Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Cannara Biotech Reports Q1 2023 Financial Results

- Company recorded $10.3 million in quarterly revenue; a 57% increase compared to Q1 2022

- Delivered its seventh consecutive quarter of positive Adjusted EBITDA of $1.7M and reported positive net income for a second consecutive quarter

- Continued to increase growing capacity to meet customer demand by activating new growing zone in its expanding Valleyfield Facility

- All financial results are reported in Canadian dollars, unless otherwise stated.

MONTREAL, Jan. 23, 2023 /CNW/ - Cannara Biotech Inc. ("Cannara" or the "Company") (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB), a vertically integrated producer of premium-grade cannabis and derivative product offerings at affordable prices with two mega facilities based in Québec spanning over 1,650,000 sq. ft., today announced its fiscal first quarter 2023 financial and operating results for the three-month period ended November 30, 2022.

Fiscal First Quarter 2023 Financial Highlights

- Q1 2023 revenue of $10.3 million, an 57% increase compared to Q1 2022.

- Recorded Q1 2023 gross profit before fair value adjustments of $4 million, an increase of 34% compared to Q1 2022.

- Delivered the Company's seventh straight quarter of positive Adjusted EBITDA of $1.7 million, a 72% increase compared to Q1 2022.

- Earned net income of $2,951 for Q1 2023.

- The Company has $27.1 million in working capital as of November 30, 2022, which includes $6.8 million of cash on hand.

Fiscal First Quarter 2023 Sales and Operational Highlights

- Cannara activated its 7th of 24 individual 25,000 square foot growing zones at its Valleyfield Facility, reaching a total of 175,000 square feet of active canopy. Combined with its Farnham Facility, the Company can currently produce approximately 23,500 kg of premium-grade cannabis per year and has a potential future capacity of 120,000 kg of premium-grade cannabis per year when both Facilities are fully built out.

- The Company has set an objective for fiscal 2023 of activating 9 growing zones, a 50% increase from the capacity the Valleyfield Facility was producing at its prior fiscal year end.

- Increased employee's headcount from approximately 190 employees in Q1 2022 to 280 employees in Q1 2023; a 47% increase, to support the growth of the operations.

- Cannara entered the British Columbia market with 7 of its dried flower, pre-roll, and hash products.

- The Company was deemed eligible to hold a cannabis representative registration by the province of Alberta in November 2022, paving the way for it to sell cannabis into the Alberta retail market.

- During the quarter, Cannara released 14 new SKUs of its premium-grade cannabis in Ontario and Quebec under the Company's flagship brands: Tribal, Nugz and Orchid CBD, bringing its total SKU count to 32 SKUs. Included in the launch was:

- The Company's premium universal 510 vape battery, the Tribal UNI Pro ARK, to complement Tribal's live resin vape carts available in Ontario.

- The Company also released Tribal's Cuban Linx Full Spectrum Extract, a derivative concentrate of Cuban Linx flower, and prerolls, for which the Company's 3.5 gram SKU is the 2nd best-selling 3.5 gram flower product in the Ontario market as of the date of this release1.

- Two new formats of dried flower: 14-gram Nugz Smalls in Ontario, and 15-gram Strain Hunter in Quebec, which will each offer different strains grown by Cannara on a rotational basis. The Company also launched its 3.5 gram format of Slapz by Nugz in Ontario, which is also available in a 28 gram format in Quebec.

- Two new genetic releases in 3.5 gram and prerolls were launched under the Tribal brand: Triple Burger in Quebec, Galactic Rntz in Quebec and Ontario.

- Four THC/CBD formulations of Orchid oil tinctures in Quebec.

- The Company's premium universal 510 vape battery, the Tribal UNI Pro ARK, to complement Tribal's live resin vape carts available in Ontario.

- The Company's Nugz Fresh Frozen Hash Rosin and Old School Hash have become top 10 best-selling concentrates in Ontario1.

- The Company estimates its current market share as of the first quarter of 2023 is approximately 7% in Quebec2 and 2% in Ontario3.

1 Ranking based on trailing 90 days units sold, Headset Data dated January 5th, 2023 |

2 Based on estimated sales data provided by Weed Crawler, for the period of September to November 2022 |

3 Based on actual wholesale sales OCS data program for period of September to November 2022 |

- In December 2022, the Company's Farnham Facility received its CUMCS Equivalency IMC-G.A.P. certification (the "Certification"), a leading certification standard for medical cannabis cultivation, harvest, and primary processing. Obtaining the Certification provides documented evidence that Cannara has met strict standards for quality and consistency in the cultivation, harvest and primary processing of cannabis needed for export of cannabis inputs to certain international jurisdictions, including Israel, Europe, and Australia.

- As part of its marketing strategy, the Company designed and launched several lines of apparel and accessories to be sold online at https://cannaraswag.shop, including Cannara's cannabis accessories: the Tribal UNI Pro Ark and the Nugz Häpple.

- In December 2022, the Company was awarded three awards at the KIND Awards gala in Ontario highlighting the Company's focus on brands and high-quality flower: The awards for Brand of the Year and Terpene Profile of the Year were given to Tribal, and CBD Runtz by Orchid CBD was named CBD Product of the year.

- In December 2022, the Company signed a lease agreement with a new tenant for a building that is under construction at its Valleyfield site. The start of the lease term is set for January 2024 with a term of 11 years. This transaction will generate income and positive cash flow on an area of the Valleyfield Facility that would otherwise been unused as it is not licensed for cannabis production.

- During the quarter, Cannara invested $3.7 million in capital expenditures which was mainly attributable to the activation of the 7th growing zone, the construction of a butane extraction lab, office and warehouse space, and initial costs related to the processing center build out at the Valleyfield Facility, in addition to capital expenditures incurred resulting from the expected increased post-harvest requirements.

- On November 30, 2022, Cannara filed with the TSX Venture Exchange, a Notice in respect of a normal course issuer bid (the "NCIB") to be transacted through the facilities of the TSX-V. Pursuant to the NCIB, Cannara may purchase up to 15,000,000 of its common shares. The Company expects that the purchase of Shares will benefit remaining shareholders by increasing their equity interest in the Company's assets.

- On January 12, 2023, The Company announced details of its proposal to consolidate all of the issued and outstanding common shares of the Company on the basis of ten (10) pre-consolidation common shares for every one (1) post-consolidation common shares, subject to the approval of shareholders at the upcoming meeting of shareholders to take place on January 25, 2023, as well as TSXV approval. Upon completion of the share consolidation, it is expected that there will be approximately 87,748,132 common shares issued and outstanding, subject to adjustment for fractional shares.

- On January 20, 2023, the Company granted a total of 378,000 stock options at an exercise price of $0.18, subject to certain vesting conditions in accordance with the employee share option plan.

"In Q1 2023, we continued to execute on Cannara's growth plan, as evidenced by the activation of our 7th grow zone at our Valleyfield Facility, our entry into the BC market and the release of 14 new high-demand SKU's," stated Zohar Krivorot, President & Chief Executive Officer of Cannara. "We have maintained our market share in Quebec, which we expect to increase in future quarters as we continue to expand in Ontario, British Colombia, and Saskatchewan in addition to launching in Alberta. The release of 14 new SKU's this quarter is a testament to the hard work of all Cannara staff here and we are confident that our premium products will continue to be a hit with our ever-expanding customer base," concluded Mr. Krivorot.

Nicholas Sosiak, Chief Financial Officer of Cannara added, "When compared to the previous year's Q1 results, the financials improved significantly across all metrics. However, we did experience some temporary pre-roll manufacturing capacity challenges that impacted sales during the quarter. We are working diligently on increasing internal pre-roll manufacturing capacity, and we expect to resume our significant growth trend during Q2. We expect to achieve 9 active growing zones at Valleyfield this year, having just activated our 7th, allowing us to greater volumes of premium-grade cannabis. As the Company continues to scale, we expect revenues, margins, and profits to continue to improve, and shareholders to be rewarded for their investment in Cannara. I am proud to be able to report our seventh consecutive quarter of Adjusted EBITDA in addition to currently being on track to achieving record monthly sales in January 2023," concluded Mr. Sosiak.

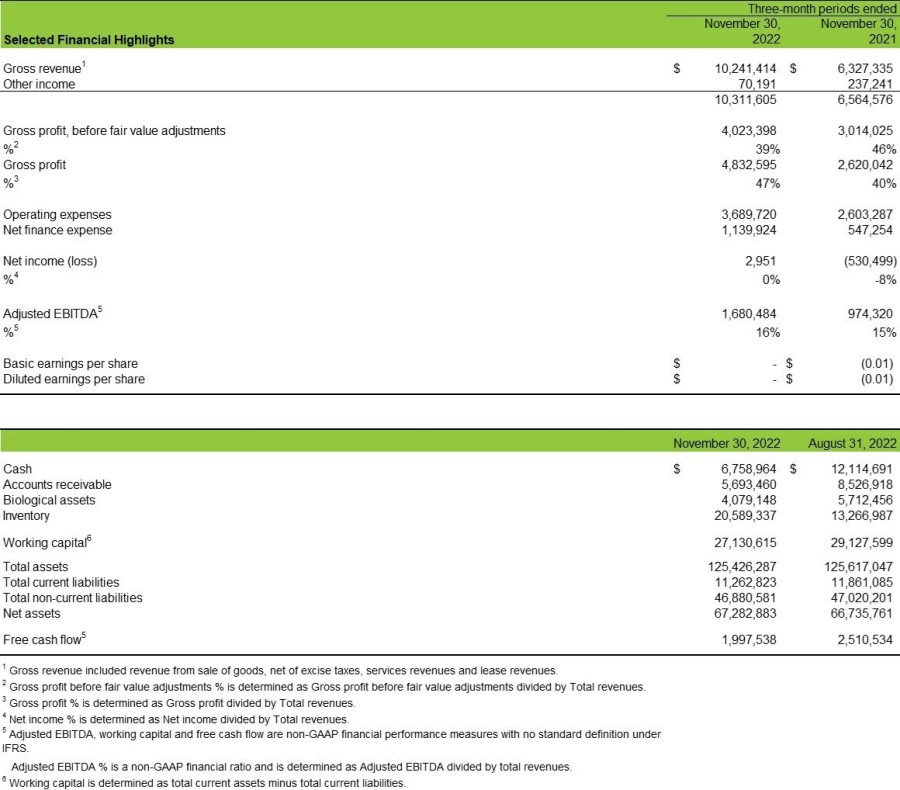

Selected Financial Information

Three-month periods ended | ||

Selected Financial Highlights | November 30, | November 30, |

Gross revenue1 | $ 10,241,414 | $ 6,327,335 |

Other income | 70,191 | 237,241 |

10,311,605 | 6,564,576 | |

Gross profit, before fair value adjustments | 4,023,398 | 3,014,025 |

%2 | 39 % | 46 % |

Gross profit | 4,832,595 | 2,620,042 |

%3 | 47 % | 40 % |

Operating expenses | 3,689,720 | 2,603,287 |

Net finance expense | 1,139,924 | 547,254 |

Net income (loss) | 2,951 | (530,499) |

%4 | 0 % | -8 % |

Adjusted EBITDA5 | 1,680,484 | 974,320 |

%5 | 16 % | 15 % |

Basic earnings per share | $ - | $ (0.01) |

Diluted earnings per share | $ - | $ (0.01) |

November 30, 2022 | August 31, 2022 | |

Cash | $ 6,758,964 | $ 12,114,691 |

Accounts receivable | 5,693,460 | 8,526,918 |

Biological assets | 4,079,148 | 5,712,456 |

Inventory | 20,589,337 | 13,266,987 |

Working capital6 | 27,130,615 | 29,127,599 |

Total assets | 125,426,287 | 125,617,047 |

Total current liabilities | 11,262,823 | 11,861,085 |

Total non-current liabilities | 46,880,581 | 47,020,201 |

Net assets | 67,282,883 | 66,735,761 |

Free cash flow5 | 1,997,538 | 2,510,534 |

1 Gross revenue included revenue from sale of goods, net of excise taxes, services revenues and lease revenues. | ||

2 Gross profit before fair value adjustments % is determined as Gross profit before fair value adjustments divided by Total revenues. | ||

3 Gross profit % is determined as Gross profit divided by Total revenues. | ||

4 Net income % is determined as Net income divided by Total revenues. | ||

5 Adjusted EBITDA, working capital and free cash flow are non-GAAP financial performance measures with no standard definition under IFRS. | ||

Adjusted EBITDA % is a non-GAAP financial ratio and is determined as Adjusted EBITDA divided by total revenues. | ||

6 Working capital is determined as total current assets minus total current liabilities. | ||

As at the date of this report, the Company had 877,481,321 common shares and 44,471,911 stock options issued and outstanding. For further information, the complete Consolidated Financial Statements and Management's Discussion and Analysis, along with additional information about the Company and all of its public filings that are available at sedar.com and the Company's investor website, investors.cannara.ca.

Cannara Biotech Inc. (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB) is a vertically integrated producer of affordable premium-grade cannabis and cannabis-derivative products for the Québec and Canadian markets. Cannara owns two mega facilities based in Québec spanning over 1,650,000 sq. ft., providing the Company with 120,000kg of potential annualized cultivation output. Leveraging Québec's low electricity costs, Cannara's facilities produce premium-grade cannabis products at an affordable price. For more information, please visit cannara.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This information release contains certain forward-looking information. Such information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance, or achievements to be materially different from those implied by statements herein, and therefore these statements should not be read as guarantees of future performance or results. All forward-looking statements are based on the Company's current beliefs as well as assumptions made by and information currently available to it as well as other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Due to risks and uncertainties, including the risks and uncertainties identified by the Company in its public securities filings, actual events may differ materially from current expectations. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$1.33 |

| Daily Volume: | 0 |

| Market Cap: | US$126.340M |

July 28, 2025 July 24, 2025 January 27, 2025 | |