VANCOUVER, British Columbia, Oct. 01, 2024 (GLOBE NEWSWIRE) -- Nevada Lithium Resources Inc. (CSE: NVLH; OTCQB: NVLHF; FSE: 87K) (“Nevada Lithium” or the “Company”) is pleased to provide the core assay results for the second and final diamond drill hole from the 2024 drill program at its 100% owned Bonnie Claire lithium project (the “Project” or “Bonnie Claire”), located in Nye County, Nevada. BC2402C is an infill hole, collared 817 feet (249 m) to the southeast of BC2301C. The hole reached a total depth of 3,002 feet (915 m) and intersected thicker, deeper high-grade mineralized rock towards the southeast for the first time.

Nevada Lithium’s CEO, Stephen Rentschler, comments:

“The results from our final hole of the 2024 drilling program are tremendous. Hole BC2024C generated two exciting and important conclusions. The first is the remarkable continuity that exists in the deep high-grade Lithium and Boron mineralized zone that we first encountered in our 2023 drilling program. We anticipate that this demonstrated continuity will significantly increase the geostatistical confidence in this zone.

This demonstrated continuity is extremely important for the support of the mine planning that is currently underway to update our existing PEA. This update will, for the first time, include the impact from the deep high-grade Lithium and Boron zone that now extends over 1km from the southwest to the northeast.”

He continued, “Although designed as an infill hole, BC2402C also confirmed the extension of the high-grade Lithium and Boron zone to the southeast. With the results of this hole, we have confirmed that the high-grade mineralization remains open in at least two directions. Our technical committee also remains confident that this high grade mineralization extends in yet another direction, to the northwest.

Bonnie Claire’s massive, existing Lithium resource currently does not include the tremendous results from our past two drilling programs. However, the data suggest that we have yet to find the deposit’s sweet spot. Therefore, the potential to add high-grade Lithium and Boron tonnages to Bonnie Claire in the future is nowhere near exhausted. We are moving as quickly as possible to demonstrate the enhanced world-class attributes of Bonnie Claire and anticipate the first of a series of updates to be completed in the very near future.”

| Join Stephen Rentschler, CEO of Nevada Lithium for a LIVE virtual event to learn more about Nevada Lithium’s Market Sentiment, Government Engagement, and Site Progress Date and time: Wednesday, October 9th at 10:00 AM PT / 1:00 PM EST |

| Click here to register for the event > |

Highlights:

The 2024 drill program completed two holes with complementary goals. Drill Hole BC20241C was completed to examine the northeast extension of the deep high-grade mineralization that was intersected in the 2023 campaign. In contrast, BC2402C was completed to investigate grade continuity within the existing mineral resource to support mine planning.

BC2402C is collared 817 feet (249 meters) to the southeast of BC2301C. It was planned as an infill hole to:

Sample assays for Hole BC2402C are shown in Table 1

Table1

| Drill Hole | From (ft)* | To (ft) | Interval (ft) | Li (ppm) | B (%) | Comments |

| BC2402C | 147 | 407 | 260 | 909 | 0.27 | Upper Zone |

| 1487 | 2847 | 1360 | 3024 | 0.90 | Lower Zone | |

| Including | 1787 | 2387 | 600 | 4089 | 1.47 | |

| Including | 2227 | 2367 | 140 | 5021 | 1.82 | |

| Including | 2307 | 2327 | 20 | 6150 | 1.76 |

*Results presented in feet (ft).

| Drill Hole | Start (m)** | End (m) | Intercept (m) | Li (ppm) | B (%) | Comments |

| BC2402C | 44.8 | 124.1 | 79.248 | 909 | 0.27 | Upper Zone |

| 453.2 | 867.8 | 414.5 | 3024 | 0.90 | Lower Zone | |

| Including | 544.7 | 727.6 | 182.9 | 4089 | 1.47 | |

| Including | 678.8 | 721.5 | 42.7 | 5021 | 1.82 | |

| Including | 703.2 | 709.3 | 6.1 | 6150 | 1.76 |

** Results presented in meters(m).

¹Intervals presented are core length

Results and Interpretation

Mineralization Continuity

BC2402C tightens the drill spacing in the southeast part of the mineral resource area. The drill results from BC2402C have increased confidence in the grade continuity of the high-grade deep Lithium and Boron mineralization with the nearest hole BC2301C, which returned 3,076 ppm Lithium over 1,100ft (335 m) (See the Company’s news release dated November 20, 2023).

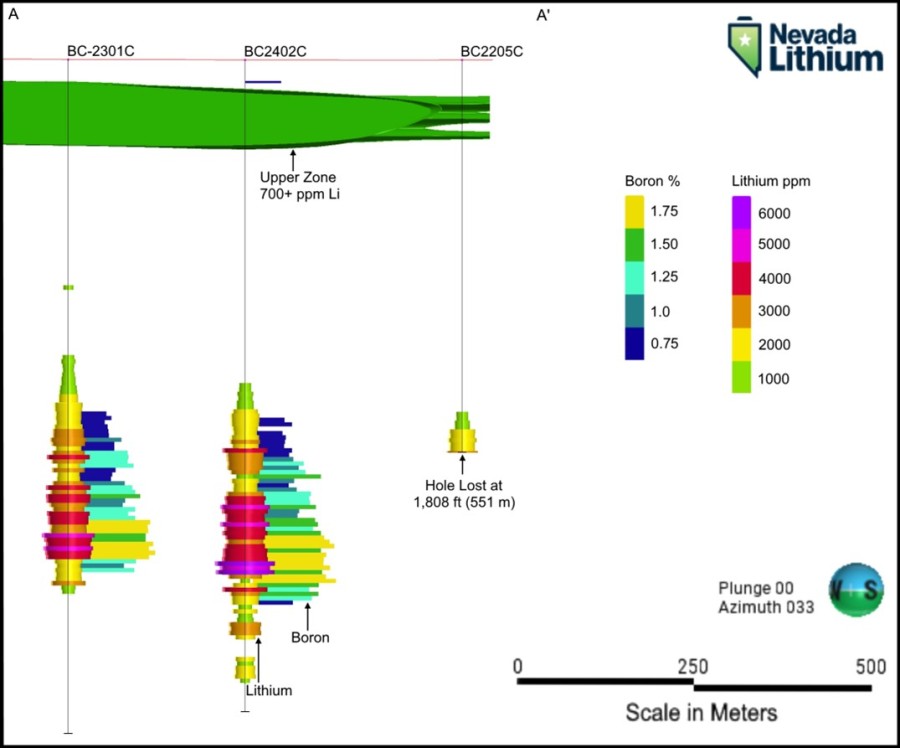

A visual examination of the downhole grade graphs provides a remarkable visual correlation between BC2301C and the new hole BC2402C, particularly in Boron (Figure 1). These assays will be included in an ongoing mineral resource estimation being conducted by Global Resource Engineering. It is anticipated that infill holes like BC2402C will increase the geostatistical confidence in grade with surrounding drillholes. This increased geostatistical confidence is necessary to move mineral resources in the vicinity from Inferred to Indicated category.

While BC2402C displays great similarity with BC2301C in downhole grade distribution, the grades and thicknesses intersected are significantly larger. The 600 ft (183 m) of 4,089 ppm Lithium encountered in BC2402C was significantly thicker than the 360 ft (110 m) of 4,291 ppm Lithium encountered in BC2301C. The same interval in BC2402C has a weighted average Boron assay of 1.47%, indicating the high-grade Boron mineralization also continues to the southeast.

The general increase in grades seems to correlate with an increase in depth, as the highest Lithium grades occurred roughly 100 ft (30 m) deeper in BC2402C than in BC2301C. The highest assay in BC2402C is 6,150 ppm Lithium from 2,307 ft (703 m) to 2,327ft (709 m).

The upper mineralized zone maintained a similar thickness to elsewhere, but was slightly lower grade in BC2402C, averaging 909 ppm Lithium over 260 ft (79 m).

High-Grade Extension to Southeast

Previous deep drilling at Bonnie Claire has been focused on following the increasing grades to the northeast, and BC2402C is the first hole to see this trend occurring to the southeast as well (Figure 2). Hole BC2402C extends high-grade deep mineralization 817ft (249m) to the southeast. Grades and thicknesses increase to the southeast and remain open in that direction. The trend of deeper mineralization providing higher grades continues and has now been demonstrated to the northeast and southeast of the existing resource area (Figure 2).

Figure 1: Cross-sectional grade comparison from drill holes BC2301C, BC2402C, and BC2205C

Figure 2: Drill collar location map of holes BC2201C, BC2203C, BC2301C, BC2303C, and BC2401C, with section line A-A’

Quality Assurance / Quality Control (QAQC)

A quality assurance / quality control protocol following industry best practice was incorporated into the program by Nevada Lithium. Drilling was conducted by Major Drilling. Core was transported by Major Drilling from the collar location and received by Nevada Lithium staff at the Company storage facility in Beatty, NV. The facility is only accessible to Nevada Lithium staff and remains otherwise locked.

Received core was logged and cut at the facility by Nevada Lithium staff. Logging and sampling included the systematic insertion of blanks, duplicates and certified reference material (CRM) MEG Li.10.12 and OREAS 750 into sample batches at an insertion rate of approximately 10%.

All core samples collected were transported by Company staff to ALS USA Inc.’s laboratory in Reno, NV. for sample preparation. Sample preparation comprises initial weighing (Code WEI-21), crushing QC Test (CRU-QC), pulverizing QC Test (PUL-QC), fine crushing at 70% <2mm (CRU-31), sample split using Boyd Rotary splitter ((SPL-22Y), pulverizing up to 250g 85% <75 µm (PUL-31), crush entire sample (CRU-21), Pulp Login LOG-24) and a crusher wash (final crusher wash between samples (WSH-21)).

Samples were shipped to ALS USA Inc.’s Vancouver laboratory in Burnaby BC, where the samples were analyzed using 48-element four-acid ICP-MS (ME-MS61) and B/Li N2O2 Fusion - ICP-AES high-grade (ME-ICP82b) procedures.

Standards, duplicates and blanks in the drill results to date have been approved as acceptable. The standards performed well (100% within 95% confidence limits for lithium and boron) as did duplicates (R2 = 1) and all blanks (average 16ppm Li, <0.02%B).

About Nevada Lithium Resources Inc.

Nevada Lithium Resources Inc. is a mineral exploration and development company focused on shareholder value creation through its core asset, the Bonnie Claire Lithium Project, located in Nye County, Nevada, where it holds a 100% interest.

Bonnie Claire has a current NI 43-101 inferred mineral resource of 3,407 million tonnes (Mt) grading 1,013 ppm Li for 18.372 million tonnes (Mt) of contained lithium carbonate equivalent (LCE), at a cut-off grade of 700 ppm Li2

The PEA for Bonnie Claire indicates a net present value (8%) of $1.5 Billion USD (after tax) using $13,400 USD per tonne LCE and after-tax IRR of 23.8%. With an LCE price of $30,000 USD per tonne, the net present value (8%) of the Project is $5.9 Billion USD (after tax) and an IRR of 60.3%2.

For further information on Nevada Lithium and to subscribe for updates about Nevada Lithium, please visit its website at: https://nevadalithium.com/

QP Disclosure

The technical information in the above disclosure has been reviewed and approved by the designated Qualified Person under National Instrument 43-101, Dr. Jeff Wilson, PhD, P.Geo, Vice President of Exploration for Nevada Lithium. Dr. Wilson is not independent of Nevada Lithium, as he is Vice President of Exploration for Nevada Lithium.

2See Preliminary Economic Assessment NI 43-101 Technical Report on the Bonnie Claire Lithium Project, Nye Country, Nevada authored by Terre Lane, J. Todd Harvey, MBA, PhD, Hamid Samari, PhD and Rick Moritz (Effective date of August 20, 2021, and Issue date of February 25, 2022) (the “PEA” or the “Preliminary Economic Assessment”) as summarized in Nevada Lithium’s news release dated October 13, 2021, which are available on Nevada Lithium’s SEDAR+ profile at www.sedarplus.ca. Results of the Preliminary Economic Assessment represent forward-looking information. This economic assessment is, by definition, preliminary in nature and includes inferred mineral resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the Preliminary Economic Assessment will be realized. Mineral resources are not mineral reserves as they do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves.

On behalf of the Board of Directors of Nevada Lithium Resources Inc.

“Stephen Rentschler”

Stephen Rentschler, CEO

For further information, please contact:

Nevada Lithium Resources Inc.

Stephen Rentschler

CEO and Director

Phone: (647) 254-9795

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Media Inquiries

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Find Nevada Lithium on Twitter and LinkedIn

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this news release. The Canadian Securities Exchange has not approved or disapproved of the contents of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. These statements relate to matters that identify future events or future performance. Often, but not always, forward looking information can be identified by words such as “could”, “pro forma”, “plans”, “expects”, “may”, “will”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved.

The forward-looking statements contained herein include, but are not limited to, statements regarding: the performance of the Project and results of the 2023 Exploration and Development Plan (including, without limitation, its mineral resources, current claims and its ability to utilize global lithium needs); and the performance of lithium as a commodity, including the sustained lithium demand and prices.

In making the forward looking statements in this news release, Nevada Lithium has applied several material assumptions, including without limitation: market fundamentals that result in sustained lithium demand and prices; the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of Bonnie Claire in a timely manner; the availability of financing on suitable terms for the development; construction and continued operation of Bonnie Claire; the Project containing mineral resources; and Nevada Lithium’s ability to comply with all applicable regulations and laws, including environmental, health and safety laws.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Nevada Lithium’s management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of managements considered reasonable at the date the statements are made. Although Nevada Lithium believes that the expectations reflected in such forward- looking statements are reasonable, such information involves risks and uncertainties, and under reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by Nevada Lithium. Among the key risk factors that could cause actual results to differ materially from those projected in the forward- looking statements are the following: operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Project; estimation or realization of mineral reserves and mineral resources, requirements for additional capital; future prices of precious metals and lithium; changes in general economic, business and political conditions, including changes in the financial markets and in the demand and market price for commodities; possible variations in ore grade or recovery rates; possible failures of plants, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays or the inability of Nevada Lithium to obtain any necessary approvals, permits, consents or authorizations, financing or other planned activities; changes in laws, regulations and policies affecting mining operations; currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities; risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on Nevada Lithium’s business; as well as those factors discussed under the heading “Risk Factors” in Nevada Lithium’s latest Management Discussion and Analysis and other filings of Nevada Lithium filed with the Canadian securities authorities, copies of which can be found under Nevada Lithium’s profile on the SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialized, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Nevada Lithium has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Nevada Lithium does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

| Last Trade: | US$0.15 |

| Daily Change: | 0.0025 1.69 |

| Daily Volume: | 40,105 |

| Market Cap: | US$39.110M |

January 06, 2026 December 11, 2025 September 24, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS