Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Xos, Inc. Reports Third Quarter 2021 Results

Xos, Inc. (NASDAQ: XOS), a leading manufacturer of fully electric Class 5 to Class 8 commercial vehicles, today reported financial results for the quarter ended September 30, 2021.

- Third quarter 2021 revenues were $357 thousand

- Third quarter 2021 net income was $34.9 million and operating loss was $14.3 million

- Cash and cash equivalents of $207.4 million, as of September 30, 2021

- Net cash used in operating activities over the third quarter was $33.0 million

- Customer unit deliveries were 3 for the third quarter, and 12 for the nine months ended September 30, 2021

- Launched new Lyra Series of next generation commercial vehicle battery packs

Third quarter 2021 diluted loss per share was $0.08, compared with $0.13 in the second quarter of 2021 and $0.05 in the third quarter of 2020, driven largely by increased investment in Research & Development and General & Administrative expense and supply chain disruptions that slowed production ramp up.

“Despite challenges resulting from unprecedented global supply chain disruptions and delays in ramping production of our new Lyra Series battery system, Xos continued to set the foundation for future growth in our first quarter as a public company,” said Dakota Semler, Xos’ Chief Executive Officer and Co-founder. “We scaled vehicle manufacturing capacity for future growth, transitioned to our new Lyra Series battery production line in our Los Angeles facility, built on our commercial momentum with several notable customer wins, and added to our world-class team. The closing of our business combination with NextGen in the quarter has positioned us well to execute our growth plans. Ongoing investment in production, engineering and business development will further build on our strong foundation as we scale deliveries in the fourth quarter and into 2022.”

Third Quarter 2021 Milestones and Accomplishments

- Completed previously announced merger with NextGen Acquisition Corp., with over $200 million of growth capital.

- Executed agreements with FedEx Ground operators to deliver 120 zero emission electric trucks across FedEx Ground operators based in California, New York, New Jersey, Massachusetts, and Texas. Current orders to FedEx Ground operators stand at over 200 vehicles. Manufacturing has commenced on FedEx Ground vehicles and deliveries are expected to begin in the fourth quarter of 2021.

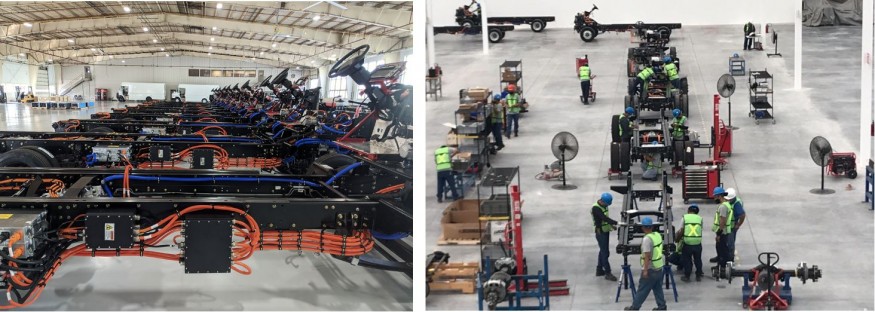

- Expanded production capacity at our two Flex Manufacturing facilities in Byrdstown, Tennessee and Monterrey, Mexico to be capable of production of a combined 2,000 units per year. Each facility is planned to eventually achieve 5,000 units of capacity per year.

- Launched Xos Energy Solutions™, the energy component within Xos’ Fleet-as-a-Service offering, which provides comprehensive infrastructure services to small and large fleets to accelerate large-scale deployments of commercial electric vehicles.

- Unveiled Xos Hub™, a mobile charging station to help fleet customers access charging infrastructure at their fleet yard without having to wait for traditional infrastructure installation.

- Launched Xos Serve™, an on-demand infrastructure-as-a-service platform that includes site evaluations, energy storage development and installation and energy management services.

- Xos’ medium duty stepvan platform successfully completed third party durability testing at an automotive test track and proving grounds.

- Tests simulate 200,000 miles of real world driving and are representative of the full range of terrain and conditions that a vehicle may encounter during its lifespan. These tests provide valuable data that is used by Xos engineers to improve on existing truck designs.

- Entered into strategic collaboration with Cox Automotive Mobility to leverage the automotive services provider’s EV battery remanufacturing capabilities for Xos battery packs.

- Began commercial production of our new Lyra Series of next generation commercial vehicle battery packs, to be installed in Xos vehicles in the fourth quarter of 2021. This new generation of battery builds on the proven durability and reliability of prior battery systems while delivering greater efficiency and modularity to meet a broad set of customer requirements. The second series of proprietary battery systems built and designed by Xos, the Lyra Series features a system level 52% improvement in gravimetric energy density and a 45% improvement in volumetric energy density, offering a lighter overall pack that is more compact for the same, or more, net payload capability.

Business Outlook for Fourth Quarter 2021

Based on current business trends and conditions, Xos is issuing the following outlook:

- 15-25 Unit deliveries for fourth quarter 2021, and 27-37 for full year 2021

- $1.7 million - $3.0 million revenues for fourth quarter 2021, and $3.5 million - $4.7 million for full year 2021

- $18.0 million - $22.0 million Non-GAAP Operating Loss(1) for fourth quarter 2021, and $45.6 million - $49.6 million for full year 2021

The guidance provided above is only an estimate of what management believes is realizable as of the date of this press release. This guidance assumes that no business acquisitions, investments, restructurings, or legal settlements are concluded in the quarter. Our results are based on assumptions that we believe to be reasonable as of this date, but may be materially affected by many factors, as discussed below in “Forward-Looking Statements.” Actual results may vary from the outlook above and the variations may be material. We undertake no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.

1 See “Non-GAAP Financial Measures” section of this press release.

Webcast and Conference Call Information

Company management will host a webcast and conference call on Thursday November 11, 2021, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time), to discuss the Company's financial results.

Interested investors and other parties can listen to a webcast of the live conference call and access the Company’s third quarter update presentation by logging onto the Investor Relations section of the Company's website at https://investors.xostrucks.com/.

The conference call can be accessed live over the phone by dialing 1-877-407-9716 (domestic) or + 1-201-493-6779 (international). A telephonic replay will be available approximately two hours after the call by dialing 1-844-512-2921 (domestic) or +1-412-317-6671 (international). The pin number for the replay is 13724530. The replay will be available until 11:59 p.m. Eastern Time on November 27, 2021.

Xos, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

| (in thousands) | September 30, 2021 (Unaudited) | December 31, 2020 | |||||

| Assets | |||||||

| Cash and cash equivalents | $ | 207,388 | $ | 10,359 | |||

| Accounts receivable, net | 583 | 408 | |||||

| Inventories | 20,834 | 1,867 | |||||

| Prepaid expenses and other current assets | 17,840 | 56 | |||||

| Total current assets | 246,645 | 12,690 | |||||

| Property and equipment, net | 4,629 | 1,084 | |||||

| Other assets | 505 | — | |||||

| Total assets | $ | 251,779 | $ | 13,774 | |||

| Liabilities and Stockholders’ Equity (Deficit) | |||||||

| Accounts payable | $ | 12,468 | $ | 1,168 | |||

| Current portion of equipment loans payable | 151 | 142 | |||||

| Current portion of convertible notes payable | — | 18,360 | |||||

| Current portion of derivative liability | — | 6,394 | |||||

| Current portion of SAFE notes payable | — | 30 | |||||

| Legacy Xos Preferred Stock Warrant liability | — | 1,707 | |||||

| Other current liabilities | 2,836 | 5,142 | |||||

| Total current liabilities | 15,455 | 32,943 | |||||

| Equipment loans payable, net of current portion | 876 | 166 | |||||

| Contingent earn-out shares liability | 53,542 | — | |||||

| Common stock warrant liability | 19,963 | — | |||||

| Total liabilities | 89,836 | 33,109 | |||||

| Commitment and Contingencies | |||||||

| Legacy Xos Preferred Stock – $0.0001 par value | |||||||

| Series A – 27,041 shares authorized; 0 and 2,762 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | — | 7,862 | |||||

| Stockholders’ Equity (Deficit) | |||||||

| Common Stock $0.0001 par value, authorized 1,000,000 shares, 162,905 and 72,277 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | 16 | 7 | |||||

| Preferred Stock $0.0001 par value, authorized 10,000 shares, 0 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | — | — | |||||

| Additional paid in capital | 177,533 | 290 | |||||

| Accumulated deficit | (15,606 | ) | (27,494 | ) | |||

| Total stockholders’ equity (deficit) | 161,943 | (27,197 | ) | ||||

| Total liabilities, Legacy Xos Preferred Stock and stockholders’ equity (deficit) | $ | 251,779 | $ | 13,774 | |||

Xos, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

| (in thousands) | 2021 | 2020 | 2021 | 2020 | |||||||||||

| Revenues | $ | 357 | $ | 1,125 | $ | 1,746 | $ | 1,698 | |||||||

| Cost of Goods Sold | 418 | 1,161 | 1,675 | 1,639 | |||||||||||

| Gross Margin | (61 | ) | (36 | ) | 71 | 59 | |||||||||

| Operating Expenses | |||||||||||||||

| Research and development | 3,237 | 727 | 6,867 | 2,440 | |||||||||||

| Sales and marketing | 549 | 65 | 700 | 142 | |||||||||||

| General and administrative | 10,211 | 2,198 | 19,580 | 4,122 | |||||||||||

| Depreciation expense | 248 | 66 | 628 | 214 | |||||||||||

| Total Operating Expenses | 14,245 | 3,056 | 27,775 | 6,918 | |||||||||||

| Loss from Operations | (14,306 | ) | (3,092 | ) | (27,704 | ) | (6,859 | ) | |||||||

| Other Income (Expenses) | |||||||||||||||

| Interest expense | (65 | ) | (867 | ) | (78 | ) | (2,186 | ) | |||||||

| Change in fair value of derivatives | 1,066 | — | 6,030 | — | |||||||||||

| Change in fair value of contingent earn-out shares liability | 48,202 | — | 48,202 | — | |||||||||||

| Write off of subscription receivable | — | — | (379 | ) | — | ||||||||||

| Realized loss on debt extinguishment | — | — | (14,104 | ) | — | ||||||||||

| Miscellaneous | (1 | ) | — | (5 | ) | 4 | |||||||||

| Total Other Income (Expenses) | 49,202 | (867 | ) | 39,666 | (2,182 | ) | |||||||||

| Net Income (Loss) | $ | 34,896 | $ | (3,959 | ) | $ | 11,962 | $ | (9,041 | ) | |||||

| Net income (loss) per share | |||||||||||||||

| Basic | $ | 0.31 | $ | (0.05 | ) | $ | 0.14 | $ | (0.13 | ) | |||||

| Diluted | $ | (0.08 | ) | $ | (0.05 | ) | $ | (0.28 | ) | $ | (0.13 | ) | |||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 113,797 | 72,277 | 86,192 | 72,145 | |||||||||||

| Diluted | 148,791 | 72,277 | 121,186 | 72,145 | |||||||||||

Non-GAAP Financial Measures

The financial information in this press release has been presented in accordance with United States generally accepted accounting principles (“GAAP”) as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include Operating Cash Flow less CapEx (Free Cash Flow), Non-GAAP Operating Loss and Adjusted EBITDA which are defined below.

“Operating Cash Flow less CapEx (Free Cash Flow)” is defined as net cash used in operating activities minus purchase of property and equipment.

“Non-GAAP Operating Loss” is defined as operating loss adjusted for stock-based compensation.

“Adjusted EBITDA” is defined as net loss before other non-operating expense or income, income tax expense or benefit, and depreciation and amortization, adjusted for stock-based compensation and other non-recurring items determined by management.

We believe that the use of Operating Cash Flow less CapEx (Free Cash Flow), Non-GAAP Operating Loss and Adjusted EBITDA reflect additional means of evaluating Xos’ ongoing operating results and trends. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. It is important to note our computation of Operating Cash Flow less CapEx (Free Cash Flow), Non-GAAP Operating Loss and Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because not all companies may calculate Operating Cash Flow less CapEx (Free Cash Flow), Non-GAAP Operating Loss and Adjusted EBITDA in the same fashion. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under GAAP when understanding our operating performance. A reconciliation between GAAP and non-GAAP financial information is provided in this press release.

Reconciliation of Operating Cash Flow less CapEx (Free Cash Flow), Non-GAAP Operating Loss and Adjusted EBITDA

Operating Cash Flow less CapEx (Free Cash Flow):

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

| (in thousands) | 2021 | 2020 | 2021 | 2020 | |||||||||||

| Net cash used in operating activities | $ | (32,982 | ) | $ | (5,809 | ) | $ | (53,135 | ) | $ | (9,849 | ) | |||

| Purchases of property and equipment | (2,641 | ) | (284 | ) | (3,343 | ) | (427 | ) | |||||||

| Free-Cash Flow | $ | (35,623 | ) | $ | (6,093 | ) | $ | (56,478 | ) | $ | (10,276 | ) | |||

Non-GAAP Operating Loss:

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

| (in thousands) | 2021 | 2020 | 2021 | 2020 | |||||||||||

| Loss from operations | $ | (14,306 | ) | $ | (3,092 | ) | $ | (27,704 | ) | $ | (6,859 | ) | |||

| Stock-based compensation | 2 | 1 | 5 | 7 | |||||||||||

| Non-GAAP Operating Loss | $ | (14,304 | ) | $ | (3,091 | ) | $ | (27,699 | ) | $ | (6,852 | ) | |||

Adjusted EBITDA:

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

| (in thousands) | 2021 | 2020 | 2021 | 2020 | |||||||||||

| Net Income (loss) | $ | 34,896 | $ | (3,959 | ) | $ | 11,962 | $ | (9,041 | ) | |||||

| Interest expense, net | 65 | 867 | 78 | 2,186 | |||||||||||

| Depreciation | 248 | 66 | 628 | 214 | |||||||||||

| EBITDA | $ | 35,209 | $ | (3,026 | ) | $ | 12,668 | $ | (6,641 | ) | |||||

| Change in fair value of derivatives | (1,066 | ) | — | (6,030 | ) | — | |||||||||

| Change in fair value of earn-out shares liability | (48,202 | ) | — | (48,202 | ) | — | |||||||||

| Stock based compensation | 2 | 1 | 5 | 7 | |||||||||||

| Adjusted EBITDA | $ | (14,057 | ) | $ | (3,025 | ) | $ | (41,559 | ) | $ | (6,634 | ) | |||

About Xos, Inc.

Xos, Inc. is an electric mobility company dedicated to decarbonizing commercial trucking fleets. Xos designs and manufactures cost-competitive, fully electric commercial vehicles. The company’s primary focus is on medium- and heavy-duty commercial vehicles that travel on last mile, back-to-base routes of less than 200 miles per day. The company leverages its proprietary technologies to provide commercial fleets with zero-emission vehicles that are easier to maintain and more cost-efficient on a total cost of ownership (TCO) basis than their internal combustion engine and commercial EV counterparts. For more information, please visit www.xostrucks.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding projected financial and performance information for the fourth quarter and full year 2021, expectations and timing related to production, customer acquisition and order metrics, and Xos, Inc.’s (“Xos”) long-term strategy and future growth. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) Xos’ ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities, (ii) Xos’ limited operating history, (iii) cost increases and delays in production due to supply chain shortages in the components needed for the production of Xos’ vehicle chassis and battery system, (iv) Xos’ ability to meet production milestones and fulfill backlog orders, (v) changes in the industries in which Xos operates, (vi) variations in operating performance across competitors, (vii) changes in laws and regulations affecting Xos’ business, (viii) Xos’ ability to implement its business plan or meet or exceed its financial projections (ix) Xos’ ability to retain key personnel and hire additional personnel, particularly in light of current and potential labor shortages, (x) the risk of downturns and a changing regulatory landscape in the highly competitive electric vehicle industry and (xi) the outcome of any legal proceedings that may be instituted against Xos. You should carefully consider the foregoing factors and the other risks and uncertainties described under the heading “Risk Factors” included in Xos’ Registration Statement on Form S-1 filed with the Securities and Exchange Commission (the “SEC”) on September 14, 2021 and Xos’ other filings with the SEC, copies of which may be obtained by visiting Xos’ Investors Relations website at https://investors.xostrucks.com/ or the SEC's website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Xos assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Xos does not give any assurance that it will achieve its expectations.

Contacts

Xos Investor Relations

This email address is being protected from spambots. You need JavaScript enabled to view it.

Xos Media Relations

This email address is being protected from spambots. You need JavaScript enabled to view it.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$2.29 |

| Daily Change: | 0.05 2.23 |

| Daily Volume: | 3,711 |

| Market Cap: | US$25.950M |

November 13, 2025 September 04, 2025 August 18, 2025 August 13, 2025 | |