Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Defense Metals Corp. Drills Highest Grade To Date At Wicheeda With 6.01% Total Rare Earth Oxide Over 23.4 Metres (WI21-38) And 3.19% Over 138 Metres From Surface (WI21-37)

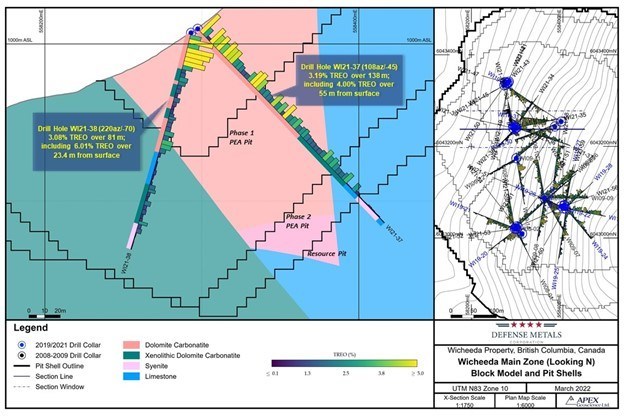

Defense Metals Corp. ("Defense Metals" or the "Company") (TSXV: DEFN) (OTCQB: DFMT) (FSE: 35D) is pleased to announce results for an additional two diamond drill holes totalling 324 metres from the Company's 29 hole, 5,349 metre diamond drill program completed during fall 2021. Drill holes WI21-37 and WI21-38 collared from the same pad on section were designed to further delineate and upgrade existing resource categories of the Wicheeda Rare Earth Element (REE) deposit.

The two infill holes intersected the highest grade REE mineralization intersected to date at Wicheeda with drill hole WI21-38 returning 6.01% TREO over 23.4 metres1 and significant widths of mineralization above the 0.5% TREO (total rare earth oxide) mineral resource lower cut-off in good agreement with geology and block modelled TREO grades.

The Company expects to receive additional assay results from the 2021 Wicheeda REE Deposit resource expansion and delineation campaign in the coming days and weeks.

Luisa Moreno, President and Director of Defense Metals commented: "We continue to be encouraged results of 2021 resource expansion and infill drilling campaign. The two holes reported today have returned the highest grade REE intercept to date at 6.01% TREO, while also confirming significant widths of potentially economic grade REE's consistent with our geological and resource models."

Resource infill drill holes WI21-37 (-45o dip / 108o azimuth), and WI21-38 (-70o dip / 220o azimuth), drilled on section, established continuity of significantly REE mineralized dolomite carbonatite at depth in accordance with block modelled TREO grades, with WI21-37 yielding 3.19% TREO over 138 metres1, including 4.00% TREO over 55 metres1; and WI21-38 intersecting a mixed-country rock bearing interval grading 3.08% TREO over 81 metres; including the highest grade interval to data at Wicheeda of 3.45% TREO over 35 metres1 and 6.01% TREO 23.4 metres1, respectively (Table 1 and Figure 1).

Table 1. Wicheeda REE Deposit 2021 Diamond Drill Intercepts

Hole ID | From | To | Interval | TREO2 | Ce2O3 | La2O3 | Nd2O3 | Pr2O3 | Sm2O3 | Gd2O3 | Eu2O3 | Dy2O3 | Tb4O7 | Ho2O3 |

WI21-37 | 2.00 | 139.85 | 137.85 | 3.19 | 1.56 | 1.10 | 0.35 | 0.12 | 351 | 144 | 66 | 30 | 11 | 3 |

including | 2.00 | 57.00 | 55.00 | 4.00 | 1.96 | 1.38 | 0.42 | 0.15 | 427 | 164 | 76 | 35 | 12 | 3 |

WI21-38 | 1.35 | 82.00 | 80.65 | 3.08 | 1.50 | 1.07 | 0.33 | 0.12 | 346 | 154 | 70 | 40 | 13 | 4 |

including | 1.35 | 24.75 | 23.4 | 6.01 | 2.91 | 2.14 | 0.62 | 0.23 | 607 | 246 | 114 | 60 | 20 | 6 |

WI21-33 | 5.00 | 201.00 | 196 | 3.17 | 1.52 | 1.07 | 0.37 | 0.13 | 382 | 181 | 81 | 42 | 14 | 4 |

including | 5.00 | 55.25 | 50.25 | 3.63 | 1.74 | 1.26 | 0.41 | 0.14 | 396 | 181 | 84 | 52 | 16 | 6 |

including | 146.00 | 201.00 | 55.00 | 4.29 | 2.07 | 1.48 | 0.47 | 0.17 | 489 | 232 | 112 | 52 | 18 | 5 |

WI21-34 | 3.00 | 117.00 | 114.00 | 2.97 | 1.46 | 1.02 | 0.33 | 0.11 | 323 | 134 | 58 | 23 | 9 | 2 |

including | 3.00 | 70.00 | 67.00 | 3.84 | 1.89 | 1.34 | 0.41 | 0.15 | 379 | 160 | 69 | 29 | 11 | 3 |

WI21-35 | 1.20 | 121.00 | 119.80 | 3.87 | 1.87 | 1.34 | 0.43 | 0.15 | 434 | 200 | 88 | 52 | 17 | 6 |

WI21-36 | 1.10 | 174.00 | 172.90 | 2.34 | 1.14 | 0.78 | 0.27 | 0.09 | 293 | 134 | 59 | 35 | 11 | 4 |

including | 1.10 | 35.65 | 34.55 | 3.45 | 1.66 | 1.21 | 0.38 | 0.13 | 374 | 170 | 72 | 37 | 13 | 4 |

including | 136.00 | 174.00 | 38.00 | 3.02 | 1.46 | 1.05 | 0.33 | 0.12 | 337 | 157 | 68 | 40 | 13 | 4 |

Figure 1. Drill Section Holes WI21-37 and WI21-38

Data Table Correction

The Company notes that in its March 2, 2022, News Release drill intercept table column headers for rare earth oxides Eu2O3, Gd2O3, Tb4O7 and Dy2O3 were inadvertently transposed. Drilled intercepts, TREO%, and major rare earth oxides values for CeO2, La2O3, Nd2O3, Pr6O11, and Sm2O3 and Ho2O3 were unaffected. The corrected values for Eu2O3, Gd2O3, Tb4O7 and Dy2O3 are reported in Table 1 above.

About the Wicheeda REE Property

The 100% owned 2,008-hectare Wicheeda REE Property, located approximately 80 km northeast of the city of Prince George, British Columbia, is readily accessible by all-weather gravel roads and is near infrastructure, including power transmission lines, the CN railway, and major highways.

The Wicheeda REE Project yielded a robust 2021 PEA that demonstrated an after-tax net present value (NPV@8%) of $517 million, and 18% IRR3. A unique advantage of the Wicheeda REE Project is the production of a saleable high-grade flotation-concentrate. The PEA contemplates a 1.8 Mtpa (million tonnes per year) mill throughput open pit mining operation with 1.75:1 (waste:mill feed) strip ratio over a 19 year mine (project) life producing and average of 25,423 tonnes REO annually. A Phase 1 initial pit strip ratio of 0.63:1 (waste:mill feed) would yield rapid access to higher grade surface mineralization in year 1 and payback of $440 million initial capital within 5 years.

Methodology and QA/QC

The analytical work reported on herein was performed by ALS Canada Ltd. (ALS) at Langley (sample preparation) and Vancouver (ICP-MS fusion), B.C. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geoanalytical laboratory and is independent of the Defense Metals and the QP. Drill core samples were subject to crushing at a minimum of 70% passing 2 mm, followed by pulverizing of a 250-gram split to 85% passing 75 microns. A 0.1-gram sample pulp was then subject to multi-element ICP-MS analysis via lithium-borate fusion to determine individual REE content (ME-MS81h). Defense Metals follows industry standard procedures for the work carried out on the Wicheeda Project, with a quality assurance/quality control (QA/QC) program. Blank, duplicate, and standard samples were inserted into the sample sequence sent to the laboratory for analysis. Defense Metals detected no significant QA/QC issues during review of the data.

Qualified Person

The scientific and technical information contained in this news release as it relates to the Wicheeda REE Project has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a director of Defense Metals and a "Qualified Person" as defined in NI 43-101. Mr. Raffle verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained therein.

About Defense Metals Corp.

Defense Metals Corp. is a mineral exploration and development company focused on the acquisition, exploration and development of mineral deposits containing metals and elements commonly used in the electric power market, defense industry, national security sector and in the production of green energy technologies, such as, rare earths magnets used in wind turbines and in permanent magnet motors for electric vehicles. Defense Metals owns 100% of the Wicheeda Rare Earth Element Property located near Prince George, British Columbia, Canada. Defense Metals Corp. trades in Canada under the symbol "DEFN" on the TSX Venture Exchange, in the United States, under "DFMTF" on the OTCQB and in Germany on the Frankfurt Exchange under "35D".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release contains "forward–looking information or statements" within the meaning of applicable securities laws, which may include, without limitation, statements relating to advancing the Wicheeda REE Project, drill results including anticipated timeline of such results/assays, the Company's plans for its Wicheeda REE Project, expanded resource and scale of expanded resource, expected results and outcomes, the technical, financial and business prospects of the Company, its project and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of rare earth elements, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company's profile on SEDAR at www.sedar.com. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological and engineering assumptions, decrease in the price of rare earth elements, the impact of Covid-19 or other viruses and diseases on the Company's ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed drilling results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

1 | The true width of REE mineralization is estimated to be 70-100% of the drilled interval. |

2 | TREO % sum of CeO2, La2O3, Nd2O3, Pr6O11, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3 and Ho2O3. |

3 | Independent Preliminary Economic Assessment for the Wicheeda Rare Earth Element Project, British Columbia, |

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.21 |

| Daily Change: | -0.004 -1.91 |

| Daily Volume: | 7,527 |

| Market Cap: | US$80.410M |

October 31, 2025 June 04, 2025 May 21, 2025 April 28, 2025 | |