Defense Metals Corp. Drills 2.50% Total Rare Earth Oxide Over 176 Metres; Including 6.14% Over 20 Metres From Surface at Wicheeda

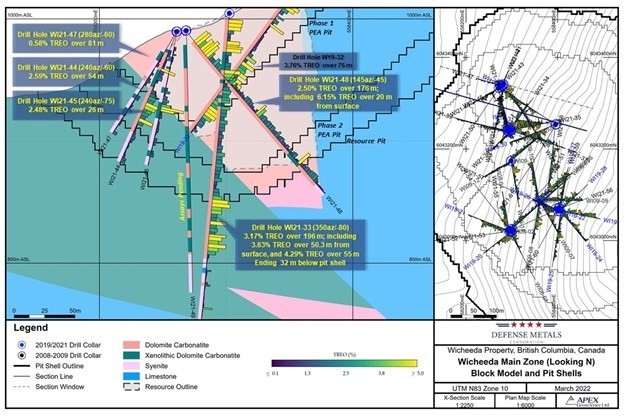

Defense Metals Corp. ("Defense Metals" or the "Company") (TSX-V: DEFN) (OTCQB: DFMTF) (FSE: 35D) is pleased to announce results for an additional four diamond drill holes totalling 615 metres from the Company's 29 hole, 5,349 metre diamond drill program completed during fall 2021. Drill holes WI21-45 through WI21-48 were collared from the same site and within the northern area of the Wicheeda Rare Earth Element (REE) deposit.

Drill hole WI21-48 returned 2.50% TREO (total rare earth oxide) over 176 metres; including 6.14% TREO over 20 metres from surface1. The drill hole terminated on the east side of the deposit 30 metres beyond the mineral resource block model.

The Company continues to receive additional assay results from the 2021 Wicheeda REE Deposit resource expansion and delineation campaign that will be released in the next days and weeks.

Luisa Moreno, President, and Director of Defense Metals commented: "Drilling within the north central area of the Wicheeda Deposit has returned some of our most significant intercepts of REE mineralization on a grade X width basis in WI21-48 while also yielding some of the highest grade REE mineralization to date near surface."

Delineation drill holes WI21-45 (-75o dip / 240o azimuth) and WI21-47 (-45o dip / 145o azimuth) established the northwest margin of the Wicheeda Deposit in the near surface intercepting mixed syenite and xenolithic carbonatite rocks above resource cut-off grade averaging 1.46% TREO over 116 metres; including 2.27% TREO over 42 metres1; and 0.58% TREO over 81 metres1, respectively (Table 1 and Figure 1).

Infill drill holes WI21-46 (-50o dip / 190o azimuth) and WI21-48 (-60o dip / 280o azimuth) targeting the north central area of the deposit both yielded broad REE mineralized dolomite carbonatite intercepts consistent with nearby drill holes. WI21-46 drilling southwest and exiting the interpreted structural footwall of the deposit returned 1.66% TREO over 116 metres; including 2.27% TREO over 42 metres, and 2.32% TREO over 18 metres1. Drilling southeast WI21-48 returned 2.50% TREO over 176 metres; including 6.14% TREO over 20 metres1 from surface (Figure 2).

1 The true width of REE mineralization is estimated to be 70-100% of the drilled interval. |

Table 1. Wicheeda REE Deposit 2021 Diamond Drill Intercepts

Hole ID | From (m) | To (m) | Interval (m) | TREO2 (%) | Ce2O3 (%) | La2O3 (%) | Nd2O3 (%) | Pr2O3 (%) | Sm2O3 (ppm) | Gd2O3 (ppm) | Eu2O3 (ppm) | Dy2O3 (ppm) | Tb4O7 (ppm) | Ho2O3 (ppm) |

WI21-45 (240/-75) | 47.8 | 106.9 | 59.1 | 1.46 | 0.67 | 0.51 | 0.17 | 0.06 | 230 | 134 | 83 | 43 | 13 | 6 |

including | 47.8 | 74 | 26.2 | 2.48 | 1.13 | 0.88 | 0.29 | 0.10 | 384 | 225 | 151 | 67 | 21 | 8 |

WI21-46 (190/-50) | 18.9 | 135.3 | 116.4 | 1.66 | 0.80 | 0.56 | 0.20 | 0.06 | 229 | 108 | 47 | 28 | 9 | 3 |

including | 48 | 90 | 42 | 2.27 | 1.09 | 0.79 | 0.25 | 0.09 | 271 | 112 | 48 | 22 | 8 | 2 |

including | 117.55 | 135.3 | 17.75 | 2.32 | 1.12 | 0.74 | 0.30 | 0.09 | 350 | 170 | 75 | 42 | 14 | 5 |

WI21-47 (280/-60) | 17 | 98.36 | 81.36 | 0.58 | 0.28 | 0.18 | 0.08 | 0.02 | 108 | 67 | 30 | 29 | 7 | 4 |

WI21-48 (145/-45) | 12 | 188 | 176 | 2.50 | 1.22 | 0.84 | 0.29 | 0.10 | 306 | 130 | 57 | 27 | 10 | 3 |

including | 12 | 32 | 20 | 6.15 | 2.98 | 2.11 | 0.69 | 0.24 | 669 | 311 | 142 | 80 | 25 | 9 |

WI21-33 (350/-80) | 5.00 | 201.00 | 196 | 3.17 | 1.52 | 1.07 | 0.37 | 0.13 | 382 | 181 | 81 | 42 | 14 | 4 |

including | 5.00 | 55.25 | 50.25 | 3.63 | 1.74 | 1.26 | 0.41 | 0.14 | 396 | 181 | 84 | 52 | 16 | 6 |

including | 146.00 | 201.00 | 55.00 | 4.29 | 2.07 | 1.48 | 0.47 | 0.17 | 489 | 232 | 112 | 52 | 18 | 5 |

WI21-34 (040/-55) | 3.00 | 117.00 | 114.00 | 2.97 | 1.46 | 1.02 | 0.33 | 0.11 | 323 | 134 | 58 | 23 | 9 | 2 |

including | 3.00 | 70.00 | 67.00 | 3.84 | 1.89 | 1.34 | 0.41 | 0.15 | 379 | 160 | 69 | 29 | 11 | 3 |

WI21-35 (080/-55) | 1.20 | 121.00 | 119.80 | 3.87 | 1.87 | 1.34 | 0.43 | 0.15 | 434 | 200 | 88 | 52 | 17 | 6 |

WI21-36 (108/-80) | 1.10 | 174.00 | 172.90 | 2.34 | 1.14 | 0.78 | 0.27 | 0.09 | 293 | 134 | 59 | 35 | 11 | 4 |

including | 1.10 | 35.65 | 34.55 | 3.45 | 1.66 | 1.21 | 0.38 | 0.13 | 374 | 170 | 72 | 37 | 13 | 4 |

including | 136.00 | 174.00 | 38.00 | 3.02 | 1.46 | 1.05 | 0.33 | 0.12 | 337 | 157 | 68 | 40 | 13 | 4 |

WI21-37 (108/-45) | 2.00 | 139.85 | 137.85 | 3.19 | 1.56 | 1.10 | 0.35 | 0.12 | 351 | 144 | 66 | 30 | 11 | 3 |

including | 2.00 | 57.00 | 55.00 | 4.00 | 1.96 | 1.38 | 0.42 | 0.15 | 427 | 164 | 76 | 35 | 12 | 3 |

WI21-38 (220/-70) | 1.35 | 82.00 | 80.65 | 3.08 | 1.50 | 1.07 | 0.33 | 0.12 | 346 | 154 | 70 | 40 | 13 | 4 |

including | 1.35 | 24.75 | 23.4 | 6.01 | 2.91 | 2.14 | 0.62 | 0.23 | 607 | 246 | 114 | 60 | 20 | 6 |

WI21-39 (285/-60) | 4 | 114 | 110 | 2.62 | 1.28 | 0.87 | 0.30 | 0.10 | 320 | 158 | 73 | 42 | 13 | 5 |

and | 114 | 224.8 | 110.8 | 0.72 | 0.35 | 0.21 | 0.10 | 0.03 | 129 | 75 | 31 | 30 | 8 | 4 |

WI21-40 (345/-65) | 2.75 | 165 | 162.25 | 3.23 | 1.57 | 1.11 | 0.36 | 0.13 | 370 | 158 | 70 | 39 | 13 | 4 |

including | 2.75 | 47.5 | 44.75 | 4.21 | 2.05 | 1.46 | 0.46 | 0.16 | 452 | 197 | 92 | 61 | 18 | 7 |

including | 96 | 167 | 71 | 3.67 | 1.79 | 1.26 | 0.41 | 0.14 | 411 | 173 | 75 | 35 | 13 | 3 |

WI21-43 (045/-85) | 10.75 | 124.1 | 113.35 | 0.55 | 0.26 | 0.17 | 0.07 | 0.02 | 121 | 84 | 33 | 35 | 9 | 5 |

WI21-44 (240/-60) | 17.5 | 125.6 | 108.1 | 1.72 | 0.83 | 0.57 | 0.20 | 0.07 | 266 | 141 | 69 | 47 | 14 | 6 |

including | 35 | 89 | 54 | 2.59 | 1.24 | 0.87 | 0.29 | 0.10 | 384 | 205 | 102 | 70 | 20 | 9 |

2TREO % sum of CeO2, La2O3, Nd2O3, Pr6O11, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3 and Ho2O3. |

About the Wicheeda REE Property

The 100% owned 2,008-hectare Wicheeda REE Property, located approximately 80 km northeast of the city of Prince George, British Columbia, is readily accessible by all-weather gravel roads and is near infrastructure, including power transmission lines, the CN railway, and major highways.

The Wicheeda REE Project yielded a robust 2021 PEA that demonstrated an after-tax net present value (NPV@8%) of $517 million, and 18% IRR[3]. A unique advantage of the Wicheeda REE Project is the production of a saleable high-grade flotation-concentrate. The PEA contemplates a 1.8 Mtpa (million tonnes per year) mill throughput open pit mining operation with 1.75:1 (waste:mill feed) strip ratio over a 19 year mine (project) life producing and average of 25,423 tonnes REO annually. A Phase 1 initial pit strip ratio of 0.63:1 (waste:mill feed) would yield rapid access to higher grade surface mineralization in year 1 and payback of $440 million initial capital within 5 years.

Methodology and QA/QC

The analytical work reported on herein was performed by ALS Canada Ltd. (ALS) at Langley (sample preparation) and Vancouver (ICP-MS fusion), B.C. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geoanalytical laboratory and is independent of the Defense Metals and the QP. Drill core samples were subject to crushing at a minimum of 70% passing 2 mm, followed by pulverizing of a 250-gram split to 85% passing 75 microns. A 0.1-gram sample pulp was then subject to multi-element ICP-MS analysis via lithium-borate fusion to determine individual REE content (ME-MS81h). Defense Metals follows industry standard procedures for the work carried out on the Wicheeda Project, with a quality assurance/quality control (QA/QC) program. Blank, duplicate, and standard samples were inserted into the sample sequence sent to the laboratory for analysis. Defense Metals detected no significant QA/QC issues during review of the data.

Qualified Person

The scientific and technical information contained in this news release as it relates to the Wicheeda REE Project has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a director of Defense Metals and a "Qualified Person" as defined in NI 43-101. Mr. Raffle verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained therein.

About Defense Metals Corp.

Defense Metals Corp. is a mineral exploration and development company focused on the acquisition, exploration and development of mineral deposits containing metals and elements commonly used in the electric power market, defense industry, national security sector and in the production of green energy technologies, such as, rare earths magnets used in wind turbines and in permanent magnet motors for electric vehicles. Defense Metals owns 100% of the Wicheeda Rare Earth Element Property located near Prince George, British Columbia, Canada. Defense Metals Corp. trades in Canada under the symbol "DEFN" on the TSX Venture Exchange, in the United States, under "DFMTF" on the OTCQB and in Germany on the Frankfurt Exchange under "35D".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

3 Independent Preliminary Economic Assessment for the Wicheeda Rare Earth Element Project, British Columbia, Canada, dated January 6, 2022, with an effective date of November 7, 2021, and prepared by SRK Consulting (Canada) Inc. is filed under Defense Metals Corp.'s Issuer Profile on SEDAR (www.sedar.com). |

Cautionary Statement Regarding "Forward-Looking" Information

This news release contains "forward–looking information or statements" within the meaning of applicable securities laws, which may include, without limitation, statements relating to advancing the Wicheeda REE Project, drill results including anticipated timeline of such results/assays, the Company's plans for its Wicheeda REE Project, expanded resource and scale of expanded resource, expected results and outcomes, the technical, financial and business prospects of the Company, its project and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of rare earth elements, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company's profile on SEDAR at www.sedar.com. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological and engineering assumptions, decrease in the price of rare earth elements, the impact of Covid-19 or other viruses and diseases on the Company's ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed drilling results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.21 |

| Daily Volume: | 2,502 |

| Market Cap: | US$81.980M |

October 31, 2025 June 04, 2025 May 21, 2025 April 28, 2025 | |