Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Simply Better Brands Announces Second Quarter results at $23.6 M IN REVENUE WHILE INVESTING IN brand GROWTH and capability expansion

- 40% growth compared to the second quarter 2022 capturing channel, category, and innovation expansion in clean-ingredient food, next generation skincare, and plant-based wellness

VANCOUVER, BC, Aug. 29, 2023 /CNW/ - Simply Better Brands Corp. ("SBBC" or the "Company") (TSXV: SBBC) (OTCQB: PKANF) is pleased to announce its interim financial results for the three and six months ended June 30, 2023. All amounts are expressed in United States dollars unless otherwise noted. Certain metrics, including those expressed on an adjusted basis, are non-International Financial Reporting Standards ("IFRS") measures, see "Non-IFRS Measures" below.

- TRUBAR Protein Bar: As a result of TRUBAR exceeding the bar category sales velocities at Costco, TRUBAR was able to access national distribution at Costco during the quarter. Supporting the brands' continued expansion are four initiatives: manufacturing capacity expansion, continued omni-channel distribution growth with retailers like Sodexo, bar flavor extensions, and the entry into the $21.5 billion protein powder category in 2023, per Global Market Insights. Back half 2023 commitments reflect a planned regional placement of a second and additional item in select Costco regions, as well as expansion into BJ's Wholesale, Circle K, and Andretti Oil.

- PureKana Wellness: PureKana, a leading plant-based wellness brand, remained focused on its customer acquisition initiative, adding over 61,925 customers during the quarter and replenishing the sales funnel into a subscription model. To expand beyond human consumption, PureKana announced its 2023 entry into the $196 million hemp-based pet category (per Grandview Research) with offerings in with calming chews, hip & joint chews, and hair & coat drops. As an estimated 60% of PureKana's loyal customers have pets, the growth opportunity is expected to be sizeable.

- No B.S. Skincare: Originally, the No B.S. brand was sourced exclusively online at livenobs.com and Amazon. In 2022, the brand entered 3,200 CVS Health stores for a Back-to-School Event and continues to maintain a on shelf presence in CVS's healthy skin section. Initial brick and mortar success had the brand enter TJ Maxx in Q2, with a planned national launch into Walgreen's in Q4 2023. Sources of growth include omni-channel expansion supported by insight-driven innovation with an expanded facial acne patch portfolio (overnight pimple patch and acne patch plus retinol night cream) and a natural deodorant category entry.

- Vibez Wellness: The Vibez Wellness line was launched in November 2022 to capture incremental millennial consumers on their preventative wellness journey. With an initial keto gummy supplement offering, the new brand has achieved $1.7M in revenue with a gross margin of 73% year-to-date 2023. Vibez's primary focus is non-CBD solutions into the weight management, focal acuity, and healthy hair consumer need states. Through portfolio and channel expansion, Vibez is forecasted to exceed $7.0M with an expected gross margin of 73% in 2023.

"As our Q2 2023 financial and commercial results illustrate, we are positioned for continued revenue growth, profit improvement, and debt reduction in 2023. Our strategic priorities remain to lead consumer-centric innovation and relentlessly acquire customers to these emerging brands by driving category and channel expansion. Even with our marketing and capability investments in Q2, we remain confident in delivering the current 2023 outlook of $80 million in revenue and $3-4 million in adjusted EBITDA at a gross margin target range of 58-60%." says SBBC CEO, Kathy Casey.

For the three months ended | ||||||

June 30, 2023 | June 30, 2022 | Change | ||||

expressed in millions * | $ | % (in terms of revenue) | $ | % (in terms of revenue) | $ | % |

Revenue | 23.60 | 100 % | 16.90 | 100 % | 6.70 | 40 % |

Cost of goods sold | (9.90) | (42 %) | (5.20) | (31 %) | (4.70) | 90 % |

Gross profit | 13.70 | 58 % | 11.70 | 69 % | 2.00 | 17 % |

Revenue for the second quarter of 2023 was $23.6 million, an increase of $6.7 million or 40% growth compared to $16.9 million in the second quarter of 2022. PureKana's second quarter revenue for the three months ended June 30, 2023, was $12.2 million compared to $13.8 million for the comparable period in 2022 (decrease of $1.6 million or 11%). PureKana's revenue decrease was driven by a reduction in profitable subscriptions during the quarter. PureKana invested heavily in marketing in the later part of the second quarter to increase new sales and subscriptions. Revenues have increased by approximately 50% in the third quarter 2023 to date over the comparable prior period. Tru's second quarter revenue for the three months ended June 30, 2023, was $9.0 million compared to $2.0 million for the comparable period in 2022 (increase of $7.0 million or 350%). Tru's strong sales performance in the second quarter was driven primarily by orders from Costco in the US for a national promotion (Multi-Vendor Mailers "MVM") and from major retailers in Canada. No BS's second quarter revenue for the three months ended June 30, 2023, was $0.2 million compared to $0.8 million for the comparable period in 2022. The major decrease was due to a later shipment planned to a large retailer for the third quarter of 2023 compared to a larger retailer product fill that occurred in the second quarter of 2022. BRN's (Vibez and Seventh Sense) second quarter revenue for the three months ended June 30, 2023, was $2.0 million, compared to $0.2 million in the second quarter of 2022. SBBC's other subsidiaries contributed $0.2 million in the second quarter compared to 0.1 million.

SBBC's cost of sales increased in the second quarter relative to the comparable period 2022 by 11 percentage points due to a higher mix of lower margin retails sales (38% of Q2 sales compared to 12% of sales in Q2 2022) which has lower gross margins than online sales. The Company continues to manage its finished goods costs with co-manufacturers with the higher order volumes it has been able to place. Cost of goods sold for online sales (Direct to Consumer "DTC") typically range in the low to mid 70's and retailer (Business to Business "B2B") gross margins range in the mid 30's to higher 40's. Cost of goods sold was $9.9 million in the second quarter of 2023 (42% of revenues) compared to $5.2 million (31% of revenues) in the comparable period.

Gross profit for the second quarter of 2023 was $13.7 million (58%) compared to $11.7 million (69%) in the second quarter of 2022. The gross profit margin was down 11 percentage points in the second quarter of 2023 over the gross profit in the comparable period driven by a higher mix of B2B sales in the second quarter of 2023 (B2B was 41% of Q1 2023 sales) compared to the second quarter of 2022 (B2B was 15% of Q1 2022 sales).

Operating costs for the second quarter of 2023 were $18.4 million, an increase of $4.9 million (or 36%), compared to $13.5 million in the second quarter of 2022. The majority of the operating costs increase incurred in the three months ended June 30, 2023, were marketing expenses ($13.4 million for Q2 or 73% of operating expenses) and they increased $5.2 million over the previous year directly related to the increase in revenues for PureKana, BRN and Tru sales. There are three main categories of marketing expenses. They are (1) online advertising, (2) email marketing and social media and (3) retailer promotional allowances. The first two categories of marketing expenses are directly related to DTC sales whereas the retailer promotional allowances are related to B2B sales. In the second quarter of 2023, online advertising accounted for 78% of the marketing expenses compared to 82% in the comparable period in 2022. In the second quarter of 2023, email marketing and social media accounted for 6% compared to 9% in the comparable period in 2022. DTC sales in the second quarter of 2023 were roughly flat with DTC revenues in the comparable period 2022. Marketing expenses related to DTC were up by $3.5 million in the second quarter of 2023 compared to those in the second quarter of 2022 due to an increased push in the second quarter to acquire customers for PureKana and Vibez brands to rebuild its subscriber base for PureKana and to develop its subscriber base for Vibez. This investment in the customer base for PureKana and Vibez did result in increases in subscribers bases for these two brands during the second quarter and the benefits are expected to be seen in the third quarter.

Other expenses for the second quarter 2023 were $1.6 million compared to other expenses of $0.4 million in the second quarter of 2022 or an increase of $1.2 million. The main components in the second quarter of 2023 for other income and expenses were finance costs of $0.4 million and losses from the remeasurement of warrant liabilities of $0.7 million.

The Company incurred a net loss of $6.3 million for the second quarter of 2023 increased by $3.6 million over the loss in the first quarter of 2023 and is primarily related to the increase in operating expenses ($3.6 million) in the second quarter of 2023.

EBITDA and Adjusted EBITDA are non-GAAP measures used by management that are not defined by IFRS. EBITDA and Adjusted EBITDA do not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Management believes that EBITDA and Adjusted EBITDA provide meaningful and useful financial information as these measures demonstrate the operating performance of a business excluding non-cash charges.

The most directly comparable measure to EBITDA and Adjusted EBITDA calculated in accordance with IFRS is net loss. The following table presents the EBITDA and Adjusted EBITDA for the three months ended June 30, 2023, and 2022, and a reconciliation of same to net income (loss):

For the three months ended | ||||

June 30, 2023 | June 30, 2022 | Change in | ||

$ | $ | $ | % | |

Net loss | (6.30) | (2.30) | (4.00) | 63 % |

Amortization | 1.00 | 0.60 | 0.40 | 40 % |

Finance costs | 0.40 | 0.20 | 0.20 | 50 % |

EBITDA | (4.90) | (1.50) | (3.40) | 153 % |

Acquisition-related costs | - | (0.10) | 0.10 | 100 % |

Acquisition costs paid by common shares | - | 0.20 | (0.20) | 100 % |

Fair value adjustment of derivative liability | 0.10 | - | 0.10 | 100 % |

Impairment of intangible assets | 0.20 | - | 0.20 | 100 % |

Impairment of inventories | 0.20 | - | 0.20 | 100 % |

Impairment of receivable | 0.10 | - | 0.10 | 100 % |

Loss on remeasurement of warrant liabilities | 0.70 | - | 0.70 | 100 % |

Share-based payments | 0.50 | 1.60 | (1.10) | (220 %) |

Shares issued for services | - | 0.30 | (0.30) | 100 % |

Write-off of advance payments | - | 0.40 | (0.40) | 100 % |

Non-recurring expenses | 0.70 | - | 0.70 | 100 % |

Adjusted EBITDA | (2.40) | 0.90 | (3.30) | 933 % |

The Company had an adjusted EBITDA loss of $2.4 million for the three months ended June 30, 2023, a decrease of $3.3 million over the adjusted EBITDA of $0.9 million for the comparable period in 2022. The primary driver for the adjusted EBITDA loss of $3.3 million for the second quarter of 2023 is the increase in cash operating expenses ($5.3 million) which were offset by increased gross profits ($2 million) compared to the prior period in 2022. The operating expense increase for the second quarter reflected investment in sales growth and automation of customer services in the PureKana and Vibez brands as well as the Tru brand to drive sales growth. The marketing and customer services technology investments in the DTC brands are expected to result in benefits in the latter half of 2023 for PureKana and Vibez (more subscription revenues and lower customer services costs). For the investments in the Tru Brand during the second quarter of 2023 (e.g., Costco MVM), the benefits are expected to materialize over the next twelve months for the Tru brand. The Costco MVM has brought significant awareness of the TRUBAR brand in mass, convenience, and grocery categories. The Company expects to be delivering TRUBAR beyond the mass category starting in the third quarter of 2023.

Our 2023 Outlook remains unchanged:

1. The Company's expectation for consolidated net sales to exceed $80 million.

2. The Company expects gross margin as a percentage of net sales to be between 58% and 60%.

3. The Company expects to achieve positive Adjusted EBITDA in the range of $3-4 million.

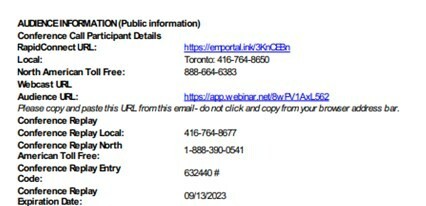

A conference call to discuss the results is scheduled for the following day on August 30, 2023, at 10:00 a.m. EST.

Simply Better Brands Corp. leads an international omni-channel platform with diversified assets in the emerging plant-based and holistic wellness consumer product categories. The Company's mission is focused on leading innovation for the informed Millennial and Generation Z generations in the rapidly growing plant-based, natural, and clean ingredient space. The Company continues to focus on expansion into high-growth consumer product categories including plant-based food, clean ingredient skincare and plant-based wellness. For more information on Simply Better Brands Corp., please visit:

https://www.simplybetterbrands.com/investor-relations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking information" and "forward looking statements" as such terms are used in applicable Canadian securities laws. Forward-looking statements and information are based on plans, expectations and estimates of management at the date the information is provided and are subject to certain factors and assumptions, including, among others, that the Company's financial condition and development plans do not change as a result of unforeseen events, the impact of the COVID-19 pandemic, the regulatory climate in which the Company operates, and the Company's ability to execute on its business plans. Specifically, this news release contains forward-looking statements relating to, but not limited to: entry into the $21.5 billion protein powder category in 2023, expansion plans for Tru Brands products, size or PureKana's pet segment, No BS's planned launch in Walgreens in Q4 and expansion of its facial acne patch portfolio (overnight pimple patch and acne patch plus retinol night cream) and a natural deodorant category entry, 2023 guidance and results of operations, growth of the Company's brands, and, success of the Company's marketing efforts.

Forward-looking statements and information are subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking statements and information. Factors that could cause the forward-looking statements and information in this news release to change or to be inaccurate include, but are not limited to, the risk that any of the assumptions referred to prove not to be valid or reliable, that occurrences such as those referred to above are realized and result in delays, or cessation in planned work, that the Company's financial condition and development plans change, ability to obtain necessary regulatory approvals for proposed transactions, as well as the other risks and uncertainties applicable to the plant-based food, clean ingredient skincare and plant-based wellness or broader wellness industries and to the Company, and as set forth in the Company's annual information form available under the Company's profile at www.sedar.com.

The above summary of assumptions and risks related to forward-looking statements in this news release has been provided in order to provide shareholders and potential investors with a more complete perspective on the Company's current and future operations and such information may not be appropriate for other purposes. There is no representation by the Company that actual results achieved will be the same in whole or in part as those referenced in the forward-looking statements and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities law.

This press release contains future-oriented financial information and financial outlook information (collectively, "FOFI") about the financial results the quarter ended June 30, 2023, and the year ended December 31, 2023, including net sales, gross margin, and Adjusted EBITDA, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set out under the heading "Forward-Looking Information". The actual financial results of the Company may vary from the amounts set out herein and such variation may be material. The Company and its management believe that the financial outlook has been prepared on a reasonable basis, reflecting management's best estimates and judgments and the FOFI contained in this press release was approved by management as of the date hereof. However, because this information is subjective and subject to numerous risks, it should not be relied on as necessarily indicative of future results. Except as required by applicable securities laws, the Company undertakes no obligation to update such FOFI. FOFI contained in this press release was made as of the date hereof and was provided for the purpose of providing further information about the Company's anticipated future business operations on a quarterly and annual basis. Readers are cautioned that the FOFI contained in this press release should not be used for purposes other than for which it is disclosed herein.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.21 |

| Daily Volume: | 0 |

| Market Cap: | US$14.830M |

January 16, 2025 January 14, 2025 March 08, 2024 March 05, 2024 November 08, 2023 | |