- Company recorded a record high of $12 million in quarterly revenue (84% YoY increase) and Net Income of $2.6 million

- Full year revenues were $36 million, a 108% increase compared to 2021

- Delivered its sixth consecutive quarter of positive Adjusted EBITDA of $2.5M, and $5.3M for fiscal year 2022

All financial results are reported in Canadian dollars, unless otherwise stated.

MONTREAL, Nov. 25, 2022 /CNW Telbec/ - Cannara Biotech Inc. ("Cannara" or the "Company") (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB), a vertically integrated producer of premium-grade cannabis and derivative products with two mega facilities based in Québec spanning over 1,650,000 sq. ft., today announced its fiscal fourth quarter and fiscal year 2022 financial and operating results for the three-month and full year periods ended August 31, 2022.

Fiscal Fourth Quarter and Fiscal Year 2022 Financial and Operational Highlights

- Q4 2022 revenue of $12 million, an 84% increase compared to Q4 2021 and a 19% increase from the previous quarter.

- 2022 fiscal year revenue of $36 million, a 108% increase compared to 2021 fiscal year revenue.

- Recorded Q4 2022 gross profit before fair value adjustments of $4.8 million, an increase of 38% compared to Q4 2021 and a 27% increase from the previous quarter.

- Increased positive Adjusted EBITDA for Q4 2022 to $2.5 million, an 83% increase vs Q4 2021.

- Increased positive Adjusted EBITDA to $5.3 million for the fiscal year 2022, a 254% increase vs fiscal year 2021.

- Delivered the Company's sixth straight quarter of positive Adjusted EBITDA.

- Earned net income of $2.6 million for Q4 2022, and $2.3 million for the full year end of 2022.

- Successfully redesigned and activated 6 of 24 growing zones and have produced 6 harvests from the new Valleyfield facility (the "Valleyfield Facility") as of August 31, 2022.

- Approximately 2,570 kg of cannabis or 730,000 units sold across 3 flagship brands during Q4 2022, an increase of 26% in kg sold compared to the Q3 2022.

- The number of kg sold during the second half of 2022 increased by 69% compared to the first half of 2022, resulting from the increase in production from the Valleyfield Facility.

- Approximately 7,300 kg of cannabis or 2 million units sold across 3 flagship brands during fiscal year 2022, an increase of approximately 1.5 million of units sold or 286% compared to the prior fiscal year.

- The Company has $29 million in working capital of August 31, 2022.

- The Company granted a total of 1,200,000 stock options to employees at an exercise price of $0.18, subject to certain vesting conditions in accordance with the employee share option plan during Q4 2022 and subsequent to year-end, the Company granted a total of 7,500,000 stock options at an exercise price of $0.10 and 14,000,000 stock options at an exercise price of $0.18 to employees and 225,000 to board members at an exercise price of $0.18, subject to certain vesting conditions in accordance with the employee share option plan.

- Subsequent to year end, a total of 500,000 stock options were exercised at a price of $0.10 per share for a total consideration of $50,000, resulting in the issuance of 500,000 new common shares of the Company.

Full Year 2022 Business Highlights

- Valleyfield License Approval: In September 2021, the Company obtained from Health Canada the license necessary to be able to sell cannabis derivative products into the retail market in addition to receiving its processing and cultivation license at its Valleyfield Facility which was acquired in June 2021.

- Ontario Expansion: In October 2021, the Company started to deliver a selection of products to the Ontario Cannabis Store on a weekly basis for the Ontario retail market. This marks the Company's second major market expansion in Canada.

- Valleyfield's first growing zone activated: In November 2021, the Company propagated its first zone in the Valleyfield Facility with 9,600 plants. In addition, the Company launched at the beginning of November its first two hash products in Quebec retail stores.

- Valleyfield's second growing zone activated: In January 2022, the Company completed the propagation of its second zone in the Valleyfield Facility with 9,600 plants.

- Valleyfield's third growing zone activated/successful harvest: In February and March 2022, the Company successfully harvested its two first lots in the newly redesigned Valleyfield Facility and activated its third growing zone during March 2022.

- Valleyfield's fourth growing zone activated: In April 2022, the Company successfully redesigned and propagated its fourth growing zone in the Valleyfield Facility.

- SWAP settlement: In April 2022, management closed an interest rate swap it had previously entered, resulting in a net cash return of $560,000.

- New Genetic/SKU released on market and fifth growing zone activated: In May 2022, the Company introduced Slapz under the Nugz brand to the Quebec market and launched its higher potency Fresh Frozen Hash Rosin under the Nugz brand in Ontario. The Company also redesigned and propagated its fifth growing zone in the Valleyfield Facility.

- Closed $50 Million Credit Facility Led by BMO Commercial Banking ("BMO"): In May 2022, the Company entered into a new a credit facility agreement with BMO for a total of $50 million plus a potential accordion facility for up to an additional $10 million of credit availability with favorable terms including a declining interest rate over time as the Company hits certain covenant thresholds and the ability to repay the facility without penalty at any time. Under the terms of this new credit facility, the Company will not make any principal payments for the first six months.

- Valleyfield's sixth growing zone activated/ BHO lab extraction/approval from BCLDB: In July 2022, the Company activated its sixth growing zone, one month ahead of schedule. Also, the Company launched its Nugz Old School Hash, in addition to its first Tribal pre-roll pack in Ontario, Gelato Mint 5 x 0.5g pre-rolls. The Company also successfully commenced extraction at its in-house BHO lab. The Company obtained approval from the British Columbia Liquor Distribution Branch ("BCLDB") to become a licensed vendor in British Columbia. A total of 7 SKUs has been accepted across the Tribal, Nugz, and Orchid CBD brands to be launched in September 2022, now providing the Company with access to 3 out of the 4 largest Canadian markets.

- Cannara signs an Exclusive Brand Partnership with Exotic Genetix in Canada: In August 2022, Cannara announced an exclusive brand partnership with 50-time award-winning US-based cannabis breeder, cultivator and hash maker, Exotic Genetix Ltd. ("Exotic Genetix"). Cannara was granted an exclusive license to use, market, sell and distribute Exotic Genetix branded products throughout Canada.

- Launch of live resin vape cartridge and its custom vape battery, Tribal Uni Pro Ark in addition to 14 other new SKUs across Ontario and Quebec: In September 2022, the Company launched its 1-gram G Mint Live Resin vape cartridge, introduced a premium universal 510 vape battery, the Tribal UNI Pro ARK, and announced plans to release 14 new SKUs of its premium-grade cannabis in Ontario and Quebec under the Company's flagship brands.

- Increased Market Penetration: Cannara continues to increase its market penetration in Quebec, Ontario, Saskatchewan, and now British Columbia, and is currently focused on expanding its market share through higher volumes of product sold in its current markets.

- Continued Positive Adjusted EBITDA: Cannara expects to continue to report positive quarterly Adjusted EBITDA resulting from the Company's focus on premium-grade cannabis products at disruptive retail pricing, its lean operational model and its two mega facilities benefiting from Quebec's low electricity cost and competitive labour rates.

"This past year was a tremendous success, and I am very proud of the team at Cannara for their dedication, hard work and support as we continue to strive towards being one of the premier cannabis cultivators in the country," stated Zohar Krivorot, President & Chief Executive Officer of Cannara. "Our state-of-the-art Valleyfield Facility is producing, as of today, seven of its twenty-four growing zones, each containing 9,600 plants each. We remain confident in fulfilling the remaining grow zones over the coming quarters, and our successful harvests should shed any doubt regarding our ability to achieve all of our expansion milestones and bring more premium-grade cannabis to market," concluded Mr. Krivorot.

Nicholas Sosiak, Chief Financial Officer of Cannara added, "Revenues, profits, and net income have all increased over the past 12 months while simultaneously adding new products for our customer base and none of this would be possible without the hard work of the entire Cannara family. Over the last twelve months, we have achieved a ramp up in production which was necessary to support the recent expansion plans to the other provinces. Given the recent expansion to the BC and the financial commitment required for such expansion, I am very proud to be able to report our sixth consecutive quarter of Adjusted EBITDA and a positive net income for our fiscal year end 2022. Our lenders continue to support us, our customers continue to purchase our products and as we continue our rapid growth, we expect to attract new customers throughout Canada who are constantly looking for new product offerings; this is just the beginning." concluded Mr. Sosiak.

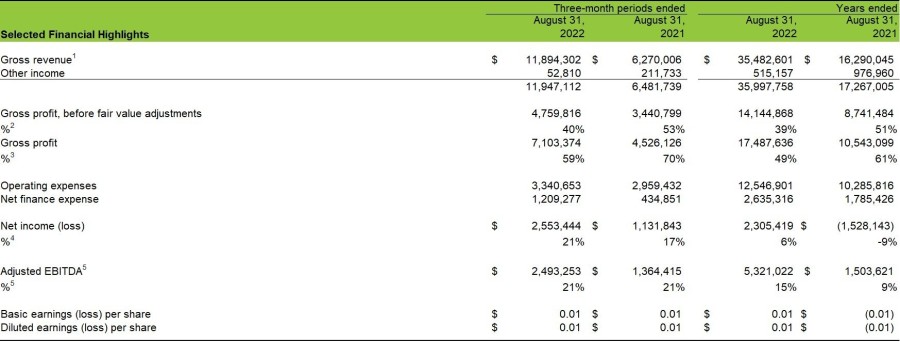

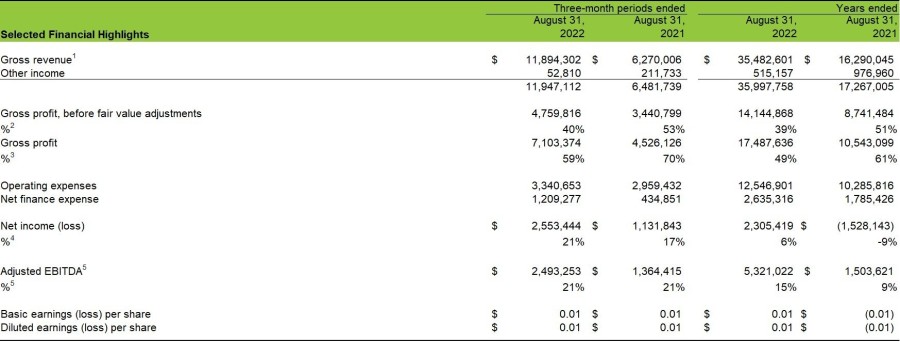

Select Financial Information

| | Three-month periods ended | | Years ended |

Selected Financial Highlights | August 31,

2022 | August 31,

2021 | | August 31,

2022 | August 31,

2021 |

| | | | | | |

Gross revenue1 | $ 11,894,302 | $ 6,270,006 | | $ 35,482,601 | $ 16,290,045 |

Other income | 52,810 | 211,733 | | 515,157 | 976,960 |

| | 11,947,112 | 6,481,739 | | 35,997,758 | 17,267,005 |

| | | | | | |

Gross profit, before fair value adjustments | 4,759,816 | 3,440,799 | | 14,144,868 | 8,741,484 |

%2 | 40 % | 53 % | | 39 % | 51 % |

Gross profit | 7,103,374 | 4,526,126 | | 17,487,636 | 10,543,099 |

%3 | 59 % | 70 % | | 49 % | 61 % |

| | | | | | |

Operating expenses | 3,340,653 | 2,959,432 | | 12,546,901 | 10,285,816 |

Net finance expense | 1,209,277 | 434,851 | | 2,635,316 | 1,785,426 |

| | | | | | |

Net income (loss) | $ 2,553,444 | $ 1,131,843 | | 2,305,419 | $ (1,528,143) |

%4 | 21 % | 17 % | | 6 % | -9 % |

| | | | | | |

Adjusted EBITDA5 | $ 2,493,253 | $ 1,364,415 | | 5,321,022 | $ 1,503,621 |

%5 | 21 % | 21 % | | 15 % | 9 % |

| | | | | | |

Basic earnings (loss) per share | $ 0.01 | $ 0.01 | | $ 0.01 | $ (0.01) |

Diluted earnings (loss) per share | $ 0.01 | $ 0.01 | | $ 0.01 | $ (0.01) |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | August 31, 2022 | August 31, 2021 |

| | | | | | |

Cash | | | | $ 12,114,691 | $ 8,159,305 |

Accounts receivable | | | | 8,526,918 | 2,847,725 |

Biological assets | | | | 5,712,456 | 1,902,206 |

Inventory | | | | 13,266,987 | 5,508,258 |

| | | | | | |

Working capital6 | | | | 29,127,599 | 12,412,935 |

| | | | | | |

Total assets | | | | 125,617,047 | 92,022,613 |

Total current liabilities | | | | 11,861,085 | 6,833,798 |

Total non-current liabilities | | | | 47,020,201 | 21,073,003 |

Net assets | | | | 66,735,761 | 64,115,812 |

| | | | | | |

1 Gross revenue included revenue from sale of goods, net of excise taxes, services revenues and lease revenues. | | |

2 Gross profit before fair value adjustments % is determined as Gross profit before fair value adjustments divided by Total revenues. | |

3 Gross profit % is determined as Gross profit divided by Total revenues. | | |

4 Net income (loss) % is determined as Net income (loss) divided by Total revenues. | | |

5 Adjusted EBITDA and working capital are non-GAAP financial performance measures with no standard definition under IFRS.

A reconciliation of these measures is presented in this MD&A. |

Adjusted EBITDA % a non-GAAP financial ratio and is determined as Adjusted EBITDA divided by total revenues. | | |

6 Working capital is determined as total current assets minus total current liabilities. | | |

Outstanding Shares

As at the date of this report, the Company had 877,481,321 common shares and 45,635,998 stock options issued and outstanding. For further information, the complete Consolidated Financial Statements and Management's Discussion and Analysis for the years ended August 31, 2022 and 2021, along with additional information about the Company and all of its public filings are available at sedar.com and the Company's investor website, investors.cannara.ca.

About Cannara Biotech Inc.

Cannara Biotech Inc. (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB) is a vertically integrated producer of affordable premium-grade cannabis and cannabis-derivative products for the Québec and Canadian markets. Cannara owns two mega facilities based in Québec spanning over 1,650,000 sq. ft., providing the Company with 125,000kg of potential annualized cultivation output. Leveraging Québec's low electricity costs, Cannara's facilities produce premium-grade cannabis products at an affordable price. For more information, please visit cannara.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This information release contains certain forward-looking information. Such information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance, or achievements to be materially different from those implied by statements herein, and therefore these statements should not be read as guarantees of future performance or results. All forward-looking statements are based on the Company's current beliefs as well as assumptions made by and information currently available to it as well as other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Due to risks and uncertainties, including the risks and uncertainties identified by the Company in its public securities filings, actual events may differ materially from current expectations. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.