Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Appia Rare Earths & Uranium Announces Plans for Drilling at the Loranger Uranium-Bearing Property, Saskatchewan, Canada

Toronto, Ontario--(Newsfile Corp. - February 2, 2024) - Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQX: APAAF) (FSE: A0I0) (MUN: A0I0) (BER: A0I0) (the "Company" or "Appia") is pleased to announce its plans for drilling at the 100%-owned uranium-bearing Loranger property in northern Saskatchewan in conjunction with the signing of a strategic collaboration agreement with the Ya'thi Néné Lands and Resources Office ("YNLR"). This diamond drilling program emphasizes Appia's excitement to capitalize on the rising uranium market in collaboration with the YNLR and local Wollaston residents.

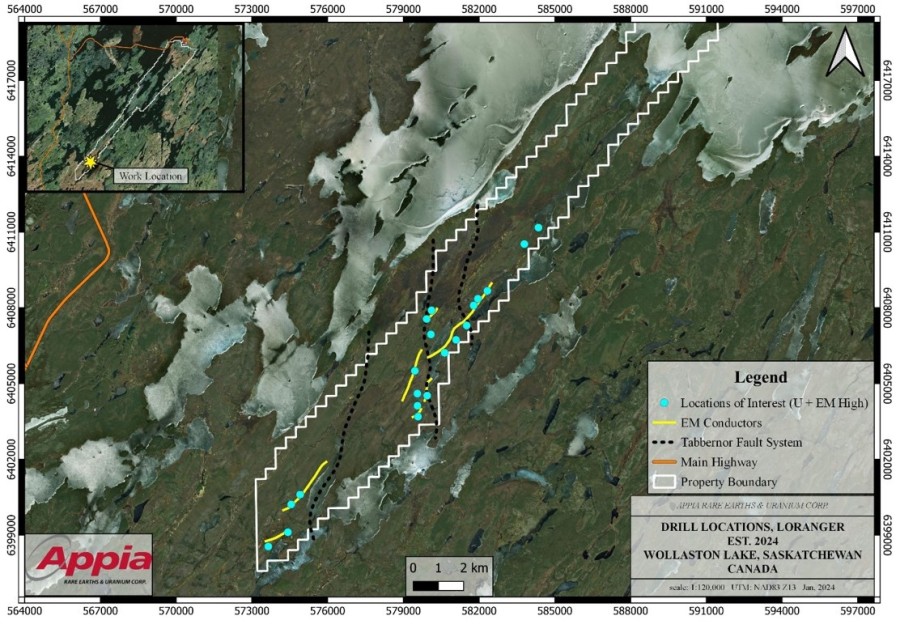

The Loranger diamond drilling program is pending permitting and is slated to commence between late February and early April, and represents a pivotal step in Appia's multi-year exploration efforts to develop its five (5) uranium properties. In partnership with the YNLR and the local Wollaston community, the program will follow up by targeting some of the approximately twenty (20) favourable electromagnetic and uranium-bearing geophysical anomalies (Figure 1) of the property within the eastern Wollaston Domain, in particular the Tabbernor Fault minerals system.

Situated adjacent to the renowned, uranium-rich Athabasca Basin, Appia believes the Loranger Property holds strong potential for valuable uranium deposits.

Appia's Loranger winter diamond drilling program is anticipated to include 1,000 to 1,200 metres across 8 to 10 drill holes, aiming to uncover new uranium discoveries to follow-up on what was drilled in 2017 and 2019. This program's success is expected to contribute significantly to the understanding of the property's uranium mineralization and the implications for further discoveries within its complex geological terrain.

The agreement between Appia and the YNLR facilitates a mutual working relationship during the Loranger diamond drilling program, allowing for respectful and timely working relationships between both parties, and a push toward the project's success. This cooperative approach ensures that the exploration activities benefit both the Company and the region's communities.

"After many constructive negotiations, we are very excited to return to northern Saskatchewan this winter season to explore the economic potential of our Loranger property, just as the uranium markets have seen a surge over the past 12 months," stated Stephen Burega, President.

The technical content in this news release was reviewed and approved by Dr. Irvine R. Annesley, P.Geo., Vice President Exploration, and a Qualified Person as defined by National Instrument 43-101.

Figure 1 - DRILL TARGET LOCATIONS, LORANGER PROJECT, SK

About Appia Rare Earths & Uranium Corp. (Appia)

Appia is a publicly traded Canadian company in the rare earth element and uranium sectors. The Company is currently focusing on delineating high-grade critical rare earth elements and gallium on the Alces Lake property, as well as exploring for high-grade uranium in the prolific Athabasca Basin on its Otherside, Loranger, North Wollaston, and Eastside properties. The Company holds the surface rights to exploration for 113,837.15 hectares (281,297.72 acres) in Saskatchewan. The Company also has a 100% interest in 13,008 hectares (32,143 acres), with rare earth elements and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario. Lastly, the Company holds the right to acquire up to a 70% interest in the PCH Project which is 17,551.07 ha. in size and located within the Goiás State of Brazil. (See June 9th, 2023 Press Release - Click HERE) The company successfully added 23,412.11 ha to the PCH project's total hectares by staking 12 new claims, bringing the overall project size to 40,963.18 ha.

Appia has 136.3 million common shares outstanding, 144.1 million shares fully diluted.

Cautionary note regarding forward-looking statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words "believes", "expects", "anticipates", "estimates", "intends", "plans" or similar expressions. Forward-looking statements are not a guarantee of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward-looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For more information, visit www.appiareu.com.

As part of our ongoing effort to keep investors, interested parties and stakeholders updated, we have several communication portals. If you have any questions online (X, Facebook, LinkedIn) please feel free to send direct messages.

To book a one-on-one 30-minute Zoom video call, please This email address is being protected from spambots. You need JavaScript enabled to view it..

Contact:

Tom Drivas, CEO and Director

(c) (416) 876-3957

(e) This email address is being protected from spambots. You need JavaScript enabled to view it.

Stephen Burega, President

(c) (647) 515-3734

(e) This email address is being protected from spambots. You need JavaScript enabled to view it.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.15 |

| Daily Change: | -0.01 -6.25 |

| Daily Volume: | 1,100 |

| Market Cap: | US$29.160M |

December 09, 2025 September 15, 2025 June 12, 2025 May 21, 2025 | |