Highlights:

ǂ TREO = sum of all lanthanide oxides + yttrium oxide

VANCOUVER, BC / ACCESSWIRE / May 22, 2024 / Commerce Resources Corp. (TSXV:CCE) (FSE:D7H0) (OTCQX:CMRZF) (the "Company" or "Commerce") is pleased to announce an updated mineral resource estimate ("MRE") for the Ashram Rare Earth and Fluorspar Deposit (the "Ashram Deposit" or "Ashram"). The Ashram Deposit, wholly owned by the Company, is located in northeastern Quebec, Canada, approximately 130 kilometres south of the community of Kuujjuaq.

The updated MRE for the Ashram Rare Earth and Fluorspar Deposit firmly establishes it as a globally significant rare earth element ("REE") deposit, and one of the largest monazite-mineralized carbonatite REE deposits in the world: 73.2 Mt at 1.89% TREO and 6.6% CaF2 (indicated), and 131.1 Mt at 1.91% TREO and 4.0% CaF2 (inferred), at a cut-off of $287 Net Metal Return (NMR) per tonne (7).

Ashram also continues to demonstrate very high NdPr distributions (i.e., percent of neodymium plus praseodymium oxide of the TREO) at 21.2% NdPr (indicated) and 21.4% NdPr (inferred), exceeding that of several active global producers. The favourable distribution starts at surface, allowing these high value elements to be targeted early on in a potential open-pit extraction scenario and thereby, enhancing the project's strategic value and operational efficiency. This enrichment in the magnet feed REEs also extends to dysprosium (Dy) and terbium (Tb).

The MRE update underscores the Ashram Deposit's potential as a long-term, sustainable source of critical minerals, vital for the evolving technology and energy sectors. The Company remains committed to advancing the project, with ongoing work to further delineate the deposit's full potential, and a planned niobium drill program poised to unlock additional value.

Chris Grove, President and CEO of Commerce Resources, stated: "We are very excited by this updated mineral resource estimate for the Ashram Deposit, as it positions the Company to become the front-runner in providing a long-term source of magnet-feed REE supply to the North American and European markets. Additionally, the Ashram Deposit has a fluorspar component which makes it one of the largest potential sources of fluorspar in the world. This milestone will be the new basis of future economic and development studies that further de-risk and unlock the development potential of this asset. In addition to the Ashram Deposit, the Eldor carbonatite remains highly prospective for a number of high value commodities, including niobium and phosphate minerals."

Patrik Schmidt, Company Vice President of Exploration, comments: "We are thrilled with this updated resource estimate, which continues to demonstrate the consistency of the magnet-feed REE enrichment throughout the Ashram Deposit. This resource has firmly established Ashram as one of the largest monazite-mineralized carbonatite rare earth deposits globally and remains open at depth."

The primary objective of the mineral resource update was to increase the confidence of resources from the inferred category to the indicated category to support economic and development studies. This conversion was highly successful with an 164% increase in the indicated resource category compared to the prior MRE completed in 2012 (see news release dated March 6, 2012).

The 2024 MRE was completed in accordance with National Instrument 43-101 with an Effective Date of April 4th, 2024, and is based on 117 diamond drill holes totaling 28,783 metres of NQ, HQ and BTW size drill core.

Table 1: NI 43-101 Mineral Resource Statement for Ashram Deposit

Cut-off NMR ($/t) | 287 | ||

Category | Indicated | Inferred | |

Tonnes | Mt | 73.2 | 131.1 |

Total TREO | % | 1.89 | 1.91 |

NdPr | 21.2 | 21.4 | |

TbDy | 0.7 | 0.5 | |

La2O3 | ppm | 4,829 | 4,969 |

Ce2O3 | 8,753 | 8,933 | |

Pr2O3 | 907 | 927 | |

Nd2O3 | 3,112 | 3,162 | |

Sm2O3 | 412 | 385 | |

Eu2O3 | 98 | 87 | |

Gd2O3 | 223 | 195 | |

Tb2O3 | 24 | 19 | |

Dy2O3 | 102 | 73 | |

Ho2O3 | 14 | 10 | |

Er2O3 | 31 | 21 | |

Tm2O3 | 3 | 2 | |

Yb2O3 | 18 | 13 | |

Lu2O3 | 2 | 2 | |

Y2O3 | 419 | 280 | |

Fluorspar (CaF2) | % | 6.6 | 4.0 |

(a) TREO is sum of lanthanides (as oxides) + yttrium oxide

(b) NdPr distribution calculated as (Nd2O3 + Pr2O3) / TREO x 100

(c) CaF2 calculated from fluorine assay using factor of 2.055 (F to CaF2). Assumes all fluorine is contained within the mineral fluorite ("fluorspar").

(d) Cut-off expressed as NMR ($)/t only considers payable elements La-Nd-Pr-Tb-Dy.

(e) TbDy distribution calculated as (Tb2O3 + Dy2O3) / TREO x 100.

(f) Prices shown are in CAD

(g) Differences may occur in totals due to rounding.

Notes for Resource Table:

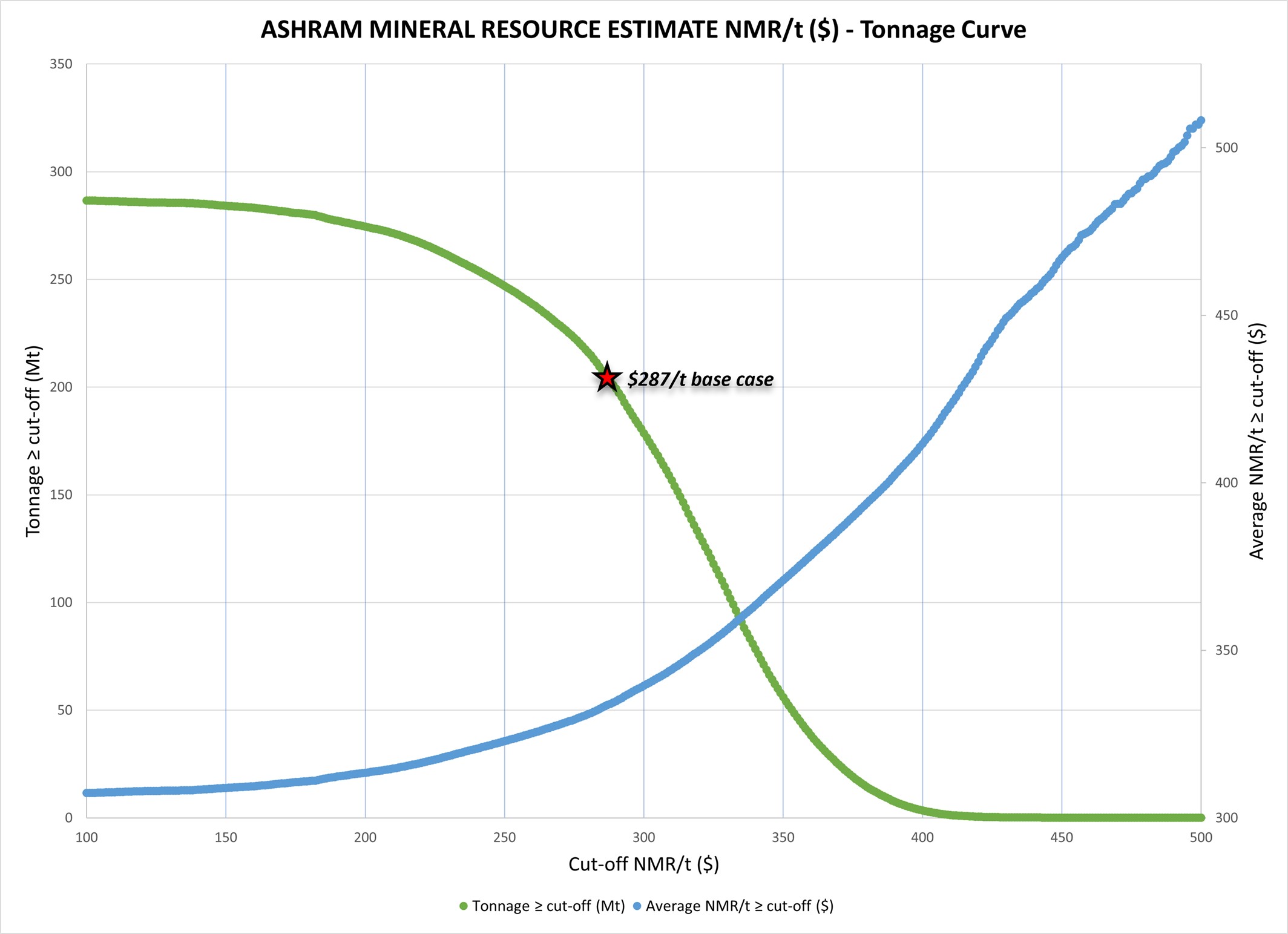

Table 2 and Figure 1 illustrate the sensitivity of the 2024 Ashram Deposit MRE with respect to various Net Metal Return cut-offs for a potential open-pit scenario with reasonable prospects of eventual economic extraction. The figures provided in these tables should not be interpreted as a mineral resource statement. The selected cut-off NMR for the base case is 287 $/tonne with the revenue factor 1 pit shell constraint.

Table 2: Mineral resource sensitivity analysis based on NMR $/t cut-off

Figure 1: Ashram mineral resource sensitivity analysis - grade-tonnage curve with base case NMR $287/t cut-off

Figure 1: Ashram mineral resource sensitivity analysis - grade-tonnage curve with base case NMR $287/t cut-off

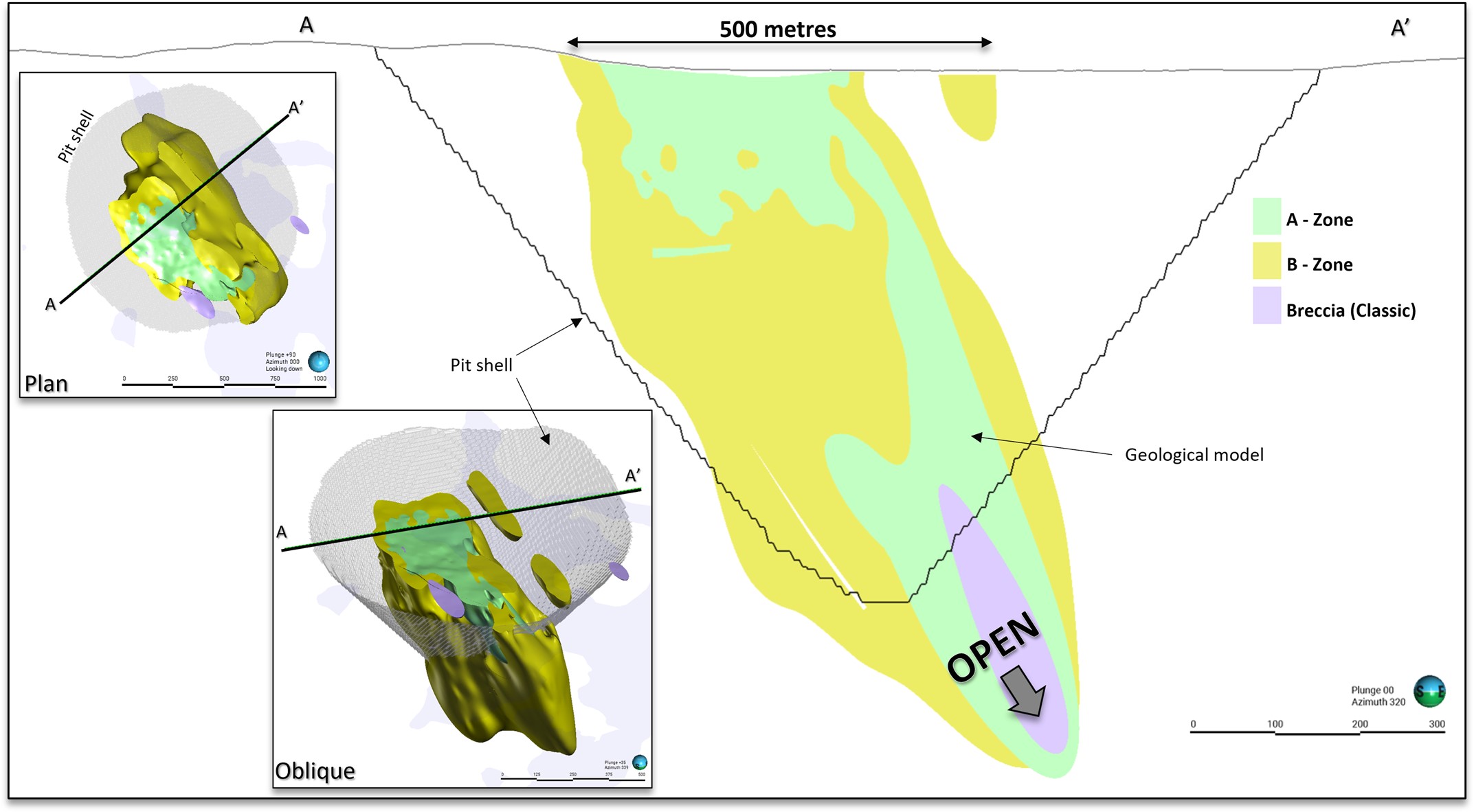

Figure 2: Pit shell and mineralized footprint of Ashram's mineral resource estimate in plan, highlighting the deposit scale and drilling post-2012 MRE used to improve the Mineral Resource Estimate

Figure 2: Pit shell and mineralized footprint of Ashram's mineral resource estimate in plan, highlighting the deposit scale and drilling post-2012 MRE used to improve the Mineral Resource Estimate

Figure 3: Geological model cross-section of the Ashram Deposit highlighting carbonatite lithological domains considered in the mineral resource estimate (A-Zone, B-Zone, Breccia (Classic)). Note the BD-Zone (not shown) is currently not part of the MRE.

Figure 3: Geological model cross-section of the Ashram Deposit highlighting carbonatite lithological domains considered in the mineral resource estimate (A-Zone, B-Zone, Breccia (Classic)). Note the BD-Zone (not shown) is currently not part of the MRE.

Figure 4: Cross-section showing Ashram indicated and inferred classifications within block model.

Figure 4: Cross-section showing Ashram indicated and inferred classifications within block model.

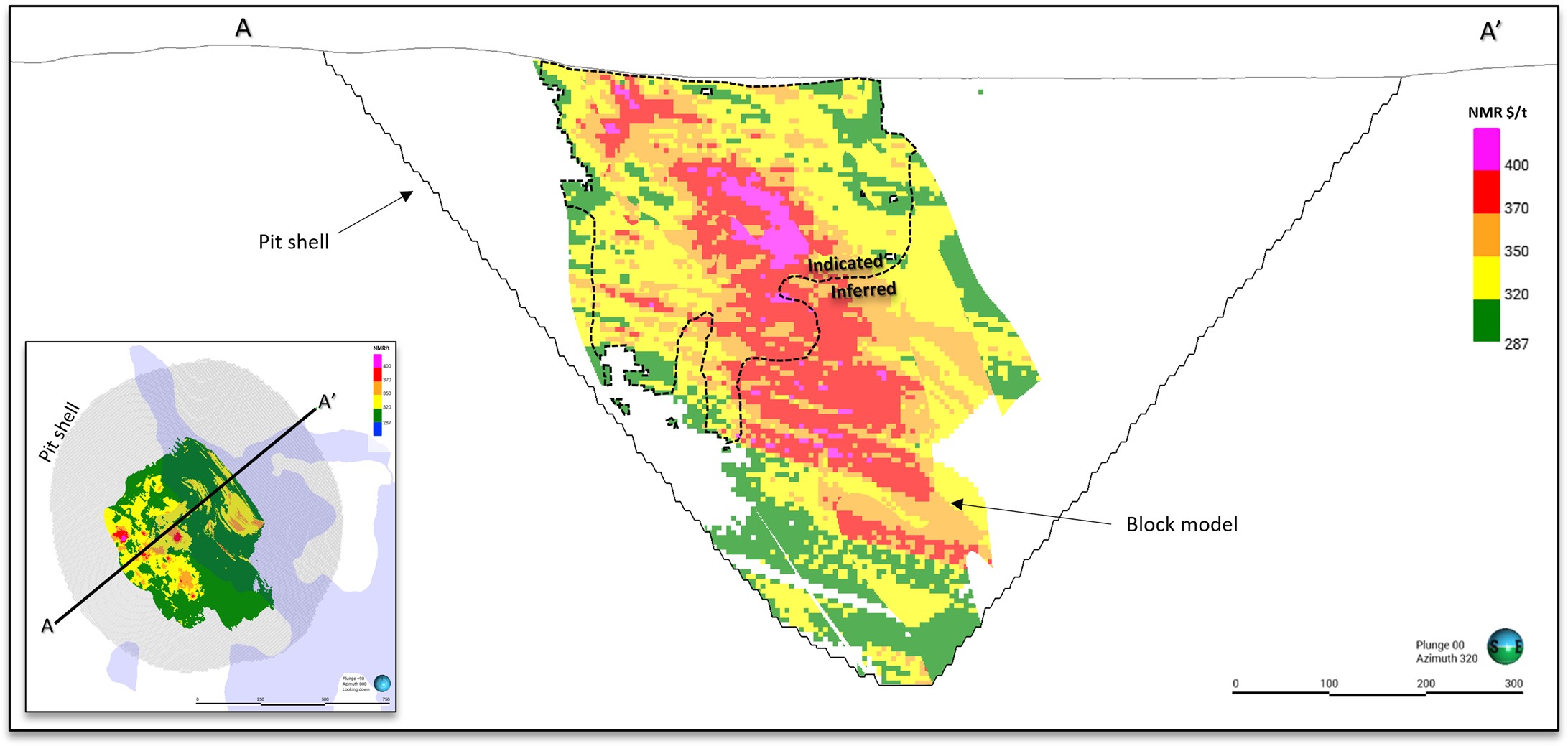

Figure 5: Ashram mineral resource block model - cross section displaying NMR ($/t) by block.

Figure 5: Ashram mineral resource block model - cross section displaying NMR ($/t) by block.

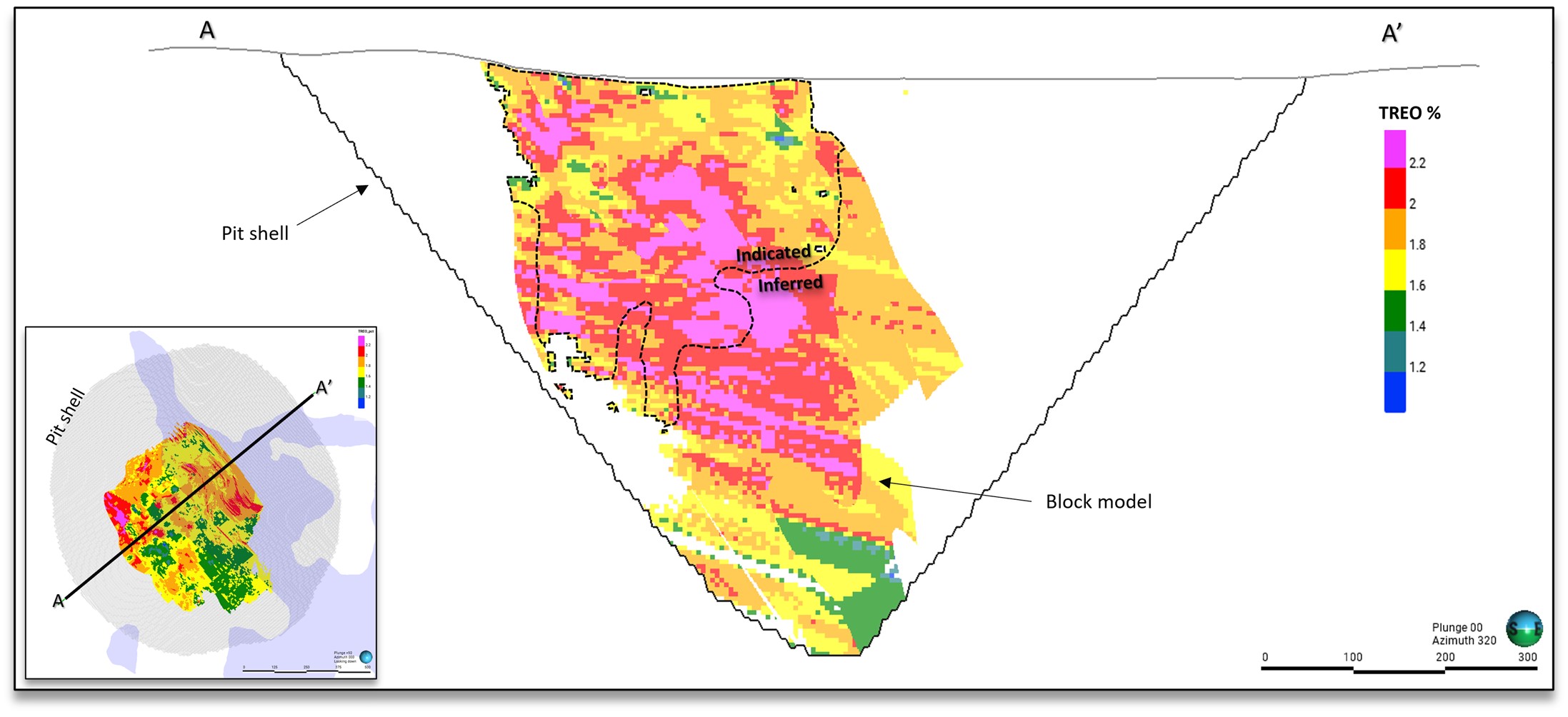

Figure 6: Ashram mineral resource block model - cross-section displaying TREO (%) distribution by block.

Figure 6: Ashram mineral resource block model - cross-section displaying TREO (%) distribution by block.

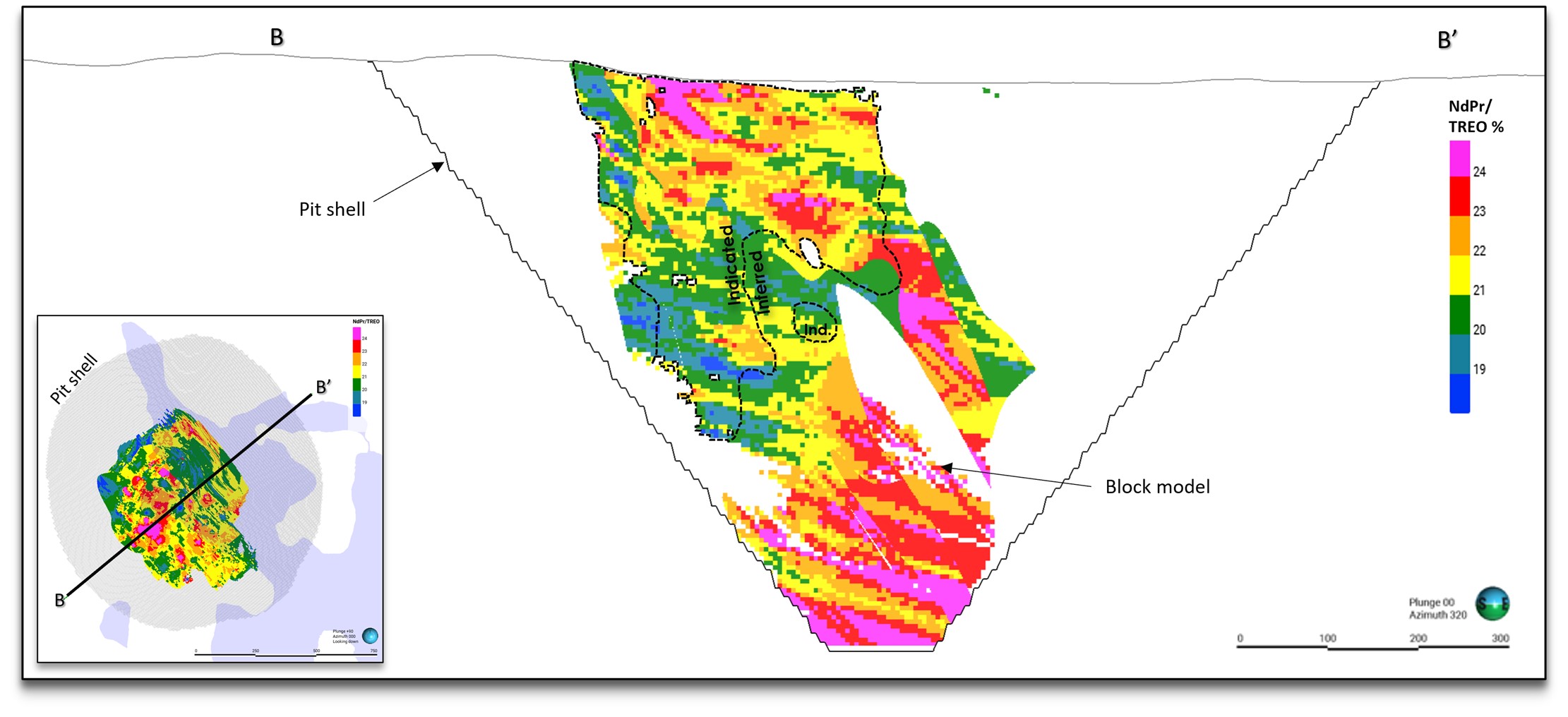

Figure 7: Cross-section through the Ashram mineral resource block model displaying NdPr distribution.

Figure 7: Cross-section through the Ashram mineral resource block model displaying NdPr distribution.

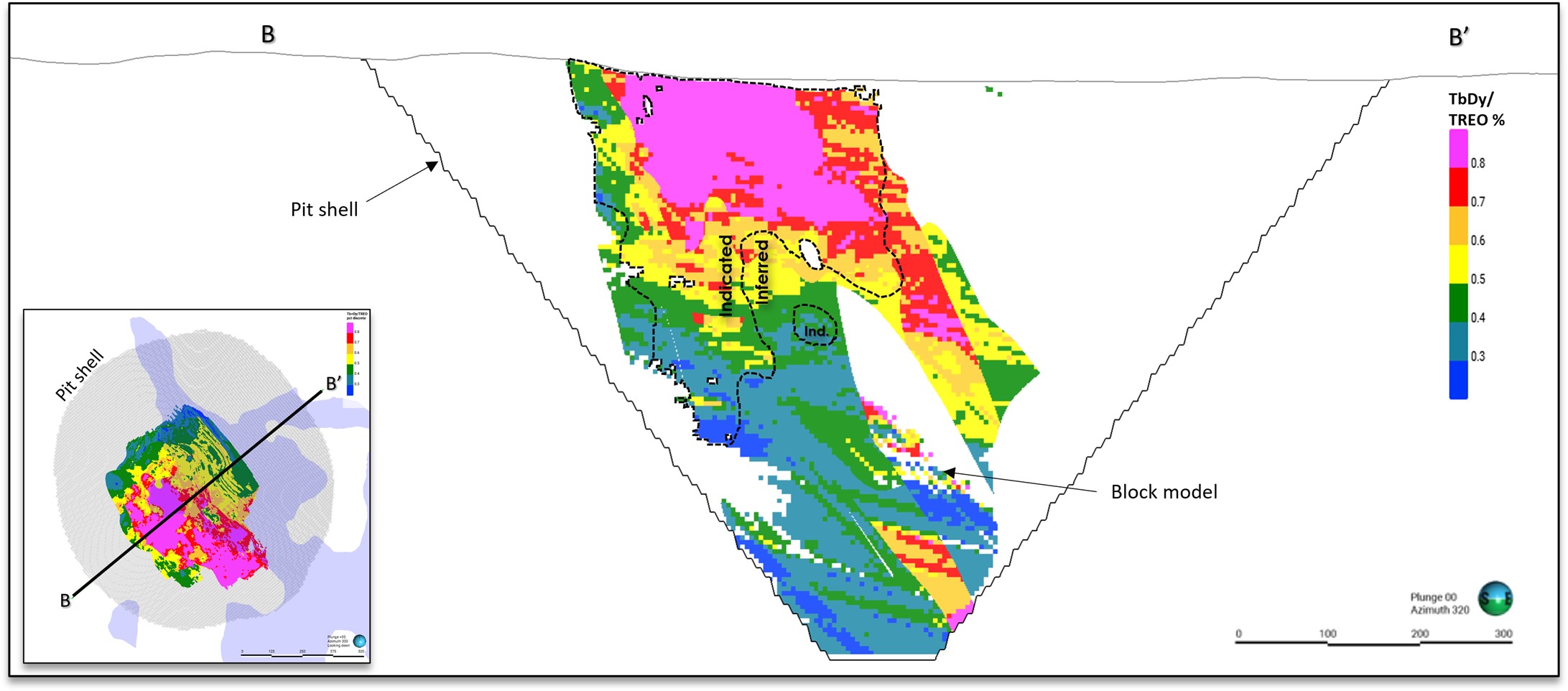

Figure 8: Cross-section through the Ashram mineral resource block model displaying TbDy distribution.

Figure 8: Cross-section through the Ashram mineral resource block model displaying TbDy distribution.

Figure 2 shows the surface projection of the pit shell and mineralized footprint of the Ashram deposit, with its lithological domains (A-Zone, B-Zone, Breccia (Classic)). It also includes the BD-Zone, another REE-bearing lithology that requires additional metallurgical studies due to their different REE-bearing mineralogy. These were therefore not considered in this MRE but represent potential upside to the project. Figure 3 is a cross-section of the monazite-mineralized lithologies that form the basis of the updated mineral resource estimate. The geological model is supported by drill holes through to the end of the 2022 fall program (hole EC22-207). Multiple cross-sections displaying parameters of the resource block model are presented in Figures 4 - 8. Figure 4 displays the indicated and inferred resource breakout in the block model which is shown in subsequent figures as dashed contour lines. Figure 5 shows the NMR ($/t) distribution within the deposit, with Figure 6 showing the respective TREO (%) distribution within the same block model slice. Figure 7 and Figure 8 are cross-sections of the magnet feed REE-oxide ratios (NdPr and TbDy, respectively) within the block model. Figure 7 shows high NdPr near surface, making it a high-value target which continues to be favourable throughout the deposit. The TbDy distribution shown in Figure 8 is overlapping with the high NdPr near surface but is not as elevated at depth.

Pit Optimization

A pit design was developed which constrains the pit shell to ensure reasonable prospects of eventual economic extraction. The pit geometry considered an overall pit slope of 52 degrees based on previous geotechnical studies. The pit design considered 3-year annualized average pricing (2021, 2022, and 2023) for five payable oxides (USD1.25/kg for La2O3, USD95/kg for Pr2O3, USD95/kg for Nd2O3, USD1,500/kg for Tb2O3, and USD375/kg for Dy2O3), which were converted to Canadian Dollars using an exchange rate of 1.30 CAD:USD. The pricing was sourced from Adamas Intelligence's Rare Earth Pricing Quarterly Outlook (Q1 2024).

The pit optimization considered the following combined metallurgical recoveries for the concentrator and hydromet plant: 60.5% for La2O3, 58.9% for Pr2O3, 59.0% for Nd2O3, 42.7% for Tb2O3, and 38.6% for Dy2O3. A mining cost of CAD8/tonne (plus an incremental mining cost with depth of CAD0.02/tonne for every 10m of depth), variable operating costs of CAD60/tonne milled for the concentrator, CAD3,000/tonne of mixed REO product for the hydromet plant, and CAD7,700/tonne of product for the separation plant, fixed annual operating costs of CAD25M, CAD10M, CAD11M, CAD10M, for G&A, the concentrator, hydromet plant, and separation plant respectively, and transportation costs of CAD200/tonne of mixed REO product. The operating costs have been established using a combination of comparable projects and industry benchmarks and are therefore conceptual in nature.

The aforementioned economic parameters result in a Net Metal Return (NMR) cut-off of CAD154/tonne. An elevated cut-off of CAD287/tonne was considered as the base case for the MRE to ensure reasonable prospects of eventual economic extraction over a reasonable timeframe.

The resulting pit shell has a conical shape with a diameter of approximately 1,200m, a depth of roughly 600m, and has a 2.7:1 ratio of waste to mineralized material.

Metallurgical Methods

The mineral processing and hydrometallurgy assumptions are based on the optimized flowsheet announced in the March 4th, 2024 press release. This was a significant simplification and optimization of the Ashram Deposit's front-end mineral processing flowsheet whereby 30-35+% TREO monazite mineral concentrates at strong recovery are produced using only flotation. In addition, a streamlined hydrometallurgical flowsheet was developed by L3 Process Development ("L3") and demonstrated at bench scale for the downstream processing of the monazite flotation concentrate. The hydrometallurgical flowsheet uses a standard acid bake - water leach process followed by thorium removal and direct rare earth element ("REE") precipitation.

Qualified Persons

The independent qualified persons for the 2024 MRE, as defined by National Instrument ("NI") 43-101 guidelines, are Pierre-Luc Richard, P.Geo., of PLR Resources Inc. (Mineral Resource Estimate), Jeffrey Cassoff, P.Eng., of BBA Inc. (Pitshell optimization and cut-off grade), Jordan Zampini, P.Eng., from DRA Global (Mineral Processing parameters), and Tommee Larochelle, P.Eng., of L3 Process Development (Hydrometallurgical parameters). The effective date of the 2024 MRE is April 4th, 2024. The qualified persons have approved the technical contents of this press release.

Mr. Richard has worked in the mining industry for over 20 years with various commodities over the years, including REE projects. Mr. Richard has acted as QP or lead QP for a considerable number of technical reports, mineral resource estimates, and due diligence reviews as a consultant with different firms, and for PLR Resources since 2022. Mr. Richard has been involved with the Ashram project since 2021 and has visited the property.

About the Ashram Deposit

The Ashram Deposit is central to the Eldor Carbonatite Complex and bordered by an earlier staged calcio-carbonatite and various altered (fenitized) wallrock units. In contrast to its host rocks, the Ashram Deposit appears as a magnetic low and gravity high. Currently, the deposit geometry and geology can best be described as a moderate to steeply NE dipping ovoid, with simple rare earth mineralogy (monazite, bastnaesite, xenotime) that has an unusual enrichment in magnet feed elements (i.e. higher Nd+Pr Oxide/TREO). The Deposit is a single mineralized body outcropping at surface and has a drill delineated footprint of over 700 m along strike, 300 m across, and 600 m deep, and remains open at depth.

About Commerce Resources Corp.

Commerce Resources Corp. is a junior mineral resource company focused on the development of the Ashram Rare Earth and Fluorspar Deposit located in Quebec, Canada. The Company is positioning to be one of the lowest cost rare earth producers globally, with a specific focus on being a long-term supplier of mixed rare earth carbonate and/or NdPr oxide to the global market. The Ashram Deposit is characterized by simple rare earth (monazite, bastnaesite, xenotime) and gangue (carbonates) mineralogy, a large tonnage resource at favourable grade, and has demonstrated the production of high-grade (more than 30 - 45% TREO) mineral concentrates at high recovery (more than 60 - 75%) in line with active global producers. Additionally, the Ashram Deposit has a fluorspar component which makes it one of the largest potential sources of fluorspar in the world and could be a long-term supplier to the met-spar and acid-spar markets.

For more information, please visit the corporate website at www.commerceresources.com or email This email address is being protected from spambots. You need JavaScript enabled to view it..

On Behalf of the Board of Directors

COMMERCE RESOURCES CORP.

"Chris Grove"

Chris Grove

CEO and President

Tel: 604.484.2700

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Web: http://www.commerceresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains forward-looking statements, which includes any information about activities, events or developments that the Company believes, expects or anticipates will or may occur in the future. Forward looking statements in this news release include that the updated mineral resource estimate positions the Company to become a frontrunner as a long-term source of magnet-feed REE to the European and North American markets; that the high NdPr distributions can be targeted early on in a potential open-pit extraction scenario; that there is potential upside of the REE-bearing mineralogy of the BD-Zone; the highly conceptual estimates of operating costs and economic parameters with respect to pit optimization to develop a constraining pit shell; that Ashram has the potential to become one of the largest fluorspar sources in the world and a long-term supplier to the met-spar and acid-spar markets; and that the Company is positioning to be one of the lowest cost rare earth element producers globally, with a focus on being a long-term global supplier of mixed rare earth carbonate and/or NdPr oxide. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these events, activities or developments from coming to fruition include: that we may not be able to fully finance any additional exploration on the Ashram Project; that even if we are able raise capital, costs for exploration activities may increase such that we may not have sufficient funds to pay for such exploration or processing activities; the timing and content of any future work programs; geological interpretations based on drilling that may change with more detailed information; potential process methods and mineral recoveries assumptions based on limited test work and by comparison to what are considered analogous deposits that, with further test work, may not be comparable; testing of our process may not prove successful or samples derived from the Ashram Project may not yield positive results, and even if such tests are successful or initial sample results are positive, the economic and other outcomes may not be as expected; the anticipated market demand for REE and other minerals may not be as expected; the availability of labour and equipment to undertake future exploration work and testing activities; geopolitical risks which may result in market and economic instability; and despite the current expected viability of the Ashram Project, conditions changing such that even if metals or minerals are discovered on the Ashram Project, the project may not be commercially viable. The forward-looking statements contained in this news release are made as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

| Last Trade: | US$0.11 |

| Daily Volume: | 0 |

| Market Cap: | US$22.260M |

February 07, 2025 November 14, 2024 | |

COPYRIGHT ©2025 GREEN STOCK NEWS