Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Consolidated Uranium Closes Acquisition of the Milo Uranium-Copper-Gold-REE and is Granted Gidyea Creek Project Tenements in Queensland, Australia

Consolidated Uranium Inc. (“CUR” or the “Company”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce that its has closed the previously announced acquisition (the “Acquisition”) of a 100% undivided interest in the Milo Uranium, Copper, Gold, Rare Earth Project (“Milo” or the “Project”) pursuant to the definitive sale and purchase agreement (the “Agreement”) dated November 10, 2021 between CUR and Isa Brightlands Pty Ltd (the “Vendor”), a wholly owned subsidiary of GBM Resources (“GBM”) (ASX: GBZ). The Project consists of Exploration Permit – Minerals (EPM) 14416, which includes 20 sub blocks or approximately 34 square kilometres located within The Mt Isa Inlier, approximately 40 kilometres west of Cloncurry in Northwestern Queensland, Australia.

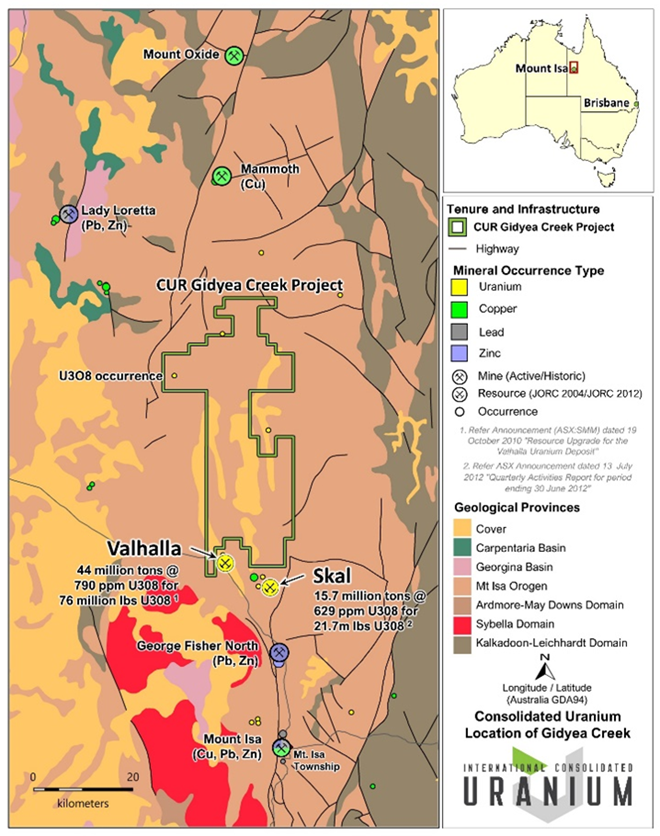

The Company is also pleased to advise that it has been granted three contiguous EPMs located approximately 65 km north of the town of Mount Isa in Queensland Australia, by the Department of Natural Resources, Mines and Energy (Figure 1). This new project called Gidyea Creek, covers an area of 785 kilometres2 and is located immediately adjacent to Paladin Energy Ltd.’s Valhalla Project, which ranks as the largest uranium deposit in the state.

Philip Williams, CEO commented, “Australia remains an important jurisdiction for CUR, and we are pleased to have closed the Milo Acquisition and established a foothold in the Mt Isa region with the granting of the Gidyea Creek project tenements. Increasingly, end users of uranium and investors are recognizing the importance of projects domiciled in geopolitically stable and mining friendly jurisdictions. The CUR global portfolio was constructed with this in mind, with the bulk of our projects located in Australia, Canada and the U.S. and we will look to continue to add projects in these and other top tier jurisdictions. Like many of our other projects, we believe that both Milo and Gidyea Creek boast strong exploration potential which we intend to pursue in short order. Our team is busy reviewing historic data from these and our other Australian projects and we look forward to providing more details on planned work programs in the coming months.”

In connection with closing of the Acquisition, CUR issued to GBM 750,000 common shares of the Company (“Common Shares”), at a deemed price of $2.85 per share which is based on the seven-day volume-weight average price of the CUR Shares on the TSX Venture Exchange (“TSXV”) up to the date immediately prior to signing of the Agreement. In addition, CUR has assumed GBM’s obligations pursuant an existing 2% NSR royalty on the value of gold or other mineral derived from ore produced from the Project payable to Newcrest Mining Limited

The Common Shares issued in connection with the Acquisition are subject to final approval of the TSXV and subject a statutory hold period under Canadian securities legislation ending on August 21, 2022.

The Milo Uranium, Copper, Gold, Rare Earth Project

The Milo deposit is a large IOCG breccia style system where base and precious metal mineralization occurs as moderate to steeply north-east dipping, sulphide rich breccia zones which are enclosed by a zone of TREEYO-P2O5 enrichment forming a halo to the base metal mineralization. Drilling by GBM from 2010 to 2012 totalled 32 drillholes with each phase of drilling extending the mineralization to the north and south. The drilling has delineated continuous Uranium, Cu and REE mineralization over a strike length of 1 kilometre and up to 200 metres wide. The 2012 drilling program intersected some high-grade Cu mineralization including 2 metres @ 6.19% Cu at 163 m downhole in MIL015, one of the most southerly drilled holes.

Exploration potential at Milo is considered to be good. Much of the previous work at Milo, including the bulk of drilling, has been directed at the Milo Gossan. A similar gossan occurs immediately to the west (Milo Western Gossan) and is over 1 kilometre long. It has a similar Radiometric signature to Milo. In addition, a further large untested radiometric anomaly occurs approximately 1 kilometre to the North (Milo North) which has the largest radiometric anomaly on the tenement. Previous work has focused on the rare earth potential of the project rather than the Uranium potential.

Mining One Consultants (“Mining One”), an independent consulting company, prepared a technical report on the Project in accordance with the disclosure standards of JORC, 2004 entitled “Milo Project Scoping Study” dated March 2013. Geomodelling Ltd. was contracted by GBM to generate a block model resource estimate for the deposit for inclusion in the Mining One report., which was detailed in a CUR news release dated November 10, 2021. This mineral resource estimate is considered to be a “historical estimate” for CUR as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and is not considered by the Company to be current and the Company is not treating it as such. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources. CUR would need to review and verify the previous drill hole data and conduct an exploration program, including twinning of historical drill holes in order to verify the historical estimate as a current mineral resource.

The Gidyea Creek Project

The Gidyea Creek Project tenure is located within the highly prospective Leichhardt River Fault Trough (LRFT), part of the Western Succession of the Mount Isa Basin. The Western Succession has a long history of Uranium exploration (over 50 years) and is associated with over 100 recorded uranium occurrences hosted within the Paleoproterozoic metasediments and mafic volcanic rocks (Polito et al., 2007) that belong to the Eastern Creek Volcanics (ECV). The majority of known uranium occurrences in the ECV occur to the east by the Gorge Creek Fault and the Quilalar Fault Zone, to the north by the Crystal Creek Fault, to the west by the eastern margin of the Sybella Granite and the Twenty-nine Mile Fault and to the south by a zone coincident with the Mount Isa township (Polito et al, 2007). The mineral occurrences are observed as ironstone gossans some associated with small historic uranium workings, generally co-incident with large radiometric, magnetic and geochemical anomalies. The most significant of these occurrences is the Valhalla group of deposits (Valhalla, Odin, Skal) which occur just to the south of the Gidyea Creek Tenement boundary.

The Valhalla deposit is an epigenetic, hydrothermal, structurally controlled and albitite-hosted deposit of uranium. It is located within a NNW-striking sequence of intercalated metabasalt, laminated meta-shales and meta-siltstone units of the Eastern Creek Volcanics, which form a thick rift/sag sequence within the Leichhardt River Domain of the Mount Isa western succession (Cover Sequence 2) thought to have occurred between 1740 and 1680 Ma within the latest Paleoproterozoic. The Valhalla and Skal mineralisation are hosted by hematite-magnetite–carbonate breccias associated with a zone of intense mylonitic/cataclastic shearing and hydraulic brecciation.

The presence of significant zones of uranium and copper mineralisation, the proximity to the regional Mt Isa Fault zone, the proximity to granite intrusives and the mineralogy of the known deposits have been taken to imply that the mineralisation has an IOCG association (Hitzman and Valenta, 2005), however others hypothesize that the uranium deposits are metamorphosed equivalents of Proterozoic unconformity-type uranium deposits (Gregory et al, 2005).

The primary exploration target at Gidyea Creek is potential uranium occurrences with the ECV sequences which extend through the Gidyea Creek project tenure. Initial exploration activity will consist of data integration and review, in conjunction with development and refinement of the mineralization models to define first-order targets within the project tenure.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Peter Mullens (FAusIMM), CUR’s VP Business Development, who is a “Qualified Person” (as defined in NI 43-101).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB: CURUF) was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, the Company has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development. Most recently, the Company completed a transformational strategic acquisition and alliance with Energy Fuels Inc., a leading U.S.-based uranium mining company, and acquired a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning CUR as a near-term uranium producer.

For More Information, Please Contact

Philip Williams

President and CEO

This email address is being protected from spambots. You need JavaScript enabled to view it.

Mars Investor Relations

+1 647 557 6640

This email address is being protected from spambots. You need JavaScript enabled to view it.

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither the TSXV nor its Regulations Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including, but not limited to, the Company’s ongoing business plan, exploration and work programs. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Consolidated Uranium set out in CUR’s annual information form in respect of the year ended December 31, 2020 filed with the Canadian securities regulators and available under CUR’s profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$1.42 |

| Daily Volume: | 0 |

| Market Cap: | US$183.980M |

December 05, 2023 December 01, 2023 November 20, 2023 | |