Avalon Advanced Materials Further Intersects 1.54% Li2O over 136.95 meters at Big Whopper Deposit, Separation Rapids JV

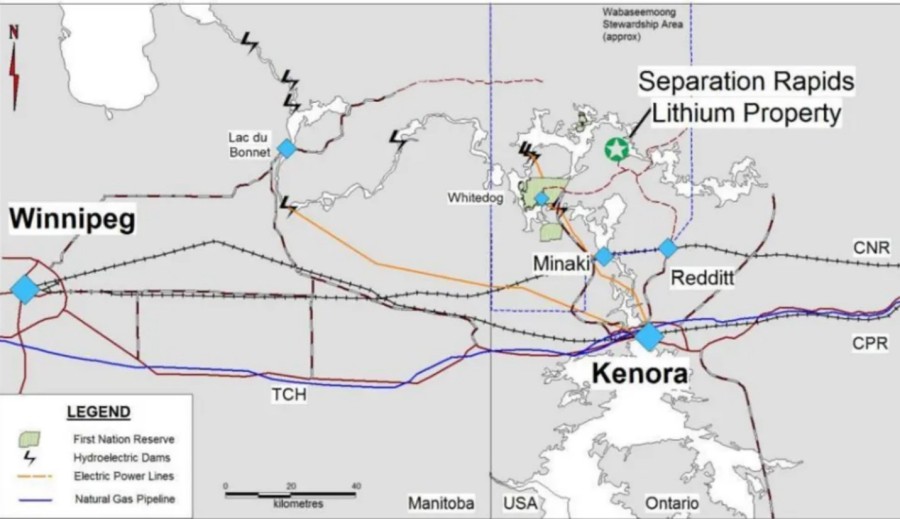

Toronto, Ontario--(Newsfile Corp. - August 19, 2024) - Avalon Advanced Materials Inc. (TSX: AVL) (OTCQB: AVLNF) ("Avalon" or the "Company"), in conjunction with its Joint-Venture ("JV") partner SCR-Sibelco NV ("Sibelco"), is pleased to report the second and final batch of drill results for the 2024 winter drill campaign (which totaled 10 holes) from the Separation Rapids Project in Kenora, Ontario (the "Project"). See Figure 1. The 2024 winter drill campaign was conducted by the Joint Venture Company Separation Rapids Ltd., which is 60% owned by Sibelco and 40% owned by Avalon.

The results represent 199 assay results from 5 diamond drill holes completed as part of the 2024 expansion and infill drill campaign at the current 750m strike length Big Whopper Deposit (See Figure 2). The drill program was intended to upgrade the 2023 Mineral Resource Estimation classification as well as to expand the mineral resources.

Drill Highlights includes from Big Whopper Deposit:

- SR24-121 intersected 1.54% Li2O over 136.95 meters from 321.00m

- including 2.28% Li2O over 4.00 meters from 421.00m

- SR24-119 intersected 1.87% Li2O over 17.15 meters from 284.40m

- SR24-120 intersected 1.60% Li2O over 12.80 meters from 66.15m

All quoted intersections comprise a cutoff grade of 0.5% Li2O. All significant assay intervals with true widths are reported in Table 1.

Scott Monteith, CEO and Director, commented, "These exceptional results taken over very long intervals are a clear indication of the highly efficient drilling program by our JV Partner Sibelco. Another long, massive intercept on Hole SR24-121 will be key to growing the mineral resource base. What is exceptionally exciting is the depth potential, with hole SR24-121 effectively intersecting 136.95m mineralization from 321m downhole.

This hole supports our belief that we have barely begun to uncover the potential of lithium resources at the Separation Rapids deposit. With our objectives for the 2024 winter drilling campaign accomplished, we look forward to the upcoming Mineral Resource Estimate."

The results from the second batch of the 2024 drill campaign continues to identify mineralization below the current resource pit shell with drill hole SR24-121 intersecting values ≥0.5% Li2O over a 136-meter interval, opening the main zone at depth. See Figure 3. Eastern drilling shows promise of possible extension to the current resource boundaries. See Figure 4.

An updated Mineral Resource Estimate (MRE) is planned for Q3 of 2024 which will include results of the 2024 winter drill campaign. Total drill meterage will increase from 18,500 meters of drilling to 26,241 meters.

A property wide mapping and sampling program was completed in late July 2024 with a focus on satellite targets and areas of limited geological data for further evaluation of the promising potential on the property. This mapping program covered approximately 5 kilometers along strike and is currently being modelled and interpreted for further evaluation.

Figure 1: - Location of Separation Rapids Project

Figure 2: Big Whopper Deposit with current released hole locations highlighted.

Figure 3: Long Section of the Big Whopper (View NNE). Current release drill traces in blue.

Four drill holes returned significant drill intercepts greater >/=0.5% Li2O.

Figure 4: Vertical Cross section showing SR24-121 with high grade mineralization below the current conceptual pit widening the 2023 thickness of the modelled pegmatites.

| Table 1: Significant drill intersection | |||||||||

| ID | Az. | Dip | From (m) | To (m) | Interval (m) | True Width (m) | Li2O% | Intercept | |

| SR24-118 | 180 | -62 | 90.00 | 92.00 | 2.00 | 1.77 | 1.32 | 1.32 Li2O% over 2.00m | |

| 101.65 | 102.05 | 0.40 | 0.35 | 1.84 | 1.84 Li2O% over 0.40m | ||||

| 103.30 | 103.70 | 0.40 | 0.35 | 2.22 | 2.22 Li2O% over 0.40m | ||||

| 104.10 | 104.45 | 0.35 | 0.31 | 2.53 | 2.53 Li2O% over 0.35m | ||||

| SR24-119 | 190 | -78 | 167.50 | 172.00 | 4.50 | 4.40 | 2.25 | 2.25 Li2O% over 4.50m | |

| 178.50 | 183.55 | 5.05 | 4.94 | 2.42 | 2.42 Li2O% over 5.05m | ||||

| including | 180.00 | 182.00 | 2.00 | 1.96 | 3.31 | 3.31 Li2O% over 2.00 m | |||

| 227.50 | 228.40 | 0.90 | 0.88 | 1.55 | 1.55 Li2O% over 0.90m | ||||

| 241.60 | 243.40 | 1.80 | 1.76 | 0.91 | 0.91 Li2O% over 1.80m | ||||

| 267.20 | 268.95 | 1.75 | 1.71 | 2.23 | 2.23 Li2O% over 1.75m | ||||

| 269.25 | 270.00 | 0.75 | 0.73 | 1.36 | 1.36 Li2O% over 0.75m | ||||

| 270.50 | 271.55 | 1.05 | 1.03 | 1.55 | 1.55 Li2O% over 1.05m | ||||

| 272.00 | 274.60 | 2.60 | 2.54 | 1.57 | 1.57 Li2O% over 2.60m | ||||

| 273.00 | 274.60 | 1.60 | 1.57 | 1.40 | 1.4 Li2O% over 1.60m | ||||

| 280.10 | 282.45 | 2.35 | 2.30 | 1.82 | 1.82 Li2O% over 2.35m | ||||

| 281.00 | 282.45 | 1.45 | 1.42 | 1.85 | 1.85 Li2O% over 1.45m | ||||

| 284.40 | 301.55 | 17.15 | 16.78 | 1.87 | 1.87 Li2O% over 17.15m | ||||

| including | 292.00 | 293.00 | 1.00 | 0.98 | 2.66 | 2.66 Li2O% over 1.00m | |||

| SR24-120 | 178 | -56 | 66.15 | 78.95 | 12.80 | 10.61 | 1.60 | 1.6 Li2O% over 12.80m | |

| 79.80 | 80.60 | 0.80 | 0.66 | 1.71 | 1.71 Li2O% over 0.80m | ||||

| 80.90 | 82.15 | 1.25 | 1.04 | 1.85 | 1.85 Li2O% over 1.25m | ||||

| 82.95 | 84.15 | 1.20 | 0.99 | 1.25 | 1.25 Li2O% over 1.20m | ||||

| 87.65 | 88.35 | 0.70 | 0.58 | 1.44 | 1.44 Li2O% over 0.70m | ||||

| 89.60 | 96.35 | 6.75 | 5.60 | 1.71 | 1.71 Li2O% over 6.75m | ||||

| 96.90 | 97.50 | 0.60 | 0.50 | 1.36 | 1.36 Li2O% over 0.60m | ||||

| 100.50 | 100.95 | 0.45 | 0.37 | 2.08 | 2.08 Li2O% over 0.45m | ||||

| 101.75 | 103.45 | 1.70 | 1.41 | 1.18 | 1.18 Li2O% over 1.70m | ||||

| 133.80 | 135.20 | 1.40 | 1.16 | 2.03 | 2.03 Li2O% over 1.40m | ||||

| 135.80 | 136.15 | 0.35 | 0.29 | 2.00 | 2 Li2O% over 0.35m | ||||

| 138.75 | 139.80 | 1.05 | 0.87 | 1.59 | 1.59 Li2O% over 1.05m | ||||

| 175.90 | 176.20 | 0.30 | 0.25 | 1.40 | 1.4 Li2O% over 0.30m | ||||

| 211.50 | 213.45 | 1.95 | 1.62 | 1.62 | 1.62 Li2O% over 1.95m | ||||

| 218.50 | 218.80 | 0.30 | 0.25 | 1.58 | 1.58 Li2O% over 0.30m | ||||

| SR24-121 | 186 | -78 | 246.30 | 248.00 | 1.70 | 1.66 | 1.79 | 1.79 Li2O% over 1.70m | |

| 251.25 | 251.90 | 0.65 | 0.64 | 1.91 | 1.91 Li2O% over 0.65m | ||||

| 254.40 | 254.85 | 0.45 | 0.44 | 1.09 | 1.09 Li2O% over 0.45m | ||||

| 260.90 | 262.75 | 1.85 | 1.81 | 1.88 | 1.88 Li2O% over 1.85m | ||||

| 265.25 | 265.90 | 0.65 | 0.64 | 2.29 | 2.29 Li2O% over 0.65m | ||||

| 266.85 | 269.75 | 2.90 | 2.84 | 1.79 | 1.79 Li2O% over 2.90m | ||||

| 268.00 | 269.75 | 1.75 | 1.71 | 1.94 | 1.94 Li2O% over 1.75m | ||||

| 270.15 | 270.55 | 0.40 | 0.39 | 1.60 | 1.6 Li2O% over 0.40m | ||||

| 272.00 | 275.05 | 3.05 | 2.98 | 1.96 | 1.96 Li2O% over 3.05m | ||||

| 274.00 | 275.05 | 1.05 | 1.03 | 1.89 | 1.89 Li2O% over 1.05m | ||||

| 279.00 | 282.25 | 3.25 | 3.18 | 1.86 | 1.86 Li2O% over 3.25m | ||||

| 283.45 | 284.25 | 0.80 | 0.78 | 1.08 | 1.08 Li2O% over 0.80m | ||||

| 285.35 | 288.30 | 2.95 | 2.89 | 1.65 | 1.65 Li2O% over 2.95m | ||||

| 289.65 | 294.90 | 5.25 | 5.14 | 1.52 | 1.52 Li2O% over 5.25m | ||||

| 293.00 | 295.65 | 2.65 | 2.59 | 2.11 | 2.11 Li2O% over 2.65m | ||||

| 296.25 | 298.60 | 2.35 | 2.30 | 1.65 | 1.65 Li2O% over 2.35m | ||||

| 299.95 | 301.25 | 1.30 | 1.27 | 1.88 | 1.88 Li2O% over 1.30m | ||||

| 301.70 | 304.35 | 2.65 | 2.59 | 2.43 | 2.43 Li2O% over 2.65m | ||||

| 306.00 | 306.55 | 0.55 | 0.54 | 2.11 | 2.11 Li2O% over 0.55m | ||||

| 306.90 | 307.35 | 0.45 | 0.44 | 1.10 | 1.1 Li2O% over 0.45m | ||||

| 308.25 | 309.05 | 0.80 | 0.78 | 1.68 | 1.68 Li2O% over 0.80m | ||||

| 309.20 | 312.95 | 3.75 | 3.67 | 1.60 | 1.6 Li2O% over 3.75m | ||||

| 313.00 | 314.55 | 1.55 | 1.52 | 1.28 | 1.28 Li2O% over 1.55m | ||||

| 314.80 | 319.00 | 4.20 | 4.11 | 1.35 | 1.35 Li2O% over 4.20m | ||||

| 319.00 | 320.30 | 1.30 | 1.27 | 1.38 | 1.38 Li2O% over 1.30m | ||||

| 321.00 | 457.95 | 136.95 | 133.96 | 1.54 | 1.54 Li2O% over 136.95m | ||||

| including | 421.00 | 425.00 | 4.00 | 3.91 | 2.28 | 2.28 Li2O% over 4.00m | |||

| 458.20 | 459.55 | 1.35 | 1.32 | 1.53 | 1.53 Li2O% over 1.35m | ||||

| 460.00 | 461.35 | 1.35 | 1.32 | 2.38 | 2.38 Li2O% over 1.35m | ||||

| 461.65 | 462.95 | 1.30 | 1.27 | 1.73 | 1.73 Li2O% over 1.30m | ||||

| 464.10 | 464.80 | 0.70 | 0.68 | 1.83 | 1.83 Li2O% over 0.70m | ||||

| 466.50 | 468.30 | 1.80 | 1.76 | 1.90 | 1.9 Li2O% over 1.80m | ||||

| 469.15 | 473.20 | 4.05 | 3.96 | 1.95 | 1.95 Li2O% over 4.05m | ||||

| 473.45 | 474.45 | 1.00 | 0.98 | 1.89 | 1.89 Li2O% over 1.00m | ||||

| 474.80 | 477.40 | 2.60 | 2.54 | 1.88 | 1.88 Li2O% over 2.60m | ||||

| 478.00 | 478.65 | 0.65 | 0.64 | 0.33 | 0.33 Li2O% over 0.65m | ||||

| 481.00 | 481.60 | 0.60 | 0.59 | 0.12 | 0.12 Li2O% over 0.60m | ||||

| SR24-122 | Not sampled | ||||||||

Note: Hole SR24-122 did not intersect mineralization Rules for Intercept Calculation | |||||

|

Qualified Persons

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Jessica Borysenko, P.Geo, ON. Member number 2279, Manager of Geology and Mines, Canada for Separation Rapids Ltd. Ms. Borysenko is a qualified person for the purposes of National Instrument 43-101, who has reviewed and approved the technical information included in this news release.

Quality Assurance-Quality Control ("QA/QC")

QA/QC protocols include the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to ALS in Thunder Bay.

Prep. and Analytical Methods Used:

PREP-33D - Log, Crush - Fine Crushing 90% <2mm, Split, Pulverize 1 kg split to 95%<106um.

- ME-4ACD81 - this is a multielement analysis using four acid digestion, that includes lithium to 10,000 ppm (1%) Li (2.15% Li2O)

- ME-ICP06 - is a "whole rock" analysis that covers components such as silicon, sodium, potassium and iron so is useful as a check on rock type, feldspar content and type, and amphibolite content.

- ME-MS81 - is a fusion multielement analysis that includes important pegmatite elements such as Rb, Ta, Nb and Sn

- F- IC881 - a fluorine specific analysis that clearly indicates whether lepidolite is present in the rock. Any value over 10,000 ppm (1%) F is likely to be Unit 6d - the lepidolite bearing unit.

Any sample that exceeds the lithium limits for ME-4ACD81 (1% Li, or 2.15% Li2O) is reanalyzed using method ME-ICP82b - a lithium specific method with limit of 10% Li (21% Li2O). Pulps are to be returned to the project site.

About Avalon Advanced Materials Inc.

Avalon Advanced Materials Inc. is a Canadian advanced manufacturing company focused on vertically integrating the Ontario lithium supply chain. The Company, through its joint venture with SCR-Sibelco NV, is currently developing its Separation Rapids lithium deposit near Kenora, ON, while also continuing to advance the Snowbank lithium and Lilypad lithium-caesium projects. Avalon is also working to develop its Nechalacho rare earths and zirconium project located in the Northwest Territories. This deposit contains critical minerals for use in advanced technologies in the communications and defense industries among other sectors.

In addition to these upstream activities, Avalon is executing on a key initiative to develop Ontario's first midstream lithium hydroxide processing facility in Thunder Bay, ON, a vital link bridging the lithium resources of the north with the downstream EV battery manufacturing base in the south.

For questions or feedback, please email the Company at This email address is being protected from spambots. You need JavaScript enabled to view it. or contact Ms. Rachel Naji, Investor Relations Manager at 416-364-4938

Cautionary Statement Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to statements related to planned work at the Project. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "add" or "additional", "advancing", "anticipates" or "does not anticipate", "appears", "believes", "can be", "conceptual", "confidence", "continue", "convert" or "conversion", "deliver", "demonstrating", "estimates", "encouraging", "expand" or "expanding" or "expansion", "expect" or "expectations", "forecasts", "forward", "goal", "improves", "increase", "intends", "justification", "plans", "potential" or "potentially", "promise", "prospective", "prioritize", "reflects", "robust", "scheduled", "suggesting", "support", "top-tier", "updating", "upside", "will be" or "will consider", "work towards", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including risks associated with mineral exploration and development operations such as: environmental hazards and economic factors as they affect the cost and success of the Company's capital expenditures, the ability of the Company to obtain required permits and approvals, the ability of the Company to obtain financing, uncertainty in the estimation of mineral resources, uncertainty with respect to the ability to successfully construct and develop the Company's lithium processing facility, the price of lithium, no operating history, no operating revenue and negative cash flow, land title risk, the market price of the Company's securities, the economic feasibility of the Company's mineral resources and the Company's commercial viability, inflation and uncertain global economic conditions, uncertain geo-political shifts and risks, successful collaboration with indigenous communities, changes in technology and advancements in innovation may impact the development of the Company's technology innovation centre and its lithium hydroxide processing facility, future pandemics and other health crises, dependence on management and other highly skilled personnel, title to the Company's mineral properties, the ongoing war in Ukraine and Israel, extensive government and environmental regulation, reliance on artificial intelligence technology to influence mining operations, volatility in the financial markets, uninsured risks, climate change, threat of legal proceedings, as well as those risk factors discussed or referred to in the annual information form of the Company dated November 28, 2023 (the "AIF") under the heading "Description of the Business - Risk Factors". Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Although the Company believes that the assumptions and expectations reflected in such forward-looking information are reasonable, undue reliance should not be placed on forward-looking information because the Company can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions identified in the AIF, assumptions have been made regarding, among other things: management of certain of the Company's assets by other companies or joint venture partners, the Company's ability to carry on its exploration and development activities without undue delays or unbudgeted costs, the ability of the Company to obtain sufficient qualified personnel, equipment and services in a timely and cost effective manner, the ability of the Company to operate in a safe, efficient and effective manner, the ability of the Company to obtain all necessary financing on acceptable terms and when needed, the accuracy of the Company's resource estimates and geological, operational and price assumptions on which these are based and the continuance of the regulatory framework regarding environmental manners. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions that may have been used. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.05 |

| Daily Change: | 0.0007 1.31 |

| Daily Volume: | 10,000 |

| Market Cap: | US$45.070M |

January 15, 2026 November 24, 2025 November 12, 2025 October 23, 2025 | |