Lithium Chile Inc. (“Lithium Chile” or the “Company”) (TSX:LITH) (OTC:LTMCF) is pleased to announce that it has signed a letter of intent (“LOI”) with Monumental Minerals Corp. (“Monumental”), whereby Monumental may acquire a 50.01% interest in the Salar de Turi Project (the “Project”) located within the prolific Lithium Triangle about 120 km northwest from the Company’s Salar de Laguna Blanca Project and 60 km northeast from the city of Calama, Chile.

To earn the 50.01% interest in the Project, Monumental must pay Lithium Chile C$700,000 over two years, incur minimum expenditures on the Project of C$1.4 million over two years and issue to Lithium Chile that number of common shares of Monumental that would result in Lithium Chile holding, on a non-diluted basis, 9.9% of the issued and outstanding common shares of Monumental after completion of their next financing.

The Lithium Triangle is an area within the central Andes high desert that includes Chile, Argentina, and Bolivia (Fig. 1) and is estimated to contain more than half of the world’s lithium supply beneath the many salt flats, also known as salars, that are common to the region. The Project is comprised of 31 exploration concessions totaling 8,500 hectares, 100% owned by Lithium Chile through its wholly owned Chilean subsidiary Minera Kairos Chile Limitada (“Minera Kairos”). The Project is accessible from the city of Calama via the paved roads and is close to infrastructure.

Figure 1. Location of the Salar de Turi Project and the 31 claims (8,500 hectares) that it encompasses. Map also includes the transient electromagnetic (TEM) survey lines (L1 to L5) contracted by Lithium Chile in 2019.

Figure 1. Location of the Salar de Turi Project and the 31 claims (8,500 hectares) that it encompasses. Map also includes the transient electromagnetic (TEM) survey lines (L1 to L5) contracted by Lithium Chile in 2019.

Jamil Sader, CEO and Director of Monumental Minerals comments “The relationship we have built with Lithium Chile continues to develop into a growing joint effort to advance high value salars towards a lithium brine resource. The Salar de Turi Project represents a great opportunity, with highly compelling geophysics and geochemistry, excellent infrastructure, and year-round access. Monumental plans to move forward with exploration activities with the same vigour as we have with our other two critical metals projects, Laguna Blanca lithium brine, and Jemi heavy rare earth elements.”

Steve Cochrane, President & CEO of Lithium Chile comments “During a recent trip to Chile, I met with Monumental Minerals technical and social governance team, and I feel that they have the capability as demonstrated with Laguna Blanca, to advance the Salar de Turi Project. This joint venture will benefit both parties substantially with Lithium Chile being the largest shareholder of Monumental Minerals. The Joint venture is consistent with our desire to maximize the return on our Chilean assets while our focus is on our Arizaro Argentinian development program.”

During 2019, Minera Kairos completed preliminary reconnaissance and detailed geochemical and geophysical surveys:

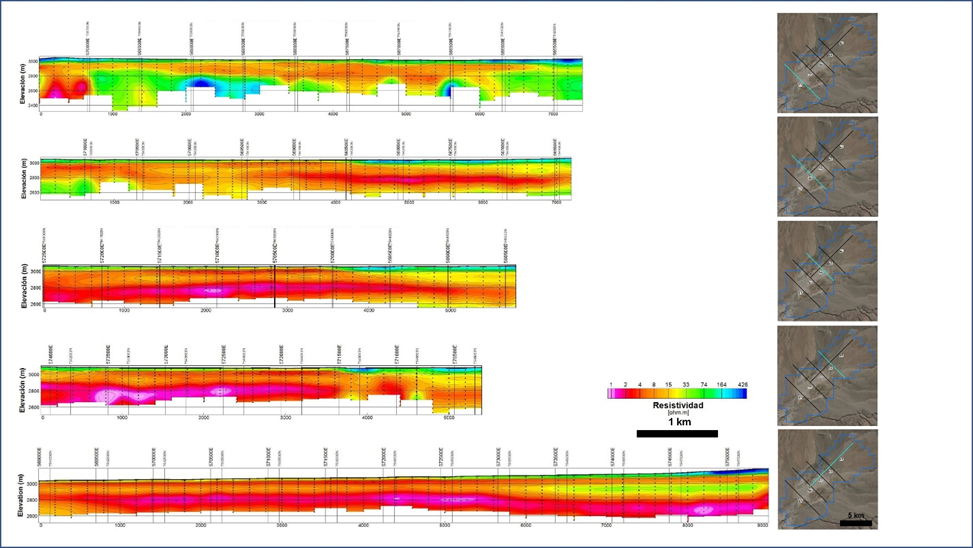

• Transient electromagnetic (TEM) geophysics exploration work conducted by Lithium Chile delineated highly prospective brine aquifers that could contain economic grades of lithium over a 63 square kilometer (km2) area. These geophysical anomalies are shallow NE-dipping at 150 – 300 meters (m) below surface and are at least 200 to 300 m thick, often open at depth (Lithium Chile Press Release April 30, 2019) (Fig. 2).

• Near surface brine samples demonstrate return values of lithium to 590 mg/L (Lithium Chile Press Release Jan. 16, 2019). The samples also reveal favourable chemistry with ratios of lithium to potassium of 0.06; and magnesium to lithium of 7.8.

Figure 2. Cross-sectional profiles of the TEM surface contracted by Lithium Chile in 2019.

Figure 2. Cross-sectional profiles of the TEM surface contracted by Lithium Chile in 2019.

Terms of the Proposed Transaction

Subject to the execution of a definitive agreement (“Definitive Agreement”), Monumental will have the option to earn-in a 50.01% interest in the Project by making certain staged cash payments and issuing common shares to Lithium Chile and incurring exploration expenditures on Project as follows:

(a) Make cash payments of an aggregate of C$700,000 according to the following schedule:

(i) $200,000 upon final TSX Venture Exchange approval of this proposed transaction (the “Acceptance Date”);

(ii) $250,000 on or before the fourteenth (14) month anniversary of the Acceptance Date; and

(iii) $250,000 on or before the second anniversary of the Acceptance Date.

(b) Incur minimum expenditures on the Project of not less than an aggregate of C$1,400,000 according to the following schedule:

(iv) $700,000 on or before the first anniversary of the Acceptance Date; and

(v) $700,000 on or before the second anniversary of the Acceptance Date.

(c) Issue and deliver to Lithium Chile, that number of common shares of Monumental that would result in Lithium Chile holding, on a non-diluted basis, 9.9% of the issued and outstanding common shares of Monumental (the “Payment Shares”), within ten (10) days of the closing of Monumental’s next completed financing (if any occurs) following the Acceptance Date, but no later than the twelve (12) month anniversary of the Acceptance Date, unless otherwise mutually agreed to by both parties.

In addition to the statutory hold period of four months and a day from the date of issuance, the Payment Shares will be subject to a 12-month voluntary hold period from the date of issuance. Upon Monumental earning a 50. 01% interest in the Project, Monumental and Lithium Chile will use commercially reasonable efforts to negotiate and execute a joint venture agreement for the purpose of jointly carrying out exploration, evaluation, and development of the Project.

The proposed transaction between Monumental and Lithium Chile is subject to, among other things, the execution of the Definitive Agreement and Monumental receiving TSX Venture Exchange approval.

About Lithium Chile

Lithium Chile is advancing a lithium property portfolio consisting of 84,478 hectares covering sections of 11 salars and 2 laguna complexes in Chile and 23,300 hectares in Argentina.

Lithium Chile also owns 5 properties, totaling 21,329 hectares that are prospective for gold, silver and copper. Exploration efforts are continuing on Lithium Chile’s Carmona gold/silver/copper property which lies in the heart of the Chilean mega porphyry gold/ silver/copper belt.

Lithium Chile’s common shares are listed on the TSX-V under the symbol “LITH” and on the OTC-BB under the symbol “LTMCF”.

To find out more about Lithium Chile Inc., please contact Steven Cochrane, President and CEO via email: This email address is being protected from spambots. You need JavaScript enabled to view it., Jose de Castro Alem, Argentina Manager via email This email address is being protected from spambots. You need JavaScript enabled to view it. or Michelle DeCecco, Vice President of Corporate Development via email This email address is being protected from spambots. You need JavaScript enabled to view it. or at 403-390-9095.

Forward Looking Statements

This news release may contain certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "expected", "anticipated", "aims to", "plans to" or "intends to" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Such forward-looking statements are based on various assumptions and factors that may prove to be incorrect, including, but not limited to, factors and assumptions with respect to: the general stability of the economic and political environment in which the Company operates; the timely receipt of required regulatory approvals; the risk that the new lithium or cesium exploration tender processes does not yield the anticipated benefits to the Company; the ability of the Company to obtain future financing on acceptable terms; currency, exchange and interest rates; operating costs; the success the Company will have in exploring its prospects and the results from such prospects and the COVID-19 pandemic. You are cautioned that the foregoing list of material factors and assumptions is not exhaustive. Although the Company believes that the assumptions and factors on which such forward-looking statements are based upon are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct or that any of the events anticipated by such forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive there from. The Company does not undertake to update any forward-looking statements herein, except as required by applicable securities laws. All forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

| Last Trade: | US$0.40 |

| Daily Volume: | 0 |

| Market Cap: | US$89.960M |

October 07, 2025 September 18, 2025 September 17, 2025 April 23, 2025 April 15, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS