August 11, 2023 - TheNewswire - Rockport, Canada - New Age Metals Inc. (NAM) (TSXV:NAM); (OTC:NMTLF); (FSE:P7J) (“NAM” or the “Company” is pleased to announce the filing of a new, positive National Instrument 43-101 Preliminary Economic Assessment (“PEA”) Technical Report (“the Report”) on SEDAR for its 100%-owned River Valley Palladium Project, 60 km east-northeast of Sudbury, Ontario. The results of the PEA were previously announced in a Company press release dated June 29, 2023. This is NAM’s second PEA completed on River Valley (see Company press release dated June 27, 2019). The effective date of this new Report is June 29, 2023.

New PEA Highlights

Pre-Tax NPV(5%): $296M; After-Tax: $140M

Pre-Tax IRR: 16%; After-tax IRR: 11%

Annual Production: 2.5 Mt of potential process plant feed at an average grade of 1.19 g/t PdEq and process recovery of 71.5%, resulting in an average annual payable Pd production of 47,400 oz.

Total Tonnes Processed over Life of Mine: 38.6 Mt/16 years

Pre-production Capital Requirement: $269M

Average Unit Operating Cost: $30.98/t

Assumed US$ Metal Prices: $2,150/oz Pd, $1,050/oz Pt, $1,830/oz Au, $4.00/lb Cu

River Valley Process Plant Feed: Treated in an on-site conventional sulphide flotation plant to produce a saleable PGM-enriched Cu concentrate for transport off-site for smelting and refining

Project Enhancement Opportunities: Increased metal recoveries and expanded Mineral Resources

Harry Barr, NAM Chairman & CEO, stated: “We are pleased to file the Report for the River Valley 2023 PEA, which shows positive results with an after-tax NPV(5%) of $140 M CAD and IRR of 11% and 16 years of palladium, platinum and copper production. Compared to the 2019 PEA, this new PEA is based on a much smaller, higher-grade operation with markedly lower CAPEX, expanded underground mining and reduced open pit mining, and significantly smaller environmental impact. These encouraging results are based on the 2021 Mineral Resource Estimate, produced in accordance with current CIM standards and guidelines, to provide feed to an on-site 2.5 Mtpa process plant. The next steps in Project development include testing of promising new technologies for improved platinum metal recoveries and targeting areas for drilling to convert Inferred to Indicated Mineral Resources, expanding current Mineral Resources, and the discovery and delineation of new mineralized zones, all for incorporation into future, more advanced economic studies.”

PEA Summary*

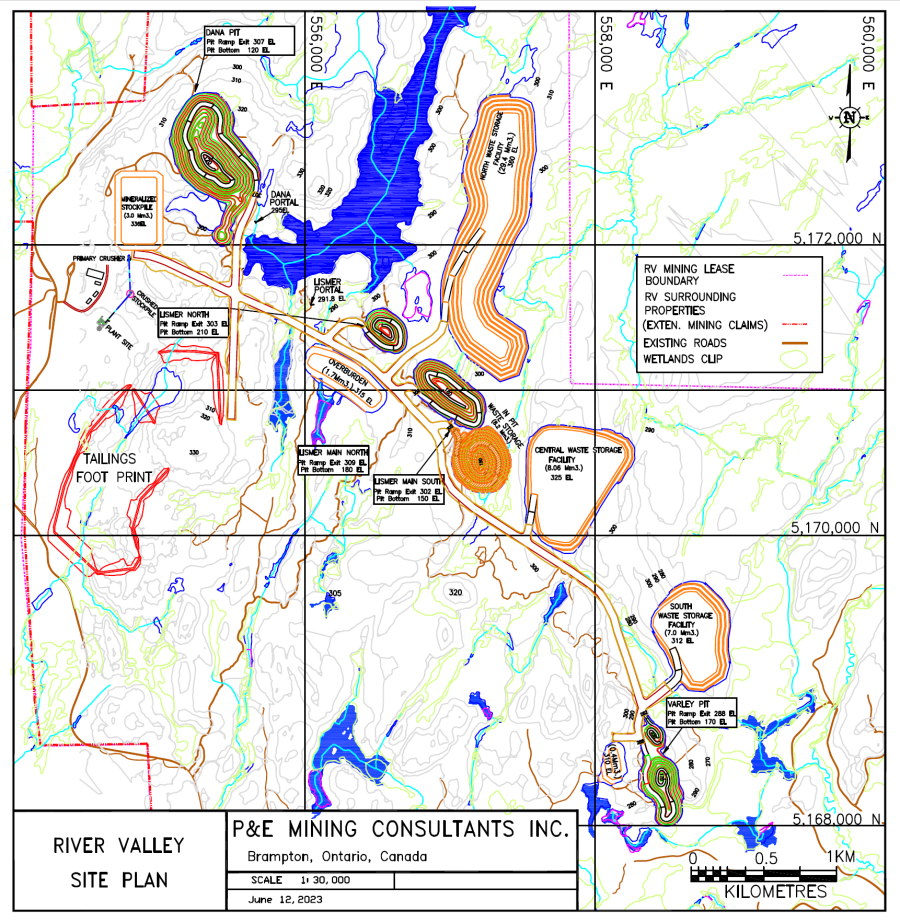

The site plan layout for the new River Valley PEA is shown in Figure 1.

Figure 1. New PEA site layout plan for the River Valley Palladium Project.

Five open pits and two underground portals that have been used in the engineering design of the Project, the proposed process plant site, low-grade stockpile, waste rock storage facilities, tailings storage facility, and site infrastructure are shown in Figure 1. The Project as represented in Figure 1 has an area of approximately 40 km2, which reflects a major reduction and increased focus from the 130 km2 site plan area in the 2019 PEA.

The parameters of the PEA are summarized in Table 1. PEA operating costs and capital costs are presented in Tables 2 and 3.

Table 1. PEA Summary Parameters

Assumptions | |

Palladium Price (Base case) US$/oz | 2,150 |

Exchange Rate US$:CDN$ | 1.35 |

Production Profile | |

Total Tonnes Processed (M) | 38.6 |

Process Plant Head Grade PdEq g/t | 1.19 |

Mine Life (years) | 16 |

Daily process plant throughput (tpd) | 6,850 |

Palladium Process Plant Recovery (%) | 71.5 |

Total Payable Palladium Equivalent Ounces (k) | 735 |

Average annual Palladium Production Ounces (k) | 47.4 |

Operating Costs ($ per tonne processed) | |

Unit Average LOM Operating Costs | 30.98 |

Open Pit Mining Costs | 12.63 |

Underground Mining Costs | 60.61 |

Processing Costs | 12.69 |

G&A | 2.01 |

LOM Average Cash Cost US$/oz Pd | 1,241 |

Capital Requirements | |

Pre-Production Capital Cost ($ M) | 268.7 |

Sustaining Capital Cost (Life of Mine) ($ M) | 163.0 |

Project Economics | |

Royalties (%) | 3 |

Royalty Payable After $2M Buy Down to 1% ($ M) | 25 |

Taxes (M $) | 258 |

Pre-Tax | |

Cumulative Undiscounted Cash Flow ($ M) | 609 |

NPV (5% Discount Rate) ($ M) | 296 |

IRR (%) | 16.1 |

Payback (years) | 6.1 |

After-Tax | |

Cumulative Undiscounted Cash Flow ($ M) | 352 |

NPV (5% Discount Rate) ($ M) | 140 |

IRR (%) | 11.3 |

Payback (years) | 6.9 |

Table 2. Operating Cost Summary

Operating Cost | Unit | LoM |

Open Pit Mining Cost | $/t mined | 2.95 |

Open Pit Mining Cost | $/t processed | 12.63 |

Underground Mining Cost | $/t processed | 60.61 |

Process Cost | $/t processed | 12.69 |

G&A | $/t processed | 2.01 |

Unit LoM Average Operating | $/t processed | 30.98 |

Table 3. Capital Cost Summary

Development Capital | Initial (Y-2, Y-1) ($ M) | Sustaining ($ M) | Total LOM ($ M) |

Open Pit Development and Equipment | 37.0 | 59.4 | 96.4 |

Process Plant | 119.2 | 119.2 | |

On-Site Infrastructure | 17.4 | 17.4 | |

Electrical Powerline | 30.0 | 30.0 | |

Tailings Management Facility | 17.0 | 27.0 | 44.0 |

Owner's Costs | 10.0 | 10.0 | |

Underground Mine Development | 37.1 | 37.1 | |

Reclamation Bond and Closure | 16.3 | 16.3 | |

Contingency | 29.9 | 18.1 | 48.0 |

Total Capital | 268.7 | 163 | 431.7 |

*This PEA was prepared in accordance with National Instrument 43-101 (“NI 43-01”) Standards of Disclosure of Mineral Projects. It was prepared by P&E Mining Consultants Inc. with D.E.N.M. Engineering Ltd., Knight Piésold Ltd. and Story Environmental. Readers are cautioned that the PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be classified as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic variability.

Next Steps

At least two major opportunities to increase the value of the River Valley Palladium Project are:

1) improved metal recoveries; and

2) increased Mineral Resources.

1)Improved Metal Recoveries

Hydrometallurgical Options. The main focus of this PEA from a processing standpoint is conventional milling and flotation with upgrading of the resultant copper concentrate to a marketable product. The final concentrate (copper and PGMs) would be shipped to specific smelters to treat the River Valley product as a part of the revenue stream.

As an alternative to shipping to smelters, pressure leaching and metal precipitation options to recover platinum group metals (“PGMs”), gold and base metals will be investigated. Several PGM deposits worldwide are currently being subject to hydrometallurgical testing, as a potentially economic alternative to base metal smelters.

Alternative Flotation Applications. Conventional flotation of the River Valley material has thus far been unable to produce a high-grade marketable smelter concentrate for maximum net smelter returns.

The expected concentrate grades based on the recent testing at SGS Lakefield were detailed in New Age Metals press release dated August 9, 2022.

Preliminary scoping work has been completed on the River Valley material utilizing two flotation alternatives to produce a higher-grade rougher concentrate and also possible increases in PGM recoveries. The two technologies being investigated are the Woodgrove flotation and the Glencore (Jameson) cell techniques.

Rhodium Recovery & Marketability. Additional work in this area would be beneficial for the Project,

due to the relatively high metal price of rhodium. The testwork recently completed showed the ability to recover rhodium in the final concentrate, albeit not at a saleable threshold grade for the smelters. Review of the rhodium mineralogy and process alternatives is recommended.

An initial proof-of-concept PLATSOLTM test program is under development with SGS Canada Inc. for completion in Q4 of 2023.

2) Increased Mineral Resources

The distribution of the current Mineral Resources at River Valley is shown in Figure 2.

Major infill, expansion and exploration drill programs are planned at River Valley to: 1) convert Inferred to Indicated Mineral Resources at the Lismer and Varley Zones; 2) expand current Mineral Resources at depth and along strike at the Dana South, Banshee, Lismer Ridge, Varley and Azen Zones; and 3) test targets and delineate mineralized zones that show potential for inclusion in future Mineral Resource modelling, particularly in the footwall to the River Valley Intrusion, as guided by the results of surface and downhole geophysical surveys and 3-D geological modelling.

The drilling programs are slated to commence in H2 2023, subject to financing.

Figure 2. Distribution of pit constrained Mineral Resources at $15/t NSR cut-off. The priority mineralized zones for infill, expansion and exploration drilling are labelled red, which are open to expansion by drilling at depth and, in places, along strike. Note that the Pine Zone is not exposed at surface. M&I = Measured and Indicated Mineral Resources, Ind = Indicated Mineral Resources, and Inf = Inferred Mineral Resources.

About the River Valley Project

The River Valley Palladium Project is located 100 road-km east-northeast from the City of Sudbury.

The Project area is linked to Sudbury by a network of all-weather highways, roads and rail beds and is accessible year-round with hydro grid and natural gas power nearby. River Valley enjoys the strong support of local communities, like the Village of River Valley, 20 km to the south. Fully executed Memorandum of Understandings are in place with the Temagami First Nation and the Nipissing First Nation groups, since 2014 and 2022, respectively. Environmental baseline studies re-commenced in 2020 are planned to continue through 2023.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration and development of green metal projects in North America. The Company has two divisions; a Platinum Group Element division and a Lithium/Rare Element division.

The PGE Division includes the 100% owned, multi-million-ounce, district-scale River Valley Project, one of North America’s largest undeveloped Platinum Group Element Projects, situated 100 km by road east-northeast of Sudbury, Ontario. The Company is actively seeking an option/joint venture partner to advance its River Valley Palladium Project.

In addition to River Valley, NAM owns 100% of the Genesis PGE-Cu-Ni Project in Alaska, and plans to complete a surface mapping and sampling program in 2022. The Company is actively seeking an option/joint venture partner for its road-accessible Genesis PGE-Cu-Ni Project in Alaska.

The Company’s Lithium Division is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field, where the Company is exploring for hard rock lithium and various rare elements, such as tantalum, rubidium, and cesium. The Company has announced its preliminary $2 million 2023-2024 exploration budget that will cover the first 4 months of the program. A larger budget has been submitted to our partner Mineral Resources Limited and we expect it to be approved this summer. Further Exploration plans for 2023 include geophysical surveying, summer field work (which will include mapping, lithogeochemistry, MMI soil geochemistry, biogeochemistry, channel sampling), and permits/ archaeological surveys. The Company has a partnership with Mineral Resource Limited (MRL, ASX: MIN), a top global lithium producer to explore and develop the Company’s lithium project portfolio in Southern Manitoba. Our philosophy is to be a project generator with the objective of optioning our projects with major and junior mining companies through to production. The Company is actively seeking an option/joint venture partner for our newly acquired Northman, McLaughlin Lake, and South Bay Lithium Projects in northern Manitoba, and its road-accessible Genesis PGE-Cu-Ni Project in Alaska.

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to This email address is being protected from spambots. You need JavaScript enabled to view it. or Harry Barr at This email address is being protected from spambots. You need JavaScript enabled to view it. or Faraz Rasheed at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 613 659 2773.

If you have not done so already, we encourage you to sign-up on our website (www.newagemetals.com) to receive our updated news.

This PEA was prepared under the supervision of Eugene Puritch, P.Eng., FEC, CET of P&E Mining Consultants Inc. The metallurgical testwork, process plant design and cost estimates were prepared by David Salari, P.Eng. of D.E.N.M Engineering Ltd. The tailings facility and water management were prepared by Jessica Breault, P.Eng., the rock mechanics design input was prepared by were prepared by Ben Peacock, P.Eng. of Knight Piésold Ltd. The Environmental, Community and ESG write-up was prepared by Maria Story, P.Eng., of Story Environmental Inc. Mr. Puritch reviewed and approved the technical information in this press release. William Stone, P.Geo., Lead Geoscience Consultant for New Age Metals, is the Company Qualified Person as defined by NI 43-101 and has reviewed and approved the technical content of this press release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

| Last Trade: | US$0.34 |

| Daily Volume: | 0 |

| Market Cap: | US$24.780M |

October 27, 2025 October 23, 2025 October 17, 2025 October 15, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS