Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Shoals Technologies Group, Inc. Reports Financial Results for Third Quarter 2021

- Revenue Increased 14% Year-Over-Year to a Record $59.8 million

- System Solutions Revenue Increased 5% Year-Over-Year to $38.6 million

- Gross Margin of 36.4% Reflecting Higher Mix of Components sales and Acquisition Impacts

- Backlog and Awarded Orders Up 101% Year-Over-Year to a Record $270.7 million

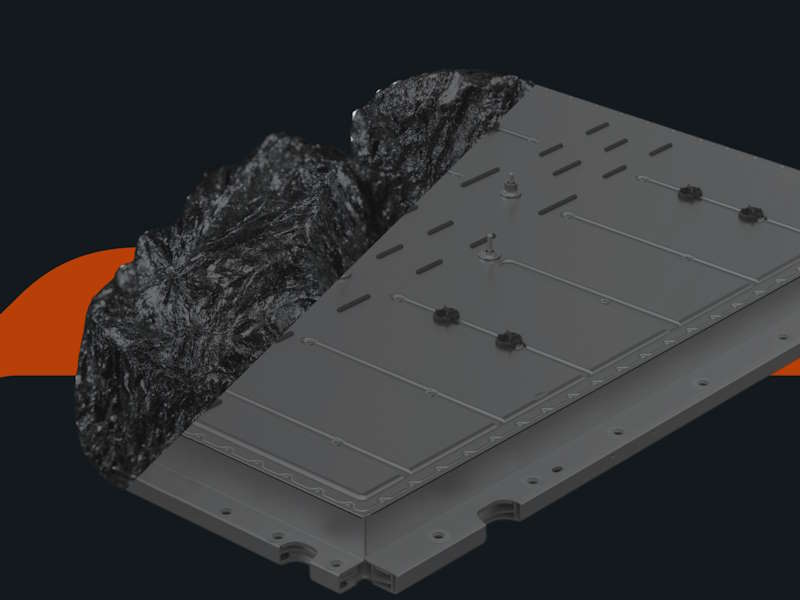

- Acquires ConnectPV, a Leading Provider of EBOS Products for Battery Storage

- Provides Fourth Quarter and First Quarter 2022 Outlook

Shoals Technologies Group, Inc. (“Shoals” or the “Company”) (Nasdaq: SHLS), a leading provider of electrical balance of system (“EBOS”) solutions for solar, battery storage and electric vehicle charging infrastructure, today announced results for its third quarter ended September 30, 2021.

“We are continuing to grow faster than the market as Shoals’ System Solutions take share from conventional solar EBOS. Third quarter revenues increased 14% year over year and we ended the quarter with the highest level of backlog and awarded orders in the company’s history. Since the beginning of the year, the number of solar EPCs and developers that use BLA has more than quadrupled and there are an additional 12 customers that are currently transitioning to our system,” said Jason Whitaker, Chief Executive Officer of Shoals.

Mr. Whitaker added, “We are not just taking a bigger slice of the pie we are in, we are growing the size of the pie available to us by broadening our product portfolio. We have been doing that organically through new product introductions like our wire management solutions and IV curve benchmarking products, and now inorganically through the acquisition of ConnectPV, which we completed during the third quarter. ConnectPV brings us new products targeted specifically to energy storage where we see tremendous growth potential. ConnectPV also gives us access to a number of customers that we did not historically serve which should further accelerate our market share gains. We are also expanding beyond solar by taking our technology and expertise to the rapidly growing EV charging market. We manufactured the first commercial versions of our full EV System Solution set including all four product families during the third quarter, and took first orders from customers in November. We remain very focused on the EV charging opportunity and are excited about the prospect of creating a significant business in EV to complement our core solar business. Between continued share gains with BLA, new products for solar and the business we are building in EV, I am incredibly excited about the future for Shoals.”

“Like many other companies, the key challenge to our growth is the current supply chain environment. Our business model has effectively insulated us from most of the margin pressure that many of our peers are experiencing as a result of rising commodity prices and the form factor of our products has limited the impact of shipping and logistics shortages on our business—but, unfortunately our customers still have to contend with these issues as they progress their projects. The result is very fluid delivery schedules, with customers making frequent changes both to product specifications and when they want product on site. Recently some of our customers’ projects have been delayed to accommodate design updates as a result of panel changes or because other materials or components needed are not available. In both cases, the impact to us is to delay when we can produce and ship product which will have the effect of shifting revenues that we expected to recognize in the fourth quarter of this year into the beginning of next year. Importantly, we have not had a single order cancel. We view these conditions as temporary and expect delivery schedules to normalize as the supply chain and logistics issues our customers are contending with abate,” concluded Mr. Whitaker.

Third Quarter 2021 Financial Results

Revenue was $59.8 million, compared to $52.6 million for the prior-year period, an increase of 14%, driven by increases in sales of both Components and System solutions. Revenues increased less than expected as certain customers changed product specifications or delayed shipment.

System Solutions represented 65% of revenues in the quarter versus 70% in the prior-year period primarily as a result of higher Components sales during the third quarter of this year compared to the third quarter of last year. The increase in Components sales as a percentage of total sales during the quarter was expected.

Gross profit increased 5% to $21.8 million, compared to $20.7 million in the prior-year period. Gross profit as a percentage of revenue decreased to 36.4% from 39.3% in the prior year period, due to the expected higher mix of Components sales in the quarter which carry lower margins than System Solutions as well as the impact of ConnectPV which we acquired during the quarter. Gross margins on Components and System Solutions products were in line with prior periods. ConnectPV’s historical gross margins are lower than Shoals’ historical gross margins primarily due to the higher prices they pay for components used in their products as a result of their smaller size relative to Shoals. Excluding the impact of ConnectPV, gross margins would have been higher in the quarter. We expect to bring ConnectPV’s margins in line with Shoals’ average gross margin as we migrate their business to our suppliers.

General and administrative expenses were $10.0 million compared to $3.5 million during the same period in the prior year. This change was primarily a result of higher non-cash stock-based compensation, acquisition related expenses for ConnectPV, planned increases in payroll expense due to higher headcount to support growth and new product initiatives, new public company costs and one-time public offering expenses.

Income from operations was $9.6 million, compared to $15.1 million during the same period in the prior year.

Net income was $5.3 million, compared to net income of $15.0 million during the same period in the prior year. This change was primarily due to higher general and administrative expenses and higher interest expense partially offset by a tax benefit. Net income for 2021 is not directly comparable to 2020 because prior to its IPO, the Company was organized as a tax flow-through partnership rather than a corporation and did not record income taxes. Basic and diluted earnings per share were $0.02.

Adjusted EBITDA was $16.9 million, compared to $19.9 million for the prior-year period.

Adjusted net income was $11.6 million, compared to $15.4 million during the same period in the prior year. Adjusted diluted earnings per share was $0.07.

During the quarter we acquired ConnectPV for a combination of cash and stock. The transaction was not significant to Shoals and the Company expects it to be accretive to 2022 earnings per share. Guggenheim Securities LLC acted as Shoals’ exclusive financial advisor in connection with the transaction.

Backlog and Awarded Orders

The Company’s backlog and awarded orders on September 30, 2021 were $270.7 million, representing an all-time record for the company and an increase of 101% and 35% versus the same time last year and June 30, 2021, respectively. The increase in backlog and awarded orders reflects continued robust demand for the company’s products from customers in the U.S. The acquisition of ConnectPV did not contribute materially to the year-over-year increase in backlog.

Fourth and First Quarter Outlook

The Company is providing an outlook for the next two quarters given the impacts of recent changes some of its customers have made to their orders as well as continued disruption in supply chain, freight and logistics availability across the solar industry. It is not the Company’s intention to provide quarterly guidance on an ongoing basis. Based on current market conditions, business trends and other factors, the Company expects:

For the quarter ended December 31, 2021:

- Revenues to be in the range of $40 million to $50 million

- Adjusted EBITDA to be in the range of $11 million to $15 million

- Adjusted net income to be in the range of $3 to $7 million

For the quarter ended March 31, 2022:

- Revenues to be in the range of $71 million to $76 million

- Adjusted EBITDA to be in the range of $22 million to $24 million

- Adjusted net income to be in the range of $14 to $17 million

A reconciliation of the Company’s non-GAAP measures to the applicable GAAP measures are found within this release. These expectations do not consider, or give effect to, material acquisitions that may be completed by the Company during 2021 or 2022, other than ConnectPV, or other unforeseen events, including changes in global economic conditions or further disruption in supply chain, freight or logistics availability.

Webcast and Conference Call Information

Company management will host a webcast and conference call on November 9, 2021, at 5:00 p.m. Eastern Time, to discuss the Company's financial results.

Interested investors and other parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of the Company's website at https://investors.shoals.com.

The conference call can be accessed live over the phone by dialing 1-844-826-3033 (domestic) or +1-412-317-5185 (international). A telephonic replay will be available approximately two hours after the call by dialing 1-844-512-2921 or for international callers, + 1-412-317-6671. The conference ID for the live call and pin number for the replay is 10161234. The replay will be available until 11:59 p.m. Eastern Time on November 23, 2021.

About Shoals Technologies Group, Inc.

Shoals Technologies Group, Inc. is a leading provider of electrical balance of system (“EBOS”) solutions for solar, battery storage and electric vehicle charging infrastructure. The Company’s mission is to provide innovative products that reduce the cost of installation while improving system performance, reliability and safety. At least one Shoals’ product was used on more than half of the solar energy projects installed in the U.S. in 2020. To learn more about Shoals Technologies, please visit the company's website at https://www.shoals.com.

Investor Relations Contact

Shoals Technologies Group, Inc.

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: 615-323-9836

Forward-Looking Statements

This report contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, technology developments, financing and investment plans, dividend policy, competitive position, industry and regulatory environment, potential growth opportunities and the effects of competition. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” "seek," “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this report. You should read this report with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Non-GAAP Financial Measures

(1) A reconciliation of projected adjusted EBITDA, adjusted net income, and adjusted diluted earnings per share, which are forward-looking measures that are not prepared in accordance with GAAP, to the most directly comparable GAAP financial measures, is not provided because we are unable to provide such reconciliation without unreasonable effort. The inability to provide a quantitative reconciliation is due to the uncertainty and inherent difficulty in predicting the occurrence, the financial impact and the periods in which the components of the applicable GAAP measures and non-GAAP adjustments may be recognized. The GAAP measures may include the impact of such items as non-cash share-based compensation, amortization of intangible assets and the tax effect of such items, in addition to other items we have historically excluded from adjusted EBITDA and adjusted net income per share. We expect to continue to exclude these items in future disclosures of these non-GAAP measures and may also exclude other similar items that may arise in the future (collectively, "non-GAAP adjustments").

Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS

We define Adjusted EBITDA as net income (loss) plus (i) interest expense, (ii) income taxes, (iii) depreciation expense, (iv) amortization of intangibles, (v) tax receivable agreement liability adjustment, (vi) loss on debt repayment, (vii) equity-based compensation, (viii) acquisition-related expenses (ix) COVID-19 expenses and (x) non-recurring and other expenses. We define Adjusted Net Income as net income (loss) plus (i) amortization of intangibles, (ii) tax receivable agreement liability adjustment, (iii) loss on debt repayment, (iv) amortization of deferred financing costs, (v) equity-based compensation, (vi) acquisition-related expenses (vii) COVID-19 expenses and (viii) non-recurring and other expenses, all net of applicable income taxes. We define Adjusted Diluted EPS as Adjusted Net Income divided by the diluted weighted average shares of Class A common shares outstanding for the applicable period, which assumes the pro forma exchange of all outstanding Class B common shares for Class A common shares.

Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS are intended as supplemental measures of performance that are neither required by, nor presented in accordance with, GAAP. We present Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS because we believe they assist investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. In addition, we use Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS: (i) as factors in evaluating management’s performance when determining incentive compensation; (ii) to evaluate the effectiveness of our business strategies; and (iii) because our credit agreement uses measures similar to Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS to measure our compliance with certain covenants.

Among other limitations, Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS do not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; in the case of Adjusted EBITDA, does not reflect income tax expense or benefit for periods prior to the reorganization; and may be calculated by other companies in our industry differently than we do or not at all, which may limit their usefulness as comparative measures.

Because of these limitations, Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP. You should review the reconciliation of net income to Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS below and not rely on any single financial measure to evaluate our business.

Shoals Technologies Group, Inc.

Consolidated Balance Sheets

(in thousands, except shares)

| September 30, 2021 | December 31, 2020 | ||||||||

| Assets | |||||||||

| Current Assets | |||||||||

| Cash and cash equivalents | $ | 14,189 | $ | 10,073 | |||||

| Accounts receivable, net | 44,588 | 27,004 | |||||||

| Unbilled receivables | 10,554 | 3,794 | |||||||

| Inventory, net | 27,832 | 15,121 | |||||||

| Other current assets | 11,706 | 155 | |||||||

| Total Current Assets | 108,869 | 56,147 | |||||||

| Property, plant and equipment, net | 14,358 | 12,763 | |||||||

| Goodwill | 69,321 | 50,176 | |||||||

| Other intangible assets, net | 67,508 | 71,988 | |||||||

| Deferred tax asset | 121,545 | — | |||||||

| Other assets | 1,204 | 4,236 | |||||||

| Total Assets | $ | 382,805 | $ | 195,310 | |||||

| Liabilities and Stockholders' Deficit / Members’ Deficit | |||||||||

| Current Liabilities | |||||||||

| Accounts payable | $ | 18,664 | $ | 14,634 | |||||

| Accrued expenses | 15,112 | 5,967 | |||||||

| Long-term debt—current portion | 2,000 | 3,500 | |||||||

| Total Current Liabilities | 35,776 | 24,101 | |||||||

| Revolving line of credit | 60,140 | 20,000 | |||||||

| Long-term debt, less current portion | 190,136 | 335,332 | |||||||

| Payable Pursuant to the Tax Receivable Agreement | 107,880 | — | |||||||

| Total Liabilities | 393,932 | 379,433 | |||||||

| Commitments and Contingencies (Note 13) | |||||||||

| Stockholders’ Deficit / Members’ Deficit | |||||||||

| Members’ deficit | — | (184,123 | ) | ||||||

| Preferred stock, $0.00001 par value - 5,000,000 shares authorized; none issued and outstanding as of September 30, 2021 | — | — | |||||||

| Class A common stock, $0.00001 par value - 1,000,000,000 shares authorized; 104,179,939 shares issued and outstanding as of September 30, 2021 | 1 | — | |||||||

| Class B common stock, $0.00001 par value - 195,000,000 shares authorized; 62,664,521 shares issued and outstanding as of September 30, 2021 | 1 | — | |||||||

| Additional paid-in capital | 92,149 | — | |||||||

| Accumulated deficit | (91,296 | ) | — | ||||||

| Total stockholders’ equity attributable to Shoals Technologies Group, Inc. / members' deficit | 855 | (184,123 | ) | ||||||

| Non-controlling interests | (11,982 | ) | — | ||||||

| Total stockholders’ deficit / members’ deficit | (11,127 | ) | (184,123 | ) | |||||

| Total Liabilities and Stockholders’ Deficit / Members’ Deficit | $ | 382,805 | $ | 195,310 | |||||

Shoals Technologies Group, Inc.

Consolidated Statements of Operations

(in thousands, except per share amounts)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||

| Revenue | $ | 59,840 | $ | 52,598 | $ | 165,166 | $ | 136,765 | |||||||||||

| Cost of revenue | 38,071 | 31,909 | 98,444 | 85,061 | |||||||||||||||

| Gross profit | 21,769 | 20,689 | 66,722 | 51,704 | |||||||||||||||

| Operating Expenses | |||||||||||||||||||

| General and administrative expenses | 10,031 | 3,515 | 26,865 | 15,390 | |||||||||||||||

| Depreciation and amortization | 2,175 | 2,069 | 6,305 | 6,194 | |||||||||||||||

| Total Operating Expenses | 12,206 | 5,584 | 33,170 | 21,584 | |||||||||||||||

| Income from Operations | 9,563 | 15,105 | 33,552 | 30,120 | |||||||||||||||

| Interest expense, net | (3,582 | ) | (104 | ) | (10,911 | ) | (601 | ) | |||||||||||

| Tax receivable agreement liability adjustment | (2,014 | ) | — | (3,678 | ) | — | |||||||||||||

| Loss on debt repayment | — | — | (15,990 | ) | — | ||||||||||||||

| Income before income taxes | 3,967 | 15,001 | 2,973 | 29,519 | |||||||||||||||

| Income tax benefit | 1,309 | — | 3,123 | — | |||||||||||||||

| Net income | 5,276 | 15,001 | 6,096 | 29,519 | |||||||||||||||

| Less: net income attributable to non-controlling interests | 2,790 | — | 1,911 | — | |||||||||||||||

| Net income attributable to Shoals Technologies Group, Inc. | $ | 2,486 | $ | 15,001 | $ | 4,185 | $ | 29,519 | |||||||||||

| Three Months Ended September 30, 2021 | Period from January 27, 2021 to September 30, 2021 | ||||||||||||||||||

| Earnings per share of Class A common stock: | |||||||||||||||||||

| Basic | $ | 0.02 | $ | 0.02 | |||||||||||||||

| Diluted | $ | 0.02 | $ | 0.02 | |||||||||||||||

| Weighted average shares of Class A common stock outstanding: | |||||||||||||||||||

| Basic | 101,890 | 96,354 | |||||||||||||||||

| Diluted | 102,251 | 96,527 | |||||||||||||||||

Shoals Technologies Group, Inc.

Consolidated Statements of Cash Flows

(in thousands)

| Nine Months Ended September 30, | |||||||||

| 2021 | 2020 | ||||||||

| Cash Flows from Operating Activities | |||||||||

| Net income | $ | 6,096 | $ | 29,519 | |||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||||

| Depreciation and amortization | 7,345 | 7,017 | |||||||

| Amortization/write off of deferred financing costs | 5,692 | 31 | |||||||

| Equity-based compensation | 6,404 | 7,219 | |||||||

| Provision for slow-moving inventory | 435 | 488 | |||||||

| Deferred taxes | 640 | — | |||||||

| Tax receivable agreement liability adjustment | 3,678 | — | |||||||

| Gain on sale of assets | 61 | — | |||||||

| Changes in assets and liabilities, net of business acquisition: | |||||||||

| Accounts receivable | (12,271 | ) | (1,087 | ) | |||||

| Unbilled receivables | (6,760 | ) | (6,076 | ) | |||||

| Inventory | (8,505 | ) | (2,953 | ) | |||||

| Other assets | (6,904 | ) | 670 | ||||||

| Accounts payable | (5,198 | ) | 285 | ||||||

| Accrued expenses | 2,608 | 3,002 | |||||||

| Net Cash Provided by (Used in) Operating Activities | (6,679 | ) | 38,115 | ||||||

| Cash Flows Used In Investing Activities | |||||||||

| Purchases of property, plant and equipment | (2,483 | ) | (2,786 | ) | |||||

| Acquisition of a business, net of cash acquired | (12,909 | ) | — | ||||||

| Net Cash Used in Investing Activities | (15,392 | ) | (2,786 | ) | |||||

| Cash Flows from Financing Activities | |||||||||

| Member / non-controlling interest distributions | (4,837 | ) | (11,356 | ) | |||||

| Employee withholding taxes related to net settled equity awards | (137 | ) | — | ||||||

| Deferred financing costs | (94 | ) | — | ||||||

| Payments on term loan facility | (152,250 | ) | — | ||||||

| Proceeds from revolving credit facility | 40,140 | — | |||||||

| Payments on senior debt - term loan | — | (21,810 | ) | ||||||

| Proceeds from issuance of Class A common stock sold in an IPO, net of underwriting discounts and commissions | 154,521 | — | |||||||

| Proceeds from issuance of Class A common stock in follow-on offering, net of underwriting discounts and commissions | 281,064 | — | |||||||

| Purchase of LLC Interests with proceeds from follow-on offering | (281,064 | ) | — | ||||||

| Payment of debt acquired in acquisition | (1,537 | ) | — | ||||||

| Deferred offering costs | (9,619 | ) | — | ||||||

| Net Cash Provided by (Used in) Financing Activities | 26,187 | (33,166 | ) | ||||||

| Net Increase in Cash and Cash Equivalents | 4,116 | 2,163 | |||||||

| Cash and Cash Equivalents—Beginning of Period | 10,073 | 7,082 | |||||||

| Cash and Cash Equivalents—End of Period | $ | 14,189 | $ | 9,245 | |||||

Shoals Technologies Group, Inc.

Adjusted EBITDA and Adjusted Net Income Reconciliation (Unaudited)

(in thousands)

Reconciliation of Net Income to Adjusted EBITDA (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||

| Net income | $ | 5,276 | $ | 15,001 | $ | 6,096 | $ | 29,519 | |||||||||

| Interest expense | 3,582 | 104 | 10,911 | 601 | |||||||||||||

| Income tax benefit | (1,309 | ) | — | (3,123 | ) | — | |||||||||||

| Depreciation expense | 449 | 391 | 1,265 | 1,029 | |||||||||||||

| Amortization of intangibles | 2,088 | 1,996 | 6,080 | 5,988 | |||||||||||||

| Tax receivable agreement liability adjustment(a) | 2,014 | — | 3,678 | — | |||||||||||||

| Loss on debt repayment | — | — | 15,990 | — | |||||||||||||

| Equity-based compensation | 2,732 | 1,032 | 6,904 | 7,219 | |||||||||||||

| Acquisition-related expenses | 1,697 | — | 1,697 | — | |||||||||||||

| COVID-19 expenses(b) | 108 | 1,200 | 269 | 2,006 | |||||||||||||

| Non-recurring and other expenses(c) | 243 | 150 | 1,821 | 444 | |||||||||||||

| Adjusted EBITDA | $ | 16,880 | $ | 19,874 | $ | 51,588 | $ | 46,806 | |||||||||

| (a) | Represents an adjustment to eliminate the remeasurement of the Tax Receivable Agreement. |

| (b) | Represents costs incurred as a direct impact from the COVID-19 pandemic, disinfecting and reconfiguration of facilities, medical professionals to conduct daily screenings of employees, premium pay during the pandemic to hourly workers in 2020 and direct legal costs associated with the pandemic. |

| (c) | Represents certain costs associated with non-recurring professional services, Oaktree’s expenses and other costs. |

Reconciliation of Net Income Attributable to Shoals Technologies Group, Inc. to Adjusted Net Income (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||

| Net income attributable to Shoals Technologies Group, Inc. | $ | 2,486 | $ | 15,001 | $ | 4,185 | $ | 29,519 | |||||||||||

| Net income impact from pro forma conversion of Class B common stock to Class A common stock (a) | 2,790 | — | 1,911 | — | |||||||||||||||

| Adjustment to the provision for income tax (b) | (668 | ) | (3,255 | ) | (476 | ) | (6,406 | ) | |||||||||||

| Tax effected net income | 4,608 | 11,746 | 5,620 | 23,113 | |||||||||||||||

| Amortization of intangibles | 2,088 | 1,996 | 6,080 | 5,988 | |||||||||||||||

| Amortization of deferred financing costs | 278 | 10 | 953 | 31 | |||||||||||||||

| Tax receivable agreement liability adjustment(c) | 2,014 | — | 3,678 | — | |||||||||||||||

| Loss on debt repayment | — | — | 15,990 | — | |||||||||||||||

| Equity-based compensation | 2,732 | 1,032 | 6,904 | 7,219 | |||||||||||||||

| Acquisition-related expenses | 1,697 | — | 1,697 | — | |||||||||||||||

| COVID-19 expenses (d) | 108 | 1,200 | 269 | 2,006 | |||||||||||||||

| Non-recurring and other expenses (e) | 243 | 150 | 1,821 | 444 | |||||||||||||||

| Tax impact of adjustments (f) | (2,166 | ) | (728 | ) | (7,972 | ) | (1,838 | ) | |||||||||||

| Adjusted Net Income | $ | 11,602 | $ | 15,406 | $ | 35,040 | $ | 36,963 | |||||||||||

| (a) | Reflects net income to Class A common shares from pro forma exchange of corresponding shares of our Class B common shares held by our founder and management. |

| (b) | Shoals Technologies Group, Inc. is subject to U.S. Federal income taxes, in addition to state and local taxes with respect to its allocable share of any net taxable income of Shoals Parent LLC. The adjustment to the provision for income tax reflects the effective tax rates below, assuming Shoals Technologies Group, Inc. owns 100% of the units in Shoals Parent LLC. |

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||

| Statutory U.S. Federal income tax rate | 21.0 | % | 21.0 | % | 21.0 | % | 21.0 | % | |||

| State and local taxes (net of federal benefit) | 2.9 | % | 0.7 | % | 2.9 | % | 0.7 | % | |||

| Permanent items, including valuation adjustment | 0.1 | % | — | % | 1.0 | % | — | % | |||

| Effective income tax rate for Adjusted Net Income | 24.0 | % | 21.7 | % | 24.9 | % | 21.7 | % | |||

| (c) | Represents an adjustment to eliminate the remeasurement of the Tax Receivable Agreement. |

| (d) | Represents costs incurred as a direct impact from the COVID-19 pandemic, disinfecting and reconfiguration of facilities, medical professionals to conduct daily screenings of employees, premium pay during the pandemic to hourly workers in 2020 and direct legal costs associated with the pandemic. |

| (e) | Represents certain costs associated with non-recurring professional services, Oaktree’s expenses and other costs. |

| (f) | Represents the estimated tax impact of all Adjusted Net Income add-backs, excluding those which represent permanent differences between book versus tax. |

Reconciliation of Diluted Weighted Average Shares Outstanding to Adjusted Diluted Weighted Average Shares Outstanding (in thousands, except per share):

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Diluted weighted average shares of Class A common shares outstanding, excluding Class B common shares | 102,251 | N/A (b) | 96,527 | N/A (b) | ||||||||||||

| Assumed pro forma conversion of Class B common shares to Class A common shares | 64,813 | N/A (b) | 70,285 | N/A (b) | ||||||||||||

| Adjusted diluted weighted average shares outstanding | 167,064 | N/A (b) | 166,812 | N/A (b) | ||||||||||||

| Adjusted Net Income (a) | $ | 11,602 | N/A (b) | $ | 35,040 | N/A (b) | ||||||||||

| Adjusted Diluted EPS | $ | 0.07 | N/A (b) | $ | 0.21 | N/A (b) | ||||||||||

| (a) | Represents Adjusted Net Income for the full period presented. |

| (b) | This Non-GAAP measure is not applicable for this period, as the reorganization transactions had not yet occurred. |

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$9.62 |

| Daily Change: | 0.96 11.09 |

| Daily Volume: | 7,058,011 |

| Market Cap: | US$1.610B |

September 11, 2025 August 18, 2025 July 08, 2025 | |