Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Stratasys Mails Letter to Shareholders Highlighting Nano Dimension's Track Record of Value Destruction

- Warns Shareholders Not to Be Fooled by Yoav Stern; Nano Continues to Make Misleading Claims

- Nano’s Campaign Risks Derailing Stratasys’ Future Growth Opportunities and Threatens to Destroy Value for Stratasys Shareholders

- Urges Shareholders to Vote on the WHITE Proxy Card Today “FOR” the Re-Election of Each of Stratasys’ Director Nominees and “AGAINST” Each of Nano’s Unqualified Nominees

MINNEAPOLIS & REHOVOT, Israel / Jul 26, 2023 / Business Wire / Stratasys Ltd. (Nasdaq: SSYS) (“Stratasys” or the “Company”), a leader in polymer 3D printing solutions, today mailed a letter to shareholders in connection with Stratasys’ Annual General Meeting of Shareholders (the “Meeting”) that will take place on August 8, 2023.

The full text of the letter follows:

Nano Continues to Make Misleading Claims; Don’t Be Fooled by Yoav Stern

Nano’s Misleading Claims | The Facts |

Nano will pay Stratasys shareholders $25.00 per share in cash in the partial tender offer. | Due to the mechanism of the partial tender offer, you will be able to sell only ~40% of your shares for $25.00, assuming full participation in the offer.

Stratasys shareholders who tender risk being left with the majority of their shares and becoming minority shareholders in a Nano-controlled company. |

The partial tender offer value is certain and shareholders will receive their cash IMMEDIATELY after Nano closes its partial tender offer. | Even Mr. Stern says that Stratasys shares not tendered could trade at $12 or $13 per share.1 If the remaining shares trade at a significantly lower price, the implied total value per share could be ~$16 to $19 or less.2 The timing of any potential closing of the partial tender offer could be months away due to the numerous conditions Nano has placed on its offer. |

If Nano completes the partial tender offer and acquires at least 31.9% to 36.9% of Stratasys, Nano will purchase the rest of the Stratasys shares. | With the cash that Nano has3, they cannot pay for all of your Stratasys shares at $25.00 per share. They can only buy enough to get to 47%4 ownership in Stratasys. |

Nano’s nominees are highly qualified and bring deep, relevant experience. | Mr. Stern has acknowledged that his current nominees are not suitable, are interim and will be replaced. Nano’s stagnant board structure indicates that Mr. Stern will likely not replace directors at Nano, so why would he do so with Stratasys? Mr. Stern provides no timetable for this replacement to happen nor any indication as to what these changes will be, which means your investment in Stratasys could be at significant risk for a prolonged period if Mr. Stern and his employees gain control of the Stratasys Board. |

(1) | Yoav Stern, Nano Business Update Call, 5/30/23. | |

(2) | Illustrative pro-rata price assumes all Stratasys shareholders except Nano tender their aggregate 58.9mm shares and maximum of 25.3mm shares purchased as per Nano tender offer (~40% total shares tendered), leaving 33.6mm shares not purchased (~60% total shares tendered); Calculation based on blended value of shares tendered to Nano at $25 per share and illustrative value of remaining Stratasys shares. The 49% of Stratasys shares illustratively trading as Nano-controlled entity assumes for illustrative purposes a $14.88 unaffected Stratasys share price as of 5/24/2023 before announcement of the transaction with Desktop Metal at the upper end and ~40% discount to Stratasys unaffected price of $14.88 implying ~$9 per share at the low end. For the lower end, the ~40% discount to Stratasys unaffected price applied is calculated on the basis of the average 2023 YTD discount of Nano’s share price to its per share value of cash and investments. |

The Stratasys Board reminds its shareholders as to what’s at stake if Nano Dimension Ltd. (“Nano”), a company that has destroyed significant shareholder value, gains control of Stratasys through its misleading and coercive campaign:

- Nano can gain control of Stratasys without paying a penny to Stratasys shareholders, if their Board nominees are elected.

- Shareholders risk becoming minority shareholders in a Nano-controlled company through Nano’s partial tender offer.

- Nano’s partial tender offer implies that your Stratasys shares are valued at ~$16 to $19 per share or less,2 assuming full participation in the offer.

- Nano’s non-independent director nominees, who are almost all Nano employees, may have significant conflicts of interest, and are not qualified to run a company of Stratasys’ scale.

- Nano’s nominees could block Stratasys from engaging in discussions regarding any transactions that would maximize value for Stratasys shareholders.

Dear Stratasys Shareholder,

The Stratasys Annual General Meeting of Shareholders on August 8, 2023 is fast approaching and your vote is critical to ensuring Stratasys can continue to deliver long-term, resilient shareholder value.

Nano has launched a highly opportunistic and self-interested campaign to take control of Stratasys by commencing a partial tender offer and nominating an unqualified group of director candidates to stand for election to Stratasys’ Board of Directors.

(3) |

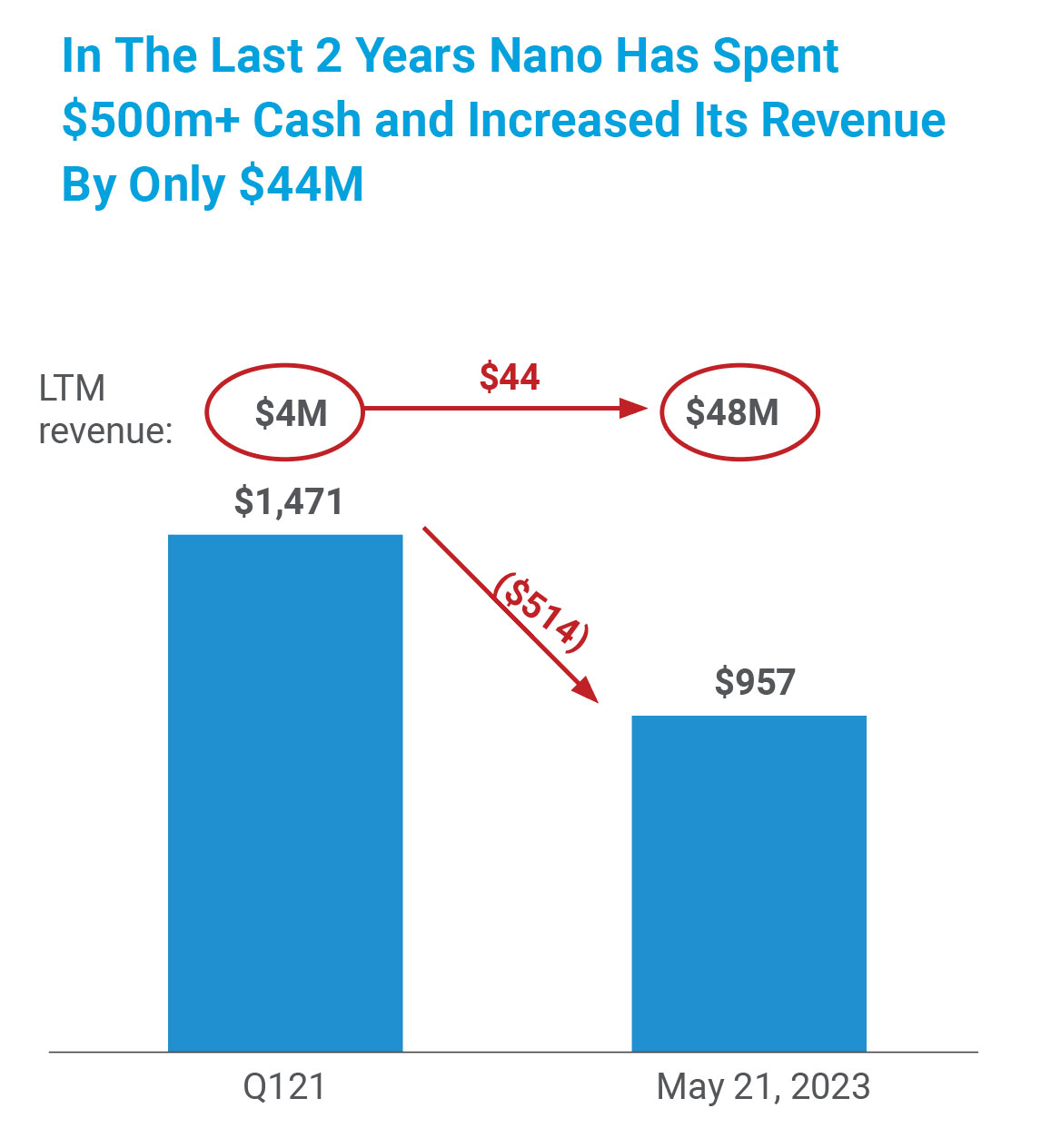

| Per Nano’s Schedule Tender Offer, Nano had $957M cash and cash equivalents as at 5/21/23. |

(4) |

| Assumes Nano maintains minimum cash balance of $150M to account for transaction expenses and expected cash burn and spends remaining cash of $807M to acquire Stratasys shares at $25 per share. Based on 68.6M Stratasys basic shares outstanding. Excludes Nano’s current ownership in Stratasys. |

Vote the WHITE Proxy Card Today |

|

Support the Stratasys Board and VOTE TODAY on the WHITE proxy card “FOR” the re-election of each of Stratasys’ directors and “AGAINST” each of Nano’s unqualified nominees. The Stratasys Board urges shareholders NOT to tender into Nano’s coercive partial tender offer, to withdraw any shares previously tendered and to contact their broker and instruct them to file a Notice of Objection. |

The Facts are Clear: Nano’s Leadership Team Has Destroyed Shareholder Value at an Alarming Rate

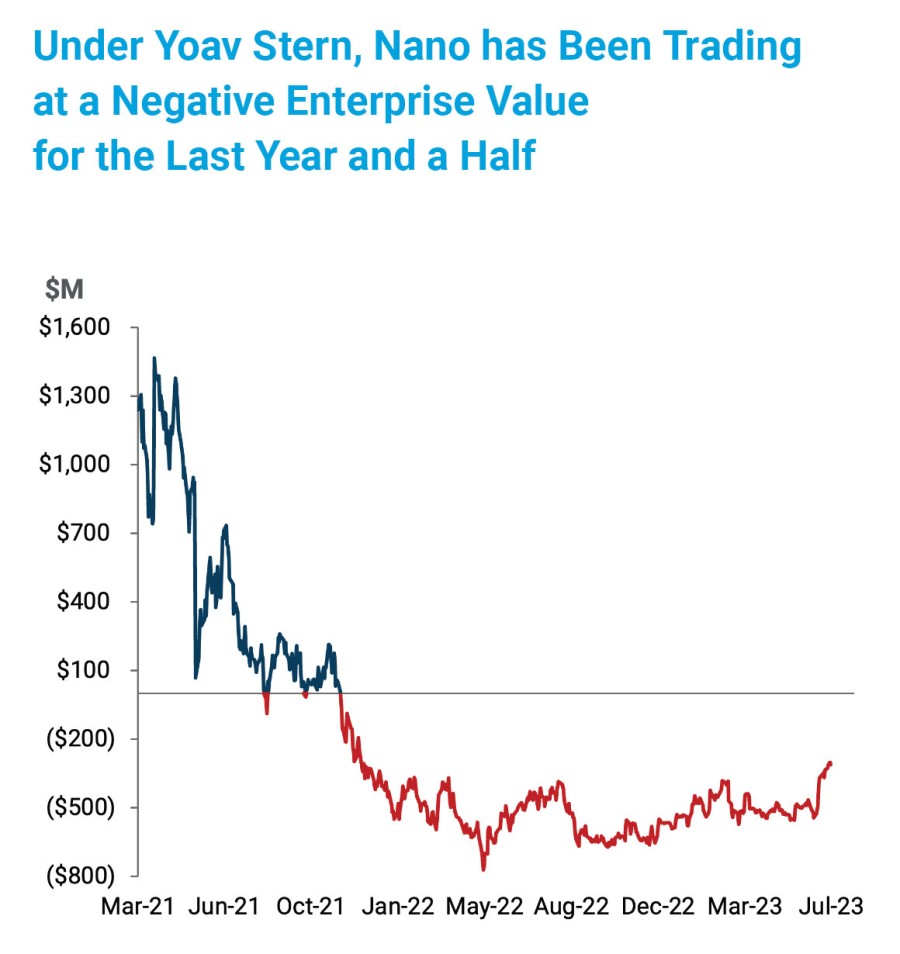

Under Nano CEO Yoav Stern’s oversight, Nano has been trading at a negative enterprise value5 for the last year and a half. In addition, Nano has lost hundreds of millions of dollars of shareholder value under the oversight of the Nano Board. In fact, without the value Stratasys has created for Nano through its 14.1% investment in Stratasys, we would expect that the value destruction will only increase.

With Nano’s track record, we are highly skeptical of the ability of Nano’s nominees - all but one of whom are Nano officers to carry out Stratasys’ significant growth opportunities and strategy to continue delivering value for all Stratasys shareholders.

(5) |

| Source: Company filings; Enterprise Value accounts for Nano’s investment in Stratasys as of Q3 2022. |

See Images 1 and 2.

Nano’s Director Candidates are Not Qualified; Don’t Trust them with Your Company and Your Investment

Six of Nano’s seven nominees for the Stratasys Board are current Nano executives, including its CEO Yoav Stern, meaning that there would be significant conflicts of interest between their roles at Nano and their roles as directors of Stratasys.

The only independent nominee put forth by Nano, Zeev Holtzman, previously served on the Stratasys Board and was replaced after a year and a half due to his failure to make the positive contributions we had anticipated based on his venture capital experience. His lack of relevant public company board experience became more apparent during his tenure, and led the Stratasys Board to refrain from nominating him for a second term. This is further accentuated by his consent to serve on a public company board in which he would be the sole independent director and which would be immediately non-compliant with SEC and Nasdaq requirements related to independence.

See Image 3.

Act Now: Protect the Value of Your Investment in Stratasys to Prevent Nano from Destroying Our Strategy for Value-Creation

The Stratasys Board unanimously recommends that Stratasys shareholders vote on the WHITE proxy card “FOR” the re-election of each of Stratasys’ current directors, consisting of: S. Scott Crump, John J. McEleney, Dov Ofer, Ziva Patir, David Reis, Michael Schoellhorn, Yair Seroussi and Adina Shorr.

The Stratasys Board unanimously recommends that Stratasys shareholders vote on the WHITE proxy card “AGAINST” the election of each of Nano’s nominees, consisting of: Yoav Stern, Nick Geddes, Hanan Gino, Zeev Holtzman, Zivi Nedivi, Tomer Pinchas and Yael Sandler.

Furthermore, the Stratasys Board urges shareholders to reject Nano's partial tender offer, deliver a Notice of Objection against the partial offer and NOT to tender their Stratasys shares in the partial offer.

Thank you for your support.

The Stratasys Board of Directors

Materials related to the Meeting can be found at http://www.NextGenerationAM.com/how-to-support-stratasys.

For assistance voting on your WHITE proxy card, please contact your broker or Stratasys’ information agent:

Morrow Sodali LLC 509 Madison Avenue, 12th Floor New York, NY 10022

Call toll-free (800) 662-5200 or (203) 658-9400

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Advisors

J.P. Morgan is acting as financial advisor to Stratasys, and Meitar Law Offices and Wachtell, Lipton, Rosen & Katz are serving as legal counsel.

About Stratasys

Stratasys is leading the global shift to additive manufacturing with innovative 3D printing solutions for industries such as aerospace, automotive, consumer products, healthcare, fashion and education. Through smart and connected 3D printers, polymer materials, a software ecosystem, and parts on demand, Stratasys solutions deliver competitive advantages at every stage in the product value chain. The world’s leading organizations turn to Stratasys to transform product design, bring agility to manufacturing and supply chains, and improve patient care.

To learn more about Stratasys, visit www.stratasys.com, the Stratasys blog, Twitter, LinkedIn, or Facebook. Stratasys reserves the right to utilize any of the foregoing social media platforms, including the Company’s websites, to share material, non-public information pursuant to the SEC’s Regulation FD. To the extent necessary and mandated by applicable law, Stratasys will also include such information in its public disclosure filings.

Stratasys is a registered trademark and the Stratasys signet is a trademark of Stratasys Ltd. and/or its subsidiaries or affiliates. All other trademarks are the property of their respective owners.

Forward-Looking Statements

This document contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements.

Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys with the SEC. These include, but are not limited to: factors relating to the partial tender offer commenced by Nano Dimension Ltd. (“Nano”), including actions taken by Nano in connection with the offer, actions taken by Stratasys or its shareholders in respect of the offer and the effects of the offer on Stratasys’ businesses, or other developments involving Nano, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ Annual Reports on Form 20-F and its Form 6-K report that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023. The forward-looking statements included in this communication are made only as of the date hereof. Stratasys does not undertake any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Important Additional Information

This communication is not an offer to purchase or a solicitation of an offer to sell the ordinary shares of Stratasys. In response to a tender offer commenced by Nano, Stratasys has filed with the Securities and Exchange Commission a Solicitation/Recommendation Statement on Schedule 14D-9. STRATASYS SHAREHOLDERS ARE ADVISED TO READ STRATASYS’ SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stratasys shareholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D-9, as well as any other documents filed by Stratasys in connection with the tender offer by Nano or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents from Stratasys by directing a request to Stratasys Ltd., 1 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 7612, Israel, Attn: Yonah Lloyd, VP Investor Relations, or by calling +972-74-745-4029.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$11.55 |

| Daily Change: | 1.42 14.02 |

| Daily Volume: | 8,976,741 |

| Market Cap: | US$986.920M |

January 15, 2026 December 10, 2025 December 01, 2025 November 13, 2025 | |