All financial results are reported in Canadian dollars, unless otherwise stated.

Cannara Biotech Inc. ("Cannara" or the "Company") (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB), a vertically integrated producer of premium-grade cannabis and derivative products with two mega facilities based in Québec spanning over 1,650,000 sq. ft., today announced its fiscal first quarter of 2022 financial and operating results for the three-month period ended November 30, 2021.

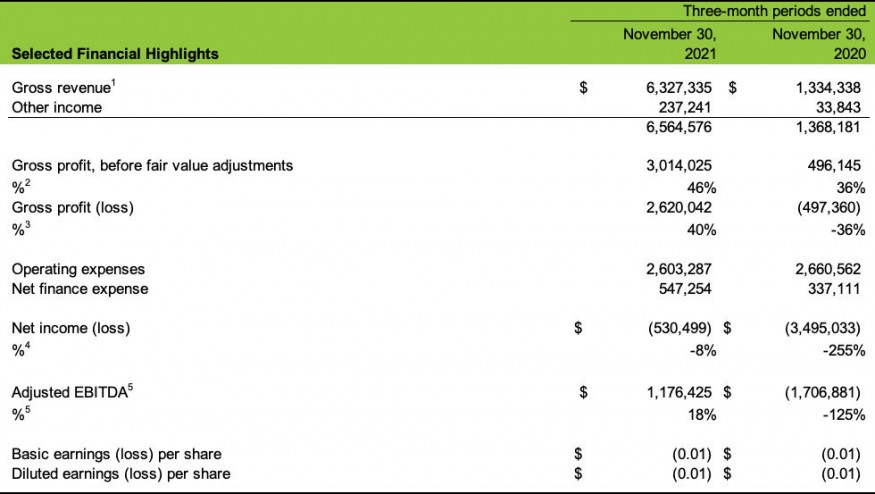

First fiscal Quarter of 2022 Financial and Operational Highlights

Financial

Operational

"Following our solid year-end results, we delivered strong financial performance for the First Fiscal Quarter of 2022 resulting from our focus and execution of delivering premium-grade cannabis products to the market at competitive retail prices," commented Zohar Krivorot, President & Chief Executive Officer of Cannara. "We are at a pivotal point in Cannara's brief but successful history as we are laser focused on delivering premium products at disruptive pricing while significantly increasing production by starting up our Valleyfield Facility. We have made significant improvements to the facility and the results have been extremely positive through our initial grow. We also continue to see increased demand for our products and, as we move forward in 2022, our mission is to increase our production capacity to help meet that unmet and growing demand while further driving shareholder value."

Nicholas Sosiak, Chief Financial Officer of Cannara commented, "As we continue to execute on our stated business strategy, we continue to hit the milestones that we have laid out for the Company. Our third consecutive quarter of positive Adjusted EBITDA was achieved while ramping up production at Quebec's largest cannabis operation which is a testament to our dedicated team committed to producing the highest quality product while controlling costs. There remains a massive opportunity just in Quebec given the modest number of retail outlets and as the Quebec market continues to expand and as Cannara has production capacity to services other markets, we are very well positioned to capitalize on this demand and to continue to gain market share."

Outstanding Shares

As at the date of this report, the Company had 876,481,321 common shares and 40,635,583 stock options issued and outstanding. For further information, the complete Audited Consolidated Financial Statements and Management's Discussion and Analysis for the three-month periods ended November 30, 2021 and 2020, along with additional information about the Company and all of its public filings are available at sedar.com and the Company's investor website, investors.cannara.ca.

About Cannara Biotech Inc.

Cannara Biotech Inc. (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB) is a vertically integrated producer of premium-grade cannabis and cannabis-derivative products for the Québec and Canadian markets. Cannara owns two mega facilities based in Québec spanning over 1,650,000 sq. ft., providing the Company with 125,000kg of potential annualized cultivation output. Leveraging Québec's low electricity costs, Cannara's facilities produce craft-cultivated premium-grade cannabis products at an affordable price. For more information, please visit cannara.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This information release contains certain forward-looking information. Such information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by statements herein, and therefore these statements should not be read as guarantees of future performance or results. All forward-looking statements are based on the Company's current beliefs as well as assumptions made by and information currently available to it as well as other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Due to risks and uncertainties, including the risks and uncertainties identified by the Company in its public securities filings, actual events may differ materially from current expectations. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1 | Gross revenue included revenue from sale of goods, net of excise taxes and lease revenues. |

2 | Gross profit before fair value adjustments % is determined as Gross profit before fair value adjustments divided by Total revenues. |

3 | Gross profit (loss) % is determined as Gross profit (loss) divided by Total revenues. |

4 | Net income (loss) % is determined as Net income (loss) divided by Total revenues. |

5 | Adjusted EBITDA, Adjusted EBITDA % and working capital are non-GAAP financial performance measures. |

6 | Working capital is determined as total current assets minus total current liabilities. |

1 | Adjusted EBITDA is a non-GAAP financial performance measure. |

| Last Trade: | US$1.27 |

| Daily Change: | -0.02 -1.55 |

| Daily Volume: | 1,800 |

| Market Cap: | US$120.520M |

July 28, 2025 July 24, 2025 January 27, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS