Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Namibia Critical Metals Lofdal Heavy Rare Earth Deposit: Exceptionally Positive Flotation Test Program Completed

Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI OTCQ:NMREF) is pleased to provide an update on the development of the Lofdal Heavy Rare Earth project. Lofdal is one of only two primary xenotime projects under development in the world, which requires pioneering processing approaches to this unusual type of rare earth mineralisation. The deposit has the potential for significant production of dysprosium and terbium, two of the most valuable heavy rare earth elements used in high powered magnets for electric vehicle motors and other high-tech applications. The Project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC") targeting a long term, sustainable supply of heavy rare earths to Japan.

The Company has successfully completed an extended flotation test work program with more than 110 individual flotation test regimes. The tests were conducted at two specialised institutions at SGS Minerals Services Canada and UVR-FIA in Germany. As an overall result, a simplified flowsheet was developed which allows for the direct flotation of run-of-mine material resulting in an upgrade of the heavy rare earths in the flotation concentrate by an impressive factor of more than twenty.

Darrin Campbell, President of Namibia Critical Metals stated:

"With the Lofdal project we are aiming at a large-scale, long-term production of the most valuable rare earths, dysprosium and terbium. The successful completion of the flotation test work program is a major milestone towards this goal. We have now proven that even the large tonnages of medium-grade resources can be beneficiated by a further simplified flow sheet using direct flotation of the run-of-mine ore. This unlocks further scale to the Lofdal project."

Lofdal project

The Lofdal Heavy Rare Earths deposits represent district-scale (20 km x 10 km) heavy rare earth element (HREE) mineralisation in subvolcanic hydrothermal alteration zones. While high grade zones (>0.2% HREE) occur locally, the majority of the deposit resembles tens of meters wide and kilometer-long zones of low grade HREE-mineralisation with an average grade of about 0.1% HREE.

Drilling in 2020 increased the Mineral Resource Estimate of the project more than seven-fold to 44.76 Mt at a grade of 0.17% TREO[1] (Measured and Indicated categories) and 8.67 Mt at a grade of 0.17% TREO in the Inferred category contained in only the two sub-deposits of "Area 4" and "Area 2B" (Press release and NI 43-101 Technical Report - 20 May 2021[2]), and applying the same cut-off of 0.1% TREO as in the historical PEA of 2014.

To develop the Lofdal project into a long-term producer of HREE, the Company focussed recent processing test work on cost-efficient technologies to upgrade lower grade material aiming at effects of economy of scale in a potential large-scale mining operation.

Bulk sampling from starter pit

The Company mined a total of 34,500 tonnes of mineralised material from a starter pit in the central Area 4 deposit in October 2021 (Press release 29 November 2021). A 500-tonne sample was taken from the mineralized zone at a depth between 12 and 15 metres in order to minimize effects of surface related oxidation. The material was blended by front-end loaders to provide homogenized samples which are representative of the wider deposit at a grade of about 0.187% TREO for bulk sample test work.

Mineralogical characterisation of the feed sample was done by MLA and TESCAN Integrated Mineral Analyzer (TIMA), a fully automated, high throughput, analytical scanning electron microscope for mineralogical studies including mineral liberation analysis, size-by-size liberation and mineral association. Key results demonstrated median xenotime grain sizes of 26 µm and 10 µm for the two head fractions tested (+38 µm and -38 µm) respectively. The main HREE-mineral xenotime, was 32% liberated in the +38 µm fraction and 76% liberated in the -38 µm fraction.

Flotation test program

The current metallurgical bulk sample test program was amended to include flotation tests directly on the fresh, low-grade sample, by-passing initially planned XRT and XRF sorting as well as magnetic separation steps prior to flotation, both of which would result in additional losses, CAPEX and OPEX.

Flotation test work was carried out at SGS Canada Inc. in Lakefield, Ontario, and at UVR-FIA GmbH in Freiberg, Germany. Both institutions, cumulatively conducted over 110 individual flotation tests using several types of collectors, depressants and considered thrifting of physical flotation conditions.

The most successful flotation test series on the milled bulk sample (P100 =53µm, P80=43µm) were performed by SGS Canada and resulted in exceptional upgrade ratios of between 22 and 27.

The impact of high intensity conditioning ahead of flotation yielded clearly improved flotation performance.

A range of collector dosages of were tested to determine the upper and lower envelopes for flotation performance versus OPEX. The lower carbonate content in the fresh feed material compared to historical sample material from trenches resulted in significantly lower depressant requirements in the flotation regime.

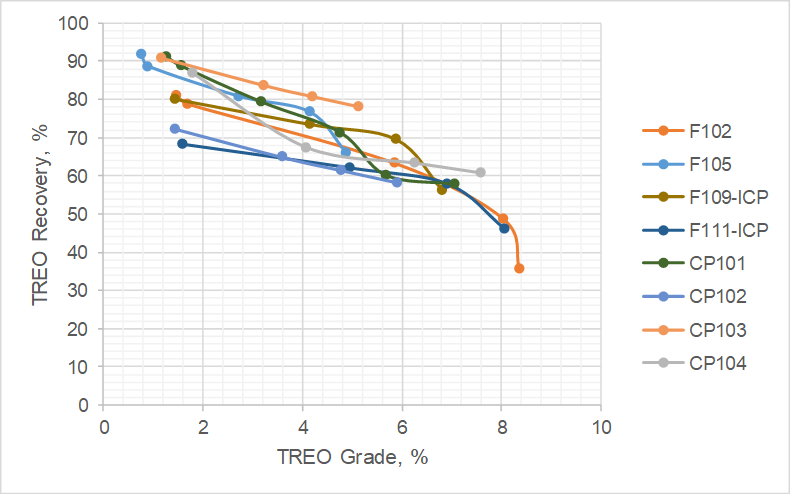

Figure 1: Grade-recovery curves for the key flotation tests by SGS. CP denotes bulk testing.

Figure 1: Grade-recovery curves for the key flotation tests by SGS. CP denotes bulk testing.

Coarser grind, as well as de-sliming of the flotation feed, water exchange techniques and regrind between rougher and cleaner flotation stages, and varying temperature regimes were tested by UVR and SGS. None of these tests resulted in significant improvements in performance or cost savings.

After defining the optimal flotation conditions, bulk flotation tests were conducted in quadruplicate to produce a flotation concentrate for downstream hydrometallurgical testing. Four bulk flotation tests demonstrated repeatable flotation performances on the low-grade feed material. The average cleaner flotation concentrate from the bulk test runs (CP101 to CP104) was produced at an overall mass pull of 2.7-3.2% with a product grade of 4.7-6% TREO and a recovery of 67-70% TREO.

Way forward

Downstream hydrometallurgical test work on the flotation concentrate is in progress with preliminary results confirming similar acid bake and leach performance as in the previous program (Press release 7 October 2021).

The revised and significantly simplified flowsheet for the Lofdal project (see Figure 2) is currently under economic evaluation based on an updated mine plan. An engineering sizing, capital and operating costing validation exercise by SGS Bateman is expected by end August 2022.

Figure 2: Simplified Lofdal process flowsheet for direct flotation of run-of-mine material

Figure 2: Simplified Lofdal process flowsheet for direct flotation of run-of-mine material

Additional test work is currently conducted at SGS Lakefield to further optimize the flotation performance with:

1) Reduced collector dosage;

2) Test effectiveness of finer grind to determine lower limit (e.g. P100=38µm);

3) Alternative collectors with potential cost savings.

About Namibia Critical Metals Inc.

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The two advanced stage projects in the portfolio are Lofdal and Epembe. The Company also holds significant land positions in areas favourable for gold mineralization.

Heavy Rare Earths: The Lofdal Dysprosium-Terbium Project is the Company's most advanced project being fully permitted with a Mining Licence (ML 200) issued in 2021. The project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC").

About Japan Oil, Gas and Metals National Corporation (JOGMEC) and the JV

JOGMEC is a Japanese government independent administrative agency which seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earths are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with US$250,000,000 in loans and equity in 2011 to ensure supplies of the Light Rare Earths metals suite to the Japanese industry.

Namibia Critical Metals owns a 95% interest in the Lofdal project with the remaining 5% held for the benefit of historically disadvantaged Namibians. The terms of the JOGMEC joint venture agreement with the Company stipulate that JOGMEC provides $3,000,000 in Term 1 and $7,000,000 in Term 2 to earn a 40% interest in the Lofdal project. Term 3 calls for a further $10,000,000 of expenditures to earn an additional 10% interest. JOGMEC can also purchase another 1% for $5,000,000 and has first right of refusal to fully fund the project through to commercial production and to purchase all production at market prices. The collective interests of NMI and historically disadvantaged Namibians cannot be diluted below a 26% carried working interest upon payment of $5,000,000 to JOGMEC for the dilution protection. The JV Agreement is structured such that no NMI equity will be issued and it is totally non-dilutive to NMI shareholders. To date, JOGMEC, has approved funding Term 1 and 2 expenditures totaling $7,800,000.

Gold: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and more recently the discovery of the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the recent Osino gold discovery at Twin Hills have been identified and exploration is progressing over this highly prospective area. The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization. Interpretation of geophysical data and regional geochemical soil sampling have identified first gold targets.

Tantalum-Niobium: The Epembe Tantalum-Niobium-Uranium Project is at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping and radiometric surveys and over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI".

Qualified Person's Statement

Rainer Ellmies, PhD, MScGeol, EurGeol, AusIMM is Vice President Exploration of Namibia Critical MetalsInc. and the Company's Qualified Person. He has reviewed and approved the scientific and technical information in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact -

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Fax: +01 (902) 835-8761

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Web site: www.NamibiaCriticalMetals.com

The foregoing information may contain forward-looking information relating to the future performance of Namibia Critical Metals Inc. forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

[1] TREO = Total Rare Earth Oxides and including Y2O3

[2] Namibia Critical Metals Inc. Lofdal Heavy Rare Earths Project, Namibia NI 43-101 Technical Report -20 May 2021 Mineral Resource Estimate is authored by Jeremy Witley, MSc, P. Sci. Nat - The MSA Group, South Africa, Scott Swinden, Ph.D, P.Geol - Swinden Geoscience Consultants Ltd. and Massoud Aghamirian, P,Eng - SGS (Canada).

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.16 |

| Daily Change: | -0.003 -1.84 |

| Daily Volume: | 20,000 |

| Market Cap: | US$35.510M |

January 13, 2026 December 03, 2025 January 22, 2025 October 18, 2024 | |