HIGHLIGHTS

TORONTO, May 30, 2023 (GLOBE NEWSWIRE) -- Banxa Holdings Inc. (TSXV: BNXA) (OTCQX: BNXAF) (FSE: AC00) ("Banxa'' or the "Company"), the leading on-and-off ramp solution for Web3, announces today its lodging of Australian fiscal year 2023 Q3 (January-March 2023) unaudited results. The full results including Management Discussion & Analysis (MD&A) are available on Sedar.

Holger Arians, Banxa CEO, said: “I am thrilled to be able to share these latest quarterly results, which demonstrate how far we have come as a business over the last year. Banxa has emerged as the premier on/off ramp solution globally. The company’s fundamentals are as strong as ever, with a far more diversified revenue base that continues to grow. Our operating profit has also grown thanks to new products and aggressive cost-cutting. Impressively, we have achieved all of this even as the crypto industry remains challenging. I am excited for Banxa’s bright future and the entire team is eager to share these successes with our shareholders.”

Domenic Carosa, Banxa Chairman, said: “The imminent relisting of the BNXA stock on the TSX Ventures Exchange (TSXv) marks a significant milestone for Banxa and its shareholders. The CTO has been painful for shareholders and I recognize the situation has damaged shareholder trust in the company. We have been working non-stop to re-list and resume trading as soon as possible. We also made much-needed improvements to Banxa’s financial reporting and controls so we can emerge as a more mature company. I hope that shareholders will take notice of Banxa’s strong results thanks to Holger and his team’s hard work. We hope to have the opportunity to restore shareholder trust as Banxa advances to its next stage of growth.”

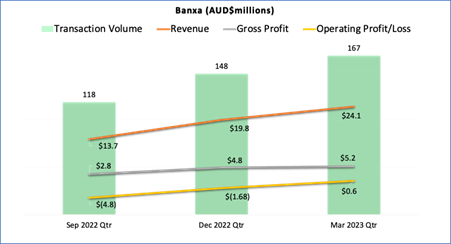

FY23 Q3 (January-March 2023) Financial Overview

FY23 Q3 (January-March 2023) General Business Update

Update on path to profitability

Update on removal of Trade Cessation Order and resumption of trading

The Company has submitted to the British Columbia Securities Commission (BCSC) and Ontario Securites Commission (OSC) requesting that the Cease Trade Order (CTO) be lifted. Once the Company has received confirmation, it will write to the TSXv requesting the Company resume trading.

Upcoming Webinar

Management anticipates holding a company webinar with Q&A and will announce this via news release shortly.

Sale of Domain Name

On 14 March 2023, Banxa Holdings Inc sold domain name for USD$250,000. Total consideration of USD$224,980 ($307,525 CAD) was received on 22 March 2023 (Consideration price included a commission fee of $25,020USD). The carrying value of the domain names at the date of disposal was nil.

CONTACTS

ON BEHALF OF THE BOARD OF DIRECTORS

Per: "DOMENIC CAROSA” https://twitter.com/DomCarosa

Domenic Carosa = Chairman (1-888-218-6863)

This email address is being protected from spambots. You need JavaScript enabled to view it.

Media:

Wachsman

Ethan Lyle

This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-looking Information and Statements

This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends”, “expects” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or will “potentially” or “likely” occur. This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding the completion of the audit by the Company’s auditor, timing for the filing of the Annual Filings and interim financial statements by the Company; expected revenue; completion of the Company’s review of audit procedures needed to validate the accounting treatment of digital assets; and that the Company will satisfy the conditions of the BCSC to have the CTO lifted.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, risks related to the completion of the audit by the Company’s auditor within the timeframe expected by management, and risks relating to the filing of the Annual Filings and interim financial statements within the timeframe expected by management, risks relating to the BCSC’s removal of the CTO, and risks related to changes in general economic, business and political conditions, including changes in the financial markets, changes in applicable laws, and compliance with extensive government regulation, as well as those risk factors discussed or referred to in the Company’s disclosure documents filed with the securities regulatory authorities in certain provinces of Canada and available at www.sedar.com.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, assumptions regarding the completion of the audit by its auditor in a timely manner and the filing of the Annual Filings and interim financial statements by the Company in a timely manner; assumptions that the Company will satisfy the conditions of the BCSC to lift the CTO; revenue numbers will be reported as stated herein and that the Company will complete the review of audit procedures needed to validate the accounting treatment of digital assets.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

| Last Trade: | US$1.07 |

| Daily Volume: | 0 |

| Market Cap: | US$48.780M |

October 10, 2025 May 30, 2025 March 03, 2025 February 18, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS