Sunday - July 27, 2025

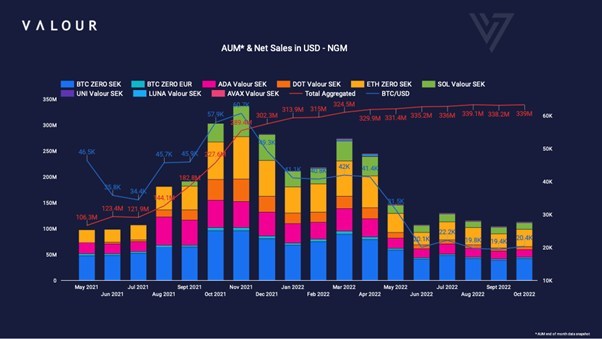

For the month ending October '22, Valour's total assets under management (AUM) stood at $112.85M, with net sales increasing to $339M.

Valour Inc. (the "Company" or "Valour") (NEO: DEFI) (GR: RMJR) (OTC: DEFTF), a technology company and the first and only publicly traded company that bridges the gap between traditional capital markets, Web3 and decentralised finance, is pleased to share updates on assets under management, net sales of its Exchange Traded Products ("ETPs") and other corporate news for the month ending October 2022.

For the month ending October '22, Valour's total assets under management (AUM) stood at $112.85M, with net sales increasing to $339M. These figures indicate a healthy interest in Valour's suite of exchange traded products, and steady growth all round.

The launch of Valour's 12th ETP, the Valour Digital Asset Basket 10 (VDAB10), as well as Valour's recent filing of a new EU-base prospectus reflect the company's undisputed resolve in bridging traditional financial markets with decentralised finance and Web3.

"Despite current macro trends, Valour is committed to innovating and launching exciting products all while we continue to see a net inflow of sales," said CEO Olivier Roussy Newton. "We are well positioned for the next bull cycle when you consider our net sales stood at $289 million in November of 2021 where our AUM was at a high of $374 million compared to today where we have added roughly $50 million in net sales. I am confident we'll continue to see a positive reception to our products while we build out our sales efforts in the DACH region which include strategic partnerships that will push our sales and AUM higher - once we see asset prices rebound."

In other corporate news, October saw several material developments including the strategic appointment of Olivier Roussy Newton as company CEO, the launch of Valour's first Multi-Asset ETP and Valour's confirmation of action on forked assets following the Ethereum merge. Further details are below.

Valour Inc. announced the filing of a new EU-Base prospectus covering digital asset exchange traded products (ETPs) with the Swedish regulator, SFSA. If approved, the prospectus will enable Valour to enhance its offering of digital asset performance tracking securities, including new index solutions, asset class mixes and derivative features. Thus, Valour will qualify to offer a wide range of ETP securities in the future, combining digital asset exposure with other asset classes such as equities and commodities, third-party funds' performances, and derivative tools, e.g. leveraged or capital protection investments.

Valour Inc. confirmed the consolidation of its full prorated ETHW allocation received as a result of the ETHPoW fork. Proceeds from the sale were reinvested into the underlying asset of Valour's Ethereum Zero certificate products, namely the native ETH of the upgraded Proof-of-Stake (beacon) chain. The change was reflected through an adjustment to the NAV (Net Asset Value) of both Valour Ethereum Zero certificates (SEK and EUR denominated), as updated on 19 October 2022.

Valour Inc. announced the launch of its first Multi-Asset exchange traded product (ETP). Currently available on the Börse Frankfurt exchange, the Valour Digital Asset Basket 10 Index (VDAB10) tracks the performance of the top 10 largest crypto assets based on market capitalization, with a maximum portfolio allocation of 30% per constituent. Having partnered with industry-leading index provider Vinter in the structuring of the basket product, Valour's 12th ETP enables both retail and institutional investors to gain a trusted and diversified exposure to the rapidly growing crypto space. The latest launch marks the company's resolve in furthering its mission to bridge the gap between traditional capital markets, Web3 and decentralised finance, undeterred by current market conditions.

Valour Inc. announced the appointment of Olivier Roussy Newton as CEO. The strategic appointment will see Olivier spearhead the company's growth trajectory, increase its reach and build new partnerships to align the company's global corporate governance initiatives. As Co-Founder of Valour, Mr. Roussy Newton brings ample experience to the role having previously founded and served as President of the first publicly traded crypto miner, HIVE Blockchain Technologies (NASDAQ:HIVE), as well as sitting on the board of SEBA Bank AG, and acting as Partner at Latent Capital, an investment fund focused on breakthrough technology in quantum computing, finance and bioinformatics. Meanwhile, Executive Chairman, Russell Starr re-assumed the role of head of capital markets, utilising his deep capital markets and industry expertise to build out the company's presence in North America, having overseen Valour's advancement across European exchanges and the expansion of the company's ETP offerings during his tenure as CEO.

The Company also announces that Mr. Johan Wattenstrom has resigned as Chief Operating Officer of the Company to focus his efforts in developing Valour Inc. (Cayman)'s ("Valour Cayman's") ETP offerings. Mr. Wattenstrom remains a director of Valour Cayman, and the board and management appreciates Mr. Wattenstrom's contributions as Chief Operating Officer of the Company looks forward to continue working with Mr. Wattenstrom.

Valour offers fully hedged digital asset ETPs with low to zero management fees, with product listings across European exchanges, banks and broker platforms. Valour's existing product range includes Valour Uniswap (UNI), Cardano (ADA), Polkadot (DOT), Solana (SOL), Avalanche (AVAX), Cosmos (ATOM), Binance (BNB), Enjin (ENJ), Valour Bitcoin Carbon Neutral, and Valour Digital Asset Basket 10 (VDAB10) ETPs with low management fees. Valour's flagship products are Bitcoin Zero and Ethereum Zero, the first fully hedged, passive investment products with Bitcoin (BTC) and Ethereum (ETH) as underlyings which are completely fee free.

Valour Inc. (NEO: DEFI) (GR: RMJ.F) (OTCQB: DEFTF) is a technology company and the first and only publicly traded company that bridges the gap between traditional capital markets and decentralised finance. Founded in 2019, Valour is backed by an acclaimed and pioneering team with decades of experience in financial markets and digital assets. Valour's mission is to expand investor access to industry-leading Web3 and decentralised technologies. This allows investors to access the future of finance via regulated equity exchanges using their traditional bank account and access.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to interest in the Company's ETP products; sales and AUM expectations; the regulatory environment with respect to the growth and adoption of decentralized finance; appointment and resignations of officers; the pursuit by Valour and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited the acceptance of Valour exchange traded products by exchanges; growth and development of DeFi and cryptocurrency sector; rules and regulations with respect to DeFi and cryptocurrency; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| Last Trade: | US$3.97 |

| Daily Volume: | 0 |

| Market Cap: | US$1.300B |

July 22, 2025 July 14, 2025 June 10, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS