NEAR SURFACE SEDIMENT SAMPLES ASSAYING UP TO 692 PPM CESIUM AND 1450 PPM LITHIUM

Lithium Chile Inc. (“LITHIUM CHILE” or the “Company”) (TSXV:LITH) (OTC:LTMCF) is pleased to announce that the Company has entered into an arm’s length letter of intent (“LOI”) with Monumental Minerals Corp. (“Monumental”) (TSX-V: MNRL; FSE: BE5) to acquire up to 75% of the 5200-hectare Salar De Laguna Blanca project (the “Laguna Project”) located near the town of San Pedro de Atacama, Chile.

The Laguna Project is located within the prolific lithium triangle, a zone within the central Andes high desert that includes Chile, Argentina, and Bolivia. This zone is estimated to contain more than half of the world’s lithium supply beneath the many salt flats, also known as salars, that are common to the region. The Laguna Project includes both active and paleo salar brines and salts (Fig. 1). The Laguna Blanca property consists of 23 exploration concessions totaling 5,200 hectares, 100% owned by Lithium Chile through its wholly owned Chilean subsidiary Minera Kairos Chile Limitada (“Minera Kairos”) (Fig. 2).

The Laguna Project is an early exploration stage project that is accessible from the town of San Pedro de Atacama, 80 kilometres to the west via the paved road 27CH to the north end of Salar de Aguas Calientes then a truck accessible trail heading north to the interior of the property. Travel time from San Pedro de Atacama to the property is approximately 1 hour and 30 minutes.

Between April 2018 and June 2021 Minera Kairos completed preliminary reconnaissance and detailed geochemical and geophysical surveys:

• Follow up sediment geochemical and surface water surveys covered the bulk of the active salar - laguna complex and adjacent paleo salts and sediments. Laboratory analysis of the sediment samples range from 75 – 692 ppm cesium and 250 – 1450 ppm lithium outline a large area of cesium enrichment of about 9 km2, which is open to the NE and SE. Water samples taken from the surface lagunas and subsurface sample from shallow 0.5 – 1.3m deep hand auger holes range from 20 – 40 mg/l cesium plus 780 – 1230 mg/l lithium from assay results.

• A 13-line kilometer reconnaissance TEM survey covering the active salar-laguna complex and its adjacent SW flank. This survey identified a 100-200m thick, 10 km2 high conductivity TEM anomaly which underlies the SW flank of the lithium – cesium anomaly.

• Bulk brine samples are currently being tested for lithium extraction.

President & CEO, Steve Cochrane remarks “The Laguna Blanca lithium joint venture is a great opportunity for both Lithium Chile and Monumental. This JV allows our Company to advance one of it’s more promising projects in Chile while still allowing the company to focus it resources on advancing and building on it’s initial 43-201 compliant resource on our Arizaro property. The large portfolio of projects the Company has in Chile allows us to bring in experienced partners that will help develop these projects more rapidly than we could do on our own.”

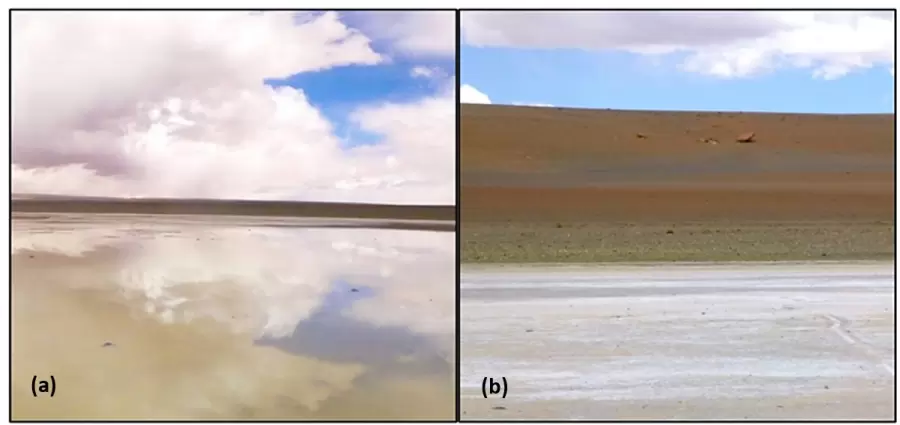

Figure 1. Photo of the (a) active salar showing lithium rich brines in the north central sector of the property and (b) the paleo-salar area of Laguna Blanca looking to the southwest.

Figure 1. Photo of the (a) active salar showing lithium rich brines in the north central sector of the property and (b) the paleo-salar area of Laguna Blanca looking to the southwest.

Figure 2. Laguna Blanca - 23 exploration concessions totaling 5,200 hectares, 100% owned by Lithium Chile through its wholly owned Chilean subsidiary Minera Kairos Chile Limitada.

Figure 2. Laguna Blanca - 23 exploration concessions totaling 5,200 hectares, 100% owned by Lithium Chile through its wholly owned Chilean subsidiary Minera Kairos Chile Limitada.

About Cesium

Currently, almost the entire global cesium supply comes from the Tanco mine, a hard rock deposit in Manitoba, Canada. The largest consumer of cesium is the oil and gas exploration sector. Cesium formate is added to drilling fluids to lubricate drill bits, to bring rock cuttings to the surface, and to prevent blowouts in high pressure wells. Cesium is also critical in the 5G communication revolution, as it is critical in atomic clocks that keep vast communication networks in sync for internet of things (IoT) functions.

About Critical Metals

The US government has identified lithium and select rare earth elements (REEs) as critical metals, and there is currently a strong push to curtail the US reliance of these metals from sources that are not politically friendly. On February 22, 2022, US President Joe Biden announced government financial incentives for both lithium and REE producers to develop downstream processing and refining of REEs and lithium. Additionally, a bi-partisan US senate bill recently passed, which would make it illegal for US defense contractors to procure REEs from China. Monumental Minerals is positioned to play a significant role in lithium and REE stability and sustainably in the Americas.

About Lithium

Over the past year, the spot price for lithium has increased by over 550% (Fig. 3). The price of the metal has out paced every other metal. The only other commodities with a similar price appreciation trajectory are rare earth elements used in the production of high-performance magnets for electric motors (neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb)). The driver for the lithium price explosion is widely believed to be due to increases in demand for the manufacturing of EV batteries, as automakers transition their fleets to EVs. According to Adamas Intelligence, a record 25,921 tonnes of lithium carbonate equivalent (LCE) were used to manufacture EV batteries for passenger vehicles globally in December 2021.

Figure 3. The lithium carbonate spot price over the past 12 months has appreciated by over 550%. Price unit is yuan/tonne.

Figure 3. The lithium carbonate spot price over the past 12 months has appreciated by over 550%. Price unit is yuan/tonne.

Terms of the Proposed Transaction

Subject to the execution of a definitive agreement (“Definitive Agreement”), Monumental will have the option to earn-in up to a 75% interest in the Laguna Project by issuing to Lithium Chile that number of common shares of Monumental that would result in Lithium Chile holding, on a non-diluted basis (after any potential financing in connection with or related to this potential transaction), 9.9% of the issue and outstanding common shares of Monumental (the “Payment Shares”). In addition, Monumental must make certain staged cash payments to Lithium Chile and incur exploration expenditures on the Laguna Project as follows:

(a) Make cash payments of an aggregate of C$1,500,000 according to the following schedule:

(i) $200,000 within fifteen (15) days of final TSX Venture Exchange approval of this proposed transaction (the “Acceptance Date”);

(ii) $250,000 on or before the eighteen (18) month anniversary of the Acceptance Date;

(iii) $300,000 on or before the second anniversary of the Acceptance Date; and

(iv) $750,000 on or before the third anniversary of the Acceptance Date.

(b) Incur minimum expenditures on the Laguna Project of not less than an aggregate of C$1,500,000 according to the following schedule:

(v) $200,000 on or before the first anniversary of the Acceptance Date;

(vi) $500,000 on or before the second anniversary of the Acceptance Date; and

(vii) $800,000 on or before the third anniversary of the Acceptance Date.

Subject to the exercise of the option to acquire 75% of the Laguna Project, Lithium Chile would retain a 1% net smelter returns royalty payable upon the commercial production of the Laguna Project. In addition to the statutory hold period of four months and a day from the date of issuance, the Payment Shares will be subject to a 12-month voluntary hold period from the date of issuance. Upon Monumental earning a 75% interest in the Laguna Project, Monumental and Lithium Chile will use commercially reasonable efforts to negotiate and execute a joint venture agreement for the purpose of jointly carrying out exploration, evaluation, and development of the Laguna Project.

Further details regarding the proposed transaction with Lithium Chile will be provided in a comprehensive news release if, and when, the parties enter into the Definitive Agreement. The proposed transaction between Monumental and Lithium Chile is subject to, among other things, the execution of the Definitive Agreement and TSX Venture Exchange approval.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Terry Walker, M.Sc., P.Geo, Vice President of Exploration, a Director of the Company and a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Lithium Chile

Lithium Chile is advancing a lithium property portfolio consisting of 69,200 hectares covering sections of 10 salars and two laguna complexes in Chile and 23,300 hectares in Argentina.

Lithium Chile also owns 5 properties, totaling 20,429 hectares, that are prospective for gold, silver and copper. Exploration efforts are continuing on Lithium Chile’s Carmona gold/silver/copper property which lies in the heart of the Chilean mega porphyry gold/ silver/copper belt.

Lithium Chile’s common shares are listed on the TSX-V under the symbol “LITH” and on the OTC-BB under the symbol “LTMCF”.

To find out more about Lithium Chile Inc., please contact Steven Cochrane, President and CEO via email: This email address is being protected from spambots. You need JavaScript enabled to view it., Jose de Castro Alem, Argentina Manager via email This email address is being protected from spambots. You need JavaScript enabled to view it. or Michelle DeCecco, Vice President of Corporate Development via email This email address is being protected from spambots. You need JavaScript enabled to view it. or at 403-390-9095.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Forward Looking Statements

This news release may contain certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "expected", "anticipated", "aims to", "plans to" or "intends to" or variations of such words and phrases or statements that certain actions, events or results "will" occur. In particular, this news release contains forward-looking statements relating to, the entering into of definitive agreements and regulatory body approvals. Such forward-looking statements are based on various assumptions and factors that may prove to be incorrect, including, but not limited to, factors and assumptions with respect to: the general stability of the economic and political environment in which the Company operates; the timely receipt of required regulatory approvals; the ability of the Company to obtain future financing on acceptable terms; currency, exchange and interest rates; operating costs; the success the Company will have in exploring its prospects and the results from such prospects. You are cautioned that the foregoing list of material factors and assumptions is not exhaustive. Although the Company believes that the assumptions and factors on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct or that any of the events anticipated by such forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive there from. Actual results could differ materially from those currently anticipated due to a number of factors and risks including, but not limited to: fluctuations in market conditions, including securities markets; economic factors; the risk that the new lithium or cesium exploration tender processes does not yield the anticipated benefits to the Company, including the risk that the Company will not receive the approvals necessary and the impact of general economic conditions and the COVID-19 pandemic. The Company does not undertake to update any forward-looking statements herein, except as required by applicable securities laws. All forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

| Last Trade: | US$0.40 |

| Daily Volume: | 0 |

| Market Cap: | US$89.960M |

October 07, 2025 September 18, 2025 September 17, 2025 April 23, 2025 April 15, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS