Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Critical Elements Lithium: Open Letter to Shareholders from Chair of the Board of Directors Eric Zaunscherb

MONTRÉAL, QC / ACCESSWIRE / June 15, 2023 / Critical Elements Lithium Corporation (TSX-V:CRE)(US OTCQX:CRECF)(FSE:F12) ("Critical Elements" or the "Company") today announced that Chair of the Board of Directors, Eric Zaunscherb has issued an open letter to shareholders.

As Chair of the Board of Directors of Critical Elements Lithium Corporation, it has been a fruitful few weeks communicating directly with shareholders and investors, via timely marketing and other initiatives.

In this letter, I want to address the recent decline in our share price and provide an update on the status of our strategic partnership negotiations. However, before diving into these topics, I want to take a moment to remind our shareholders why they own shares of Critical Elements Lithium and why our management team is passionately dedicated to realizing the potential of the Rose project:

- Continued healthy lithium demand for electric vehicles and energy storage systems as supply growth remains challenged.

- Strong economic support for the development of lithium projects available from the governments of Québec, Canada, and the United States.

- Pikhuutaau Agreement (IBA) signed July 2019 with the Cree Nation of Eastmain, the Grand Council of the Crees (Eeyou Istchee), and the Cree Nation Government.

- An important land package for hardrock lithium exploration and development in North America, with the right geological setting, scale (1,050 square kilometres), proximity to infrastructure (roads and inexpensive, 100% renewable energy), and location in Québec - known as one of the top mining jurisdictions globally.

- Robust Rose lithium-tantalum project

- 2022 Feasibility Study (see press release dated June 13, 2022) for a mine and concentrator annually producing ~175,000 tonnes of high purity spodumene concentrate for the battery industry, and ~50,000 tonnes of premium spodumene concentrate for the glass and ceramics industry.

- A conservative price deck delivering a US$1.9 billion after-tax NPV (8%) and 82.4% internal rate of return.

- Key approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government, and received the Certificate of Authorization pursuant to section 164 of Québec's Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks, as well.

- Advanced strategic funding negotiations to support a Final Investment Decision ongoing.

- Critical Elements Lithium is a home-grown company with strong Québec roots. Management, including the recently recruited owner's team headed by Yves Perron, VP Engineering, Construction and Reliability, has extensive experience in discovering, engineering, and constructing mining projects in the province. Management is also uniquely endowed with lithium industry experience: Drs. Steffen Haber and Marcus Brune, former CEO and CFO, respectively, of Rockwood Lithium, were instrumental in building, growing, and ultimately selling Rockwood Lithium for US$6.2 billion in January 2015.

Why is Critical Elements Lithium's share price down?

High close for Critical Elements Lithium's share price was $2.92 on February 6, 2023. Since then, the share price has closed as low as $1.65, a fall of 43%. What are the market headwinds that have stalled the Company's share price growth? Which are the factors that are external to the Company (i.e., things we cannot change) versus factors that are internal and under the control of the Company? I would suggest that these are the key factors highlighted to us by investors:

- Spot lithium pricing weakness,

- Strategic deal fatigue,

- Challenged timeline guidance,

- Sparse corporate communications, and

- Concerns about an imminent equity financing.

Spot lithium pricing weakness

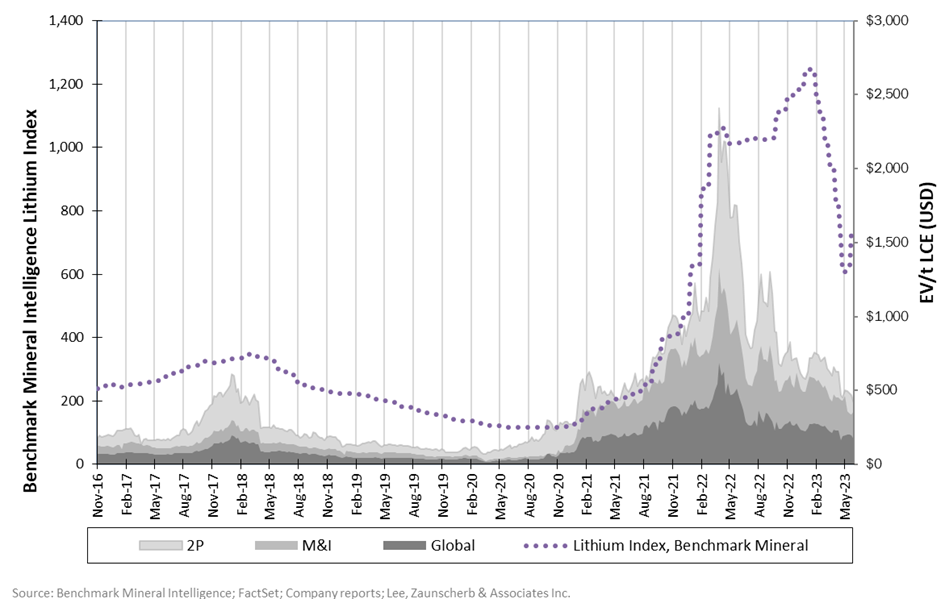

Since the beginning of the year, the post-COVID opening economic bounce expected in China has failed to materialize. This, and fears of recession elsewhere globally, have dampened enthusiasm for industrial metals. The S&P/TSX Global Mining Index captures the equity expression of these fears, falling 16% since the end of January to its recent low. Copper has gone through a similar correction (13%) over the same period. Spot lithium, poster child for decarbonization, has gone through an even more dramatic correction. The Benchmark Mineral Intelligence Lithium Index peaked in January 2023 at 1248 and fell 51% into May, before beginning its recent rebound of 21% (see Figure 1). The Global X Lithium & Battery Tech ETF (LIT), representing both materials and end-users, caught that cold dropping 20% from the beginning of February into April before rebounding 12% recently.

The spot market for spodumene concentrate is miniscule relative to that traded under contract. It is exposed to inventory stocking and destocking by end-users, which had been very vocal at the end of 2022 about lithium pricing being too high. For an excellent discussion on this topic, view RK Equity's Rodney Hooper on The Assay, May 2023. Despite being a de minimis portion of the market, spot spodumene concentrate prices are, unfortunately, the most visible and available to investors. In my opinion, this means that the spot lithium "tail" can wag the lithium equity "dog". Figure 1 also shows valuations expressed as enterprise value per tonne of lithium carbonate equivalent for exploration and development companies and how they have been negatively impacted by the spot price decline.

Actual realized spodumene concentrate prices, largely through market-related contracts, have remained robust in Q1/2023 (e.g., Pilbara at US$4,840/t and AMG at US4,846/t). By contrast, Fastmarkets' spot spodumene concentrate price assessment (min 6% Li2O, CIF China) is currently close to US$4,000/t. Unfortunately, we only get visibility on actual realized pricing weeks after the end of the past quarter.

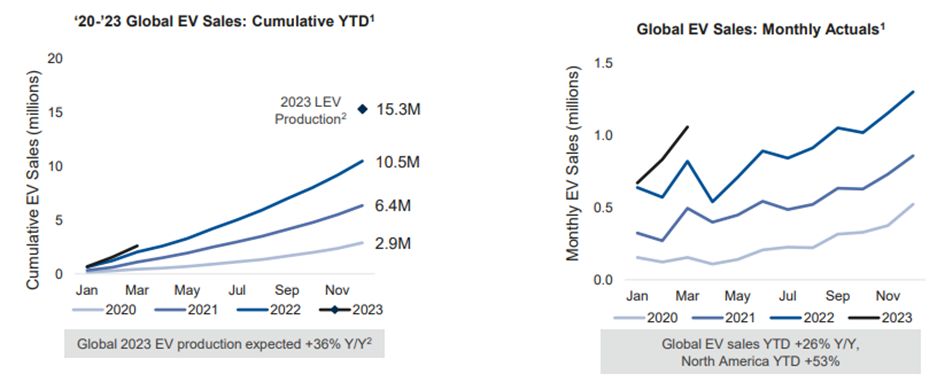

Although Chinese consumers may be keen to talk spodumene concentrate prices down early in the year, the inventory destocking that seems to occur annually is also related to the seasonality of EV sales (see Figure 2) as buyers scramble to buy vehicles before the year-end expiry of subsidies (particularly in China). Global EV sales continue to be robust with strong growth forecasts. Canaccord Genuity, for example, has called the bottom of the market (Lithium | 1H'23 recharge: Chinese pricing bottoms as demand rolls on, May 5) looking for "market deficits to widen materially into the late 2020s" driven by "persistent demand tension" and "challenges to long-term supply growth." From my perspective, lithium demand remains robust for the foreseeable future while supply will likely surprise to the downside as the industry struggles with inherent sovereign, financial, and execution risks.

Figure 1: Benchmark Mineral Intelligence Lithium Index vs. Lithium Equity Valuations (EV/t)

Figure 2: Global EV sales, cumulative and monthly by year

A big factor cited by investors concerned by Critical Elements Lithium's share price performance is strategic deal fatigue. As noted earlier this year (see press releases dated February 1, 2023 and May 16, 2023) Critical Elements commenced a formal process to receive and analyze multiple expressions of interest in participating in the financing and development of the Rose Project. There is the sense that since the formal process began after the Rose project received its Certificate of Authorization from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks last year (see press release dated November 2, 2022), this process should have been concluded by now with a strategic deal providing the capital for project development in hand. Surely the fact that it hasn't, indicates that the "collapse" in lithium pricing (see discussion above) has diminished interest in the Rose project, that there is something wrong with the project, or that management is holding out for the perfect deal, or worse, is incompetent. The perceived delay in financing is pushing timelines out interminably. I want to assure the shareholder that, as we have continuously reported, the process is ongoing, and that interest is increasing not decreasing.

I sympathize with the market's frustrations as time seemingly slips by. I remain, however, highly confident in our management. Management has done a superb job of execution in advancing the Rose project. Past lithium projects in Québec were rushed and resulted in poor outcomes for investors and a tainted reputation for Québec. Critical Elements Lithium today stands as the only home-grown bearer of the Fleur-de-lys in the lithium space, with a robust feasibility study, an Impact and Benefits Agreement with our Cree neighbours, the key environmental permits required to move forward, and an owners' team with the proven expertise to execute. CEO Jean-Sébastien Lavallée's dogged determination and passionate dedication, supported by CFO Nathalie Laurin, have made the project's advancement possible, while President Steffen Haber and VP Finance Marcus Brune are applying their hard-won lithium industry experience from the former Rockwood Lithium to anchor the strategic team and counter the heavyweights on the other side of the negotiating table.

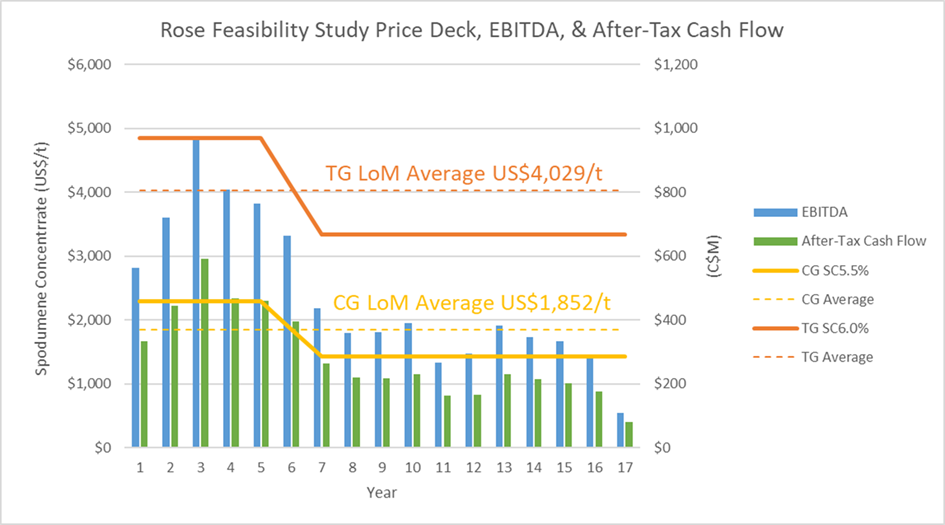

The strategic investment timeline is not delaying the project timeline. We have not "missed" the lithium pricing opportunity as serious market forecasters (e.g., Canaccord Genuity in Lithium | 1H'23 recharge: Chinese pricing bottoms as demand rolls on, May 5, and RK Equity on The Assay, May 2023) see significant supply deficits ahead of us. The price deck used in the Updated Feasibility Study (see press release dated July 27, 2022 announcing the filing of the NI43-101 technical report) is conservative relative to the current pricing outlined above. Figure 3 shows the price assumptions used for premium Technical Grade spodumene concentrate to be used by the glass and ceramics industry and the Chemical Grade spodumene concentrate to be used in conversion for the battery industry.

Figure 3: Rose Project Feasibility Study price assumptions for premium Technical Grade (TG) and Chemical Grade (CG) spodumene concentrate.

There are several project arcs that need to be advanced together before a Final Investment Decision ("FID") can be made:

- Strategic partnership and project financing (see discussion above).

- Detailed engineering is currently at 35% and management targets achieving 60% to 65% completion in August; this is normally the threshold level of detailed engineering at which an FID is possible. We are on track with positive outcomes.

- The conditions required under the Pikhuutaau Agreement (see press release dated July 8, 2019), the Favourable Decision Statement of the Federal Minister of Environment and Climate Change (see press release dated August 11, 2021), and the Certificate of Authorization from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks, are extensive. These involve putting into place sophisticated programs and procedures, as well as the committees to monitor and oversee them. Several routine permits need to be applied for and granted. This process must be well-advanced before an FID can be made. Our relationship with our Cree neighbours remains very positive with collaborative goals well-aligned.

- There are some key long lead-time equipment orders that must be placed, after detailed drawings are produced as part of the detailed engineering stage, to achieve the projected timeline. We expect to see these items ordered in this calendar quarter.

The strategic investment timeline is one of several project arcs that merge in advance of a project's FID. Putting an arbitrary deadline on the table yields the advantage to the party(s) on the other side of the negotiation table. Every time an OEM or other end-user enters into a supply agreement, the other end-users see the supply pool shrinking; this is a seller's market and market intensity is increasing, not declining. Management is negotiating for the optimal deal for stakeholders, fully recognizing that the perfect deal does not exist.

Challenged timeline guidance

As I have stated, management has done a superb job of execution, in advancing the project. Management is under constant pressure to provide timeline guidance. Admittedly, the guidance provided has been "challenged" at times and has proven optimistic in some cases. Some timelines, like the progress of the Rose project through the thorough permitting process, are out of management's control. The mining industry is notorious for delivery delays and the lithium segment is no exception. In the Canaccord Genuity report previously mentioned, the authors note that the average project delay before ramp up, is three years. Project ramp up and commissioning is frequently an additional extended process as the project works to attain strict end-user product qualification.

Senior management of Critical Elements Lithium spent much of 2022 recruiting the right person to head the Company's owner's team. This was achieved in August 2022 (see press release dated August 2, 2022) with the appointment of Yves Perron as Vice-President, Engineering, Construction and Reliability. Since then, Mr. Perron has brought a new level of knowledge and expertise to the engineering process while building a highly qualified execution team in the unique and extremely tight Québec talent market. The execution team has taken the project through front-end engineering design, value engineering and gap analysis, a process which has greatly increased project confidence and brought us to the current detailed engineering status. Understandably, this comprehensive but essential process has taken longer than management originally anticipated. The mining industry is littered with rushed but failed projects, reinforcing the carpenter's admonition to "measure twice, cut once". Critical Elements Lithium believes it is on track to get the Rose project right from the beginning and remains highly committed to this achievement.

Sparse corporate communications

One of the criticisms leveled at the Company's management is of sparse corporate communications. This point is well-taken and we commit to improving our communications. Over the past couple of years, we have seen the emergence of exciting exploration programs and the discovery of important new lithium deposits in the James Bay Region of Québec. Figure 4 shows the well-known Lassonde Curve, which visualizes the life cycle of a mineral discovery. In the early stages of exploration and discovery, share valuations are driven by speculation as drills turn and drill results are pushed out through frequent news releases. Each new hole can arbitrarily add tens of millions of dollars as back-of-the-napkin resource estimates proliferate. Valuations frequently get ahead of themselves before the cold realities of technical studies and permitting timelines set in. These are not our Company's peers.

Critical Elements Lithium is currently in the Orphan Period of the Lassonde Curve. We have an IBA, key permits, and an owners' team that is advancing detailed engineering, but we are assembling the project financing needed before making an FID. Generally, this is the period when speculative money hands over to institutional investment in anticipation of successful construction, initiation of commercial production, and commencement of cash flow. The hallmark of this period is a significant discount in price to net asset value relative to peers, a discount that normally resets when initial cash flow is successfully delivered.

Figure 4: The Lassonde Curve visualizes the life cycle of a mineral discovery.

At this point, the market is laser-focused on the delivery of Critical Elements Lithium's Rose financing package. As discussed above, rushing this step is detrimental to the negotiation process and can lead to less-than-optimal outcomes. Project financing, for example, can be readily available at higher interest rates. As others have found out, a high cost of capital can be financially fatal. Attracting lower cost project debt requires patience for thorough due diligence and extended timelines.

Concerns about an imminent equity financing

We are informed by investors that they have been approached by at least one brokerage firm pre-marketing an equity financing for the Company. At the end of the second fiscal quarter ended February 28, Critical Elements Lithium reported a cash position of $33.9 million and working capital of $41.0 million. This monetary resource is more than sufficient to cover the Company's planned expenditures on engineering, exploration, long lead-time item purchases, and general and administrative expenses. In my view, it would be entirely undesirable and unnecessary to conduct any equity financing at this level in advance of the strategic investment package.

What is Critical Elements Lithium management doing about our share price?

I think it is quite clear why Critical Elements Lithium's share price has suffered over the past few months. More important, however, is management's intent to address it. In the Company's opinion, the answer is two-fold: first, negotiate and deliver a quality strategic investment package that will fund the development of the Rose project and, second, demonstrate the value of the Company's extensive exploration land package. We will work harder to effectively communicate our progress on these two themes.

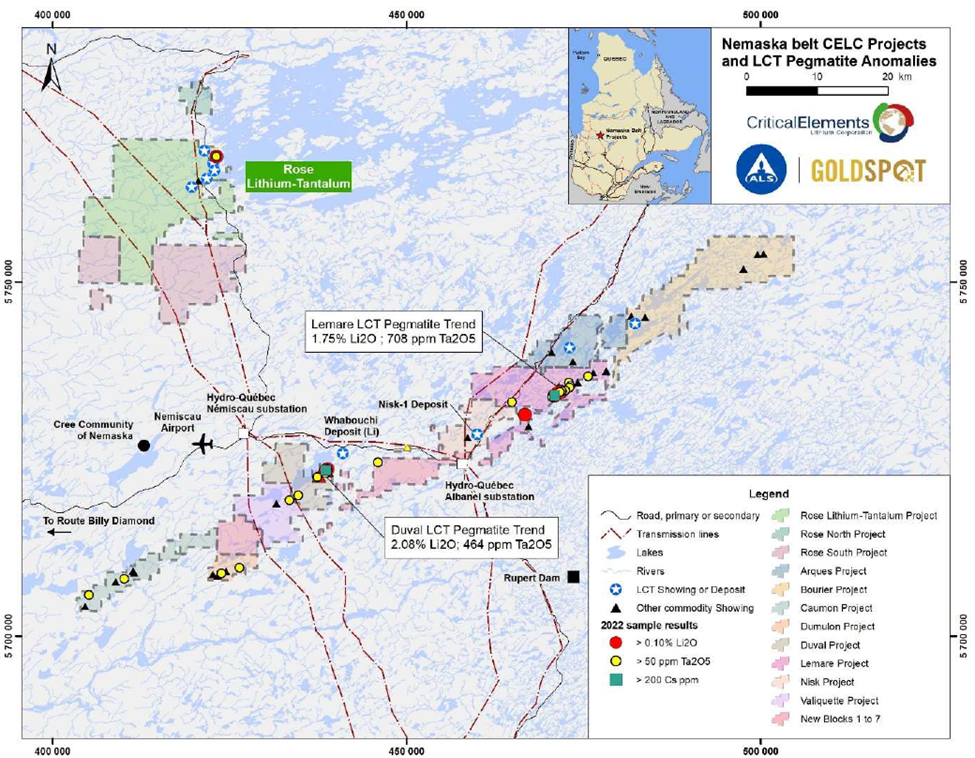

The Company's exploration portfolio (Figure 5) is extensive and well situated in Canada, measuring over 1,050 square kilometres in a top mining jurisdiction, and designed with proximity to road and power access in mind. We have already discussed the strategic process that is ongoing, so let's finish with a look at exploration.

Figure 5: Critical Elements Lithium's land package location map, including the Rose project to the northwest and the Nemaska belt projects to the south. Note the highlighted Lemare and Duval trends.

Critical Elements Lithium has outlined its exploration plans in several press releases, most recently on February 1, May 16, and May 31. In addition to demonstrating the value inherent in the Company's exploration land package, there are three goals: 1) extend the life of the Rose project, 2) advance the Lemare project toward an initial resource estimate and technical studies if warranted, and 3) demonstrate the potential of new targets highlighted via machine learning, or artificial intelligence. At this point, we believe the market is valuing Critical Elements Lithium on the Rose project alone. Some covering analysts have only included exploration value to their target net asset values this year. Over the next few months, management intends to demonstrate the potential for additional lithium mines in its portfolio, consistent with the Company's stated vision to become a large, responsible supplier of lithium.

Expanding the known mineralization at Rose and Lemare is a classic geological exercise in exploration. Drill programs at both locations will proceed systematically with pauses to compile data and establish next steps. Outcomes will be released in context as available and an update on Lemare drill results from the recent drill program is expected near-term.

With a small land package, a promotionally oriented junior company will usually drill test any pegmatite poking its head above the landscape in the hope that it is spodumene-bearing. With a massive land package, one must be more systematic and efficiently apply all the tools at one's disposal. To this end, Critical Elements Lithium's geologists have been working closely with ALS GoldSpot Discoveries Ltd. to compile all the available scientific data, process the database for trends, and develop exploration vectoring techniques. As noted in the press release of May 31, they were able to isolate "a unique geochemical signal associated with mineralized LCT pegmatite", as opposed to barren pegmatite. Once the current wildfire crisis passes, five helicopter-supported crews will resume their work to ground truth the new targets with a view to initial drill testing.

Depending on the exploration outcome of the upcoming drill programs, we believe this could be an important period in Critical Elements Lithium's history. Your continued support and patience as shareholders have been very welcome in these challenging times. We look forward to delivering results beneficial to all of us.

Eric Zaunscherb

Chair of the Board of Directors

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly owned, high purity Rose lithium project in Québec, the Corporation's first lithium project to be advanced within a land portfolio of over 1,000 square kilometers. On June 13th, 2022, the Corporation announced results of a feasibility study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at 82.4%, with an estimated after-tax net present value of US$1.9 B at an 8% discount rate. In the Corporation's view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 94% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government and also received the Certificate of Authorization pursuant to section 164 of Québec's Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks.

For further information, please contact:

Patrick Laperrière

Director of Investor Relations and Corporate Development

514-817-1119

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.cecorp.ca

Jean-Sébastien Lavallée, P. Geo.

Chief Executive Officer

819-354-5146

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including expectations regarding spodumene / lithium demand (and prices) and the potential to deliver robust returns for equity investors, expectations regarding world EV sales, growth and capacity of the EV market, expectations regarding Rose project-level activities including (i) completion of the permitting process, (ii) securing a strategic partnership and project financing leading to a Final Investment Decision and (iii) respecting the Rose project ramp up and commissioning timeline, expectations regarding potential value creation from ongoing and future exploration activities on the Company's projects, and the Company's ongoing business plan. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that fundamentals of lithium / spodumene demand and EV market growth and capacity will continue to be strong, that project financing will be available on reasonable terms, and that governmental and other approvals required to conduct the Company's development activities and planned exploration will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, reliance on key management and other personnel, potential downturns in (i) general economic conditions, (ii) demand for lithium / spodumene and (iii) EV market growth, capacity and demand, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals, and the risk factors with respect to the Company set out in its Management Discussion and Analysis for its most recent quarter ended February 28, 2023 and other disclosure documents available under the Company's SEDAR profile filed with the Canadian securities regulators at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.34 |

| Daily Volume: | 0 |

| Market Cap: | US$77.730M |

June 23, 2025 May 12, 2025 | |