CASTLE ROCK, Colo., Feb. 22, 2024 (GLOBE NEWSWIRE) -- Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin (“BTC”) mining, reports financial results for the full year ended December 31, 2023. The audited financial statements are available on Riot’s website and here.

“I am pleased to announce results for Riot for 2023, which proved to be another milestone year in Riot’s ongoing development as a leading vertically integrated Bitcoin miner,” said Jason Les, CEO of Riot. “We achieved record results in 2023, generating all-time highs of $281 million in total revenues, 6,626 Bitcoin produced, and $71 million in power credits earned from our unique power strategy.

“In addition to our record financial performance in 2023, Riot achieved significant progress across our key strategic development targets, including: (i) completion of our 700 megawatt Rockdale Facility expansion; (ii) successful scaling of our power strategy, which drove our industry-leading low cost to mine in FY 2023 to $7,539 per Bitcoin; (iii) a landmark partnership with MicroBT to lock-in a long-term, fixed-price supply of latest-generation miners, ensuring that Riot operates among the most efficient mining fleets in our industry; and (iv) ongoing development of our 1 gigawatt Corsicana Facility, which will begin energization at the end of Q1 2024 and which, when fully developed, will be the largest dedicated Bitcoin mining facility in the world.

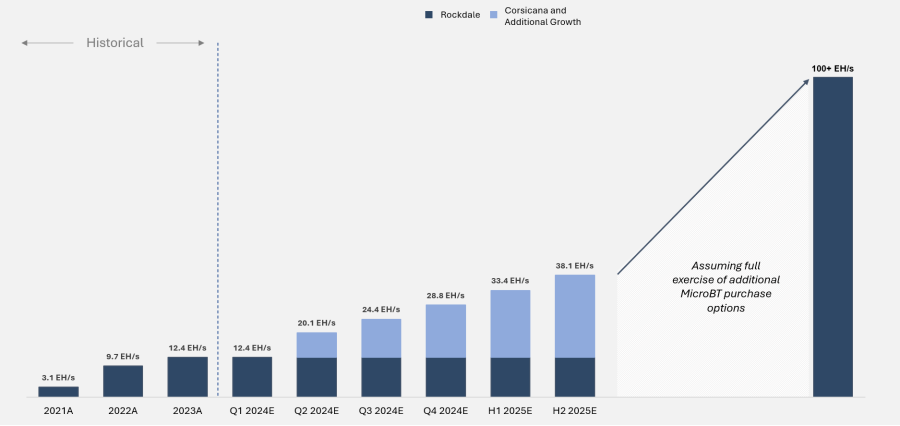

“At the same time, Riot has also further enhanced our already industry-leading balance sheet strength, ending 2023 with approximately $597 million in cash, 7,362 Bitcoin, worth approximately $311 million based on year-end Bitcoin prices, and nominal long-term debt. As a leading vertically integrated Bitcoin miner, coupling development of our Corsicana Facility with a secured supply of leading-edge miners from MicroBT, and our strong balance sheet gives Riot the most secure, visible path in our industry to achieving our growth plans. Our targets are to reach 28 EH/s in total hash rate capacity by the end of 2024, 38 EH/s by the end of 2025, and ultimately 100 EH/s and beyond.”

Fiscal Year 2023 Financial and Operational Highlights

Key financial and operational highlights for the fiscal year ended December 31, 2023 include:

Fiscal Year 2023 Financial Results

Total revenue for the year ended December 31, 2023, was $280.7 million, and consisted of $189.0 million in Bitcoin Mining revenue, $27.3 million in Data Center Hosting revenue, $64.3 million in Engineering revenue, and $0.1 million in other revenue.

Bitcoin Mining revenue in excess of mining cost of revenue for the year ended December 31, 2023, was $92.4 million (48.9% of mining revenue), as compared to $82.5 million (52.6% of mining revenue) for the same twelve-month period in 2022, an increase of $9.9 million. Bitcoin Mining cost of revenue consists primarily of direct production costs of mining operations, including electricity, labor, and insurance, but excluding depreciation and amortization. The increase in Bitcoin Mining cost of revenue in 2023 is primarily due to the increase in mining capacity at the Rockdale Facility, which requires more headcount and direct costs necessary to maintain and support the mining operations.

Data Center Hosting cost in excess of revenue for the year ended December 31, 2023, was $69.8 million. Data Center Hosting costs consisted primarily of direct power costs, with the balance primarily incurred for compensation and rent costs.

Engineering revenue in excess of engineering cost of revenue for the year ended December 31, 2023 was $3.7 million. Engineering cost of revenue for 2023 consisted primarily of direct materials and labor, as well as indirect manufacturing costs.

Under Riot’s long-term power agreements, the Company has the ability to return unused power and receive power credits at market-driven spot prices. Power credits received from these activities totaled $71.2 million for the twelve-month period ended December 31, 2023, as compared to $27.3 million during the same twelve-month period in 2022, equating to approximately 2,497 Bitcoin as computed by using average daily closing Bitcoin prices on a monthly basis.

If power credits were directly allocated between Bitcoin Mining cost of revenue and Data Center Hosting cost of revenue based on proportional power consumption, Bitcoin Mining cost of revenue would have decreased by $46.6 million, increasing Bitcoin Mining revenue in excess of Bitcoin Mining cost of revenue to $139.0 million (73.6% of Bitcoin Mining revenue) on a non-GAAP basis, while Data Center Hosting cost of revenue would have decreased by $24.6 million, and Data Center Hosting revenue in excess of Data Center Hosting cost of revenue would equal $(45.2) million ((165.9)% of Data Center Hosting revenue) on a non-GAAP basis.

Selling, general and administrative expenses during the year ended December 31, 2023 totaled $100.3 million, as compared to $67.5 million for the same twelve-month period in 2022. The increase of $32.9 million was primarily attributable to an increase in compensation expense, which increased by $12.2 million as a result of hiring additional employees to support Riot's ongoing growth, increased stock-based compensation of $7.6 million due to the adoption of the long-term incentive plan and additional headcount, increased legal and professional fees of $8.1 million primarily related to ongoing litigation and public company compliance, and an increase of $5.0 million in other general operating costs such as insurance and information technology projects to support the Company’s growth.

Net loss for 2023 was $(49.5) million, or $(0.28) per share, compared to a net loss of $(509.6) million, or $(3.65) per share in 2022. The net loss in 2023 included non-cash stock-based compensation of $32.2 million and depreciation and amortization of $252.4 million. Net loss in 2023 was impacted by the early adoption of ASU 2023-08, which was issued by FASB in December 2023, under which Riot recognizes its Bitcoin held at fair value, with changes in the fair value recognized in income.

Non-GAAP Adjusted EBITDA for the twelve-month period ended December 31, 2023, was $214.0 million, as compared to Non-GAAP Adjusted EBITDA of $(67.2) million for the same twelve-month period in 2022. Non-GAAP Adjusted EBITDA in 2023 was impacted by the early adoption of ASU 2023-08, which was issued by FASB in December 2023, under which Riot recognizes its Bitcoin held at fair value, with changes in the fair value recognized in income.

Hash Rate Growth

Riot plans to energize the first building (Building A1) at its new Corsicana Facility at the end of Q1 2024. Miners will be brought online in batches over the first several weeks of April 2024. Building A2 is expected to be completed and brought online towards the end of Q2 2024, with Buildings B1 & B2 being brought online during the third and fourth quarters of 2024.

At this pace, Riot’s self-mining hash rate is expected to grow from 12.4 EH/s to over 28 EH/s by the end of 2024. Phase II of the Corsicana Facility will bring two additional buildings online by the end of 2025, increasing total self-mining hash rate to over 38 EH/s.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading Bitcoin-driven infrastructure platform.

Our mission is to positively impact the sectors, networks and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining operations in central Texas, and electrical switchgear engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the benefits of acquisitions, including financial and operating results, and the Company’s plans, objectives, expectations, and intentions. Among the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the Navarro site expansion; our expected schedule of new miner deliveries; our ability to successfully deploy new miners; M.W. capacity under development; we may not be able to realize the anticipated benefits from immersion-cooling; the integration of acquired businesses may not be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; and the impact of COVID-19 on us, our customers, or on our suppliers in connection with our estimated timelines. Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such forward-looking statements.

For further information, please contact:

Investor Contact:

Phil McPherson

This email address is being protected from spambots. You need JavaScript enabled to view it.

303-794-2000 ext. 110

Media Contact:

Alexis Brock

303-794-2000 ext. 118

This email address is being protected from spambots. You need JavaScript enabled to view it.

Non-GAAP Measures of Financial Performance

In addition to financial measures presented under generally accepted accounting principles in the United States of America (“GAAP”), we consistently evaluate our use of and calculation of the non-GAAP financial measures such as “Adjusted EBITDA”. Adjusted EBITDA is a financial measure defined as EBITDA adjusted to eliminate the effects of certain non-cash and/or non-recurring items that do not reflect our ongoing strategic business operations, which management believes results in a performance measurement that represents a key indicator of the Company’s core business operations of Bitcoin mining. The adjustments include fair value adjustments such as derivative power contract adjustments, equity securities value changes, and non-cash stock-based compensation expense, in addition to financing and legacy business income and expense items. We believe Adjusted EBITDA can be an important financial measure becauseit allows management, investors, and our board of directors to evaluate and compare our operating results, including our return on capital and operating efficiencies, from period-to-period by making such adjustments. Additionally, Adjusted EBITDA is used as a performance metric for share-based compensation.

Adjusted EBITDA is provided in addition to and should not be considered to be a substitute for, or superior to, net income, the most comparable measure under GAAP to Adjusted EBITDA. Further, Adjusted EBITDA should not be considered as an alternative to revenue growth, net income, diluted earnings per share or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of our liquidity. Adjusted EBITDA has limitations as an analytical tool, and you should not consider this financial measure either in isolation or as a substitute for analyzing our results as reported under GAAP.

The following table reconciles Adjusted EBITDA to Net income (loss), the most comparable GAAP financial measure:

| Years Ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Net income (loss) | $ | (49,472 | ) | $ | (509,553 | ) | $ | (15,437 | ) | |||

| Interest (income) expense | (8,222 | ) | (454 | ) | 296 | |||||||

| Income tax expense (benefit) | (5,093 | ) | (11,749 | ) | 254 | |||||||

| Depreciation and amortization | 252,354 | 107,950 | 26,324 | |||||||||

| EBITDA | 189,567 | (413,806 | ) | 11,437 | ||||||||

| Adjustments: | ||||||||||||

| Stock-based compensation expense | 32,170 | 24,555 | 68,491 | |||||||||

| Acquisition-related costs | — | 78 | 21,198 | |||||||||

| Change in fair value of derivative asset | (6,721 | ) | (71,418 | ) | (12,112 | ) | ||||||

| Change in fair value of contingent consideration | — | (159 | ) | 975 | ||||||||

| Realized gain on sale/exchange of long-term investment | — | — | (26,260 | ) | ||||||||

| Realized loss on sale of marketable equity securities | — | 8,996 | — | |||||||||

| Unrealized (gain) loss on marketable equity securities | — | — | 13,655 | |||||||||

| Loss (gain) on sale/exchange of equipment | 5,336 | (16,281 | ) | — | ||||||||

| Casualty-related charges (recoveries), net | (5,974 | ) | 9,688 | — | ||||||||

| Impairment of goodwill | — | 335,648 | — | |||||||||

| Impairment of miners | — | 55,544 | — | |||||||||

| Other (income) expense | (260 | ) | 59 | (2,378 | ) | |||||||

| License fees | (97 | ) | (97 | ) | (97 | ) | ||||||

| Adjusted EBITDA | $ | 214,021 | $ | (67,193 | ) | $ | 74,909 | |||||

In addition to Adjusted EBITDA , we believe “Bitcoin Mining revenue in excess of cost of revenue, net of power curtailment credits”, “Data Center Hosting revenue in excess of cost of revenue, net of power curtailment credits”, “Cost of revenue – Bitcoin Mining, net of power curtailment credits” and “Cost of revenue – Data Center Hosting, net of power curtailment credits” are additional non-GAAP performance metrics that represent a key indicator of the Company’s core business operations of both Bitcoin Mining and Data Center Hosting.

We believe our ability to offer power back to the grid at market-driven spot prices, thereby reducing our operating costs, is integral to our overall strategy, specifically our power management strategy and our commitment to supporting the ERCOT power grid. While participation in various grid demand response programs may impact our Bitcoin production, we view this as an important part of our partnership-driven approach with ERCOT and our commitment to being a good corporate citizen in our communities.

We also believe netting power credits against our costs can be an important financial measure because it allows management, investors, and our board of directors to evaluate and compare our operating results, including our operating efficiencies, from period-to-period by making such adjustments. We have allocated the benefit of the power sales to our Bitcoin Mining and Data Center Hosting segments based on their proportional power consumption during the periods presented.

Bitcoin Mining revenue in excess of cost of revenue, net of power curtailment credits, Data Center Hosting revenue in excess of cost of revenue, net of power curtailment credits, Cost of revenue – Bitcoin Mining, net of power curtailment credits and Cost of revenue – Data Center Hosting, net of power curtailment credits are provided in addition to and should not be considered to be a substitute for, or superior to Revenue – Bitcoin Mining, Revenue – Data Center Hosting, Cost of revenue – Bitcoin Mining or Cost of revenue – Data Center Hosting as presented in our Consolidated Statements of Operations.

The following table presents reconciliations of these non-GAAP performance metrics to the most comparable GAAP financial measures:

| Years Ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Bitcoin Mining | ||||||||||||

| Revenue (A) | $ | 188,996 | $ | 156,870 | $ | 184,422 | ||||||

| Cost of revenue | 96,597 | 74,335 | 45,513 | |||||||||

| Bitcoin Mining revenue in excess of cost of revenue (B) | 92,399 | 82,535 | 138,909 | |||||||||

| Power curtailment credits allocated to Bitcoin Mining | 46,646 | 11,991 | — | |||||||||

| Bitcoin Mining revenue in excess of cost of revenue, net of power curtailment credits (C) | $ | 139,045 | $ | 94,526 | $ | 138,909 | ||||||

| Bitcoin Mining revenue in excess of cost of revenue, as a percentage of revenue (B/A) | 48.9 | % | 52.6 | % | 75.3 | % | ||||||

| Bitcoin Mining revenue in excess of cost of revenue, net of power curtailment credits, as a percentage of revenue (C/A) | 73.6 | % | 60.3 | % | 75.3 | % | ||||||

| Data Center Hosting | ||||||||||||

| Revenue (A) | $ | 27,282 | $ | 36,862 | $ | 24,546 | ||||||

| Cost of revenue | 97,122 | 61,906 | 32,998 | |||||||||

| Data Center Hosting revenue in excess of cost of revenue (B) | (69,840 | ) | (25,044 | ) | (8,452 | ) | ||||||

| Power curtailment credits allocated to Data Center Hosting | 24,569 | 15,354 | 6,514 | |||||||||

| Data Center Hosting revenue in excess of cost of revenue, net of power curtailment credits (C) | $ | (45,271 | ) | $ | (9,690 | ) | $ | (1,938 | ) | |||

| Data Center Hosting revenue in excess of cost of revenue, as a percentage of revenue (B/A) | (256.0 | )% | (67.9 | )% | (34.4 | )% | ||||||

| Data Center Hosting revenue in excess of cost of revenue, net of power curtailment credits, as a percentage of revenue (C/A) | (165.9 | )% | (26.3 | )% | (7.9 | )% | ||||||

| Allocation of Power Curtailment Credits | ||||||||||||

| Consolidated power curtailment credits | 71,215 | 27,345 | 6,514 | |||||||||

| Percentage of consolidated power curtailment credits allocated to Bitcoin Mining | 65.5 | % | 43.9 | % | 0.0 | % | ||||||

| Percentage of consolidated power curtailment credits allocated to Data Center Hosting | 34.5 | % | 56.1 | % | 100.0 | % | ||||||

| Last Trade: | US$13.48 |

| Daily Change: | -0.23 -1.68 |

| Daily Volume: | 3,357,307 |

| Market Cap: | US$5.010B |

December 04, 2025 November 04, 2025 October 30, 2025 September 03, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS