Saturday - April 19, 2025

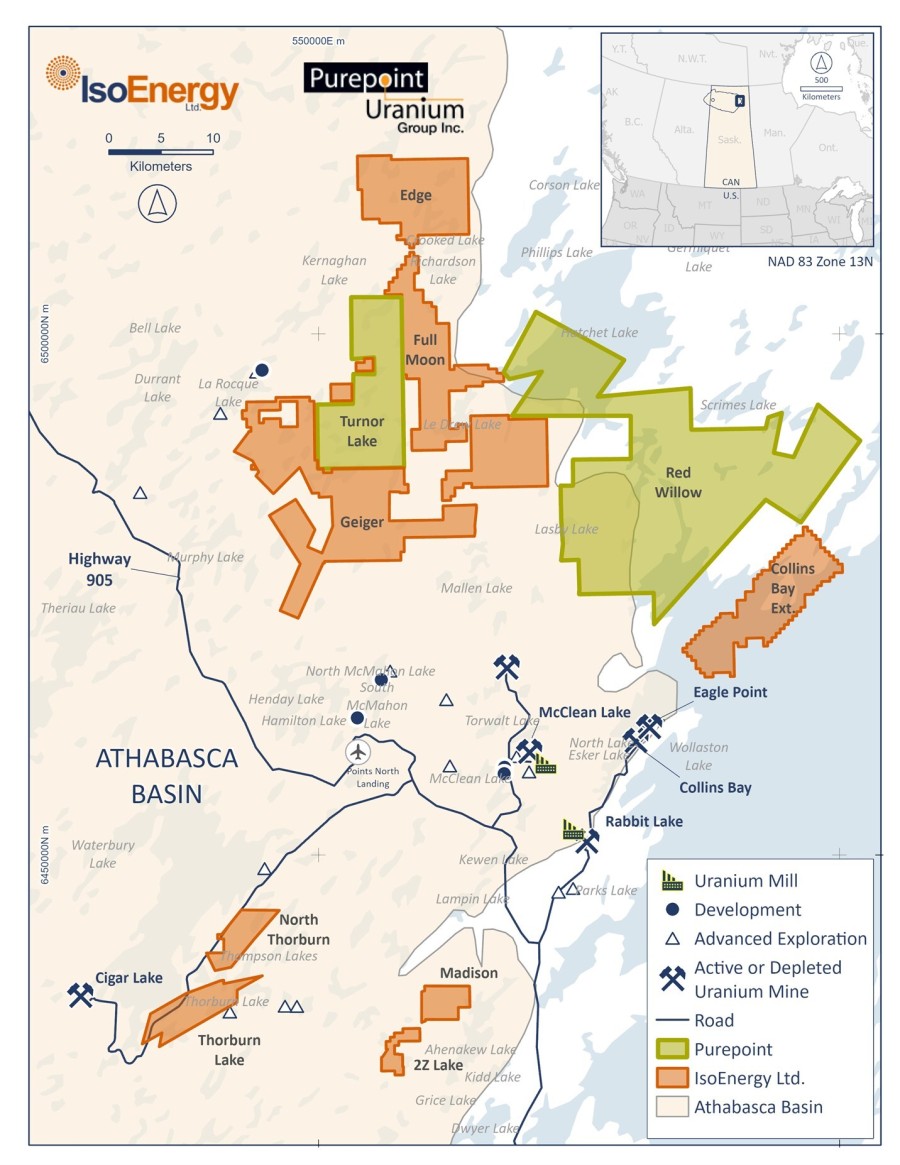

TORONTO, Dec. 19, 2024 /CNW/ - IsoEnergy Ltd. (TSX: ISO) (OTCQX: ISENF) ("IsoEnergy") and Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint") are pleased to announce the successful implementation of their previously announced joint venture (the "Joint Venture") (see press release dated October 22, 2024), consolidating 10 uranium projects spanning over 98,000 hectares in the eastern Athabasca Basin, Saskatchewan (Figure 1). This strategic collaboration strengthens both companies' efforts to advance high-potential uranium assets in one of the world's premier uranium-producing regions.

The joint venture establishes an initial ownership structure of 60% by IsoEnergy and 40% by Purepoint, with the option to adjust to a 50/50 split through the exercise of put/call options (the "Put/Call Option") pursuant to which 10% of IsoEnergy's initial participation interest may be transferred to Purepoint in exchange for 4,000,000 common shares of Purepoint (the "PTU Shares"). The Put/Call Option is exercisable within six months of the Joint Venture's formation, with the exercise of one option resulting in the expiry of the other. Following completion of the Put/Call Option period, IsoEnergy will hold a further option to purchase an additional 1% interest from Purepoint for $2 million, giving IsoEnergy a 51% participation interest and Purepoint a 49% participation interest. This option expires on the earlier of February 28, 2026, or 60 days after a material uranium discovery. The ownership interests of each company are subject to standard dilution, with any participation interest that is reduced to 10% or less being automatically exchanged for a 2% net smelter royalty (NSR) on the Joint Venture properties.

The Joint Venture brings together a complementary portfolio of highly prospective properties strategically positioned along the Larocque Trend, a region renowned for high-grade uranium discoveries such as IsoEnergy's Hurricane Deposit (Figure 2). Subject to the terms of the Joint Venture agreement, Purepoint will serve as operator during the exploration phase, while IsoEnergy will assume operational control as the projects advance to pre-development stages. Work programs across the joint portfolio are expected to commence in the near future.

Philip Williams, CEO and Director of IsoEnergy, commented, "This partnership allows us to advance a promising portfolio of uranium projects while maintaining our focus on IsoEnergy's core development assets. By working alongside Purepoint, a highly experienced operator in the Athabasca Basin, we ensure these projects receive the dedicated attention and resources needed to unlock their full potential."

Chris Frostad, President and CEO of Purepoint, added, "Our strategy of partnering with the strongest players in the uranium sector ensures that our most prospective projects, like those within this joint venture, are supported by a secure and sustainable source of funding. This collaboration not only validates the potential of these assets but also aligns with our commitment to advance them responsibly and efficiently."

Early Warning Disclosure

In connection with the formation of the Joint Venture, IsoEnergy is deemed to have acquired beneficial ownership of the 4,000,000 PTU Shares issuable upon exercise of the Put/Call Option pursuant to applicable Canadian securities laws. Prior to the implementation of the Joint Venture, IsoEnergy beneficially owned an aggregate of 3,333,334 PTU Shares and 3,333,334 warrants ("PTU Warrants"), representing approximately 5.81% of the issued and outstanding PTU Shares on a non-diluted basis, and approximately 10.98% of the issued and outstanding PTU Shares on a partially diluted basis, assuming the exercise of the PTU Warrants held by IsoEnergy. Following implementation of the Joint Venture, IsoEnergy beneficially owns an aggregate of 7,333,334 PTU Shares and 3,333,334 PTU Warrants, assuming the exercise of the Put/Call Option, representing approximately 11.94% of the issued and outstanding PTU Shares on a non-diluted basis, and approximately 16.48% of the issued and outstanding PTU Shares on a partially diluted basis, assuming the exercise of the PTU Warrants held by IsoEnergy.

While IsoEnergy currently has no plans or intentions with respect to the Purepoint securities, IsoEnergy may develop such plans or intentions in the future and, at such time, may from time to time acquire additional securities, dispose of some or all of the existing or additional securities or may continue to hold the PTU Shares, PTU Warrants or other securities of Purepoint based on market conditions, general economic and industry conditions, trading prices of Purepoint's securities, Purepoint's business, financial condition and prospects and/or other relevant factors.

A copy of the early warning report to be filed by IsoEnergy will be available under Purepoint's profile on SEDAR+ at www.sedarplus.ca or by contacting Graham du Preez, Chief Financial Officer of IsoEnergy, at 306-373-6399. IsoEnergy's head office is located at 217 Queen St. West, Suite 401, Toronto, Ontario, M5V 0R2.

Qualified Person Statement

The scientific and technical information contained in this news release relating to IsoEnergy was reviewed and approved by Dr. Dan Brisbin, P.Geo., IsoEnergy's Vice President, Exploration, who is a "Qualified Person" (as defined in NI 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101")).

For additional information with respect to the current mineral resource estimate for IsoEnergy's Hurricane Deposit, please refer to the Technical Report prepared in accordance with NI 43-101 entitled "Technical Report on the Larocque East Project, Northern Saskatchewan, Canada" dated August 4, 2022, available under IsoEnergy's profile at www.sedarplus.ca.

About IsoEnergy Ltd.

IsoEnergy is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S. and Australia at varying stages of development, providing near-, medium- and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East project in Canada's Athabasca basin, which is home to the Hurricane deposit, boasting the world's highest-grade indicated uranium mineral resource.

IsoEnergy also holds a portfolio of permitted past-producing, conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels. These mines are currently on standby, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

About Purepoint Uranium Group Inc.

Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) is a focused explorer with a dynamic portfolio of advanced projects within the renowned Athabasca Basin in Canada. The most prospective projects are actively operated on behalf of partnerships with industry leaders including Cameco Corporation, Orano Canada Inc. and IsoEnergy Ltd.

Additionally, the Company holds a promising VHMS project currently optioned to and strategically positioned adjacent to and on trend with Foran Corporation's McIlvena Bay project. Through a robust and proactive exploration strategy, Purepoint is solidifying its position as a leading explorer in one of the globe's most significant uranium districts.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this Press release.

Disclosure regarding forward-looking statements

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". This forward-looking information may relate to the Joint Venture, including statements with respect to the anticipated benefits of the Joint Venture to the parties; the expected ownership interests of IsoEnergy and Purepoint in the Joint Venture; the prospects of each company's respective projects, including mineralization of each project; the potential for, success of and anticipated timing of commencement of future exploration and development of the Joint Venture projects; IsoEnergy's expectations with respect to the sale or purchase or sale of Purepoint securities shares in the future; and any other activities, events or developments that the companies expect or anticipate will or may occur in the future.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, the accuracy of management's assessment of the effects of the successful completion of the Joint Venture and that the anticipated benefits of the Joint Venture will be realized; the anticipated mineralization of IsoEnergy's and Purepoint's projects being consistent with expectations and the potential benefits from such projects and any upside from such projects; the price of uranium; that general business and economic conditions will not change in a materially adverse manner; that financing will be available if and when needed and on reasonable terms; and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Joint Venture's planned activities will be available on reasonable terms and in a timely manner. Although each of IsoEnergy and Purepoint have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current views of IsoEnergy and Purepoint with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by IsoEnergy and Purepoint, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: the inability of the parties to realize the benefits anticipated from the Joint Venture and the timing to realize such benefits; changes to IsoEnergy's and/or Purepoint's current and future business plans and the strategic alternatives available thereto; growth prospects and outlook of IsoEnergy's and Purepoint's business; regulatory determinations and delays; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, the United States and other jurisdictions where the applicable party conducts business. Other factors which could materially affect such forward-looking information are described in the risk factors in each of IsoEnergy's and Purepoint's most recent annual management's discussion and analyses or annual information forms and IsoEnergy's and Purepoint's other filings with the Canadian securities regulators which are available, respectively, on each company's profile on SEDAR+ at www.sedarplus.ca. IsoEnergy and Purepoint do not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| Last Trade: | US$1.85 |

| Daily Volume: | 0 |

| Market Cap: | US$330.800M |

February 18, 2025 February 13, 2025 January 23, 2025 January 14, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS