

| Inferred | 11.2 | 0.99 | % | ||||

| AMG Lithium | Mibra | Americas | Production | Measured | 3.4 | 1.00 | % |

| Indicated | 16.9 | 1.07 | % | ||||

| Inferred | 4.2 | 1.03 | % | ||||

| Sibanye-Stillwater | Keliber | EMEA | Development | Measured | 10.2 | 0.96 | % |

| Indicated | 3.9 | 1.06 | % | ||||

| Inferred | 3.3 | 0.83 | % | ||||

| Premier African Minerals | Zulu | EMEA | Development | Measured | - | - | |

| Indicated | - | - | |||||

| Inferred | 20.1 | 1.06 | % | ||||

| Frontier Lithium | PAK | Americas | Development | Measured | 1.3 | 2.14 | % |

| Indicated | 24.7 | 1.59 | % | ||||

| Inferred | 32.5 | 1.41 | % | ||||

| Sigma Lithium | Grota do Cirilo | Americas | Production | Measured | 37.1 | 1.43 | % |

| Indicated | 39.9 | 1.43 | % | ||||

| Inferred | 8.6 | 1.43 | % | ||||

| Piedmont Lithium | Carolina | Americas | Development | Measured | - | - | |

| Indicated | 28.2 | 1.11 | % | ||||

| Inferred | 15.9 | 1.02 | % | ||||

| Sinomine (Bikita Minerals) | Bikita | EMEA | Production | Measured | 21.7 | 1.17 | % |

| Indicated | 12.5 | 1.09 | % | ||||

| Inferred | 6.1 | 1.08 | % | ||||

| Delta Lithium | Mt Ida | APAC | Development | Measured | - | - | |

| Indicated | 3.3 | 1.40 | % | ||||

| Inferred | 9.3 | 1.10 | % | ||||

| Avalon Advanced Materials | Separation Rapids | Americas | Development | Measured | 3.4 | 1.43 | % |

| Indicated | 5.0 | 1.39 | % | ||||

| Inferred | 1.8 | 1.35 | % | ||||

| Andrada Mining | Uis | EMEA | Development | Measured | 21.0 | 0.72 | % |

| Indicated | 17.0 | 0.73 | % | ||||

| Inferred | 43.0 | 0.73 | % | ||||

| Global Lithium | Manna | APAC | Development | Measured | - | - | |

| Indicated | 18.5 | 1.03 | % | ||||

| Inferred | 14.2 | 0.97 | % | ||||

| Global Lithium | Marble Bar | APAC | Development | Measured | - | - | |

| Indicated | 3.8 | 0.97 | % | ||||

| Inferred | 14.2 | 1.01 | % | ||||

| Snow Lake Resources | Thompson Brothers | Americas | Development | Measured | - | - | |

| Indicated | 9.1 | 1.00 | % | ||||

| Inferred | 2.0 | 0.98 | % | ||||

| Latin Resources | Colina | Americas | Development | Measured | 0.4 | 1.34 | % |

| Indicated | 29.7 | 1.37 | % | ||||

| Inferred | 15.0 | 1.22 | % | ||||

| Essential Metals | Dome North | EMEA | Development | Measured | - | - | |

| Indicated | 8.6 | 1.23 | % | ||||

| Inferred | 2.6 | 0.92 | % | ||||

| Kodal Minerals | Bougouni | EMEA | Development | Measured | - | - | |

| Indicated | 11.6 | 1.13 | % | ||||

| Inferred | 9.7 | 1.08 | % | ||||

| Savannah Resources | Mina Do Barroso | EMEA | Development | Measured | 6.6 | 1.10 | % |

| Indicated | 11.8 | 1.00 | % | ||||

| Inferred | 9.6 | 1.10 | % | ||||

| Zinnwald Lithium | Zinnwald | EMEA | Development | Measured | 18.5 | 0.78 | % |

| Indicated | 17.0 | 0.73 | % | ||||

| Inferred | 4.9 | 0.76 | % | ||||

| Rock Tech Lithium | Georgia Lake | Americas | Development | Measured | - | - | |

| Indicated | 10.6 | 0.88 | % | ||||

| Inferred | 4.2 | 1.00 | % | ||||

| Core Lithium | Finniss | APAC | Production | Measured | 7.0 | 1.45 | % |

| Indicated | 12.4 | 1.33 | % | ||||

| Inferred | 11.3 | 1.21 | % | ||||

| Patriot Battery Metals | Corvette | Americas | Development | Measured | - | - | |

| Indicated | - | - | |||||

| Inferred | 109.2 | 1.42 | % | ||||

About Patriot Battery Metals Inc.

Patriot Battery Metals Inc. is a hard-rock lithium exploration company focused on advancing its district-scale 100% owned Corvette Property located in the Eeyou Istchee James Bay region of Quebec, Canada, and proximal to regional road and powerline infrastructure. The Corvette Property hosts the CV5 Spodumene Pegmatite with a maiden inferred mineral resource estimate of 109.2 Mt at 1.42% Li2O and 160 ppm Ta2O5 (at a cut-off of 0.40% Li2O), and ranks as the largest lithium pegmatite resource in the Americas, and is the 8th largest lithium pegmatite resource in the world. Additionally, the Corvette Property hosts multiple other spodumene pegmatite clusters that remain to be drill tested, as well as more than 20 km of prospective trend that remain to be assessed.

Mineral resources are not minerals reserves as they do not have demonstrated economic viability. The Effective Date of the mineral resource estimate is June 25, 2023 (through drill hole CV23-190).

For further information, please contact us at This email address is being protected from spambots. You need JavaScript enabled to view it. or by calling +1 (604) 279-8709, or visit www.patriotbatterymetals.com. Please also refer to the Company’s continuous disclosure filings, available under its profile at www.sedar.com and www.asx.com.au, for available exploration data.

This news release has been approved by the Board of Directors,

“BLAIR WAY”

Blair Way, President, CEO, & Director

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements other than statements of historical fact, included in this news release are forward-looking statements that involve risks and uncertainties, including without limitation statements with respect to potential continuity of pegmatite bodies, and mineral resource estimate preparation. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include the results of further exploration and testing, and other risks detailed from time to time in the filings made by the Company with securities regulators, available at www.sedar.com and www.asx.com.au. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable law.

No securities regulatory authority or stock exchange has reviewed nor accepts responsibility for the adequacy or accuracy of the content of this news release.

| Last Trade: | US$4.42 |

| Daily Change: | 0.02 0.45 |

| Daily Volume: | 2,700 |

| Market Cap: | US$717.230M |

December 14, 2025 November 14, 2025 November 12, 2025 October 20, 2025 October 08, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS