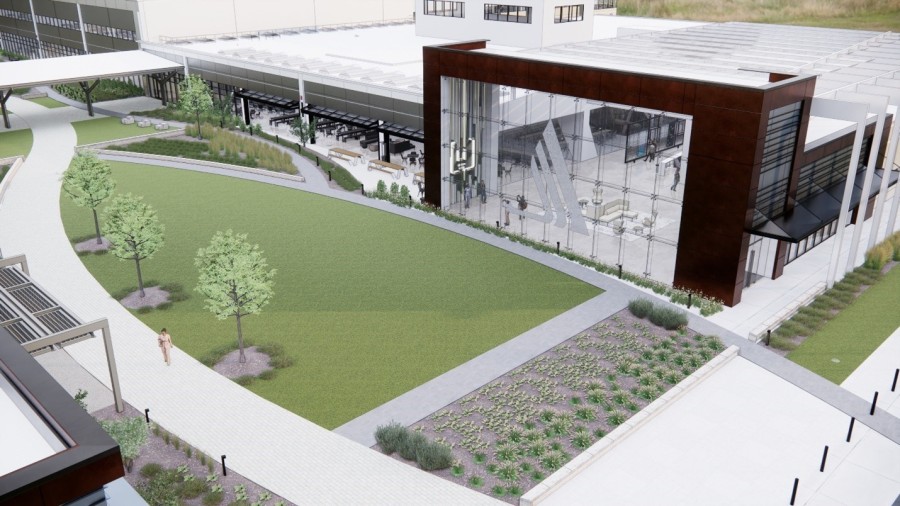

CHARLOTTE, N.C., Dec. 13, 2022 /PRNewswire/ -- Albemarle Corporation (NYSE: ALB), a leader in the global specialty chemicals industry, today announced it has acquired a location in Charlotte, North Carolina, where it will invest at least $180 million to establish the Albemarle Technology Park (ATP), a world-class facility designed for novel materials research, advanced process development, and acceleration of next-generation lithium products to market. The company anticipates that innovations from the new site will enhance lithium recovery, improve production methods, and introduce new forms of lithium to enable breakthrough levels of battery performance.

"Albemarle Technology Park is part of our mine-to-market innovation strategy to invest in the U.S. EV battery supply chain and to be a leader in advanced lithium materials for next-generation energy storage," said Kent Masters, Albemarle CEO. "This facility will focus and accelerate our lithium technology leadership, better enabling the world's transition to more sustainable energy."

Albemarle was awarded a nearly $13 million incentive package from the State of North Carolina to develop the advanced lithium materials research, process development, and product innovation facility in Mecklenburg County, North Carolina.

"Albemarle's work on the next generation of products related to lithium batteries really advances North Carolina's leadership in the emerging clean energy economy," said Governor Cooper. "Reducing carbon emissions is good for our environment and great for our economy too."

The incentive package is part of a Job Development Investment Grant (JDIG) supporting a portion of Albemarle's investment to transform the former IBM and Flextronics facility. The company anticipates creating at least 200 jobs at the site, with an average salary of $94,000 per year. In particular, the team intends to triple the number of Ph.D. professionals in the Albemarle Technology Park.

"Charlotte has been home to Albemarle Corporation for several years," said Charlotte Mayor Vi Lyles. "This investment signifies their commitment to the growth and innovation of the company as well as our city, and we have a talented workforce that can fill the jobs this expansion will bring."

Albemarle's vision for the ATP spans from novel lithium materials and manufacturing processes to new product commercialization in close partnership with strategic customers. By co-locating these critical activities and collaborations, the company expects ATP will become a lithium innovation hub that anchors technology leadership in the Southeast U.S., where the EV industry is rapidly expanding. The company anticipates that enhanced process technologies developed at the ATP will unlock new lithium resources, increase sustainability by reducing energy and water use, and enable lithium recovery at end-of-life through cost-effective recycling.

Albemarle expects initial occupancy of the new facility by early 2025 and completion of the ATP campus by late 2026.

About Albemarle

Albemarle Corporation (NYSE: ALB) is a global specialty chemicals company with leading positions in lithium, bromine, and catalysts. We think beyond business as usual to power the potential of companies in many of the world's largest and most critical industries, such as energy, electronics, and transportation. We actively pursue a sustainable approach to managing our diverse global footprint of world-class resources. In conjunction with our highly experienced and talented global teams, our deep-seated values, and our collaborative customer relationships, we create value-added and performance-based solutions that enable a safer and more sustainable future.

We regularly post information to www.albemarle.com, including notification of events, news, financial performance, investor presentations and webcasts, non-GAAP reconciliations, SEC filings and other information regarding our company, its businesses and the markets it serves.

Forward-Looking Statements

Some of the information presented in this press release, including, without limitation, information related to Albemarle's investment in the ATP facility, including the amount of such investment; the timing of initial occupancy and completion of the facility and its campus; the number of jobs created at the facility and average salaries of such positions; the type of operations and activities to be conducted at the facility and the outcomes of any such operations or activities; and including all information relating to matters that are not historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from the views expressed. Factors that could cause Albemarle's actual results to differ materially from the outlook expressed or implied in any forward-looking statement include, without limitation: the availability of company funds and resources to make planned investments in the ATP facility; delays in the construction of the facility or unexpected costs relating thereto; changes in economic and business conditions; changes in financial and operating performance of the company's major customers and industries and markets served by it; the timing of orders received from customers; the gain or loss of significant customers; fluctuations in lithium market pricing, which could impact the company's revenues and profitability particularly due to its increased exposure to index-referenced and variable-priced contracts for battery grade lithium sales; changes with respect to contract renegotiations; potential production volume shortfalls; competition from other manufacturers; changes in the demand for its products or the end-user markets in which its products are sold; limitations or prohibitions on the manufacture and sale of its products; availability of raw materials; increases in the cost of raw materials and energy, and its ability to pass through such increases to its customers; technological change and development, changes in its markets in general; fluctuations in foreign currencies; changes in laws and government regulation impacting its operations or its products; the occurrence of regulatory actions, proceedings, claims or litigation (including with respect to the U.S. Foreign Corrupt Practices Act and foreign anti-corruption laws); the occurrence of cyber-security breaches, terrorist attacks, industrial accidents or natural disasters; the effect of climate change, including any regulatory changes to which it might be subject; hazards associated with chemicals manufacturing; the inability to maintain current levels of insurance, including product or premises liability insurance, or the denial of such coverage; political unrest affecting the global economy, including adverse effects from terrorism or hostilities; political instability affecting our manufacturing operations or joint ventures; changes in accounting standards; the inability to achieve results from its global manufacturing cost reduction initiatives as well as its ongoing continuous improvement and rationalization programs; changes in the jurisdictional mix of its earnings and changes in tax laws and rates or interpretation; changes in monetary policies, inflation or interest rates that may impact its ability to raise capital or increase its cost of funds, impact the performance of its pension fund investments and increase its pension expense and funding obligations; volatility and uncertainties in the debt and equity markets; technology or intellectual property infringement, including cyber-security breaches, and other innovation risks; decisions it may make in the future; future acquisition and divestiture transactions, including the ability to successfully execute, operate and integrate acquisitions and divestitures and incurring additional indebtedness; continuing uncertainties as to the duration and impact of the coronavirus (COVID-19) pandemic; performance of Albemarle's partners in joint ventures and other projects; changes in credit ratings; and the other factors detailed from time to time in the reports Albemarle files with the SEC, including those described under "Risk Factors" in Albemarle's most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this press release. Albemarle assumes no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws.

| Last Trade: | US$161.29 |

| Daily Change: | 2.98 1.88 |

| Daily Volume: | 2,519,647 |

| Market Cap: | US$18.980B |

November 05, 2025 July 30, 2025 April 30, 2025 February 12, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS