Highlights:

CALGARY, Alberta / Feb 21, 2024 / Business Wire / E3 LITHIUM LTD. (TSXV: ETL) (FSE: OW3) (OTCQX: EEMMF), “E3 Lithium” or the “Company,” a leader in Canadian lithium, is pleased to share its plans for the upcoming year. The Company made significant progress in 2023 on the path for producing commercial lithium in Alberta. Looking ahead into 2024, E3 Lithium’s primary focus remains on advancing the Clearwater Project to commercial operations. The milestones it will achieve in 2024 will establish its project as one of the few advanced stage lithium developments in Canada and North America. In addition to the Clearwater Project, the magnitude of E3 Lithium’s resources enables the Company to unlock the potential of the significant land package throughout 2024 across its permit areas.

Going into 2024, E3 Lithium maintains a strong financial position. In the current market conditions, E3 Lithium has positioned itself to continue accelerating a path forward to producing first commercial lithium from its significant resources in South-Central Alberta.

“E3 Lithium had a very successful 2023 by progressing all core aspects of our business, putting us in position to deliver ambitious targets in 2024 moving us closer to first commercial lithium,” said Chris Doornbos, President and CEO of E3 Lithium. “The achievement of this year’s goals will mark a fundamental shift in our business, one that sees us move from a technology and resource developer to a commercialization company on a clear and demonstrated pathway to operations.”

E3 Lithium is focusing on the following goals in 2024.

Progressing the Clearwater Project Towards Commercial Operations

E3 Lithium’s Clearwater Project is the Company’s primary focus for its first commercial lithium facility, located in South-Central Alberta. The milestones the Company will achieve in advancing its development this year, including progressing engineering studies and commercial permitting, will establish the Clearwater Project as one of the few advanced stage lithium projects in Canada and North America. The PFS for the Clearwater Project represents a monumental milestone for Canadian lithium brines as it results in the booking of reserves.

To move towards commercial operations in the Clearwater Project, the Company looks forward to completing the PFS and releasing the NI 43-101 report, aiming for late Q2 2024. E3 Lithium is working diligently to deliver the PFS report in Q2; the critical path to be able to do so is receiving engineering packages from external vendors. If delivery is delayed, the public report may be delayed as well. The Company will update the market on its progress and delivery times as they become firm.

The PFS is designed to a level of detail that will enable the Company to move directly into Feasibility Study (FS) and includes the full design of the first commercial facility, along with an updated cost estimate and development schedule. With the publication of the PFS NI 43-101 report, E3 Lithium will book Canada’s first lithium-in-brine reserves in the Clearwater Project area, a significant milestone for the Canadian lithium brine industry. E3 Lithium has initiated the permitting process for the commercial facility and will look to advance this throughout 2024. The milestones E3 Lithium looks forward to completing include publishing the PFS NI 43-101 report, selecting the EPC for and kicking off the FS, completing environmental and wildlife surveys and public consultation for its commercial facility, and preparing regulatory applications for approval.

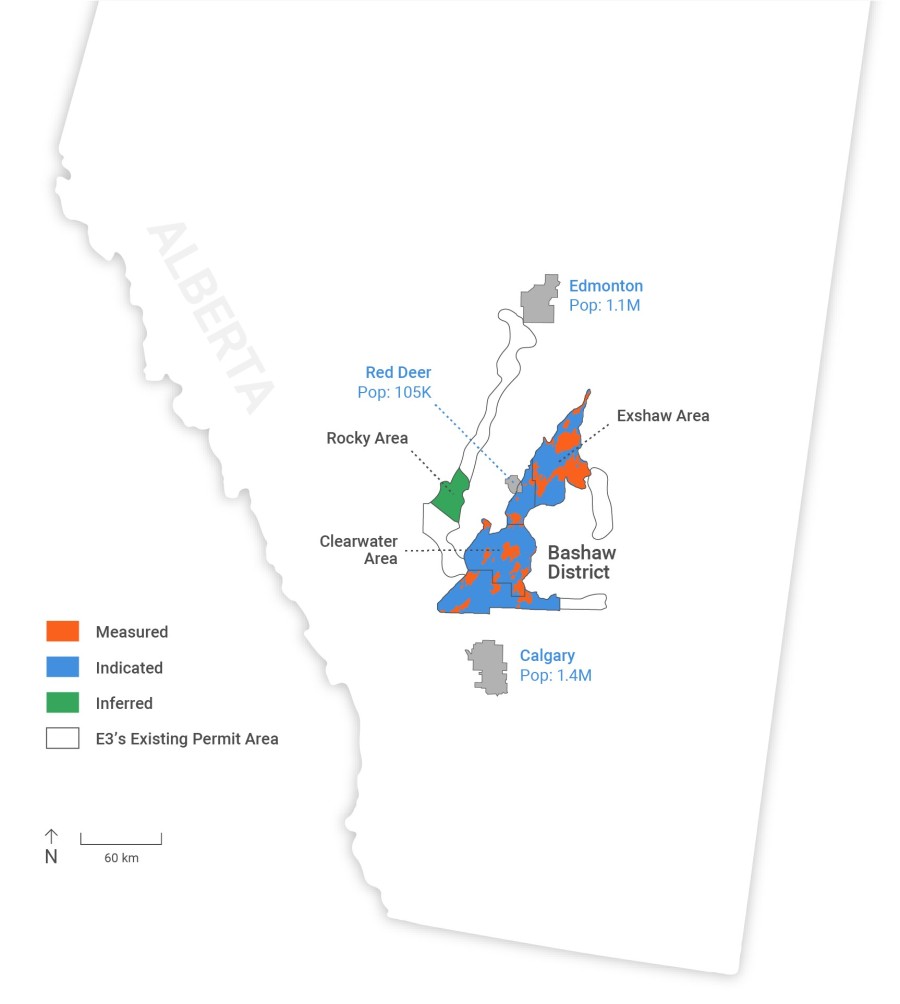

While the PFS will outline details of the first commercial facility, the Clearwater area is likely to be able to support further production expansion. Based on the sheer size and consistency of E3 Lithium’s resources in Alberta, demonstrating a successful development in the Clearwater area supports the value of the remaining land in the Exshaw (northern Bashaw) and Rocky areas. E3 Lithium believes it has enough brines to produce approximately 150,000 tonnes of battery grade lithium per year once fully operational across multiple commercial facilities, which is enough lithium for approximately 2.2M EVs1 annually.

Developing E3 Lithium’s Other Significant Resource Areas

In addition to its Clearwater area in Alberta, E3 Lithium’s significant land package includes the Exshaw and Rocky areas and its Saskatchewan property. While E3 Lithium’s focus remains firmly on the Clearwater Project, the team is evaluating and progressing additional projects across its resource base.

Exshaw Area

In the Northern part of the Bashaw District lies the Exshaw area. The brine composition in the Exshaw area is very similar to the Clearwater Project, and the development of this area is expected to be similar to the Clearwater area. This area is larger by total brine volume than the Clearwater. E3 plans to begin the evaluation of how to develop the Exshaw area once theClearwater PFS is complete.

Rocky Area

In the Western trend of the Leduc Aquifer lies the Rocky area. This portion of the aquifer is largely disconnected from the Bashaw District and hosts a significant volume of lithium enriched brine. The Company plans to update the resource to include the full aquifer trend in 2024. Once complete, the Company will evaluate how this area fits into its larger development plans.

Nisku Aquifer across E3 Lithium’s Alberta Resource Areas

Recent sampling results indicate that the Nisku Aquifer, located above the Leduc Aquifer, has similar concentrations of lithium to the Leduc. This aquifer is coincident with the Leduc in the Bashaw Area, making it a candidate for co-production. As the Company’s production wells will go through the Nisku to reach the Leduc, it offers the potential to add more production to the plant in a commercial setting by co-producing both the Leduc and the Nisku. If successful, the benefit would be an increase to the lifespan of each well and therefore, a reduction in the well capital required over the life of the plant.

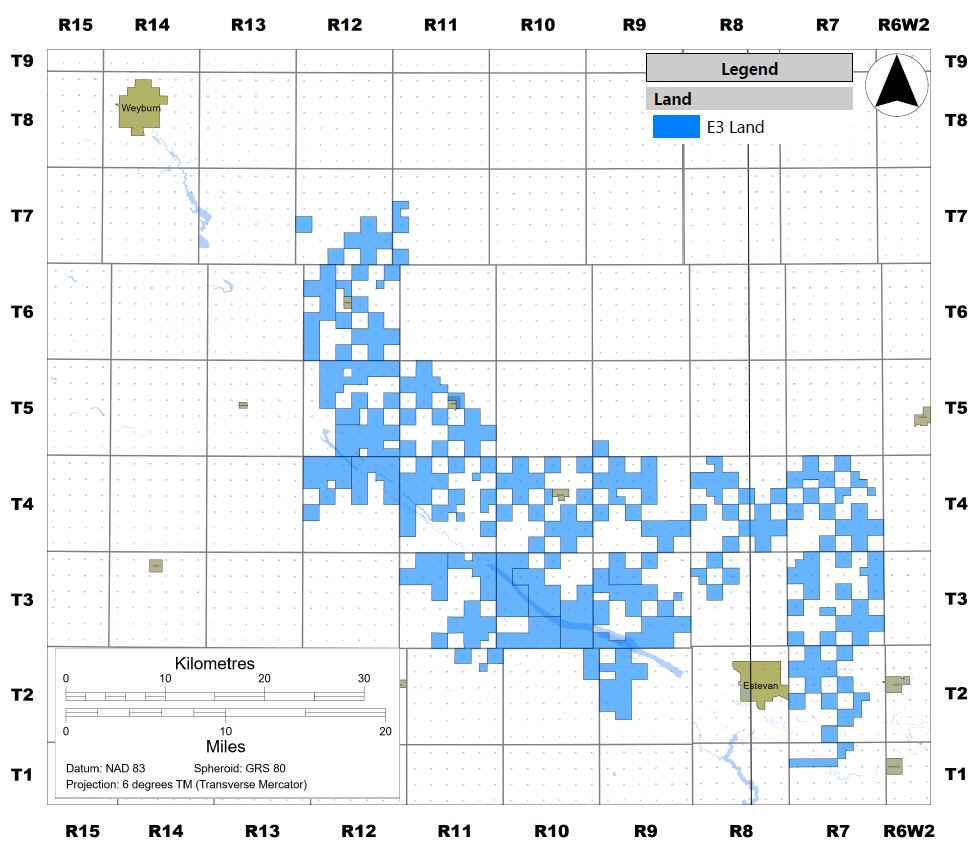

Saskatchewan

E3 Lithium holds a strategic land position in the heart of the Estevan lithium belt in Saskatchewan. Resource holders that surround E3 Lithium have recently completed resource updates and economic studies that look to advance Saskatchewan into a commercially producing region for lithium. E3 Lithium plans to complete an inaugural resource in Saskatchewan in 2024. As this area does not form the core of E3 Lithium’s focus, the Company is evaluating the best options for creating value from the land for its shareholders.

Advancing Commercial Development and Offtake

E3 Lithium has been developing strong relationships with potential customers that include companies in the automotive, cell and cathode manufacturing sectors. The completion of the PFS is a major milestone for these discussions to mature towards sale contracts. E3 Lithium has been working to grow its commercial team to support this effort and will continue to prioritize identifying mutually beneficial arrangements with offtakers.

E3 Lithium’s Strengths Going into 2024

Balance sheet strength supports ability to execute 2024 plans: E3 Lithium raised more than $30M CAD via capital raises and grant funding in 2023 and has more than $20M remaining to draw down on from the Strategic Innovation Fund. The Company is in a strong financial position to execute on its goals in 2024. E3 Lithium continues to actively seek, identify and pursue all sources of non-dilutive funding to meet the Company’s ongoing needs for capital.

Long-term outlook for EV uptake and lithium demand: The long-term outlook for EV uptake and demand remains strong, with North American policy objectives in full alignment with a comprehensive shift to EVs into the 2030s. According to Benchmark Mineral Intelligence, entering 2024, North America is expected to grow lithium production to approximately 40,000 tonnes per annum (tpa) of battery-grade lithium, while demand is expected to be more than 150,000 tpa. By 2030 global demand could exceed 3M tpa, growing at over 15% per year.

Commercial production to coincide with rising demand: E3 Lithium’s initial commercial production is likely to be timed in to coincide with the increase in demand for and shortfall of supply of lithium, which may create favourable pricing environments for E3 Lithium’s offtake.

Lithium offtake sold in long-term contracts: Most lithium today is sold in long-term offtake arrangements that contain negotiated sales prices. The best gauge for these prices is long term price forecasts provided by reputable research firms, which are outlining prices much higher than current spot prices. The price forecasts provided by reputable research firms will be relied upon for the PFS.

Efficient and well-known permitting regime: Alberta is home to one of the world’s most efficient and well known regulatory and permitting processes for energy project development, led by the Government of Alberta and the Alberta Energy Regulator. Recently E3 Lithium’s permits to its significant land position in Alberta were converted to the province’s new Brine-Hosted Mineral Licences, reaffirming E3 Lithium’s ownership of ‘surface to basement’ mineral rights to saline aquifers throughout its operating areas and underscoring the province’s commitment to providing regulatory certainty and growing the lithium industry. The requirements for E3 Lithium’s commercial permits are well understood and the Company looks forward to progressing its regulatory work in 2024.

Join us at our Upcoming Webinar

E3 Lithium will be hosting a webinar for investors and other interested parties to share more information about its 2024 Corporate Guidance and the progress made to-date. Details for this virtual webinar are below and questions can be submitted in advance to This email address is being protected from spambots. You need JavaScript enabled to view it..

ON BEHALF OF THE BOARD OF DIRECTORS

Chris Doornbos, President & CEO

E3 Lithium Ltd.

About E3 Lithium

E3 Lithium is a development company with a total of 16.0 million tonnes of lithium carbonate equivalent (LCE) Measured and Indicated and 0.9 million tonnes LCE Inferred mineral resources1 in Alberta. As outlined in E3’s Preliminary Economic Assessment, the Clearwater Lithium Project has an NPV8% of USD 1.1 Billion with a 32% IRR pre-tax and USD 820 Million with a 27% IRR after-tax1. E3 Lithium’s goal is to produce high purity, battery grade lithium products to power the growing electrical revolution. With a significant lithium resource and innovative technology solutions, E3 Lithium has the potential to deliver lithium to market from one of the best jurisdictions in the world.

1: The Preliminary Economic Assessment (PEA) for the Clearwater Lithium Project NI 43-101 technical report is amended Sept 17, 2021. Gordon MacMillan, P.Geol, QP, Fluid Domains Inc. and Grahame Binks, MAusIMM, QP (Metallurgy), formerly of Sedgman Canada Limited (Report Date: June 15, 2018, Effective Date: June 4, 2018 Amended Date: September 17, 2021). The mineral resource NI 43-101 Technical Report for the North Rocky Property, effective October 27, 2017, identified 0.9Mt LCE (inferred). The mineral resource NI 43-101 Technical Report for the Bashaw District Project, effective March 21, 2023, identified 16.0Mt LCE (measured & indicated). All reports are available on the E3 Lithium’s website (e3lithium.ca/technical-reports) and SEDAR+ (www.sedarplus.ca).

Forward-Looking and Cautionary Statements

This news release includes certain forward-looking statements as well as management’s objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”, “intend” and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the effectiveness and feasibility of emerging lithium extraction technologies which have not yet been tested or proven on a commercial scale or on the Company’s brine, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

| Last Trade: | US$0.73 |

| Daily Volume: | 0 |

| Market Cap: | US$63.290M |

December 08, 2025 December 03, 2025 November 21, 2025 October 29, 2025 October 21, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS