Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

FPX Nickel Adopts Best-in-Class Technology to Reduce Baptiste's Carbon Intensity and Receives BC Hydro Support

VANCOUVER, BC, July 30, 2024 /CNW/ - FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) ("FPX Nickel" or the "Company") is pleased to provide an update on value engineering ("Value Engineering") studies that have improved the conceptual mine plan and facilities of the Baptiste Nickel Project ("Baptiste" or "the Project") in central British Columbia. Results of the mine Value Engineering studies have identified improvements to project economics and mine operability, and a significant reduction to Baptiste's greenhouse gas emissions estimate and the resultant carbon intensity.

Highlights

- Optimization of the Baptiste mine plan and application of trolley-assist haul truck systems has improved operability and reduced overall diesel consumption by approximately 50%

- The mine Value Engineering program has reduced Baptiste's carbon intensity to 1.2 tCO2e/tNi, which is in the lowest decile of current global nickel production and 50% below the amount reported in the 2023 preliminary feasibility study

- FPX has received funding support from BC Hydro that will enable Baptiste to commence interconnection studies in the second half of 2024, advancing electrification of the project and supporting BC's and Canada's critical minerals strategy

"Our plans to adopt best-in-class mining technologies are expected to enable Baptiste to be one of the lowest-carbon nickel operations in the world. The optimization of our approach to mine planning highlights our made-in-Canada advantage. British Columbia's clean power underpins Baptiste's potential for responsible production of high-value nickel units that will support decarbonization of the global economy. We are grateful for BC Hydro's support as we move toward entry into the provincial and federal environmental assessment process in 2025."

- Martin Turenne, President and CEO of FPX Nickel

"FPX Nickel is setting new global standards in responsibly mined high-value nickel, exemplifying British Columbia's leadership in environmental, social, and governance practices. Mining and mineral exploration are a foundational part of our transition to a low-carbon future, and projects like this one will help us build a stronger and more sustainable British Columbia where our hard work benefits everyone. I congratulate FPX Nickel on their progress on this world-class project."

- The Honourable Josie Osborne, British Columbia's Minister of Energy, Mines and Low Carbon Innovation

Background

The Baptiste 2023 preliminary feasibility study ("PFS") demonstrates the potential to develop a high-margin and low-carbon nickel mine producing an average of 59,100 tonnes per year of nickel over a 29-year mine life (see the Company's September 6, 2023 news release). Due to awaruite's properties, Baptiste has the unparalleled flexibility to produce either a high-grade concentrate (60% nickel) for direct feed into the stainless steel industry (the "Base Case") or for further refining into battery-grade nickel and cobalt products for the electric vehicle battery supply chain (the "Refinery Option").

While the PFS presents robust economics, including a Base Case after-tax NPV8% of US$2.01 Billion and after-tax IRR of 18.6% at US$8.75 /lb. Ni, FPX continues to strive towards adding further value to Baptiste, focusing on a holistic blend of economics, constructability, operability, risk and ESG considerations.

The key Value Engineering studies pursued by FPX in 2024 are:

- Mineral processing (see the Company's July 10, 2024 news release)

- Mine planning and engineering (described herein)

- Refinery planning (to be completed in the third quarter of 2024)

Baptiste Carbon Intensity

The Baptiste PFS reported life-of-mine ("LOM") average carbon intensity of 2.4 tCO2e/tNi on a Scope 1+2 basis. Approximately 85% of this PFS carbon intensity is due to diesel consumption, with the remainder from other fuels (propane and gasoline), minor use of limestone for neutralization in the process plant, and minor contribution from BC Hydro's grid electricity emission intensity factor (11.3 tCO2e/Gwh in 2023).

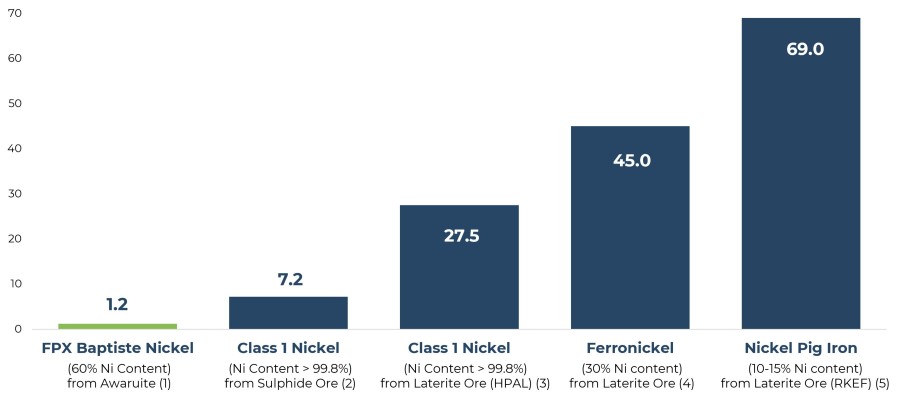

Following the Value Engineering work described herein, the Baptiste carbon intensity has been reduced to a LOM average of 1.2 tCO2e/tNi, representing a 50% reduction from the reported PFS value. This value would place Baptiste within the lowest decile of current global nickel production.

According to Skarn Associates, a mining sustainability consultancy, approximately 85% of global nickel production in 2023 had a carbon intensity greater than 10 tCO2e/tNi, and approximately 70% of global nickel production had a carbon intensity greater than 30 tCO2e/tNi.

BC Hydro Support

FPX has enjoyed a positive relationship with BC Hydro, working closely through our project development activities to evaluate potential grid connection scenarios. BC Hydro will provide funding support to FPX as the Company formally enters the grid connection queue in the second half of 2024 with the initiation of a System Impact Study ("SIS") for Baptiste.

Mine Value Engineering Studies

The mine Value Engineering studies focused on optimization of the PFS mine plan through the following parameters:

- Design criteria,

- Equipment selection,

- Autonomous haulage technology; and

- Lower-carbon haulage technology.

Design Criteria and Equipment Selection

An evaluation of key design criteria and equipment selection has demonstrated improved economics and tangible carbon intensity reductions through increasing bench heights and haulage equipment size. The now 15 m bench heights (vs. 10 m in the PFS) and 400-ton class haul trucks (vs. 300-ton class in the PFS) have resulted in improved loading equipment efficiency, reduced haul truck counts, and optimization of ore and waste quantities on a year-to-year basis, all without material impact to initial capital costs.

Additionally, further engagement with haul truck vendors on benchmarkable diesel consumption rates indicate the PFS considered an overly conservative diesel consumption rate. The total impact of these design criteria and equipment selection evaluations improve project economics and mine operability while reducing the average life of mine ("LOM") diesel consumption by approximately 20%.

Autonomous Haulage Technology

An evaluation of autonomous haulage system ("AHS") technology has demonstrated reduced mine operating costs along with means to improving Baptiste's post-expansion operating basis. Two scenarios were evaluated, including (1) implementation of an AHS as part of the initial mine construction ("Phase 1"); and (2) implementation of an AHS for the planned mine expansion ("Phase 2") from a processing throughput of 108,000 tonnes per day ("tpd") to 164,000 tpd.

With the increased mining rate in Phase 2, the Value Engineering study concluded that the adoption of AHS will reduce mine operating costs without impacting initial capital costs. Adoption of AHS in Phase 2 will allow personnel serving as haul truck operators in Phase 1 to be uptrained for positions within the expanded Phase 2 operations, thereby providing new opportunities to the Phase 1 mine haulage workforce while also mitigating the expanded work force requirements.

Lower-Carbon Haulage Technology

An evaluation of mine haulage technology has yielded significant carbon intensity reductions. With 85% of the PFS carbon intensity associated with haul truck diesel consumption, the application of lower-carbon mine haulage technologies is the most direct means to reduce Baptiste's carbon intensity. This evaluation considered trolley-assist haulage systems, such as that successfully implemented at the Copper Mountain Mine in southern British Columbia, while further evaluations during the FS will also consider battery-powered haul trucks, hydrogen-powered haul trucks, and other emerging technologies.

A series of trolley assist system concepts were evaluated, including in-pit systems, ex-pit systems, and combinations thereof. Ultimately, a scenario adding an in-pit system for operating year 5 and an ex-pit system for operating year 8 results was selected. The net result of the in- and ex-pit trolley assist systems is an approximate 30% reduction in total LOM diesel consumption without impacting the Project's initial capital intensity.

Carbon Sequestration in Mine Waste and Tailings

Due to their ultramafic mineralization, Baptiste's mine waste and tailings have the potential to sequester carbon dioxide through carbonation of brucite, serpentine, and other magnesium-based minerals. For reference, Baptiste's tailings will contain an average of 1% brucite. This has been demonstrated through multiple field- and lab-based testwork campaigns in tandem with the University of British Columbia, as well as carbonation modelling work with independent consultants. FPX continues to pursue means to promote carbon sequestration in the Baptiste tailings facility; however, in line with our conservative approach to project development, no benefit thereof is currently considered within Baptiste's project economics or carbon intensity. As such, carbon sequestration within Baptiste mine waste and tailings is considered to be a future potential economic and environmental opportunity.

About the Decar Nickel District

The Company's Baptiste Nickel Project represents a large-scale greenfield discovery of nickel mineralization in the form of a sulphur-free, nickel-iron mineral called awaruite (Ni3Fe) hosted in an ultramafic/ophiolite complex. The Baptiste mineral claims cover an area of 408 km2, west of Middle River and north of Trembleur Lake, in central British Columbia. In addition to the Baptiste Deposit itself, awaruite mineralization has been confirmed through drilling at several target areas within the same claims package, most notably at the Van Target which is located 6 km to the north of the Baptiste Deposit. Since 2010, approximately US $30 million has been spent on the exploration and development of Baptiste.

The Baptiste Deposit is located within the Baptiste Creek watershed, on the traditional territories of the Tl'azt'en Nation and the Binche Whut'en, and within several Tl'azt'enne and Binche Whut'enne keyohs. FPX has conducted mineral exploration activities to date subject to the conditions of agreements with First Nations and keyoh holders.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia, and other occurrences of the same distinctive style of awaruite nickel-iron mineralization.

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne, President, CEO and Director

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: 604-681-8600

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.39 |

| Daily Change: | -0.02 -4.59 |

| Daily Volume: | 14,906 |

| Market Cap: | US$122.410M |

November 24, 2025 September 23, 2025 September 16, 2025 | |